Electric Hair Brush Market Size

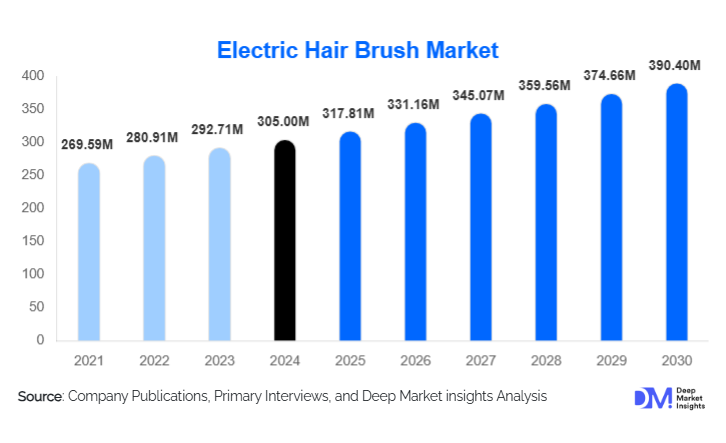

According to Deep Market Insights, the global electric hair brush market size was valued at USD 305.00 million in 2024 and is projected to grow from USD 317.81 million in 2025 to reach USD 390.40 million by 2030, expanding at a CAGR of 4.2% during the forecast period (2025–2030). The electric hair brush market growth is primarily driven by rising consumer focus on personal grooming, increased adoption of at-home styling solutions, and rapid expansion of e-commerce channels, which have significantly boosted global accessibility to advanced hair-styling tools.

Key Market Insights

- Flat/straightening electric brushes dominate globally, driven by consumer preference for convenient, quick hairstyling solutions.

- E-commerce continues to expand its share as a preferred buying channel, supported by product variety, influencer marketing, and transparent customer reviews.

- Asia-Pacific leads global demand, powered by a rising middle class, urbanization, and increasing grooming awareness.

- Mid-range electric brushes remain the highest-volume tier, offering strong value and advanced features at accessible prices.

- Technological innovations such as ionic and infrared heating are reshaping product differentiation and driving premium adoption.

- Household female users account for the majority of purchases, making this the largest and fastest-growing end-use segment.

What are the latest trends in the electric hair brush market?

Technology-Integrated Hair Styling Gaining Rapid Traction

Manufacturers are increasingly integrating advanced technologies such as ionic heating, ceramic plates, and infrared heat systems to improve hair protection and styling efficiency. These features reduce frizz, add shine, and minimize heat damage, appealing to users seeking salon-quality results at home. Smart temperature sensors, auto shut-off safety mechanisms, and ergonomic lightweight designs are further improving the user experience. Some upcoming models integrate app-based controls and usage analytics, appealing strongly to tech-savvy consumers. The trend toward multifunctional styling, combining detangling, straightening, and volumizing, continues to drive product upgrades and repeat purchases.

Rise of At-Home Beauty and Self-Care Lifestyles

A strong global shift toward at-home grooming and styling routines has accelerated electric hair brush adoption. Social-media-driven beauty trends, remote working lifestyles, and increased preference for DIY styling tools are boosting demand for user-friendly electric brushes. Consumers increasingly seek products that offer quick styling with minimal effort, especially in urban regions with busy professional lifestyles. Influencer-driven marketing, online tutorials, and beauty content creation have further made electric brushes a mainstream part of daily grooming. This trend is expected to remain a key long-term growth pillar.

What are the key drivers in the electric hair brush market?

Growing Emphasis on Personal Grooming & Lifestyle Enhancement

Global consumers, especially women and younger urban demographics, are increasingly investing in personal grooming products that offer convenience and professional-level styling. As beauty consciousness grows, electric hair brushes provide a versatile and time-saving solution compared to traditional manual brushes or salon visits. This lifestyle-driven demand continues to elevate market penetration across both developed and emerging economies.

Product Innovation and Expanding Feature Set

Continuous innovation in ionic technology, ceramic plates, precision temperature control, and fast-heating mechanisms has elevated the functional appeal of electric brushes. These technologies reduce hair damage, improve styling performance, and cater to specialized needs such as frizzy, curly, or coarse hair. Manufacturers investing in ergonomic design, cordless models, travel-friendly devices, and multi-use features are driving higher adoption among sophisticated consumers.

Strong Growth of Online Retail & Social Commerce

E-commerce platforms have become crucial for market growth, offering easy comparison, customer reviews, influencer-driven content, and wider availability of global brands. Online sales now account for roughly 30–35% of the global market. Social-commerce ecosystems on Instagram, TikTok, and YouTube have further helped beauty-tech brands build massive visibility and trust among young consumers, boosting product sales globally.

What are the restraints for the global market?

High Price Sensitivity in Emerging Markets

Premium electric hair brushes using ionic or infrared technology can be expensive, particularly in price-sensitive economies across Africa, Latin America, and parts of Asia. In these regions, consumers still rely heavily on manual brushes or low-cost appliances. This price barrier restricts the deeper penetration of premium and mid-range segments, forcing manufacturers to maintain tight cost controls.

Safety Concerns & Competition from Alternative Styling Tools

Heat-related safety concerns, such as possible hair damage, scalp sensitivity, or improper temperature usage, continue to limit certain consumer groups from adopting electric brushes. Also, traditional hair straighteners, curling irons, and blow-dryers remain widely used alternatives. This competitive overlap challenges market expansion, especially among consumers seeking high-performance styling tools.

What are the key opportunities in the electric hair brush industry?

Untapped Demand in Emerging Markets

Asia-Pacific, Middle East & Africa, and Latin America present huge room for penetration as disposable incomes rise and beauty-conscious consumer segments expand. Manufacturers offering localized designs, lower-priced variants, and region-specific marketing can capture millions of first-time electric brush users. E-commerce growth across India, Indonesia, Vietnam, and Nigeria is opening new distribution pathways for global brands.

Advanced Technology Integration & Smart Styling Devices

Premium electric brushes integrating AI-based heat control, Bluetooth connectivity, smart usage logs, and adaptive temperature response represent a major future growth opportunity. Consumers are increasingly open to paying premium prices for devices that safeguard hair from heat damage while delivering professional results. Such innovation-led differentiation will drive brand loyalty and higher-margin sales.

Expansion of At-home Beauty & DIY Grooming Kits

The self-care movement has created strong demand for hair-styling bundles, travel-friendly grooming kits, and multifunctional devices. Manufacturers can tap into this segment by offering curated product kits, tutorials, and influencer-led styling guides. This trend opens new opportunities for cross-selling and subscription-based grooming packages.

Product Type Insights

Flat/straightening electric brushes dominate the market with approximately 45–50% share of the global 2024 value. Their popularity stems from the global consumer preference for sleek, straight hair and the ability to achieve it quickly without complex tools. Round/volumizing brushes, ionic brushes, and basic entry-level products follow, each catering to specific styling needs such as curls, frizz control, or affordability. Technological upgrades, such as ceramic coatings, better grip designs, and temperature precision, are further driving upgrades within the flat brush category.

Application Insights

Household/personal use is the dominant application, accounting for nearly 60% of total sales. Consumers increasingly prefer at-home styling solutions due to time constraints, remote-working lifestyles, and rising grooming awareness. Professional salon usage, while smaller, continues to expand steadily as salons adopt advanced tools for faster, more efficient styling. The emergence of niche applications, such as men’s grooming, travel kits, and curly-hair specialty tools, is expanding the overall application landscape.

Distribution Channel Insights

Online channels account for about 30–35% of global 2024 sales and remain the fastest-growing distribution segment. E-commerce platforms provide wider brand access, transparent pricing, product demos, and review-based selection, all major drivers of consumer trust. Offline channels, including supermarkets, beauty stores, and salons, maintain a significant presence, especially in regions where consumers prefer physical product verification. Direct-to-consumer (D2C) brand websites and social media storefronts are emerging as influential digital sales channels.

End-User Insights

Female consumers represent the dominant end-user segment with approximately 35–40% of market share in 2024. The demand is driven by daily grooming needs, higher engagement with beauty trends, and greater adoption of multi-functional styling tools. The male grooming segment, while smaller, is expanding quickly due to rising interest in hair wellness and styling. Youth and teen users represent an emerging opportunity, influenced heavily by social-media trends and celebrity styling content.

| By Product Type | By End-Use/Application | By Distribution Channel | By Price Tier |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for around 20–25% of the global market, driven by strong consumer purchasing power and widespread adoption of advanced styling appliances. The U.S. leads demand due to high e-commerce penetration and a strong preference for technologically advanced tools. Premium and mid-range devices are particularly popular among working professionals and younger households.

Europe

Europe represents 15–20% of worldwide demand, with Germany, the U.K., France, and Italy leading consumption. Consumers here emphasize safety compliance, quality build, and heat-protection technology, making premium and mid-range devices the most popular. Mature distribution channels and a strong beauty culture support steady growth.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, making up around 30–35% of global 2024 sales. China and India dominate volume growth due to expanding middle-class populations, rapid urbanization, and high digital adoption. Japan, South Korea, and Southeast Asia also show steady demand for premium and tech-enhanced grooming tools. APAC’s growing beauty-tech culture continues to unlock new opportunities for global brands.

Latin America

Latin America holds around 8–10% of the global demand, with Brazil and Mexico leading adoption. Price sensitivity remains moderate, favoring mid-range and budget tools. Social-media influence and growing interest in grooming convenience are key demand drivers in the region.

Middle East & Africa

The MEA region contributes 10–12% of global market demand, with strong growth in GCC countries such as the UAE and Saudi Arabia. African urban hubs, including Nigeria, Kenya, and South Africa, are experiencing rising beauty-product adoption. Growing retail development and digital commerce expansion continue to support upward demand trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Hair Brush Market

- Philips

- G.B. Kent & Sons PLC

- Conair Corporation

- Dafni

- Corioliss

- Revlon

- Gooseberry

- Panasonic

- Remington

- BaByliss

- InStyler

- Drybar

- Vega

- Ikonic

- Alan Truman

Recent Developments

- In March 2025, Philips announced new smart electric hair brushes featuring AI-assisted temperature regulation and improved ionic technology to reduce heat damage.

- In January 2025, Revlon launched an advanced volumising brush line targeting consumers seeking salon-like blowout results at home.

- In October 2024, Dafni introduced a travel-friendly mini electric brush designed for on-the-go grooming, expanding its premium product portfolio.