Electronic Pet Training Product Market Size

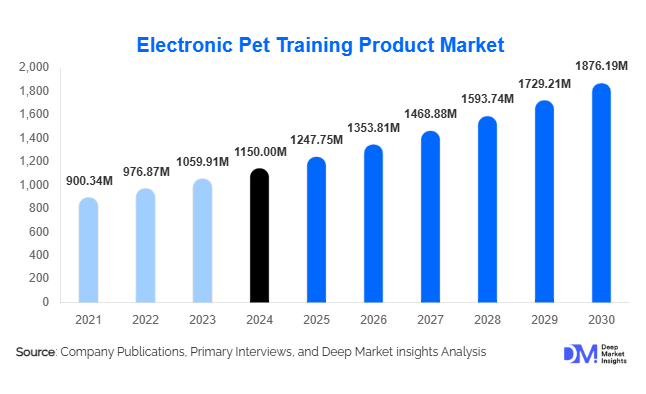

According to Deep Market Insights, the global electronic pet training product market size was valued at USD 1,150 million in 2024 and is projected to grow from USD 1,247.75 million in 2025 to reach USD 1,876.19 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is driven by rising global pet ownership, growing awareness of humane and effective training methods, and rapid adoption of smart, connected pet-training technologies across households and professional pet-care facilities.

Key Market Insights

- Electronic pet training devices are transitioning toward smart, app-enabled systems, integrating Wi-Fi, Bluetooth, and AI to track and improve pet behaviour.

- North America dominates global revenue share, supported by high pet expenditure and advanced retail distribution networks.

- Asia-Pacific is the fastest-growing region, driven by rising urban pet ownership and e-commerce expansion in China and India.

- Dog training devices represent the largest product segment, accounting for nearly 70% of the 2024 global market.

- Online retail channels lead distribution, contributing over 60% of total global sales due to convenience and wider product availability.

- Ethical and welfare-compliant training products are gaining preference amid increasing regulatory focus on humane animal handling.

Latest Market Trends

Smart and Connected Training Systems

Technological innovation is reshaping the electronic pet training landscape. Modern devices integrate smartphone apps, AI-driven feedback, and GPS tracking, allowing owners to monitor pet activity and training progress remotely. These smart collars and interactive trainers collect behavioural data and adapt training intensity accordingly. Manufacturers are launching Bluetooth and Wi-Fi-enabled devices that provide vibration, tone, or positive reinforcement cues, aligning with growing demand for humane solutions. App-integrated ecosystems offering training tutorials and analytics are transforming user experience and expanding product stickiness.

Shift Toward Humane and Positive Reinforcement Methods

Growing concern over the ethics of aversive training methods has accelerated the shift toward vibration-, sound-, and treat-based electronic trainers. Manufacturers are phasing out high-intensity static shock functions and repositioning products as “behaviour-management systems.” This trend aligns with animal-welfare legislation in Europe and increasing consumer awareness globally. Product certifications emphasising humane compliance and safety are becoming key differentiators, particularly for professional trainers and veterinary users.

Electronic Pet Training Product Market Drivers

Rising Global Pet Ownership

Pet ownership is expanding worldwide, particularly in urban and middle-income households. Dogs remain the primary pets requiring structured training, driving demand for effective and easy-to-use electronic training aids. Pet humanisation, treating pets as family members, has boosted expenditure on premium devices aimed at improving pet behaviour, safety, and lifestyle quality.

Technological Advancement and Digital Integration

Rapid integration of IoT, sensors, and AI is elevating product performance. Connected collars and automated training tools allow data-driven insights, real-time monitoring, and progress tracking through mobile applications. Consumers increasingly prefer smart devices that combine efficiency with convenience, leading to higher average selling prices (ASPs) and sustained revenue growth for manufacturers.

Expansion of Online Retail and Direct-to-Consumer Models

E-commerce platforms have become pivotal in shaping consumer purchasing behaviour. Online sales of pet training devices surpass offline channels due to broader product selection, transparent pricing, and detailed reviews. Direct-to-consumer brands leverage social media marketing and subscription programs for replacement accessories and software upgrades, expanding recurring revenue streams.

Market Restraints

Ethical and Regulatory Concerns

Controversy surrounding static shock collars and aversive training methods poses a regulatory challenge. Several European countries and U.S. states have restricted or scrutinised their sale. Manufacturers must adapt to humane alternatives or face limited market access. Negative consumer sentiment can also constrain growth unless product design emphasises safety and positive reinforcement.

High Product Cost and Limited Awareness in Developing Regions

Advanced smart collars and connected systems remain expensive for price-sensitive markets. Low awareness among new pet owners in emerging economies further limits penetration. Traditional training techniques and professional services often substitute for electronic devices, restraining near-term adoption in developing regions.

Electronic Pet Training Product Market Opportunities

Smart Technology and AI Integration

The next growth wave lies in AI-enabled collars that automatically interpret pet behaviour and adjust training cues. Integration with wearables and health monitoring systems will enable multi-functionality, training, tracking, and wellness combined. Companies that merge behavioural analytics with user-friendly mobile ecosystems can capture premium niches and build long-term user engagement.

Emerging Market Penetration

Asia-Pacific and Latin America offer untapped potential due to rapid pet adoption and increasing disposable incomes. Affordable models customised for local price points and supported by local-language mobile apps will open new customer segments. Partnerships with e-commerce giants and pet-care chains are helping brands accelerate reach in countries like India, China, and Brazil.

Rise of Humane, Welfare-Certified Devices

Global emphasis on animal welfare presents an opportunity to design and certify ethically compliant devices. Manufacturers investing in welfare testing, adjustable intensity levels, and reward-based systems can command premium positioning. Collaborations with veterinary associations and training schools further enhance product credibility and trust.

Product Type Insights

Electronic training collars dominate the product landscape, accounting for nearly 55% of global market share in 2024. Their popularity stems from versatility, affordability, and established familiarity among dog owners. Recent innovations are transforming collars into multifunctional smart devices integrating GPS tracking and behaviour analytics. Automated and interactive trainers are the fastest-growing sub-segment, expanding at a double-digit CAGR due to growing appeal among urban pet owners seeking hands-free solutions.

End-Use Insights

Individual pet owners form the core consumer base; however, professional training centres and animal shelters represent the fastest-growing end-use categories. These institutions increasingly deploy electronic aids to improve training efficiency and manage behavioural rehabilitation. The expansion of pet hospitality services, boarding, day-care, and grooming centres, is creating new commercial demand. Export-driven supply from Asian manufacturers to North America and Europe also underpins volume growth, leveraging cost advantages and OEM partnerships.

| By Product Type | By Technology | By Pet Type | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 35% share in 2024, driven by high pet ownership (over 65% of households), strong purchasing power, and advanced online retail ecosystems. The United States remains the largest national market, supported by innovation, premiumisation, and early adoption of smart collars. Canada contributes steady demand growth from tech-savvy pet owners.

Europe

Europe holds nearly a 30% share, led by Germany, the U.K., and France. The region’s consumers prioritise ethical and welfare-compliant products. Regulations restricting aversive collars are fostering innovation in vibration- and sound-based systems. The U.K. market demonstrates rapid migration toward app-integrated smart trainers and subscription-based upgrades.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing roughly a 25% share in 2024 with a forecast CAGR of 8–9%. China and India are witnessing explosive growth in urban pet adoption, supported by rising incomes and strong e-commerce networks. Japan and South Korea maintain mature markets favouring high-quality, tech-advanced devices, while Australia and New Zealand sustain demand for professional training equipment.

Latin America

Latin America represents around 5% market share, with Brazil and Mexico as the primary markets. Growth is steady but constrained by affordability issues. Increasing adoption of online shopping platforms and cross-border e-commerce is helping consumers access global brands more easily, gradually expanding the market base.

Middle East & Africa

The region accounts for another 5% of global revenue. GCC countries, particularly the UAE and Saudi Arabia, show growing enthusiasm for premium pet care products among affluent owners. South Africa leads the African sub-market, leveraging a mature pet industry and rising awareness of behaviour-management devices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electronic Pet Training Product Market

- PetSafe (Radio Systems Corporation)

- Dogtra

- SportDOG Brand

- Garmin Ltd.

- E-Collar Technologies Inc.

- PAC Collars

- D.T. Systems

- Petkit (China)

- Shenzhen WellTurn Technology Co., Ltd.

- Shenzhen Jianfeng Electronic Pet Products Co., Ltd.

- Alpha K9

- Canicom (Num’Axes Group)

- Petrainer

- iPets

- DogCare

Recent Developments

- June 2025 – PetSafe launched its new Smart Trainer Pro series, featuring AI-driven behavioural tracking and smartphone connectivity for personalised pet training programs.

- April 2025 – Garmin introduced an upgraded GPS-enabled dog training collar integrating health monitoring sensors and cloud-based activity reporting.

- February 2025 – Dogtra announced an expansion of its humane training product line, focusing on vibration-only and tone-based systems aligned with animal-welfare standards.