Electric Golf Cart Market Size

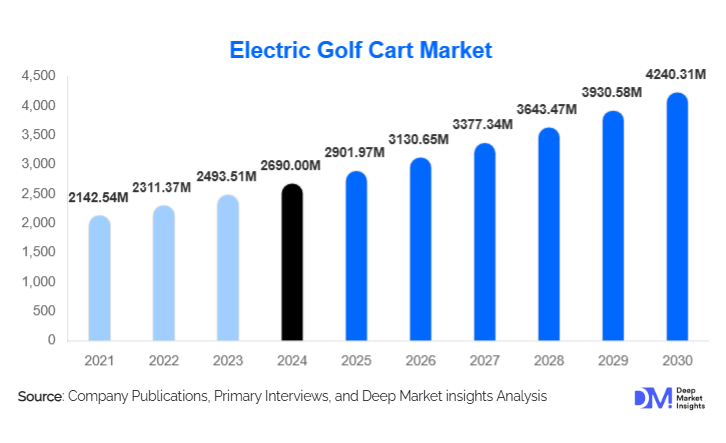

According to Deep Market Insights, the global electric golf cart market size was valued at USD 2,690.00 million in 2024 and is projected to grow from USD 2,901.97 million in 2025 to reach USD 4,240.31 million by 2030, expanding at a CAGR of 7.88% during the forecast period (2025–2030). Growth in this market is primarily driven by rising electrification across recreational and commercial mobility, rapid adoption of lithium-ion batteries, and increasing demand for sustainable, low-speed vehicles in residential, hospitality, industrial, and municipal applications.

Key Market Insights

- Lithium-ion adoption is accelerating, replacing traditional lead-acid batteries and significantly improving range, charging efficiency, and lifecycle economics.

- 4-seater and utility-configured electric carts dominate global fleet purchases, driven by resorts, campuses, airports, and industrial parks.

- North America leads the global market due to mature golf infrastructure, strong LSV regulations, and high adoption in gated communities.

- Asia-Pacific is the fastest-growing region, propelled by expanding hospitality sectors and increasing use of NEVs (Neighborhood Electric Vehicles).

- Technological upgrades are transforming fleet management, including GPS tracking, remote diagnostics, and telematics-driven maintenance.

- Increasing commercial applications, from logistics to security patrols, are expanding the addressable market beyond traditional golf use.

What are the latest trends in the electric golf cart market?

Rapid Shift Toward Lithium-Ion and Solar-Assisted Systems

One of the most significant transformations in the electric golf cart market is the shift from lead-acid to lithium-ion batteries. Lithium platforms offer fast charging, significantly longer lifecycles, reduced maintenance, and improved vehicle performance. Commercial operators, especially resorts, universities, and rental fleets, are rapidly adopting lithium-based carts to reduce downtime and increase fleet utilization. Additionally, solar-assisted carts are beginning to gain traction, particularly in regions with high sunlight exposure, providing supplemental charging that lowers operational costs. This trend is closely tied to sustainability initiatives and fleet modernization programs worldwide.

Expansion of Low-Speed Vehicle (LSV) and Neighborhood Electric Vehicle (NEV) Use Cases

Electric golf carts are increasingly being used as street-legal low-speed vehicles in residential communities, campuses, tourist districts, and industrial estates. This expansion is driven by favorable regulations, rising environmental concerns, and consumer preference for quiet, compact mobility solutions. LSV-certified models equipped with safety features such as seat belts, turn signals, and reinforced frames are becoming popular alternatives to conventional automobiles for short-range commuting. Municipalities are incorporating NEVs into maintenance, security, and park services, further broadening the market’s scope.

What are the key drivers in the electric golf cart market?

Growing Fleet Electrification Across Hospitality, Industrial, and Institutional Sectors

As sustainability becomes a strategic priority for global businesses, resorts, airports, universities, hospitals, and logistics hubs are rapidly transitioning from gas-powered to electric fleets. Electric golf carts offer lower total cost of ownership, reduced noise, and zero tailpipe emissions, making them ideal for guest transportation, internal mobility, and cargo handling. Bulk procurement of electric carts and long-term fleet contracts are significantly boosting annual sales and aftermarket demand.

Technological Advancements Enhancing Efficiency and User Experience

Innovations such as advanced motor controllers, regenerative braking, smart battery management, IoT-enabled telematics, and GPS tracking are elevating fleet efficiency and safety. Operators can now monitor vehicle health, schedule predictive maintenance, and optimize routing. These improvements not only enhance productivity but also increase the appeal of electric carts for commercial buyers seeking data-driven fleet solutions.

What are the restraints for the global market?

High Upfront Costs for Lithium-Based and Premium Fleet Models

While electric carts deliver substantial long-term cost advantages, their upfront prices, particularly for lithium-equipped or street-legal models, remain a barrier for small businesses and budget-sensitive buyers. The initial investment for high-end fleets can be significant, slowing adoption in emerging markets and smaller hospitality establishments. Although financing, leasing, and Battery-as-a-Service (BaaS) models are growing, global availability remains uneven.

Fragmented Industry Standards and Limited Charging Infrastructure

The industry faces challenges related to inconsistent component standards and varying charger compatibilities across OEMs. This fragmentation complicates large-scale fleet integration and raises maintenance costs. Moreover, regions without established charging infrastructure experience slower adoption, particularly in industrial and municipal sectors that rely on coordinated energy and logistics planning.

What are the key opportunities in the electric golf cart industry?

Growth of Commercial and Municipal Use Cases

Electric golf carts are increasingly being deployed for last-mile logistics, security patrols, parks management, and industrial transport. These applications represent a high-growth frontier, especially as urban centers embrace compact, eco-friendly mobility solutions. Municipal electrification initiatives and public-sector sustainability mandates will further expand demand.

Aftermarket Modernization: Lithium Retrofits & Fleet Management Solutions

The large installed base of lead-acid carts provides a significant retrofit opportunity. Lithium upgrade kits, battery management systems, and telematics packages allow operators to enhance existing fleets rather than replace them outright. Service providers offering retrofit bundles, battery leasing, and subscription-based fleet monitoring solutions are positioned to capitalize on strong recurring revenue streams.

Product Type Insights

4-seater electric golf carts dominate the market, driven by their widespread use across resorts, gated communities, campuses, and rental fleets. Their balance of capacity, efficiency, and versatility makes them the preferred choice for commercial operators. Utility and cargo-configured carts are experiencing rapid adoption in industrial, airport, and warehouse environments, where they serve as low-cost alternatives to larger vehicles. Specialty models, such as lifted, off-road, or customized luxury carts, are gaining traction in premium residential communities and recreational properties. Low-Speed Vehicles (LSV-certified models) represent a growing subsegment, particularly in regions with supportive NEV regulations.

Application Insights

Golf courses and hospitality fleets remain the largest application segment, accounting for nearly half of global demand. These sectors require consistent fleet replacement, bolster recurring aftermarket revenue, and increasingly specify lithium-powered models. Residential and NEV applications are rapidly expanding as consumers adopt carts for short-distance commuting within gated communities. Industrial uses, internal logistics, maintenance, and personnel movement are among the fastest-growing categories. Municipal and government fleets are emerging as a new application area, supported by sustainability targets and urban mobility initiatives.

Distribution Channel Insights

OEM dealership networks dominate distribution, offering full-service sales, maintenance, and customization capabilities. Fleet contracts and B2B direct sales are critical for large institutional buyers. The aftermarket channel, including battery replacements, tires, controllers, chargers, and retrofits, plays a vital role in recurring revenue generation. Online platforms are gaining relevance for smaller buyers seeking accessories, refurbished carts, or entry-level models. Subscription-based fleet solutions and leasing programs are emerging channels that reduce upfront costs and improve fleet flexibility.

End-User Insights

Commercial users, such as resorts, campuses, airports, and industrial parks, represent the highest-value end-user segment due to large fleet sizes and recurring service needs. Residential users form a strong growth demographic, especially in planned communities and retirement villages, where NEVs are replacing second cars. Government and municipal users are increasingly adopting electric carts for parks and recreation operations, facility maintenance, and public safety patrols. Rental operators benefit from rising tourism activity and short-term mobility needs at events, exhibitions, and entertainment venues.

| By Product / Vehicle Type | By Battery & Power System | By Seating & Capacity | By Application / End-Use | By Sales & Service Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 44–45% of global demand in 2024. The U.S. leads adoption with its extensive golf course network, mature NEV regulation, and growing use of carts in residential communities. Municipal and commercial applications, airports, universities, and tourist districts continue to expand, while lithium adoption is accelerating due to higher expectations for range and reliability.

Europe

Europe exhibits steady growth driven by sustainability mandates, tourism sector modernization, and the adoption of LSV-compliant vehicles in resort towns. Countries such as Germany, the U.K., France, and Spain are key markets, where electric carts are used for guest transport, maintenance, and short-range mobility. Strict emissions guidelines support a shift toward battery-powered low-speed vehicles.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market. China serves as both a major manufacturing hub and a high-adoption market for hospitality and residential NEV applications. India and Southeast Asia are experiencing rising demand due to large-scale resort developments and campus electrification. Australia and Japan show steady, high-value demand for premium utility and recreation carts.

Latin America

Latin America is witnessing gradual growth driven by tourism and industrial campus expansion. Brazil and Mexico represent the largest opportunities, where electric carts are increasingly used by resorts and gated communities. Economic variability remains a constraint, but infrastructure development supports long-term prospects.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is emerging as a premium market with strong demand for luxury and utility electric carts in hospitality complexes and mega-projects. Africa remains a significant market for golf and tourism applications, especially in South Africa and Kenya, supported by expanding hospitality infrastructure and electrification initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Golf Cart Market

- Textron Inc. (E-Z-GO)

- Club Car (Platinum Equity)

- Yamaha Motor Co., Ltd.

- Polaris Inc.

- Toyota Motor Corporation

- Garia A/S

- Kandi Technologies

- Lvtong

- Columbia Vehicle Group

- Alke

- Icon Electric Vehicles

- Star EV Corporation

- Waev

- Bradshaw

- Hawke