Electronic Insect Killers Market Size

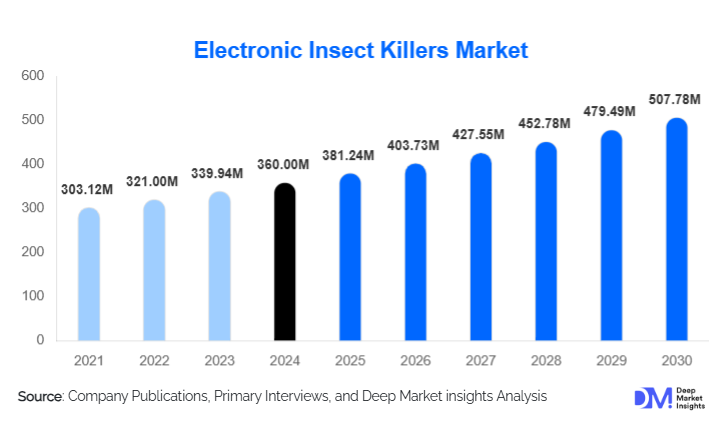

According to Deep Market Insights, the global electronic insect killers market size was valued at USD 360.00 million in 2024 and is projected to grow from USD 381.24 million in 2025 to reach USD 507.78 million by 2030, expanding at a CAGR of 5.9% during the forecast period (2025–2030). The growth of the electronic insect killers market is primarily driven by increasing consumer awareness regarding insect-borne diseases, rising adoption of chemical-free pest control solutions, and rapid technological advancements in smart and IoT-enabled devices.

Key Market Insights

- UV light-based insect killers dominate the market, attracting residential and commercial consumers due to high efficiency, affordability, and low maintenance requirements.

- Technological innovations such as IoT-enabled and hybrid systems are driving growth, offering remote monitoring, automation, and energy-efficient pest control solutions.

- North America and Europe dominate the market in 2024, due to stringent hygiene regulations, high disposable incomes, and awareness of eco-friendly pest control methods.

- Asia Pacific is the fastest-growing region, fueled by urbanization, industrialization, and rising demand from residential and commercial segments in India, China, and Southeast Asia.

- Online retail channels are expanding rapidly, providing consumers with easy access to smart and advanced EIK devices, enhancing market penetration.

- Government initiatives and public health programs promoting chemical-free insect control are creating significant opportunities for manufacturers to expand in commercial and industrial applications.

What are the latest trends in the electronic insect killers market?

Smart and IoT-Enabled Pest Control

Manufacturers are increasingly developing smart EIK devices equipped with IoT capabilities, remote monitoring, and automation. These devices allow users to track insect activity, optimize energy consumption, and receive real-time alerts via mobile applications. Smart insect killers are particularly gaining traction in commercial spaces such as restaurants, hotels, and warehouses, where efficiency and data-driven pest control are critical. Hybrid devices that combine UV light with electromagnetic or electric grid technologies are also emerging, offering more comprehensive solutions for consumers and industrial users alike.

Eco-Friendly and Chemical-Free Solutions

Global consumers are shifting away from chemical insecticides toward environmentally safe alternatives. Electronic insect killers, being chemical-free and energy-efficient, align with sustainable living trends. Residential consumers, food processing industries, and healthcare facilities are increasingly adopting these devices to comply with regulations, maintain hygiene, and reduce the environmental footprint associated with traditional pest control methods. Manufacturers are emphasizing green marketing, highlighting energy efficiency and non-toxic insect control benefits to attract health-conscious and environmentally aware customers.

What are the key drivers in the electronic insect killers market?

Growing Awareness of Insect-Borne Diseases

The increasing prevalence of mosquito-borne diseases such as dengue, malaria, and Zika virus is driving demand for effective insect control solutions. Both residential and commercial consumers are adopting electronic insect killers as a safer alternative to chemical pesticides. Heightened health consciousness post-pandemic has further accelerated the shift toward automated, efficient pest control solutions.

Technological Advancements in EIK Devices

Modern EIK devices now integrate advanced technologies such as UV-C light, electric zappers, electromagnetic systems, and smart sensors. IoT-enabled devices allow real-time monitoring, automation, and predictive maintenance, particularly in industrial and commercial settings. Such innovations increase the effectiveness, convenience, and energy efficiency of pest control, driving adoption globally.

Eco-Friendly Trends and Government Support

Governments, NGOs, and consumers are increasingly advocating for chemical-free pest control solutions. Public health programs promoting insect control in schools, hospitals, and urban public spaces are supporting market growth. Eco-friendly devices align with sustainability trends and energy efficiency standards, creating strong incentives for both residential and commercial adoption.

What are the restraints for the global market?

High Initial Cost of Advanced Devices

Smart and hybrid EIK devices have higher upfront costs compared to conventional insecticides or basic electronic devices. Price sensitivity in emerging economies and rural areas can limit adoption, particularly for residential users with budget constraints.

Limited Awareness in Certain Regions

Despite urban adoption, rural and semi-urban regions in Asia, Africa, and Latin America show low penetration due to a lack of awareness and limited access to advanced devices. Manufacturers must invest in awareness campaigns and affordable product solutions to overcome this barrier.

What are the key opportunities in the electronic insect killers market?

Emerging Regional Demand in Asia Pacific and LATAM

Rapid urbanization, growing middle-class income, and heightened awareness of insect-borne diseases in countries like India, China, Brazil, and Mexico are driving demand for both residential and commercial EIK devices. Localized products that meet regional energy standards and user preferences can capture high-growth potential in these emerging markets.

Integration of Smart and IoT Technologies

IoT-enabled EIK devices with remote monitoring, data analytics, and automation capabilities present new growth avenues. Smart devices allow predictive maintenance, real-time alerts, and energy optimization, making them attractive for commercial establishments and high-end residential consumers seeking efficiency and convenience.

Government Initiatives and Public Health Programs

Several governments are actively promoting chemical-free and sustainable pest control through grants, subsidies, and public-private collaborations. Public health campaigns and sanitation drives create opportunities for manufacturers to supply hospitals, schools, and urban spaces with advanced EIK solutions, further expanding market reach.

Product Type Insights

UV light insect killers dominate the market, accounting for 42% of the 2024 market. Their efficiency, affordability, and low maintenance requirements make them popular among residential and commercial consumers. Electric zappers and hybrid systems are gaining traction in industrial and large commercial applications due to their high coverage and instant insect elimination capabilities. Smart, IoT-enabled devices are the fastest-growing segment, offering automation, monitoring, and energy-saving benefits.

Application Insights

Residential applications represent 40% of the market in 2024, driven by consumer preference for chemical-free pest control and compact device designs. Commercial applications, including restaurants, hotels, and offices, contribute significantly due to hygiene compliance requirements. Industrial applications, particularly in food processing, warehousing, and pharmaceuticals, are emerging as high-value segments, adopting large-scale EIK systems for operational safety and regulatory adherence.

Distribution Channel Insights

Online retail channels hold 35% of the 2024 market, fueled by e-commerce penetration, ease of comparison, and availability of advanced devices. Offline retail, including hypermarkets, specialty stores, and B2B supply chains, remains significant. Direct B2B sales to industrial and commercial clients are expanding as manufacturers offer large-scale customized solutions and maintenance services.

| By Product Type | By Technology | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 30% of the global market in 2024, driven by high disposable incomes, stringent hygiene regulations, and early adoption of advanced EIK technologies. The U.S. and Canada lead demand, particularly in residential and commercial segments, with strong interest in smart and hybrid devices.

Europe

Europe accounts for 28% of the market in 2024, led by Germany, France, and the U.K. High awareness of insect-borne diseases, eco-friendly trends, and regulatory compliance are major growth factors. Smart and IoT-enabled devices are increasingly preferred in commercial and industrial applications.

Asia Pacific

Asia Pacific is the fastest-growing region, with strong demand from China, India, Japan, and Southeast Asia. Urbanization, industrialization, and rising disposable incomes are driving adoption in residential and commercial segments. China leads demand for large-scale industrial solutions, while India is driving residential and mid-range device sales.

Latin America

Latin America is emerging steadily, particularly in Brazil, Mexico, and Argentina, with growth driven by affluent urban consumers and increasing awareness of insect-borne diseases. Demand is mainly for residential and small commercial devices.

Middle East & Africa

MEA represents both a source and consumption region, with high adoption in the UAE, Saudi Arabia, and South Africa. Public health initiatives, luxury commercial applications, and urban residential adoption are supporting market growth. Intra-regional trade and tourism-related demand are additional growth drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|