Entertainment Robots Market Size

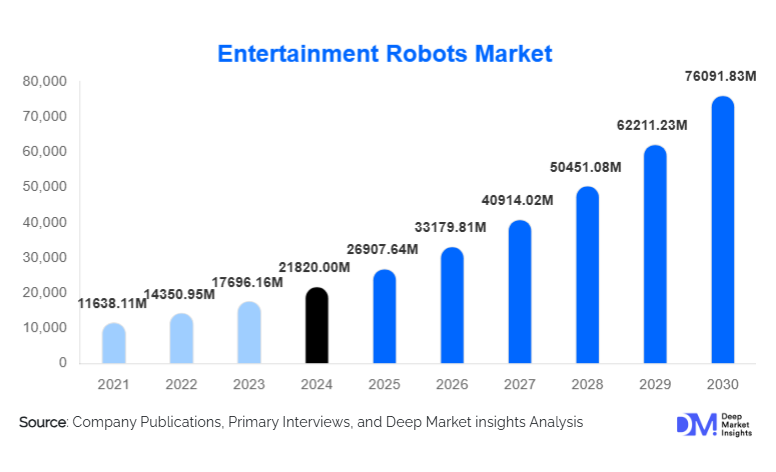

According to Deep Market Insights, the global entertainment robots market size was valued at USD 21,820.00 million in 2024 and is projected to grow from USD 26,907.64 million in 2025 to reach USD 76,091.83 million by 2030, expanding at a CAGR of 23.31% during the forecast period (2025–2030). The entertainment robots market growth is primarily driven by rapid advancements in artificial intelligence (AI), rising demand for interactive and personalized entertainment experiences, and increasing adoption of companion and educational robots across households, commercial venues, and institutions.

Key Market Insights

- AI-enabled and emotionally interactive robots dominate market demand, as consumers increasingly seek personalized and adaptive entertainment experiences.

- Household and personal-use entertainment robots account for the largest share, driven by adoption among families, children, and aging populations.

- Asia-Pacific leads global production and consumption, supported by strong electronics manufacturing ecosystems and domestic demand.

- North America remains the largest premium market, driven by high disposable income and demand for advanced humanoid and companion robots.

- Mid-range robots (USD 200–1,000) dominate sales volumes, balancing affordability with advanced functionality.

- Online direct-to-consumer channels are reshaping distribution, accounting for more than half of global entertainment robot sales.

What are the latest trends in the entertainment robots market?

AI-Driven Personalization and Emotional Intelligence

Entertainment robots are increasingly incorporating advanced AI algorithms that enable adaptive learning, emotional recognition, and context-aware interactions. Robots can now recognize voice tone, facial expressions, and behavioral patterns, allowing them to respond in more human-like ways. This trend is particularly strong in companion and pet-like robots, which are designed to form long-term emotional bonds with users. Continuous software updates and cloud-based learning models are extending product lifecycles while creating recurring revenue opportunities through subscriptions and premium content upgrades.

Expansion of Robots in Commercial Entertainment Spaces

Theme parks, shopping malls, airports, and hospitality venues are rapidly deploying entertainment robots to enhance visitor engagement and brand differentiation. Robots are used for interactive performances, customer guidance, and immersive experiences, helping businesses attract footfall and improve customer satisfaction. Custom-branded robots and interactive mascots are becoming common in large venues, reflecting a shift from novelty use cases toward scalable commercial entertainment applications.

What are the key drivers in the entertainment robots market?

Advancements in AI, Sensors, and Connectivity

Continuous improvements in AI, speech recognition, computer vision, and sensor technology are the most significant drivers of market growth. These advancements allow entertainment robots to interact naturally with users, learn from engagement patterns, and deliver increasingly immersive experiences. Integration with cloud platforms and IoT ecosystems further enhances functionality through remote updates and content expansion.

Rising Demand for Interactive Home Entertainment

Consumers are seeking alternatives to passive screen-based entertainment. Entertainment robots provide physical interaction combined with digital intelligence, appealing to children, families, and elderly users. Companion robots and educational entertainment robots are increasingly viewed as long-term household devices rather than short-term toys, driving higher spending and repeat purchases.

Commercial and Institutional Adoption

Beyond households, entertainment robots are gaining traction in schools, healthcare facilities, and public venues. Educational institutions are adopting robots for interactive learning, while elderly care facilities use entertainment robots to improve engagement and emotional well-being. This broadening of end-use applications is accelerating market expansion.

What are the restraints for the global market?

High Cost of Advanced Robots

Premium entertainment robots equipped with advanced AI, humanoid motion, and emotional intelligence remain expensive, limiting adoption in price-sensitive regions. Although component costs are declining, software development and integration expenses continue to keep prices elevated, particularly for high-end models.

Data Privacy and Regulatory Challenges

Entertainment robots often collect sensitive audio, visual, and behavioral data. Growing concerns around data privacy, cybersecurity, and child protection are prompting stricter regulations in several regions. Compliance with these regulations increases development costs and can delay product launches.

What are the key opportunities in the entertainment robots industry?

Integration with Education and Healthcare Entertainment

Entertainment robots that combine learning, therapy, and leisure represent a major growth opportunity. Governments and institutions are increasingly investing in robots that support cognitive development, STEM education, and elderly engagement. These use cases benefit from public funding, long-term contracts, and stable demand.

Growth in Emerging Markets

Rising middle-class incomes in Asia-Pacific, Latin America, and the Middle East are creating new demand for affordable and mid-range entertainment robots. Localization of language, cultural behaviors, and educational content presents strong opportunities for market expansion in these regions.

Product Type Insights

Companion robots dominate the entertainment robots market, accounting for approximately 28% of global revenue in 2024, driven by demand for emotional engagement and long-term interaction. Toy robots represent a significant volume segment, particularly in low-cost categories, while educational entertainment robots are the fastest-growing product type due to rising STEM education initiatives. Humanoid robots, though smaller in volume, command premium pricing and contribute disproportionately to market value.

Application Insights

Household and personal-use applications account for over 50% of market demand, driven by adoption among families and elderly users. Educational applications are expanding rapidly, supported by school and learning center adoption. Commercial entertainment applications, including theme parks and malls, are emerging as high-value segments due to bulk procurement and customization requirements.

Distribution Channel Insights

Online direct-to-consumer channels dominate the market, accounting for nearly 58% of global sales, as consumers increasingly prefer e-commerce platforms for product comparison and customization. Specialty electronics retailers remain important for premium products, while institutional and B2B sales are growing steadily through partnerships with schools, healthcare facilities, and entertainment venues.

| By Product Type | By Interaction Capability | By Connectivity | By Price Band | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global entertainment robots market with approximately 38% share in 2024. China, Japan, and South Korea are major contributors, supported by strong manufacturing capabilities, government support for robotics, and high domestic demand. The region is also the fastest-growing, with a CAGR exceeding 17% through 2030.

North America

North America accounts for around 27% of the global market share, driven primarily by the United States. High disposable incomes, strong demand for premium AI-enabled robots, and early adoption of smart home technologies support market growth.

Europe

Europe holds approximately 22% of the market, with Germany, the UK, and France leading demand. The region emphasizes educational and commercial entertainment applications, supported by strong regulatory frameworks and institutional adoption.

Latin America

Latin America represents an emerging market, led by Brazil and Mexico. Growth is driven by increasing consumer awareness and the gradual adoption of mid-range entertainment robots.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is witnessing a rising demand for premium entertainment robots in commercial and hospitality settings. Africa remains a nascent but gradually growing market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Entertainment Robots Market

- Sony Group

- SoftBank Robotics

- LEGO Group

- UBTECH Robotics

- Hasbro

- Mattel

- Hanson Robotics

- WowWee Group

- Sphero

- Robotis