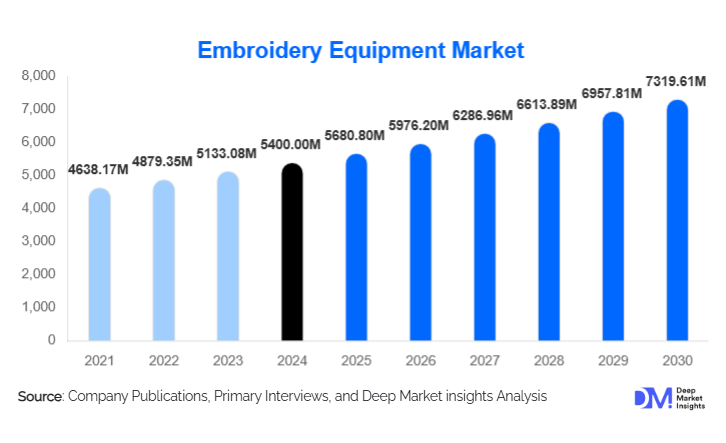

Embroidery Equipment Market Size

According to Deep Market Insights, the global embroidery equipment market size was valued at USD 5,400.00 million in 2024 and is projected to grow from USD 5,680.80 million in 2025 to reach USD 7,319.61 million by 2030, expanding at a CAGR of 5.20% during the forecast period (2025–2030). Market growth is driven by rising global demand for customized apparel, rapid automation of textile production, and expanding adoption of computerized multi-needle embroidery machines across fashion, home textiles, and promotional branding applications.

Key Market Insights

- Demand for customization in fashion and home textiles is accelerating, making embroidery machines essential for differentiated apparel and branded merchandise.

- Multi-needle computerized embroidery machines dominate industrial usage due to high throughput, automatic color changes, and advanced digitizing capabilities.

- Asia-Pacific leads global demand, supported by large-scale garment manufacturing clusters in China, India, Vietnam, and Bangladesh.

- North America and Europe are major adopters of high-end computerized machines, driven by premium fashion, corporate wear, and small custom embroidery studios.

- Automation is reshaping production economics, lowering labor dependency and enabling efficient small-batch customization for on-demand fashion models.

- Export-oriented textile industries are significantly boosting machine procurement, particularly in emerging manufacturing hubs.

Latest Trends in the Embroidery Equipment Market

Rapid Adoption of Computerized and Multi-Needle Technologies

Embroidery production is undergoing a sharp technological shift as factories and SMEs transition from mechanical and semi-automatic systems to fully computerized multi-needle machines. These machines support faster stitching speeds, automated thread trimming, advanced pattern memory, and color-change mechanisms that significantly enhance productivity. Manufacturers are also integrating real-time monitoring and digital control systems to improve production accuracy and reduce downtime. The trend aligns with the rising need for high-volume, consistent decorative stitching in apparel, uniforms, and home décor.

Digitized Design & On-Demand Production Ecosystems

The integration of digitizing software, cloud-based design libraries, and online customization tools is redefining the embroidery value chain. Fashion brands, merchandisers, and small embroidery studios now rely on digital workflows to convert artwork into stitch-ready formats. This trend supports the booming on-demand fashion economy, where personalized apparel is produced in smaller batches with rapid turnaround. Coupling embroidery machines with e-commerce platforms enables real-time customization and fulfillment, attracting both startups and established brands seeking agile production models.

Key Drivers in the Embroidery Equipment Market

Growing Consumer Demand for Personalized and Branded Products

Customization has become a defining characteristic of modern apparel, accessories, and corporate merchandise. Embroidery offers durable, premium-quality personalization that brands prefer over printing for uniforms, sportswear, promotional apparel, and luxury garments. The rise of influencer brands, small-batch designers, and home-based creators further boosts market demand, supporting strong sales of both industrial and household embroidery machines.

Technological Advancements and Automation

Innovations such as auto-hooping systems, high-speed multi-needle mechanisms, advanced digitizing software, and automatic thread management have significantly reduced production times and manual labor requirements. Fully automated systems dominate large textile factories, ensuring consistent stitching quality at high volume. These improvements also make embroidery viable for new applications, such as performance wear, premium sports apparel, and high-end furnishings.

Restraints for the Global Embroidery Equipment Market

High Capital and Maintenance Costs

Industrial-grade embroidery machines, especially multi-needle computerized systems, require substantial investment. Small workshops and start-ups often struggle with the upfront cost, limiting adoption in certain markets. Ongoing maintenance, skilled labor requirements, and spare-part availability also add long-term cost burdens, particularly in developing regions.

Demand Volatility in the Apparel Sector

Fluctuations in global apparel consumption, driven by economic downturns, inflationary pressures, and supply-chain disruptions, directly impact embroidery demand. During slowdowns, manufacturers may shift toward simpler garment designs or prioritize cost-reduction over decorative embellishments, limiting machine purchases.

Key Opportunities in the Embroidery Equipment Industry

High-Growth Potential in Emerging Export Manufacturing Hubs

Countries such as Bangladesh, Vietnam, Cambodia, and Ethiopia are experiencing rapid expansion in garment manufacturing, driven by cost competitiveness and growing export orders. These markets present substantial opportunities for embroidery equipment suppliers aiming to tap into fast-growing textile clusters. Government incentives for industrial development and export-driven investments further fuel equipment procurement.

Automation-Integrated Smart Factories and Digitization

As textile factories adopt Industry 4.0 technologies, there is an increasing need for embroidery equipment compatible with digital production environments. IoT-enabled machines, predictive maintenance algorithms, and cloud-based design integrations are emerging opportunities for equipment manufacturers. Firms offering automation-ready products with real-time data analytics stand to capture significant market share.

Product Type Insights

Multi-needle computerized embroidery machines dominate the global market, holding approximately 40–45% of the 2024 share. Their high speed, automatic color-change capability, and superior precision make them indispensable for mass garment production. Single-needle and domestic machines cater to hobbyists, boutiques, and SMEs, while mechanical/manual machines serve niche artistic applications. Accessory equipment, such as hoops, stabilizers, and digitizing software, constitutes a growing auxiliary segment as customization demand increases across consumer and commercial markets.

Application Insights

Apparel and fashion applications account for 50–55% of the embroidery equipment market, driven by demand for embellished garments, sports uniforms, corporate wear, and luxury ethnic apparel. Home textiles, including embroidered curtains, cushions, table linens, and bedding, form the second largest segment. Promotional and branding applications, such as embroidered logos for corporate merchandise, continue to grow steadily. Small custom embroidery studios, creative hobbyists, and online sellers represent a rapidly expanding application segment due to accessible entry-level machines and rising adoption of on-demand customization models.

Distribution Channel Insights

Direct sales to textile and garment factories dominate distribution, capturing 60% of the market. Industrial buyers prefer direct procurement for service reliability, installation assistance, and long-term maintenance contracts. Distributors and dealers primarily support SMEs and small studios. E-commerce channels are rising quickly as home-use machines gain popularity and small businesses purchase equipment online. Digital brand websites and online product configurators are now major factors influencing buyer decisions.

End-User Insights

Industrial garment manufacturers hold the largest share, contributing 45–50% of total equipment demand. These buyers prioritize machine durability, high production capacity, and advanced automation features. SMEs and boutique embroidery houses form a growing segment, thanks to accessible pricing tiers and expanded consumer interest in customized apparel. Hobbyist users also represent a rising share of the domestic machine market, supported by online tutorials, design marketplaces, and the growth of home-based crafting businesses.

| By Product Type | By Application | By Distribution Channel | By End-User Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 20–25% of the global market, driven by high adoption of computerized equipment among fashion brands, promotional product manufacturers, and independent embroidery studios. The U.S. leads regional demand, especially for premium multi-needle machines used in sportswear, custom apparel, and corporate branding. The region’s robust e-commerce ecosystem also supports small-scale embroidery entrepreneurship.

Europe

Europe accounts for 18–22% of global demand, with Germany, Italy, France, and the U.K. leading adoption. The region’s strong luxury fashion sector drives demand for advanced, high-precision embroidery equipment. European buyers prioritize durability, sustainability, and technical sophistication, making it a well-established market for premium embroidery systems.

Asia-Pacific

Asia-Pacific is the largest regional market with a 35–40% share in 2024. China and India dominate demand, fueled by large-scale garment and home-textile manufacturing. Bangladesh, Vietnam, and Indonesia are emerging as high-growth countries due to strong export economies and the expansion of apparel factories. APAC remains the fastest-growing region, driven by industrialization and technology upgrades.

Latin America

LATAM contributes 4–6% of global demand, with Brazil and Mexico serving as key markets. Growth is supported by regional apparel producers, rising interest in promotional textiles, and the adoption of SME-level embroidery operations. The region is gradually shifting toward digital and multi-needle technologies.

Middle East & Africa

MEA holds 5–7% of the market demand. The Middle East (UAE, Saudi Arabia, Qatar) shows strong import activity for promotional apparel and luxury textiles. In Africa, South Africa, Kenya, and Ethiopia exhibit growing embroidery equipment adoption, driven by local apparel manufacturing, school uniform production, and regional branding needs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Embroidery Equipment Market

- Tajima Group

- Barudan Co., Ltd.

- Brother Industries, Ltd.

- ZSK Stickmaschinen

- SWF (SunStar)

- Ricoma International Corporation

- Happy Japan

- Bernina International

- Janome Sewing Machine Co.

- Mesa Supplies (industrial machines)

- Feiya Group

- Jack Sewing Machine Co.

- Jiangsu Baima Co.

- Schiffli Machine Manufacturers

- Axiom America

Recent Developments

- In 2025, Tajima introduced a new line of AI-enhanced industrial multi-needle machines featuring predictive maintenance and cloud-based monitoring for large factories.

- In 2025, Brother launched upgraded domestic and semi-professional embroidery units targeting home creators and SME craft businesses.

- In early 2025, Barudan expanded its manufacturing facility to meet rising export demand from South Asia and Europe.