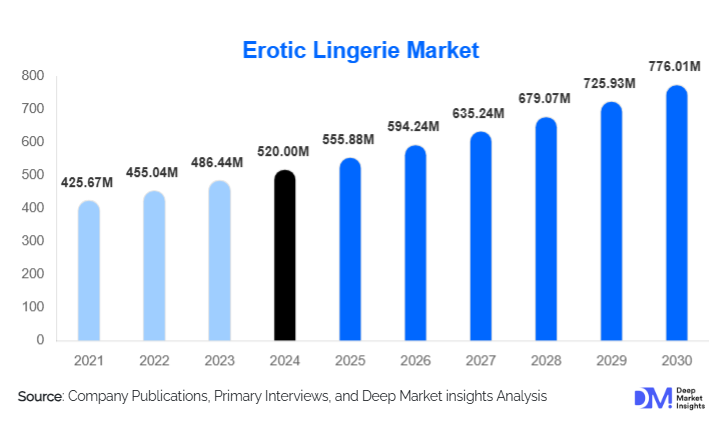

Erotic Lingerie Market Size

According to Deep Market Insights, the global erotic lingerie market size was valued at USD 520.00 million in 2024 and is projected to grow from USD 555.88 million in 2025 to reach USD 776.01 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). The market growth is primarily driven by increasing social acceptance of intimate apparel, the expansion of e-commerce and digital sales channels, and rising demand for luxury and premium erotic lingerie offerings across global markets.

Key Market Insights

- Online platforms are increasingly dominating sales, offering privacy, convenience, and personalized shopping experiences, which is boosting market penetration globally.

- Premium and designer lingerie segments are expanding, catering to high-income consumers seeking luxury materials such as silk and lace, along with customized fittings and exclusive collections.

- Asia-Pacific is emerging as a key growth region, led by rising middle-class wealth in China, India, and Southeast Asia, coupled with increasing social acceptance of intimate apparel.

- North America and Europe continue to hold the largest market share, driven by established consumer awareness, digital penetration, and demand for luxury lingerie products.

- Sustainability and eco-friendly fabrics such as organic cotton and recycled lace are becoming increasingly preferred, offering new opportunities for ethical and premium product lines.

- Technological adoption, including virtual fitting rooms, AI-based size recommendations, and immersive online experiences, is enhancing customer engagement and reducing returns.

What are the latest trends in the erotic lingerie market?

Luxury & Personalized Offerings Driving Demand

Consumers are increasingly seeking lingerie that combines aesthetic appeal with personalized fit and comfort. Designer collections, themed sets, and limited editions are becoming mainstream in the luxury segment. Brands are offering customization options such as monogramming, personalized sizing, and curated gift bundles. This trend is particularly strong in North America and Europe, where consumers prioritize premium quality and exclusivity. Online platforms provide tailored recommendations and subscription services, allowing consumers to discover new designs and maintain consistent engagement with brands.

Sustainable and Eco-Friendly Lingerie

Rising awareness of environmental issues has led to a surge in demand for lingerie made from organic, recycled, and ethically sourced materials. Companies are increasingly incorporating lace, bamboo, and sustainable silk blends to appeal to eco-conscious consumers. Government incentives for sustainable manufacturing in regions like Europe and North America further support this trend. Sustainable lingerie is not only a differentiator but also drives premium pricing, appealing to consumers seeking high-quality, environmentally responsible products.

What are the key drivers in the erotic lingerie market?

Changing Consumer Behavior & Social Acceptance

Shifting cultural norms and greater acceptance of intimate apparel are encouraging consumers to embrace erotic lingerie as both fashion and self-expression. Body positivity movements and inclusivity initiatives have broadened product offerings to include diverse sizes and designs, which drives adoption globally.

Digital Sales Channels and E-Commerce Growth

Online retail channels dominate sales due to convenience, privacy, and customization options. Virtual fitting rooms, AI-based size recommendations, and personalized styling have enhanced online experiences, leading to higher consumer engagement and repeat purchases. Social media marketing, influencer collaborations, and targeted advertising also drive demand, especially among younger demographics.

Rising Disposable Income and Premiumization

Increasing disposable income in developed and emerging markets is fueling the growth of mid-range and premium lingerie. Consumers are willing to invest in designer pieces, luxury sets, and specialty products, leading to higher average transaction values. Asia-Pacific and North America show strong growth in the premium segment, driven by urban middle-class and high-income populations.

What are the restraints for the global market?

Cultural Sensitivities and Regulatory Barriers

Conservative regions impose restrictions on the sale, advertising, and display of erotic lingerie, limiting market penetration. Import regulations, cultural taboos, and social norms in the Middle East and parts of Asia act as significant growth restraints.

High Production Costs and Price Sensitivity

Premium materials like silk and lace increase production costs, making some products unaffordable for price-sensitive consumers in emerging markets. Balancing high-quality production with competitive pricing remains a critical challenge for manufacturers.

What are the key opportunities in the erotic lingerie industry?

Emerging Markets Expansion

Growing urbanization, rising disposable incomes, and changing cultural perceptions in regions like India, Brazil, and Southeast Asia present significant opportunities. Brands can introduce mid-range and premium offerings to tap into these underserved consumer bases.

Tech-Enabled Consumer Engagement

Virtual fitting rooms, AI-powered recommendations, and interactive e-commerce experiences allow brands to connect directly with consumers. These technologies reduce returns, enhance customer satisfaction, and enable smaller brands to compete with established players effectively.

Eco-Friendly and Sustainable Products

Consumers increasingly value sustainable fabrics and ethical production. Lingerie made from organic cotton, bamboo blends, or recycled lace appeals to environmentally conscious buyers, particularly in Europe and North America. Government initiatives promoting sustainable textiles further enhance growth potential.

Product Type Insights

Bra and panty sets dominate the erotic lingerie market, accounting for approximately 35% of the global market share in 2024. This segment leads primarily due to its versatility, wide consumer acceptance, and availability across economy, mid-range, and premium price points. Bra and panty sets serve both functional and aesthetic purposes, making them suitable for everyday wear as well as special occasions. The increasing popularity of coordinated sets, inclusive sizing, and body-positive marketing campaigns has further strengthened demand.

Luxury bra and panty sets are gaining traction globally, supported by premium fabrics such as lace, silk, and satin, along with online customization options that allow consumers to personalize fit and design. Corsets and bustiers represent the next significant product category, driven by premiumization trends, bridal demand, and fashion-inspired lingerie collections. Meanwhile, teddies and bodysuits are experiencing rapid growth among younger consumers, particularly millennials and Gen Z, who favor bold, fashion-forward, and novelty-driven designs influenced by social media and celebrity endorsements.

Material Insights

Lace remains the most widely used material in the erotic lingerie market, capturing around 40% of global market revenue in 2024. Its dominance is driven by its strong aesthetic appeal, sensual transparency, and adaptability across both mid-range and luxury segments. Lace-based lingerie is perceived as premium yet accessible, making it a preferred choice for consumers seeking elegance and sensuality.

Silk and satin materials are witnessing increased adoption within the premium segment, particularly in North America and Europe, where consumers exhibit a higher willingness to pay for luxury comfort and superior craftsmanship. These materials are commonly associated with bridal collections and high-end designer lingerie. In contrast, cotton blends and synthetic fabrics dominate affordability-driven markets in Asia-Pacific and Latin America, where comfort, durability, and price sensitivity influence purchasing decisions. The growing availability of sustainable and recycled lace fabrics is also emerging as a key material trend globally.

Distribution Channel Insights

Online retail channels lead the erotic lingerie market, accounting for approximately 45% of total sales in 2024. The dominance of e-commerce is driven by convenience, discreet purchasing, extensive product variety, and personalized shopping experiences enabled by AI-based size recommendations and virtual fitting technologies. Direct-to-consumer (D2C) brand websites, online marketplaces, and social-commerce platforms play a critical role in expanding reach, particularly in emerging markets.

Offline retail channels, including specialty lingerie boutiques and department stores, continue to hold strategic importance, especially for premium and luxury purchases. In Europe and North America, in-store experiences remain relevant for consumers seeking personalized fittings, premium fabric evaluation, and curated collections. The integration of omnichannel strategies, such as click-and-collect, in-store digital kiosks, and loyalty programs, is strengthening the synergy between online and offline sales.

End-User Insights

Women remain the primary end users, accounting for approximately 75% of total market revenue in 2024. This segment drives innovation across product design, materials, and branding, with increasing emphasis on inclusivity, comfort, and aesthetic appeal. Women’s demand is supported by rising self-purchase behavior, shifting perceptions of lingerie as a form of self-expression, and growing acceptance of premium intimate apparel.

Men and couples represent fast-growing niche segments. Male consumers increasingly purchase erotic lingerie as gifts, particularly during festive seasons and special occasions. The couples segment is expanding due to rising interest in experiential intimacy, coordinated lingerie sets, and themed collections. This trend is encouraging brands to develop couple-focused product lines, accessories, and curated lingerie packages, contributing to higher average order values.

| By Product Type | By Material | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a dominant position in the global erotic lingerie market, contributing approximately 30% of total revenue in 2024. The region’s leadership is driven by high disposable incomes, strong social acceptance of intimate apparel, and a well-established e-commerce ecosystem. The U.S. and Canada remain the largest contributors, with strong demand across mid-range and premium categories. Key regional growth drivers include widespread adoption of subscription-based lingerie services, advanced digital marketing strategies, and strong brand loyalty toward established players. Additionally, growing demand for inclusive sizing, luxury collections, and sustainable lingerie products is further supporting long-term market expansion in North America.

Europe

Europe accounts for approximately 28% of the global market in 2024, led by the U.K., Germany, France, and Italy. The region benefits from socially progressive attitudes, strong fashion influence, and high awareness of premium and sustainable lingerie products. European consumers show a strong preference for ethically produced lingerie, eco-friendly fabrics, and high-quality craftsmanship. Regional growth is driven by premiumization trends, rising demand for sustainable and locally manufactured lingerie, and strong offline retail presence through boutique stores. Younger demographics are driving demand for fashion-forward designs, while established luxury brands continue to dominate the high-end segment.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, supported by China, India, Japan, South Korea, and Southeast Asia. Rapid urbanization, rising disposable incomes, and expanding middle-class populations are fueling demand for mid-range and premium erotic lingerie. Key growth drivers include increasing digital penetration, widespread use of online marketplaces, and rising social acceptance of intimate apparel. Influencer marketing, celebrity endorsements, and social media-driven fashion trends play a crucial role in shaping consumer preferences. Local brands and international players are actively expanding their presence through online-first strategies in this region.

Latin America

Latin America represents an emerging market, with Brazil, Argentina, and Mexico as the primary contributors. Demand is largely concentrated in urban centers, where younger consumers exhibit growing interest in fashion-forward and gift-oriented lingerie products. Regional growth is driven by increasing e-commerce adoption, improving logistics infrastructure, and rising awareness of global lingerie trends. Although price sensitivity remains high, the mid-range segment is gaining traction, supported by localized product offerings and promotional pricing strategies.

Middle East & Africa

The Middle East and Africa collectively represent a smaller share of the global erotic lingerie market. In the Middle East, cultural sensitivities restrict offline sales, making discreet online channels and premium private-label offerings the primary growth avenues. The UAE and Saudi Arabia are the most active markets, driven by high-income consumers and cross-border e-commerce. In Africa, demand is limited but growing in urban centers such as South Africa and Nigeria. Growth drivers include expanding retail infrastructure, rising urban middle-class populations, and increasing exposure to global fashion trends through digital platforms.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Erotic Lingerie Market

- Victoria’s Secret

- La Perla

- Agent Provocateur

- Hunkemöller

- Triumph International

- Calvin Klein

- Adore Me

- Savage X Fenty

- Etam

- Yandy

- Bluebella

- Bendon Lingerie

- Intimissimi

- ThirdLove

- Playboy Lingerie