Electrolysis Hair Removal Market Size

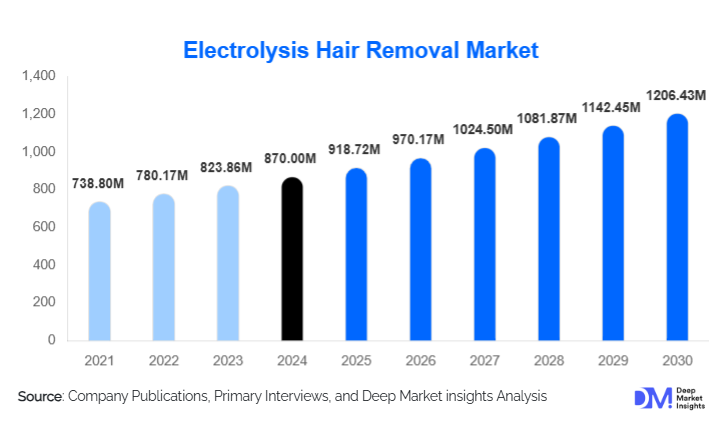

According to Deep Market Insights, the global electrolysis hair removal market size was valued at USD 870.00 million in 2024 and is projected to grow from USD 918.72 million in 2025 to reach USD 1,206.43 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). Market expansion is being driven by sustained demand for truly permanent hair removal solutions, increased clinical adoption in gender-affirming and pre-surgical pathways, rising medspa penetration, and product innovation that shortens treatment time and improves operator ergonomics.

Key Market Insights

- Electrolysis remains the only widely recognized permanent hair removal method, making it the treatment of choice for white/grey hair and small, precision areas where lasers are less effective.

- Service revenue dominates the market; a large share of market value is derived from per-session and packaged services delivered by licensed electrologists and dermatology clinics rather than device sales alone.

- Thermolysis-led systems account for the largest share of device modality revenue due to faster treatment cycles and greater patient comfort.

- North America is the largest regional market by revenue (leading clinic density, high per-capita aesthetic spend), while Asia Pacific is the fastest-growing region in percentage terms.

- Consumables & recurring revenue models (single-use probes, gels, service contracts) are an increasing focus for OEMs to enhance lifetime customer value.

- Technology integration (semi-automation, sensors, digital interfaces) is reshaping device preferences among clinics that prioritize throughput and predictable outcomes.

What are the latest trends in the electrolysis hair removal market?

Automation and Digitization Shortening Treatment Time

Manufacturers are integrating pre-set energy profiles, skin-sensing feedback, and semi-automated probe control to reduce operator burden and shorten the time-per-treatment. These improvements make electrolysis financially more attractive to higher-throughput clinics and medspa chains by increasing the number of treatable follicles per hour. Software updates, device connectivity, and training modules bundled with equipment are becoming differentiators in device procurement decisions.

Clinical Integration and Specialist Referrals

Electrolysis is increasingly embedded into clinical pathways, particularly gender-affirming care and pre-surgical hair removal, where definitive, permanent hair removal is required. Formal referral relationships between hospitals, surgical centers, and certified electrologists have emerged in many markets, which creates steady, higher-value demand and improves predictability for device and consumable procurement.

What are the key drivers in the electrolysis hair removal market?

Clinical Differentiation: Permanent Results

Because electrolysis destroys hair growth cells directly, it is often the only clinically recommended option for permanent removal of light-colored or fine hair. This unique clinical positioning drives consistent baseline demand even where laser and IPL are dominant for large-area treatments.

Growing Aesthetic and Specialized Medical Demand

Rising disposable incomes, increased acceptance of cosmetic procedures among men, and the growth of gender-affirming treatments have widened the addressable population. This fuels medspa expansion and hospital-clinic partnerships that purchase advanced devices and opt for recurring consumable supplies.

What are the restraints for the global market?

Treatment Duration and Labor Intensity

Electrolysis is inherently time-consuming because each follicle is treated individually. For large surface areas, laser/IPL remains more time- and cost-efficient. The labor-intensive nature of electrolysis limits adoption in high-volume chains unless meaningful productivity gains are achieved.

Fragmented Training and Variable Quality

Wide variations in practitioner training and certification across countries can lead to inconsistent outcomes and occasional adverse events, which undermine consumer confidence. Lack of standardized certification and quality assurance is a constraint on wider, faster market expansion.

What are the key opportunities in the electrolysis hair removal industry?

High-value Clinical Pathways (Gender-affirming & Pre-surgical)

Formalizing electrolysis within hospital and surgical pre-op protocols creates predictable, higher-margin demand. Clinics and OEMs that partner with surgical centers and gender-medicine programs can secure bulk procurement contracts and referral pipelines. Advocacy and evidence-generation (clinical outcome studies) can help establish electrolysis as a reimbursable or partially reimbursable care component in select healthcare systems.

Automation + Consumable Subscription Models

Introducing semi-automated probe control and sensor-driven settings increases throughput and reduces training time. When combined with consumable subscription models (single-use probes, gels, sterilization supplies), OEMs can build recurring revenue streams and higher customer retention. This shift from one-time device sales to software + consumable monetization is attractive to investors and increases lifetime customer value.

Regional Channel Expansion in APAC & LATAM

Asia Pacific and Latin America represent high-percentage-growth markets driven by rising middle-class incomes, urbanization, and growing acceptance of professional aesthetics. Localized mid-tier devices (price-performance optimized) and robust distributor/e-commerce channels will allow OEMs and newcomers to scale faster in these regions. Partnerships with local training academies reduce the barrier of operator technique and improve treatment quality.

Product Type Insights

The electrolysis market is segmented by product and modality. Thermolysis remains the dominant product type for professional settings because of faster pulse delivery and improved patient comfort; clinics prefer devices that maximize throughput. Galvanic systems remain relevant for specific hair conditions and older modalities; they find niche use where chemical reaction-based follicle destruction is preferred. Blend systems (combining thermolysis and galvanic) address a broader range of hair types and are popular in clinics offering a full spectrum of solutions. Home/Consumer devices are growing but are limited in efficacy versus professional units; they primarily address small, price-sensitive use cases.

Application Insights

Electrolysis is most widely applied to facial hair (upper lip, chin, cheeks, eyebrow shaping), accounting for the largest single-application revenue share because of patient preference for permanence in visible areas. Body hair treatments (underarms, bikini, chest, back) are also offered, but for large areas, lasers remain more economical. Emerging applications include gender-affirming hair removal and pre-surgical hair removal for reconstructive procedures, both higher-value clinical use cases. Cosmetic micro-shaping (brows, shaping beards) is a repeat-revenue niche that sustains frequent clinic visits.

Distribution Channel Insights

Professional devices and consumables sell primarily through direct OEM sales and distributor networks, supplying clinics and medspas. Online channels and D2C e-commerce dominate the home device segment. Increasingly, OEMs offer bundled training and after-sales service through certified distributor partners to reduce adoption friction. Consumable subscription services and inventory-management programs are a growing channel strategy for recurring revenue.

End-User Insights

The largest end-users are licensed electrologists and dermatology/plastic surgery clinics, who account for the majority of professional service revenue. Medspas and aesthetic chains are rapidly expanding and represent a fast-growing buyer segment for mid- to premium-tier devices. Independent electrologists and beauty studios form a fragmented but stable base of purchasers that favor mid-tier systems and cost-effective consumables. The home user segment remains small but shows steady growth in urban markets driven by online retail availability.

Patient Age Group Insights

Adults aged 25–45 years represent the largest demand group, combining disposable income with aesthetic priorities for facial and small-area treatments. Younger adults (18–24) drive interest in home devices and shorter-course services, while older adults (46–65+) represent a stable cohort for clinical adopters seeking long-term solutions. Demand patterns vary by region and cultural grooming norms.

| By Product Type | By Application | By Distribution Channel | By End-User | By Technology / Modality |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market (approximately 43% of global revenue in 2024), driven by high per-capita aesthetic spend, extensive medspa and dermatology networks, and patient willingness to pay for permanent outcomes. The United States leads in device purchases, clinics per capita, and high utilization of premium thermolysis systems. Canada contributes through both practitioner networks and some OEM activity.

Europe

Europe exhibits mature demand with stable growth. The UK, Germany, and France are leading markets for premium devices and certified clinicians. Regulatory standards and patient safety expectations favor established OEMs that provide training and after-sales service, and consumers show a strong preference for certified practitioners.

Asia-Pacific

Asia Pacific is the fastest-growing region in percentage terms. Rapid urbanization, increasing disposable income in China and India, and expanding medspa chains in South Korea and Australia are driving device and service adoption. Local OEMs offering competitively priced mid-tier systems help accelerate penetration in price-sensitive clinics.

Latin America

Brazil leads in Latin America due to a large beauty market and cultural acceptance of aesthetic procedures. Adoption is steadier in Argentina and Mexico. Economic volatility can affect discretionary spend, but long-term demand fundamentals remain favorable.

Middle East & Africa

Gulf countries (UAE, Saudi Arabia) represent premium pockets driven by high-income populations and luxury clinic openings. South Africa is a regional hub for medical aesthetics in sub-Saharan Africa, with a mix of domestic and international device purchases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electrolysis Hair Removal Market

- Dectro International (Apilus)

- Ballet Technologies Ltd.

- Lumenis

- Silhouet-Tone

- R.A. Fischer Co.

- Sterex

- Kree International

- Genco (regional OEM)

- Epibos / regional device manufacturers

- Epilady (consumer devices)

- Iluminage (adjacent cosmetic devices)

- Panasonic (consumer grooming device segment)

- Silk’n (home device brands)

- Tria Beauty (home device innovators)

- Various regional specialist OEMs and medical-device producers

Recent Developments

- 2024–2025: Several OEMs introduced semi-automated thermolysis devices with improved probe ergonomics and preset programs to reduce operator learning curves and treatment time.

- 2024–2025: A growing number of clinics and medspa chains formalized referral relationships with surgical centers to provide pre-surgical hair removal and gender-affirming care, improving order visibility for professional devices.

- 2024–2025: Manufacturers expanded consumable subscription offerings (probe replenishment and maintenance contracts) to increase recurring revenues and strengthen customer retention.