Escape Room Market Size

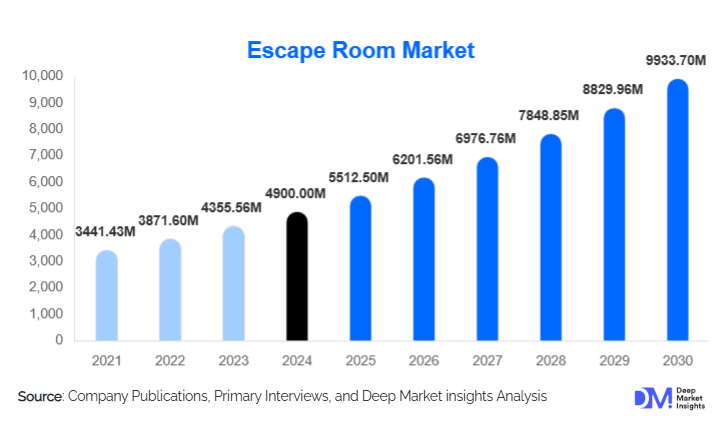

According to Deep Market Insights, the global escape room market size was valued at USD 4,900 million in 2024 and is projected to grow from USD 5,512.50 million in 2025 to reach USD 9,933.70 million by 2030, expanding at a CAGR of 12.5% during the forecast period (2025–2030). The growing demand for immersive entertainment, rapid penetration of digital technology in gaming formats, and rising corporate adoption for team-building and experiential learning are among the major factors positively driving global escape room market growth.

Key Market Insights

- Physical escape rooms remain dominant, accounting for over 52% of the global market due to strong consumer preference for collaborative and in-person experiences.

- Asia-Pacific is the fastest-growing regional market, driven by strong growth in tourism, entertainment startups, and rising disposable income in China, Japan, South Korea, and India.

- Franchise and chain-operated escape rooms hold nearly 34% of the market share, led by scalable business models and brand reputation.

- Corporate and team-building applications are growing at over 13% CAGR, fueled by demand for behavioral assessment, leadership training, and HR development tools.

- Technology integration (AI, VR, AR, and IoT) is reshaping user engagement, enabling enhanced storytelling and automated puzzle experiences.

- Mystery and detective-themed escape rooms remain the most popular segment, holding approximately 28% market share in 2024.

What are the latest trends in the Escape Room Market?

AI-Enhanced Escape Room Experiences

Escape room operators are increasingly integrating AI to design intelligent puzzle engines, automate scenario transformations, and refine difficulty levels based on user behavior. AI-powered game masters can deliver personalized hints, automate timer management, and adjust narrative pathways according to decisions made by players. This enables greater replay value, reduces reliance on manual staff intervention, and improves operational efficiency. AI-based analytics also collect insights into player performance, emotional responses, and group interactions, enabling operators to refine experience design and upsell premium packages. This trend supports smart escape rooms that continuously evolve, offering dynamic scenarios that retain customer interest and allow for scalable franchise models.

Hybrid Physical-Digital Escape Rooms

Hybrid escape rooms are combining physical environments with digital puzzle layers using AR headsets, VR simulations, interactive projections, and IoT-enabled objects. Digital overlays allow operators to change game themes from horror to sci-fi or detective mysteries without physically altering the room, reducing redevelopment costs. VR escape rooms allow users to access immersive environments beyond physical space constraints, while AR-based experiences offer enhanced engagement in compact locations like hotels, museums, and malls. This trend has also led to the growth of mobile escape room setups for corporate events, team-building workshops, and educational simulations, enabling new revenue streams for operators in non-traditional locations.

What are the key drivers in the Escape Room Market?

Growing Demand for Experiential Entertainment

Consumers are shifting from passive entertainment such as cinemas and gaming to active, immersive experiences that offer social interaction and cognitive challenge. Escape rooms appeal to this demand by combining storytelling, teamwork, and puzzle-solving, creating high-engagement live experiences. Urban millennials and Gen Z are driving bookings for group-based outings, celebrations, and skill-based entertainment. The rise of experiential leisure in malls, resorts, and mixed-use entertainment centers has further contributed to escape room adoption. This shift toward experience-based spending, particularly in developed economies, remains a core driver of market expansion.

Corporate Training and Educational Applications

Escape rooms are being utilized for leadership development, collaborative assessments, and behavioral simulations within corporate HR programs. These setups allow organizations to observe communication, creativity, and problem-solving dynamics in controlled environments. Corporate escape experiences are in high demand for team-building events, gamified recruitment programs, and decision-making evaluations. Educational institutions are also implementing escape rooms to improve engagement in STEM, history, psychology, and business studies. The shift toward gamified learning and cognitive training has positioned escape rooms as practical tools for experiential education.

What are the restraints for the global market?

High Setup and Maintenance Costs

Escape room operators face significant initial investments associated with leased space, theme construction, puzzle automation, safety compliance, IoT-enabled equipment, and digital technology integration. Developing advanced VR/AR or sensor-based rooms further increases CapEx, with many installations requiring USD 100,000 or more for setup. Frequent maintenance is also essential to ensure puzzle functionality and user safety. Theme upgrades and puzzle redesigns increase ongoing costs, reducing profit margins for smaller operators and delaying returns on investment.

Limited Replay Value and Customer Retention

Escape rooms have a fixed gameplay experience, which limits repeat visits unless new themes or expanded storylines are introduced consistently. Once customers complete a room, they are less likely to return to the same venue unless new rooms are developed. This necessitates continuous content redesign, significant investment in innovation, and marketing strategies to attract new audiences. Operators without multiple themed rooms or franchise upgrades often face stagnation in return engagement, making customer retention a persistent market challenge.

What are the key opportunities in the Escape Room Industry?

Digital and Edutainment-Based Escape Rooms

Escape rooms are increasingly being adopted in schools, universities, and training centers for interactive learning. STEM-based escape rooms simulate real-world problem-solving scenarios in physics, mathematics, coding, and robotics courses. Psychology and medical schools are using escape room simulations for mental health training and emergency response assessments. Companies are developing digital escape rooms for remote learning, enabling broader accessibility. This shift toward educational and training-oriented escape rooms is unlocking new funding opportunities and government-backed support in edtech and skill development sectors.

Hospitality and Tourism Integration

Escape rooms are being integrated into hotels, resorts, airports, cruise ships, amusement parks, and shopping malls to enhance guest entertainment and increase length of stay. Tourism-heavy locations such as Dubai, Singapore, Las Vegas, and Barcelona are incorporating escape room attractions into hospitality packages. Luxury resorts are building fully themed escape room experiences that merge storytelling, immersive environments, and interactive hospitality services. Escape rooms are increasingly being bundled with tourism packages, driving higher spending among travelers and positioning escape entertainment as a tourism asset.

Product Type Insights

Mystery and detective-themed escape rooms hold approximately 28% of the market due to their broad player appeal, logical reasoning-based puzzles, and easy adaptability across educational, corporate, and entertainment segments. Horror and thriller rooms are gaining strong traction among younger audiences in North America and Europe, while adventure-themed rooms dominate family and tourist demand. Technology-based escape rooms, including AI-driven, VR, and AR-integrated rooms, are rapidly expanding, growing at double-digit rates as operators seek higher engagement and monetizable premium experiences. Historical and culture-based escape rooms are evolving as tourism learning tools, particularly in Europe, Asia, and the Middle East, where heritage preservation and storytelling are strategic priorities.

Application Insights

Leisure and group entertainment constitute about 45% of global demand, driven by birthday celebrations, family group outings, and weekend entertainment. Corporate training applications are growing rapidly, used for behavioral analysis, leadership development, and strategic thinking workshops. Educational institutions are adopting escape rooms for teaching chemistry, mathematics, history, and psychological studies using gamified learning. Tourism-based applications are rising in hotels, resorts, airports, theme parks, and cruise lines, as experiential activities are increasingly embedded in travel itineraries.

Distribution Channel Insights

Online booking channels and direct digital platforms account for the largest share of bookings due to ease of comparison, group scheduling, and subscription membership management. Franchise-operated websites offer tailored booking portals for corporate events and school programs. Aggregator travel platforms, hotel concierge systems, and experience marketplaces are being used to sell escape room packages as part of broader entertainment itineraries. Social media optimization, influencer partnerships, and location-based digital campaigns are increasingly influencing booking decisions.

End-User Insights

Friends and family groups represent nearly 45% of demand in 2024, driven by preferences for recreational experiences, celebrations, and weekend activities. Corporate users represent a growing segment, with enterprises using escape rooms for HR training simulations, recruitment, and team-building events. Tourism and hospitality customers contribute significantly to demand in airport lounges, hotels, resorts, and cruise liners. Educational institutions and training centers represent an emerging high-value segment, driving adoption in experiential learning and skill development.

| By Theme Type | By Ownership Model | By Game Format & Technology |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 33% of the global escape room market, supported by strong urban entertainment culture, high corporate spending on employee engagement, and widespread adoption in malls, universities, and entertainment complexes. The U.S. contributes nearly 27% of global revenue, with high franchise penetration and VR-enabled room installations in major cities. Corporate training and school-based escape applications are significant growth drivers.

Europe

Europe represents around 26% of global market share, led by the U.K., Germany, France, Spain, and Poland. Educational escape rooms are popular in European schools and museums for interactive cultural learning. Cities such as London, Berlin, Barcelona, and Amsterdam host escape rooms within heritage buildings, museums, and tourist sites, increasing adoption in tourism-based entertainment. The U.K. market is growing at 11% CAGR due to high demand for branded escape room experiences.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at around 15% CAGR, driven by rapid entertainment sector expansion, increasing consumer disposable income, and rising popularity of VR gaming. China, Japan, and South Korea lead in digital escape experiences, while India and Australia are major markets for corporate and educational escape rooms. China is projected to reach USD 1.4 billion by 2030, driven by smart escape room franchises and mall integrations.

Middle East & Africa

Dubai, Saudi Arabia, and South Africa are emerging as experience tourism hubs with strong investments in mall-based entertainment and luxury escape room resorts. Dubai, in particular, is integrating escape rooms into retail centers, tourism zones, and hotel experiences, positioning itself as a global hub for interactive leisure.

Latin America

Latin America shows growing adoption in urban entertainment centers, with Brazil, Mexico, and Argentina leading demand. Young urban populations and mall-based entertainment formats are driving adoption. Franchises and cross-border partnerships are fueling geographic expansion and market scale.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Escape Room Market

- Escape Hunt Group

- Breakout Games

- Komnata Quest

- Puzzle Break

- Parapark Entertainment

- Escapology

- HintHunt

- Fox in a Box

- QuestRoom

- AdventureRooms International

- The Room

- ExitGame

- KeyQuest

- Omescape

- Trapped Co.

Recent Developments

- In June 2024, Escape Hunt Group announced tech-enabled escape room expansions across Singapore and Dubai, integrating AR and AI-driven puzzle automation.

- In March 2024, Komnata Quest launched hybrid VR escape experiences for corporate training, blending physical and digital environments.

- In August 2024, Breakout Games partnered with Marriott Hotels to introduce escape room-themed resort experiences in Southeast Asia.