Enamel Pots Market Size

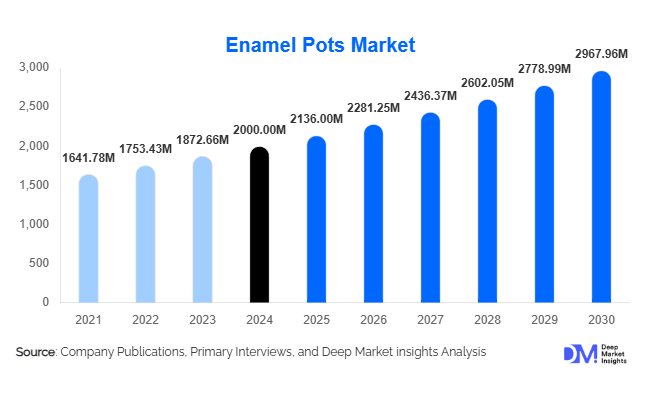

According to Deep Market Insights, the global enamel pots market size was valued at USD 2,000 million in 2024 and is projected to grow from USD 2,136.0 million in 2025 to reach USD 2,967.96 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is driven by increasing consumer preference for durable, aesthetically appealing, and chemical-free cookware, along with rising awareness of sustainable kitchenware products across residential and commercial sectors.

Key Market Insights

- Growing demand for non-toxic and eco-friendly cookware is boosting the adoption of enamel pots among health-conscious consumers globally.

- Asia-Pacific dominates the global enamel pots market, led by strong manufacturing bases in China, Japan, and South Korea, and rising urban middle-class populations.

- Europe remains a key consumer market, with strong interest in artisanal and designer enamel cookware driven by sustainability and aesthetics.

- North America is experiencing steady growth, supported by the rising popularity of retro-style cookware and premium kitchen aesthetics.

- Online retail channels are increasingly driving sales due to expanding e-commerce penetration and the convenience of direct-to-consumer brands.

- Product innovation in coating technology is enhancing heat resistance, durability, and design flexibility, further propelling market growth.

Latest Market Trends

Rising Popularity of Vintage and Designer Cookware

Enamel pots are witnessing renewed consumer interest due to the growing popularity of vintage-inspired kitchen aesthetics. Designers and premium cookware brands are reintroducing enamel pots with modern color palettes, ergonomic handles, and enhanced heat retention properties. This design evolution is driving demand in high-income markets, particularly among millennial homeowners and culinary enthusiasts seeking both functionality and style in their cookware choices.

Sustainable Manufacturing Practices

Manufacturers are increasingly focusing on eco-friendly production methods, including the use of non-toxic coatings, recyclable materials, and energy-efficient processes. The absence of harmful chemicals like PFOA and PTFE makes enamel pots an environmentally responsible alternative to traditional non-stick cookware. Several brands are also introducing packaging made from biodegradable or recycled materials, aligning with broader sustainability trends in the kitchenware industry.

Market Drivers

Health-Conscious Consumer Behavior

Rising awareness about the potential health risks of chemical-coated cookware has fueled interest in enamel pots, which are non-reactive and safe for all cooking types. This shift is especially strong in developed markets, where consumers prioritize safety and quality over low-cost alternatives. Enamel pots also preserve food flavor and resist corrosion, making them suitable for long-term use and contributing to their growing appeal.

Expanding Middle-Class Population and Urbanization

The expanding global middle-class population, particularly in Asia-Pacific and Latin America, is driving higher spending on premium home and kitchen products. Urban consumers are investing in cookware that blends durability with modern design. Enamel pots, known for their vibrant finishes and long lifespan, are benefiting from this lifestyle shift toward functional luxury and aesthetically curated home spaces.

Market Restraints

High Production and Maintenance Costs

Enamel pots are generally more expensive to manufacture than aluminum or stainless-steel cookware due to the multi-layer enameling process. The brittle nature of enamel coatings also increases replacement and maintenance costs for consumers. These factors can deter budget-conscious buyers and limit mass-market adoption, especially in price-sensitive regions.

Competition from Alternative Materials

The enamel pots market faces stiff competition from materials such as stainless steel, cast iron, and ceramic cookware. Innovations in these alternatives, particularly ceramic-coated non-stick pans, pose a challenge to enamel pot manufacturers. Additionally, consumer perception that enamel pots are fragile or less durable may hinder adoption in high-intensity commercial cooking environments.

Market Opportunities

Premium and Customizable Product Offerings

Brands are increasingly introducing customizable enamel cookware collections featuring personalized colors, engravings, and design patterns. This premiumization strategy is appealing to consumers seeking unique kitchenware pieces that match their personal style. Collaborations between designers and cookware brands are also enhancing product visibility in lifestyle markets.

Growth in Online and Direct-to-Consumer Channels

Rising global e-commerce adoption provides a strong growth avenue for enamel pot manufacturers. Digital retail allows niche brands to target specific consumer groups and promote premium or handmade enamelware directly. Influencer marketing, online recipe content, and social media platforms such as Instagram and Pinterest are playing pivotal roles in shaping consumer buying behavior in this segment.

Product Type Insights

Cast Iron Enamel Pots dominate the market due to superior heat retention and versatility across stovetop and oven use. Steel-based enamel pots are preferred for lighter cooking and affordability, making them popular in emerging markets. Handcrafted enamel pots are gaining traction in premium and gift segments, valued for artisanal appeal and unique finishes.

Application Insights

The residential segment holds the largest market share, supported by growing consumer interest in home cooking and sustainable kitchenware. The commercial segment, including restaurants, cafés, and culinary schools, is also expanding steadily, with enamel pots valued for their aesthetic presentation and easy-to-clean surfaces.

Distribution Channel Insights

Online retail is the fastest-growing channel, driven by global e-commerce giants and D2C cookware brands. Offline channels such as supermarkets, specialty cookware stores, and home furnishing outlets remain crucial for consumers who prefer tactile product evaluation before purchase. Hybrid retail models combining physical stores with digital engagement are increasingly popular among leading brands.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global enamel pots market, accounting for the majority of production and consumption. China, Japan, and South Korea are key manufacturing hubs, benefiting from advanced coating technologies and large domestic demand. India’s emerging middle class and expanding retail sector further bolster regional growth.

Europe

Europe is a mature market characterized by strong consumer affinity for artisanal and sustainable cookware. Countries like France, Germany, and Italy are major consumers, with leading brands emphasizing traditional craftsmanship and eco-friendly designs. The region’s strict environmental regulations are also promoting demand for non-toxic enamel coatings.

North America

North America shows steady growth fueled by rising demand for premium and designer cookware. The U.S. market is witnessing a trend toward retro-style and multicolored enamel pots, reflecting nostalgia-driven kitchen aesthetics. Brand collaborations with celebrity chefs and social media influencers are enhancing market visibility.

Latin America

Latin America’s enamel pots market is gradually expanding, supported by increasing household spending and urbanization. Brazil and Mexico lead regional demand, with consumers favoring durable cookware suitable for traditional cooking methods. Distribution through retail chains and e-commerce platforms is strengthening market accessibility.

Middle East & Africa

Growing hospitality and tourism industries in the Middle East are driving demand for high-quality kitchenware, including enamel pots. In Africa, rising disposable incomes and expanding retail infrastructure are supporting gradual market growth, particularly in South Africa and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Enamel Pots Market

- Le Creuset

- Staub (Zwilling Group)

- Tramontina

- Ceramcor

- Fissler GmbH

- Cooker King

- Supor Group

- World Kitchen LLC (Corelle Brands)

Recent Developments

- In August 2025, Le Creuset launched a new line of eco-conscious enamel cookware using 100% recyclable materials and low-emission enameling processes.

- In May 2025, Tramontina expanded its enamel pot manufacturing facility in Brazil to meet growing Latin American and export demand.

- In March 2025, Supor Group introduced AI-integrated enamel cookware with smart temperature monitoring to improve cooking precision.