Energy-Efficient Lighting Market Size

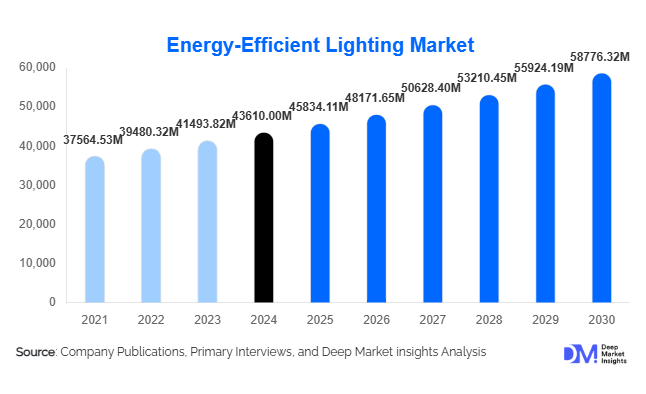

According to Deep Market Insights, the global energy-efficient lighting market size was valued at USD 43,610.00 million in 2024 and is projected to grow from USD 45,834.11 million in 2025 to reach USD 58,776.32 million by 2030, expanding at a CAGR of 5.10% during the forecast period (2025–2030). The market growth is primarily driven by the rapid adoption of LED technologies, government regulations promoting energy efficiency, and the rise of smart lighting solutions in residential, commercial, and industrial applications.

Key Market Insights

- LED lighting dominates the market, offering energy savings of up to 80% and long lifespans of 50,000–70,000 hours, making it the preferred choice across sectors.

- Smart and connected lighting solutions are rapidly expanding, integrating IoT, sensors, and automation systems for enhanced energy management.

- Asia-Pacific leads global demand, driven by China and India’s large-scale urbanization, infrastructure growth, and export capabilities.

- Europe and North America focus on retrofitting and regulatory compliance, driving demand for energy-efficient upgrades in commercial and public infrastructure.

- Government initiatives, such as China’s “Made in China 2025” and India’s UJALA program, are accelerating adoption in both developed and emerging markets.

- Industrial and commercial sectors are key growth drivers, leveraging energy-efficient lighting to reduce operational costs and support sustainability commitments.

What are the latest trends in the energy-efficient lighting market?

Rapid LED Adoption and Smart Integration

The transition from incandescent and fluorescent lamps to LED lighting continues to accelerate globally due to falling LED prices and enhanced performance. LEDs now offer smart features such as dimming, tunable white light, and wireless connectivity. Integration with IoT systems allows centralized control, occupancy-based automation, and predictive maintenance, which are increasingly adopted in smart homes, commercial buildings, and industrial facilities. The rise of smart-city projects has further strengthened demand for intelligent outdoor and street lighting systems that combine energy savings with operational efficiency.

Horticulture and Specialized Lighting Applications

New applications in horticulture, UV-C disinfection, and automotive lighting are creating additional growth avenues. Indoor farming and greenhouse operations are increasingly deploying LED grow lights, while hospitals and commercial spaces are adopting UV-C lighting for sanitation. These emerging segments are attracting R&D investments and specialized product development, expanding the overall market beyond conventional lighting applications.

What are the key drivers in the energy-efficient lighting market?

Falling LED Prices and Technological Advancements

LED cost reductions of nearly 80% over the last decade have made energy-efficient lighting more accessible. Innovations in chip design, high-lumen output, and long lifespans are driving adoption across sectors. Smart LEDs with app controls and integrated sensors are enhancing functionality, further accelerating market growth.

Government Regulations and Incentives

Global regulations, including the EU Ecodesign Directive, US Energy Star standards, and India’s UJALA program, are mandating energy-efficient lighting solutions. Tax incentives, subsidies, and public procurement initiatives have boosted replacement and retrofit activities in residential, commercial, and public infrastructure applications.

Growing Demand from Commercial and Industrial Sectors

Commercial buildings, factories, and warehouses are implementing energy-efficient lighting to cut operational costs and meet ESG targets. Smart lighting systems, occupancy sensors, and daylight-harvesting technologies enable reductions of 30–40% in electricity consumption, making them a preferred choice for enterprises seeking sustainability.

What are the restraints for the global market?

High Initial Costs for Smart Lighting Systems

Although LEDs are increasingly affordable, fully integrated smart lighting solutions incur significant upfront investment. Small businesses and budget-constrained public projects may delay adoption due to high installation costs, limiting short-term market growth.

Low Awareness in Developing Regions

In rural and underdeveloped areas, limited awareness, lack of distribution infrastructure, and preference for traditional lighting hinder the penetration of advanced energy-efficient lighting solutions.

What are the key opportunities in the energy-efficient lighting market?

Expansion of Smart Cities and Connected Infrastructure

Urbanization and smart-city initiatives globally are increasing demand for sensor-based street lighting, smart building automation, and connected outdoor lighting solutions. Companies offering IoT-enabled and remotely managed systems can capture large-scale municipal and industrial contracts.

Industrial Energy Management and Automation

Manufacturing and industrial facilities are retrofitting lighting systems to optimize energy efficiency and integrate with automation platforms. Solutions combining lighting with software and monitoring services represent high-value opportunities in regions such as APAC and North America.

Government Policies and Sustainability Programs

Energy-efficiency regulations, rebate programs, and carbon-reduction targets offer new market access. Companies that align with national energy-saving initiatives or offer domestically produced solutions are well-positioned to benefit from public-sector contracts and incentive-driven demand.

Product Type Insights

LED lighting dominates the market, accounting for 72% of total revenue in 2024, driven by efficiency, longevity, and smart integration capabilities. Fluorescent lighting is gradually declining but remains relevant for cost-sensitive retrofit applications. HID, induction, and OLED technologies are emerging niches with specialized industrial and commercial applications.

Application Insights

Indoor lighting, including residential, commercial, and industrial spaces, represents 64% of the market, fueled by retrofits and smart-building adoption. Outdoor lighting, such as street and highway illumination, parking lots, and parks, is rapidly adopting smart LEDs with automation features to reduce energy consumption and maintenance costs.

Distribution Channel Insights

Direct B2B sales dominate (55%), particularly for commercial, industrial, and government procurement. Retail stores and e-commerce platforms are growing rapidly in residential segments, offering easy access to LED and smart lighting products.

End-Use Insights

The commercial sector accounts for 36% of the market and is the largest contributor to growth due to office buildings, retail centers, and hospitality facilities. Industrial manufacturing facilities are adopting energy-efficient lighting as part of automation and sustainability programs. New applications, including horticulture, UV-C sanitation, and automotive lighting, are expanding demand further. Export-driven growth is significant, with China leading global LED exports (35–40% of global volumes).

| By Technology | By Application | By End-Use Industry | By Light Source Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

The U.S. and Canada are driving market growth due to energy regulations, smart-building adoption, and infrastructure upgrades. North America holds 23% of the global market share in 2024, with retrofitting and smart lighting deployments contributing to sustained demand.

Europe

Europe accounts for 26% of the market and is the largest regional market, led by Germany, France, and the U.K. Strong sustainability policies and regulatory compliance initiatives are driving demand, particularly in commercial and industrial applications.

Asia-Pacific

APAC is the fastest-growing region (38% share), led by China and India. Rapid urbanization, smart-city projects, and industrial expansion are fueling high demand for LED and smart lighting solutions. Southeast Asia (Vietnam, Indonesia, Thailand) is experiencing notable growth in commercial lighting deployments.

Middle East & Africa

MEA is expanding steadily, driven by government infrastructure spending and urban development in the UAE and Saudi Arabia. African countries with energy-efficiency mandates are increasingly adopting LED-based street and commercial lighting solutions.

Latin America

Brazil, Mexico, and Chile represent the key markets, with growth supported by rising electricity costs and urban construction. Adoption is moderate but stable, particularly in commercial and industrial facilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Energy-Efficient Lighting Market

- Signify (Philips Lighting)

- Osram Licht AG

- Acuity Brands

- Panasonic Lighting

- GE Lighting

- Zumtobel Group

- Eaton Lighting

- Cree Lighting

- Seoul Semiconductor

- Nichia Corporation

- Havells

- Syska

- Opple Lighting

- MLS Co. (LEDVANCE brand owner)

- Hubbell Lighting

Recent Developments

- In August 2025, Signify launched a new series of IoT-enabled smart street lighting solutions in Europe, integrating adaptive dimming and remote monitoring.

- In July 2025, Osram expanded its LED industrial lighting portfolio in North America, focusing on energy-efficient warehouse and manufacturing applications.

- In May 2025, Panasonic Lighting introduced smart LED fixtures for residential and commercial buildings in India under the UJALA program, aiming to improve energy efficiency and reduce costs.