Electrical Protection Glove Market Size

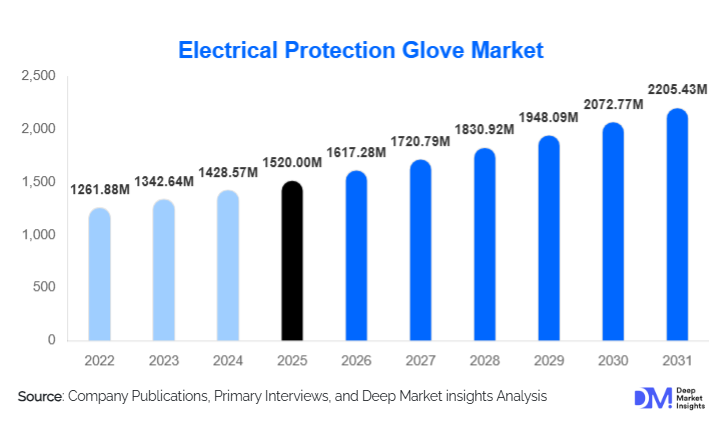

According to Deep Market Insights, the global electrical protection glove market size was valued at USD 1,520.00 million in 2025 and is projected to grow from USD 1,617.28 million in 2026 to reach USD 2,205.43 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). Market growth is primarily driven by increasing investments in power transmission and distribution infrastructure, stricter enforcement of occupational safety regulations, and rising demand for certified personal protective equipment across utilities, construction, and industrial maintenance sectors.

Key Market Insights

- Insulating electrical gloves remain the dominant product category, accounting for nearly half of global revenue due to mandatory usage in live electrical operations.

- Medium-voltage gloves (1–17 kV) represent the largest voltage segment, reflecting widespread use in utilities, substations, and industrial facilities.

- North America leads global demand, supported by grid modernization programs and strict workplace safety compliance.

- Asia-Pacific is the fastest-growing region, driven by large-scale electrification, renewable energy projects, and infrastructure expansion.

- Utilities and power generation account for the largest end-use share, supported by recurring maintenance and replacement cycles.

- Technological advancements in materials, including enhanced dielectric strength and ergonomic multi-layer designs, are improving durability and worker comfort.

What are the latest trends in the electrical protection glove market?

Rising Adoption of Arc-Flash and High-Performance Gloves

One of the most prominent trends in the electrical protection glove market is the growing adoption of arc-flash-rated and high-performance gloves. Utilities and industrial operators are increasingly prioritizing gloves that provide combined protection against electrical shock, thermal hazards, and mechanical risks. This trend is being reinforced by updated safety standards and heightened awareness of arc-flash incidents, particularly in high-voltage environments. Manufacturers are responding by introducing gloves with layered insulation, improved cut resistance, and extended service life, enabling operators to reduce injury risks while optimizing long-term procurement costs.

Shift Toward Certified and Compliance-Driven Procurement

Procurement practices are increasingly shifting toward certified, standards-compliant electrical gloves. Large utilities, EPC contractors, and industrial firms are moving away from low-cost, uncertified products in favor of gloves that meet international voltage and performance standards. This trend is strengthening demand for premium products and increasing average selling prices across developed markets. In emerging economies, compliance-driven procurement is accelerating as governments tighten enforcement of workplace safety regulations.

What are the key drivers in the electrical protection glove market?

Expansion of Power Transmission and Distribution Infrastructure

Global investments in power transmission and distribution networks are a major growth driver for the electrical protection glove market. Aging grids in developed economies and rapid electrification in developing regions are creating sustained demand for live-line maintenance and repair activities. Each new substation, transmission line, or distribution upgrade directly increases the need for voltage-rated protective gloves, supporting long-term market growth.

Strengthening Occupational Safety Regulations

Regulatory bodies worldwide are enforcing stricter workplace safety standards, particularly for electrical work. Mandatory use of certified electrical gloves has become a core compliance requirement across utilities, construction, oil & gas, and heavy manufacturing. This regulatory environment is driving consistent replacement demand and encouraging adoption of higher-quality gloves with improved protection characteristics.

What are the restraints for the global market?

High Cost of Advanced and Certified Gloves

Advanced electrical protection gloves, particularly those designed for high-voltage and arc-flash applications, carry significantly higher costs than basic PPE. In price-sensitive markets, especially among small contractors, this can limit adoption or lead to extended usage beyond recommended replacement cycles, potentially slowing overall market penetration.

Volatility in Raw Material Prices

Fluctuations in natural rubber and synthetic polymer prices pose challenges for manufacturers. Rising input costs can compress margins or result in higher end-user prices, which may temporarily restrain demand in cost-sensitive regions.

What are the key opportunities in the electrical protection glove industry?

Grid Modernization and Renewable Energy Expansion

Large-scale grid modernization programs and rapid expansion of renewable energy installations present a significant opportunity for the electrical protection glove market. Wind farms, solar parks, and smart grid systems require frequent maintenance under energized conditions, driving demand for high-voltage and arc-flash-rated gloves. Manufacturers that tailor products for renewable energy technicians can capture a fast-growing niche.

Technological Differentiation and Smart PPE Integration

Innovation in materials and smart safety integration offers another key opportunity. Gloves incorporating improved ergonomics, longer inspection cycles, and compatibility with digital safety tracking systems can differentiate suppliers in competitive markets. Early adoption of RFID-enabled inspection management and predictive replacement solutions can enhance value propositions for large utility customers.

Product Type Insights

Insulating electrical gloves dominate the market, accounting for approximately 46% of global revenue in 2024, as they are mandatory for live electrical work across voltage classes. Arc-flash protection gloves are the fastest-growing product type, driven by rising awareness of thermal hazards in high-energy environments. Mechanical and cut-resistant electrical gloves maintain steady demand, particularly in industrial maintenance and construction, where combined electrical and physical protection is required.

Material Type Insights

Natural rubber gloves represent the largest material segment, holding around 41% of the market, due to their superior dielectric strength and flexibility. Synthetic rubber gloves, including EPDM and neoprene variants, are gaining traction for their enhanced durability and chemical resistance. Leather-composite gloves are widely used as outer protectors, particularly in heavy-duty industrial applications.

Voltage Rating Insights

Medium-voltage gloves (1–17 kV) account for nearly 38% of global demand, reflecting extensive use in utilities, substations, and industrial electrical systems. Low-voltage gloves remain essential for construction and light industrial applications, while high-voltage gloves serve specialized transmission and live-line maintenance operations.

End-Use Insights

Power generation and utilities dominate end-use demand, contributing approximately 44% of global market revenue in 2024. Construction and infrastructure projects represent a significant secondary segment, supported by urbanization and industrial expansion. Renewable energy is emerging as a high-growth end-use segment, expanding at double-digit rates as solar and wind installations increase globally.

Distribution Channel Insights

Direct industrial sales account for about 52% of total market revenue, as utilities and large industrial operators prefer long-term supply contracts with certified manufacturers. Safety equipment distributors play a critical role in serving small and mid-sized enterprises, while digital procurement platforms are gradually gaining adoption for standardized PPE purchases.

| By Product Type | By Material Type | By Voltage Rating | By End-Use Industry | Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of global market share, led primarily by the United States. Strong regulatory enforcement related to worker safety, aging power transmission and distribution infrastructure, and frequent replacement cycles for protective equipment continue to support steady demand. Utility companies, industrial operators, and contractors increasingly favor premium electrical protection gloves to meet compliance requirements and reduce workplace risk.

Europe

Europe represents around 22% of global demand, driven by stringent occupational safety regulations and ongoing investments in grid modernization. Countries such as Germany, the U.K., and France maintain consistent demand through utility upgrades, renewable energy integration, and strict enforcement of personal protective equipment standards across industrial and construction sectors.

Asia-Pacific

Asia-Pacific holds nearly 29% of global revenue and is the fastest-growing regional market. Rapid industrialization, expanding power generation capacity, and large-scale electrification programs in China and India are key growth drivers. Rising investments in renewable energy, transmission infrastructure, and manufacturing activity continue to accelerate demand for certified electrical safety gloves across utilities and industrial operations.

Latin America

Latin America contributes roughly 8% of global demand, with Brazil and Mexico leading regional consumption. Growth is supported by power infrastructure expansion, industrial development, and increasing adoption of formal safety practices within utilities, mining, and heavy manufacturing sectors.

Middle East & Africa

The Middle East & Africa region accounts for about 9% of the market, driven by large-scale power projects and high-risk industrial operations. Demand is concentrated in Saudi Arabia, the UAE, and South Africa, where oil & gas activities, utilities expansion, and infrastructure investments require consistent use of high-voltage electrical protection equipment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The electrical protection glove market is moderately consolidated. The top five manufacturers collectively account for approximately 41% of global market share, supported by broad certification portfolios, strong distribution networks, and long-term utility contracts.

Key Players in the Electrical Protection Glove Market

- Ansell Limited

- Honeywell International Inc.

- 3M Company

- MCR Safety

- Catu Group

- Dipped Products PLC

- Regeltex

- Derancourt

- Yotsugi Co., Ltd.

- Boddingtons Electrical

- Saf-T-Gard International

- Hubix

- PIP Global

- Cementex

- Other regional certified manufacturers