Electronic Counting Machine Market Size

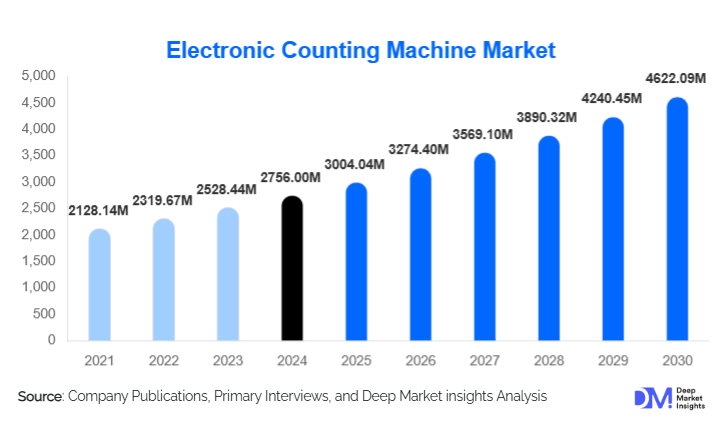

According to Deep Market Insights, the global electronic counting machine market size was valued at USD 2756.00 million in 2024 and is projected to grow from USD 3004.04 million in 2025 to reach USD 4622.09 million by 2030, expanding at a CAGR of 9.00% during the forecast period (2025–2030). Market growth is driven by rising automation across banking, retail, manufacturing, and pharmaceutical sectors, along with increasing adoption of AI-powered counting systems that enhance accuracy, reduce operational errors, and integrate seamlessly with enterprise workflows.

Key Market Insights

- Automation in cash handling and inventory processes is accelerating the adoption of electronic counting machines globally across banks, retail chains, and logistics operations.

- AI-based counterfeit detection and vision-enabled counting systems are gaining prominence, reshaping how organizations perform high-volume counting tasks.

- Asia-Pacific is the fastest-growing market due to banking expansion, retail modernization, and large-scale manufacturing adoption.

- North America dominates the market with strong technological adoption and early integration of enterprise-connected counting systems.

- Industrial part-counting machines are emerging as a high-growth segment, propelled by Industry 4.0 transformation and smart factory deployments.

- Pharmaceutical tablet and capsule counters are expanding rapidly, driven by stringent regulatory requirements for production precision.

- Shift toward portable and connected counting devices is creating new opportunities in logistics, field operations, and decentralized cash collection.

What are the latest trends in the electronic counting machine market?

AI-Enabled Counting and Fraud Detection

AI-powered counting systems are transforming traditional cash and part-counting workflows. Machine learning algorithms enhance counterfeit detection accuracy, automatically identify damaged currency, and optimize counting of irregularly shaped items in manufacturing setups. These intelligent systems generate real-time analytics, audit logs, and predictive maintenance insights, significantly boosting operational transparency. The integration of AI has also enabled multi-currency recognition, dynamic calibration, and automated error reporting. As financial institutions and manufacturing plants prioritize data-driven decision-making, AI-enabled counting machines are becoming the technological benchmark for next-generation automation.

Smart Connectivity and Integrated Enterprise Systems

Modern counting machines are increasingly equipped with IoT, Wi-Fi, and cloud connectivity, allowing seamless integration with ERP, POS, MES, and accounting software. This shift toward connected counting environments enables centralized device management, remote diagnostics, automated data backup, and audit compliance monitoring. Retailers, banks, and pharmaceutical manufacturers are leveraging connected counters to standardize operations across distributed networks. Mobile apps now allow managers to monitor counting activities in real time, while enterprise dashboards provide insights into cash cycles, inventory accuracy, and error rates. This connectivity-driven transformation supports the broader trend of digital automation across industries.

What are the key drivers in the electronic counting machine market?

Growing Need for High-Speed, Accurate Cash Handling

Banks, retail chains, casinos, and transportation hubs rely heavily on high-volume cash handling, where accuracy and speed are critical. The shift toward self-checkout systems and centralized cash management has amplified the demand for reliable counting machines capable of supporting multi-denomination, multi-currency operations. Advanced sensors, batch processing, and sorting features reduce reconciliation time and minimize losses from human errors. This expanding operational complexity in cash ecosystems is a major growth driver for the market.

Industrial Automation and Smart Manufacturing Growth

Manufacturers across electronics, automotive, aerospace, and consumer goods industries are deploying part-counting machines to replace manual counting, reduce bottlenecks, and enhance production accuracy. Automated counting supports real-time inventory tracking, improves quality control, and facilitates just-in-time manufacturing. As global industries transition toward Industry 4.0, demand for smart counting solutions, integrated with robotics, conveyor systems, and vision-based inspection, is accelerating rapidly.

What are the restraints for the global market?

High Initial Investment for Advanced Counting Systems

AI-enabled and networked counting machines command premium prices due to sophisticated sensors, embedded software, and advanced verification features. For small retail stores, small-scale manufacturers, and microfinance institutions, these upfront costs pose a significant adoption barrier. Additionally, integration with enterprise systems often requires additional investment in IT infrastructure and trained personnel, increasing the total cost of ownership.

Shift Toward Digital Payments in Developed Regions

Increasing penetration of mobile payments, contactless transactions, and digital wallets reduces the volume of physical cash handling in some economies. As a result, demand for currency-focused counting machines may experience gradual stagnation in advanced markets. While industrial and pharmaceutical counting devices remain unaffected, reduced cash circulation acts as a mild restraint for the overall market.

What are the key opportunities in the electronic counting machine industry?

AI-Supported Smart Counter Ecosystems

The integration of AI and machine vision presents a transformative opportunity for manufacturers. Smart counters capable of automated anomaly detection, self-calibration, and real-time reporting can dramatically enhance productivity and transparency. These systems also open recurring revenue channels through software subscriptions, analytics dashboards, and cloud-based monitoring services. Enterprises are increasingly demanding such intelligent solutions to meet internal audit, compliance, and operational efficiency goals.

Expansion in Emerging Markets Through Banking Modernization

Countries in the Asia-Pacific, Africa, and Latin America are undergoing rapid financial inclusion and retail digitization. New bank branches, microfinance institutions, and organized retail networks require efficient counting systems. Government-backed modernization programs, such as India’s Digital Banking initiatives and Africa’s rapid POS expansion, are creating substantial growth opportunities. Localized, rugged, and cost-effective counting products tailored to these regions represent an untapped market for global manufacturers.

Product Type Insights

Currency counting machines dominate the market, accounting for approximately 35% of the global revenue in 2024. Their strong presence stems from widespread adoption in banks, retail stores, casinos, and transportation hubs where high-volume cash handling is routine. Part and component counting machines serve industrial applications and are growing rapidly as smart factories become mainstream. Pharmaceutical tablet and capsule counters are expanding due to FDA and EMA requirements for precision dosage and batch integrity. Specialized RFID and vision-based counting systems cater to aerospace, electronics, and logistics sectors that require high accuracy and traceability.

Application Insights

Banking and financial services represent the largest application segment, followed by retail and supermarket chains. Manufacturing applications are rising sharply due to the adoption of automated part-counting systems within assembly lines. Pharmaceutical applications are expanding as companies integrate automated counters into packaging and quality assurance workflows. Logistics and warehousing increasingly use smart counting systems to accelerate SKU verification, reduce shrinkage, and support e-commerce fulfillment demands.

Distribution Channel Insights

Direct OEM sales dominate the market for high-value, enterprise-grade counting systems, especially in banking and industrial sectors. Authorized distributors and value-added resellers play a crucial role in serving retail, SMEs, and pharmaceutical firms. Online sales channels are growing quickly, particularly for portable and mid-tier counting devices used in small businesses and decentralized operations. Integrated service contracts and leasing models are becoming popular, allowing organizations to adopt advanced systems with reduced upfront costs.

End-User Insights

Banks, retail chains, pharmacies, manufacturing units, casinos, and logistics centers constitute the primary end-use sectors. Manufacturing and pharmaceuticals are the fastest-growing segments due to automation and compliance-driven requirements. Government agencies, research institutions, and educational laboratories represent emerging users of precision counting systems. As global supply chains expand, demand for counting machines in export-driven industries continues to rise.

| By Product Type | By Application | By Technology | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 32% share in 2024. Strong adoption of AI-powered counters, advanced banking systems, and widespread retail automation supports regional dominance. The U.S. remains the largest market, driven by large enterprises, casinos, and logistics centers, while Canada exhibits stable demand through retail expansion and banking modernization.

Europe

Europe holds around 22% of the market, driven by strict currency authentication requirements and high adoption in pharmaceutical and precision manufacturing industries. Germany, the U.K., France, and Italy are key contributors, with strong uptake of industrial counting technologies aligned with EU automation initiatives.

Asia-Pacific

Accounting for 29% of global demand, the Asia-Pacific is the fastest-growing region. China and India lead growth through large-scale manufacturing, banking expansion, and retail digitization. Japan and South Korea drive demand for advanced industrial counters integrated with robotics and smart factory architecture.

Latin America

Brazil, Mexico, and Argentina represent emerging markets, where retail chain expansion and modernization of banking and cash management systems are driving demand. Industrial applications are gaining traction as regional manufacturing investments increase.

Middle East & Africa

MEA demand is rising due to financial sector development, casino growth, and retail modernization. The UAE and Saudi Arabia are major markets in the Middle East, while South Africa leads consumption in Africa with strong retail and banking penetration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electronic Counting Machine Market

- Toshiba Infrastructure Systems & Solutions Corporation

- Giesecke+Devrient GmbH

- Godrej Security Solutions

- Glory Ltd.

- Cummins Allison Corp.

- KisanKraft

- Royal Sovereign

- Xerox Corporation (Cash Handling Solutions)

- Hitachi Industrial Equipment

- De La Rue plc

- CAS Corporation

- Koyo Electronics

- DRS Technologies

- Fujitsu Frontech

- Glory Global Solutions

Recent Developments

- In 2025, Toshiba introduced an AI-enhanced multi-currency counting system for banks and casinos, offering advanced anomaly detection and cloud integration.

- In early 2025, Giesecke+Devrient expanded its smart counting solutions portfolio with enterprise connectivity and enhanced counterfeit authentication algorithms.

- In 2024, Glory Ltd. launched a next-generation industrial part-counting system integrated with robotic assembly lines for electronics manufacturers.