Electric Facial Cleansing Brush Market Size

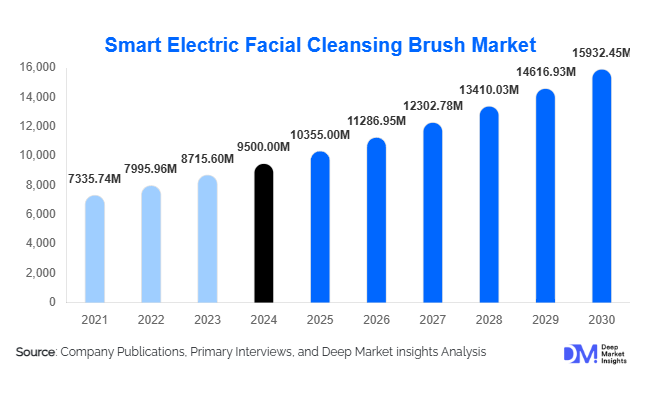

According to Deep Market Insights, the global Electric Facial Cleansing Brush Market was valued at USD 9,500 million in 2024 and is projected to grow from USD 10,355 million in 2025 to reach USD 15,932.45 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). Market growth is primarily driven by rising consumer focus on skincare routines, technological integration in personal care devices, and the rapid expansion of online beauty and wellness retail channels across emerging economies.

Key Market Insights

- Silicone-based brushes dominate the market, accounting for nearly 45% of the global share in 2024, driven by superior hygiene, softness, and durability compared to bristle types.

- Sonic and ultrasonic cleansing technologies are leading due to their effectiveness and skin-friendly operation, contributing nearly 40% of the market share in 2024.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, digital adoption, and increasing beauty-conscious consumers in China, India, and South Korea.

- Online retail channels are rapidly expanding, with e-commerce contributing around 22% of sales in 2024 due to influencer marketing and direct-to-consumer brand strategies.

- Premium beauty devices priced above USD 100 are gaining traction, accounting for nearly 35% of global revenue in 2024, supported by growing consumer preference for advanced skincare tools.

- The top 5 companies control 35–40% of the market, reflecting moderate concentration and increasing innovation-driven competition.

Latest Market Trends

Smart & Connected Cleansing Devices

Integration of digital technologies into skincare devices is redefining consumer expectations. Smart facial cleansing brushes now feature Bluetooth connectivity, app-based skin analysis, and customized cleansing programs based on user data. These innovations enable real-time feedback and personalized skincare routines. Manufacturers are incorporating AI algorithms that analyze skin conditions to adjust vibration intensity and duration, enhancing user experience and efficacy. The convergence of beauty and technology, often referred to as “beauty tech,” is creating a premium segment that appeals strongly to millennials and Gen Z consumers.

Sustainability and Eco-Friendly Materials

The growing preference for eco-conscious products is pushing brands toward sustainable materials, recyclable packaging, and long-lasting brush designs. Manufacturers are reducing plastic use and shifting to medical-grade silicone and biodegradable packaging. Companies adopting circular economy models, such as replaceable heads or recycling programs, are strengthening their brand loyalty. This sustainability trend is particularly influential in Europe and North America, where regulatory emphasis and consumer awareness around environmental impact are high.

Men’s Grooming and Gender-Neutral Beauty Devices

Rising awareness about skincare among men has opened new market opportunities. Electric facial cleansing brushes designed specifically for men’s thicker skin and facial hair are gaining traction. The introduction of gender-neutral designs and targeted marketing campaigns is expanding the consumer base beyond traditional female demographics. The men’s skincare device segment is expected to grow at over 10% CAGR through 2030, outpacing the broader market growth rate.

Electric Facial Cleansing Brush Market Drivers

Growing Focus on Skincare and Daily Self-Care Rituals

Increasing consumer awareness of the importance of skincare routines and self-care has significantly boosted demand for facial cleansing devices. Consumers are shifting from traditional cleansing methods toward technology-driven solutions that offer deeper pore cleansing and enhanced skincare results. Social media trends and influencer endorsements have accelerated product visibility, making electric brushes a must-have in personal grooming routines.

Rising Disposable Income and Premiumization of Beauty Devices

With global disposable incomes increasing, especially in emerging markets, consumers are willing to spend more on premium beauty devices that promise professional-grade results at home. Premium electric facial cleansing brushes with advanced features such as multiple speed settings, temperature control, and ergonomic designs are experiencing higher adoption rates, contributing to overall revenue growth.

Proliferation of E-Commerce and Digital Marketing Channels

The availability of electric facial cleansing brushes across leading online retail platforms has made it easier for brands to reach global consumers. E-commerce platforms, coupled with digital influencer marketing, are reshaping purchase decisions. Consumers rely heavily on online reviews and demonstration videos, while brands benefit from lower distribution costs and direct access to customer data for product personalization.

Market Restraints

High Product Costs and Maintenance Requirements

Despite rising popularity, electric facial cleansing brushes remain premium products for many consumers. High initial costs and ongoing expenses for replacement heads and batteries deter adoption in price-sensitive markets. The perceived value gap between manual cleansing tools and electric devices continues to be a barrier, particularly in developing economies.

Market Saturation in Mature Regions

In developed markets such as North America and Western Europe, penetration levels are approaching maturity. Consumers often delay repurchasing due to the long lifespan of these devices, resulting in slower replacement cycles. Without significant product innovation, brands risk stagnation in these regions, prompting a shift toward emerging markets for sustained growth.

Electric Facial Cleansing Brush Market Opportunities

Emerging Market Expansion

Untapped potential in Asia-Pacific, Latin America, and the Middle East & Africa offers significant growth opportunities. Rising urbanization, growing awareness of skincare, and expanding online retail access are creating favorable conditions for market penetration. Localization strategies such as region-specific pricing, localized marketing campaigns, and distribution partnerships will be key to unlocking demand in these areas.

Technology Integration and AI-Driven Personalization

Advanced technologies such as AI, IoT, and sensors are revolutionizing product functionality. Future devices will likely incorporate skin diagnostics, moisture detection, and automated cleansing programs. Integrating these technologies enhances brand differentiation and justifies premium pricing. AI-based skincare recommendations and app connectivity will further strengthen consumer engagement and loyalty.

Eco-Friendly Innovations and Sustainable Branding

Eco-friendly innovation remains a major opportunity. Manufacturers that develop rechargeable, long-life devices using sustainable materials can cater to the growing population of environmentally conscious consumers. Partnerships with environmental organizations and the introduction of recycling programs for used devices and components can boost brand reputation and create new customer segments.

Product Type Insights

By brush type, silicone brushes lead the market with approximately 45% share in 2024. Their hypoallergenic, non-porous nature makes them suitable for sensitive skin and easy to clean, reducing bacterial growth. Traditional bristle brushes, though effective, are gradually losing share due to hygiene concerns. Within silicone brushes, soft-textured variants dominate, appealing to daily-use consumers seeking gentle exfoliation. Hard and medium-textured versions cater to deeper cleaning needs and professional spa applications.

Technology Insights

Sonic and ultrasonic technology dominate the market, accounting for nearly 40% of total sales in 2024. These brushes use high-frequency vibrations to dislodge impurities from pores without damaging skin, making them suitable for daily use. Rotating or oscillating devices, while popular in earlier years, are gradually declining in demand as consumers prefer quieter, gentler, and more effective sonic devices.

Price Range Insights

The premium price segment (above USD 100) commands approximately 35% of global revenue. Premium devices integrate smart features, ergonomic designs, and longer-lasting batteries, appealing to affluent consumers and professionals. The mid-range segment (USD 50–100) attracts mass consumers looking for reliability and performance, while the economy segment (< USD 50) focuses on first-time buyers and emerging market consumers. The premiumization trend is expected to sustain as consumers increasingly seek spa-quality experiences at home.

Distribution Channel Insights

Online retail platforms are the fastest-growing sales channel, contributing around 22% of global market revenue in 2024. The surge in e-commerce adoption, coupled with influencer marketing and beauty vloggers, has significantly boosted product visibility. Offline specialty stores and beauty salons still retain strong consumer trust, particularly in regions like Europe and North America, where in-person demonstrations influence purchase decisions. Direct-to-consumer brand websites are emerging as critical touchpoints, offering personalized recommendations and subscription models for replacement heads.

Application Insights

The household or personal-use segment dominates the market with a 60% share in 2024. Growing awareness about skincare and the rise of self-care culture have driven consumers to adopt home-use beauty devices. The commercial-use segment, including salons, spas, and dermatology clinics, represents a smaller share but contributes to premium product sales and brand endorsements. The increasing trend of professional-grade devices for at-home use is blurring the boundaries between commercial and consumer applications.

| By Product Type | By Technology | By Price Range | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share, accounting for approximately 35% of the global market (USD 3.3 billion in 2024). High consumer awareness, widespread online retail adoption, and preference for premium beauty devices drive regional dominance. The U.S. remains the primary market, with growing demand for smart, AI-enabled skincare tools and sustainable product lines.

Europe

Europe represents around 25% of global revenue (USD 2.4 billion in 2024). Germany, the U.K., and France lead demand, with consumers emphasizing eco-friendly, dermatologically tested devices. The region’s mature skincare culture and strict quality standards make it a key market for premium and sustainable beauty products. Eastern Europe offers untapped potential due to increasing middle-class spending power.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at over 11% CAGR through 2030. China dominates regional demand, driven by domestic manufacturing, local brand proliferation, and digital influencer marketing. India, Japan, and South Korea are key markets fueled by rising disposable income, growing beauty culture, and high social media engagement. Asia’s increasing export capacity also supports global supply chains for cleansing brushes.

Latin America

Latin America accounts for roughly 10% of the 2024 global market. Brazil and Mexico are the largest contributors, driven by growing consumer awareness of skincare and beauty-tech adoption. Local distribution partnerships and influencer collaborations are improving accessibility in this price-sensitive region.

Middle East & Africa

The Middle East & Africa collectively contribute about 10% of global revenue. The GCC region, led by Saudi Arabia and the UAE, exhibits strong demand for premium beauty devices, while South Africa represents a growing sub-Saharan market. Increased retail infrastructure and youth-driven beauty trends are accelerating regional adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Electric Facial Cleansing Brush Market

- L’Oréal S.A.

- Koninklijke Philips N.V.

- Panasonic Corporation

- Shiseido Company, Limited

- Mary Kay Inc.

- Nu Skin Enterprises, Inc.

- Conair Corporation

- Braun GmbH

- HoMedics LLC

- Foreo AB

- Silk’n Home Skinovations Ltd.

- Tria Beauty Inc.

- Michael Todd Beauty LLC

- Lavo Skin Co. Ltd.

- Guangzhou COSBEAUTY Co., Ltd.

Recent Developments

- In August 2025, Foreo AB launched a new AI-integrated silicone facial brush featuring skin-type detection and app-based cleansing routines, targeting the premium beauty segment.

- In May 2025, Panasonic announced the expansion of its skincare appliance production facility in Japan to meet growing demand across the Asia-Pacific.

- In February 2025, L’Oréal introduced a sustainable beauty device line using recyclable materials and renewable energy manufacturing at its European plants.

- In January 2025, Philips launched a next-generation sonic cleansing brush under its “BeautySense” brand, integrating smart sensors and app connectivity for real-time skin health monitoring.