Elderly Bath Chairs Market Size

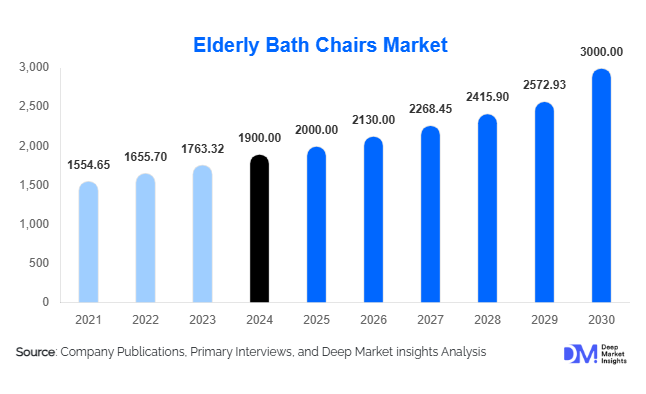

According to Deep Market Insights, the global elderly bath chairs market size was valued at USD 1,900 million in 2024 and is projected to grow from USD 2,000 million in 2025 to reach USD 3,000 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing aging populations, rising home healthcare adoption, and technological advancements in bath chair design, including safety, comfort, and accessibility features.

Key Market Insights

- Standard bath chairs dominate the market, accounting for nearly 45–50% of global revenue in 2024, due to their affordability and wide usage in residential settings.

- Aluminum bath chairs are preferred, offering lightweight durability and corrosion resistance for wet environments, holding 25–30% of the market share.

- North America leads globally, capturing 40–45% of the market, driven by high healthcare spending, a large elderly population, and strong awareness of safety and mobility aids.

- Online retail channels are rapidly expanding, accounting for 20–30% of total sales, particularly for residential users seeking convenience and variety in purchasing.

- Asia-Pacific is emerging as a high-growth region, led by Japan, China, and India, supported by rising disposable incomes and growing awareness of eldercare safety solutions.

- Technological innovations, such as foldable designs, electric adjustment, and sensor integration, are reshaping product offerings and enabling premium pricing.

Latest Market Trends

Rise of Home Healthcare and Aging-in-Place Solutions

As more elderly individuals prefer to remain in their own homes rather than institutional care, there is increasing demand for bathing solutions that enhance safety and independence. Bath chairs with features like adjustable height, foldability, armrests, and non-slip surfaces are gaining popularity in residential settings. Caregivers and home healthcare providers are actively recommending or procuring these products to prevent falls and improve patient comfort. The trend of “aging in place” has become a major growth driver, particularly in North America and Europe, and is increasingly influencing product design and distribution strategies.

Technological Integration Enhancing Safety and Comfort

Emerging innovations are transforming traditional bath chairs into advanced safety and comfort solutions. Features such as motorized adjustments, swivel seating, antimicrobial surfaces, and occupancy sensors provide improved usability and hygiene. Some premium chairs also offer smart features for caregiver monitoring, making them attractive in both residential and institutional settings. These technological enhancements appeal to safety-conscious consumers and caregivers, fostering market differentiation and premium product adoption.

Elderly Bath Chairs Market Drivers

Increasing Aging Population and Mobility Impairment

The rising proportion of elderly individuals globally is driving demand for mobility and safety solutions. Conditions such as arthritis, post-operative recovery, and chronic illnesses contribute to limited mobility, necessitating supportive devices like bath chairs. Healthcare providers, rehabilitation centers, and home care services are increasingly investing in these products to enhance patient safety and independence.

Expansion of Homecare and Institutional Facilities

Growth in nursing homes, assisted living facilities, and rehabilitation centers has boosted the institutional demand for bath chairs. Regulations and safety standards require these facilities to provide appropriate bathing support, creating consistent procurement opportunities for manufacturers. Investments in facility upgrades and patient-centered designs further strengthen this demand.

Consumer Preference for Safety, Comfort, and Convenience

End-users are increasingly prioritizing safety, comfort, and ergonomic design in bath chairs. Lightweight, foldable, and aesthetically pleasing models are particularly popular in residential segments. The rising awareness of fall prevention and home safety is encouraging the adoption of advanced bath chairs with premium features, fueling market growth.

Market Restraints

High Cost of Advanced Models

Premium bath chairs, particularly motorized or smart models, remain expensive, limiting accessibility in lower-income regions. Out-of-pocket costs for consumers and institutional buyers can be prohibitive, slowing adoption in emerging markets. Additionally, import tariffs and material costs further increase prices for advanced models.

Lack of Awareness and Infrastructure Limitations

In certain regions, elderly individuals and caregivers are unaware of the benefits of bath chairs or perceive them as unnecessary. In older homes, bathroom sizes and layouts may prevent proper installation, limiting usability. Regulatory compliance and certification requirements can also create barriers for manufacturers entering new markets.

Elderly Bath Chairs Market Opportunities

“Aging-in-Place” and Home Modification Programs

The increasing focus on home-based eldercare presents opportunities for manufacturers to develop compact, foldable, and aesthetically designed bath chairs. Governments and private healthcare providers are promoting programs to enhance home safety, including subsidies and insurance reimbursement, which manufacturers can leverage to expand market reach.

Government and Insurance Support

Health insurance and government programs in North America and Europe often cover durable medical equipment, including bath chairs, creating an opportunity for manufacturers to partner with insurers and healthcare providers. Inclusion in approved supplier lists or reimbursement programs can accelerate adoption among end-users.

Technological Innovation and Feature Differentiation

Advanced features such as motorized height adjustments, foldable designs, antimicrobial coatings, and caregiver-monitoring sensors allow manufacturers to differentiate products. Niche segments, such as bariatric chairs or post-operative recovery solutions, offer high-margin opportunities. Integrating technology enhances safety, usability, and consumer appeal, supporting premium product growth.

Product Type Insights

Standard bath chairs dominate the market due to affordability and widespread applicability, particularly in residential settings. Transfer benches and shower stools also have significant adoption, especially in healthcare and rehabilitation facilities. Bariatric and specialized models are gaining traction as obesity and mobility issues increase globally, driving the demand for high-capacity and feature-rich designs.

Application Insights

Residential use remains the primary application segment, driven by “aging-in-place” trends. Hospitals, nursing homes, and rehabilitation centers are also key consumers, favoring durable and easy-to-clean chairs. Emerging applications include post-operative care, bariatric support, and disability-focused products. Telecare and caregiver monitoring integrations are increasingly being explored, broadening the scope of application.

Distribution Channel Insights

Online retail is rapidly growing as a distribution channel, particularly for residential buyers, offering convenience, product variety, and home delivery. Specialty medical supply stores, pharmacies, and direct sales remain critical for institutional procurement. Manufacturers are increasingly enhancing their digital presence, offering online catalogs and virtual demonstrations to capture tech-savvy consumers.

End-User Insights

Residential end-users represent the largest market share, while nursing homes and assisted living facilities show consistent institutional demand. Home care service providers are expanding the reach of bath chairs into remote or underserved regions. Post-operative care and bariatric support are emerging as high-growth segments, driven by demographic and lifestyle changes.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 40–45% of the global market, with the U.S. leading due to high healthcare spending, regulatory support, and awareness of home safety. Canada also shows steady adoption in residential and institutional segments. Demand is driven by “aging-in-place” programs, insurance reimbursements, and technological adoption.

Europe

Europe holds roughly 30–35% of the market, led by Germany, the UK, and France. High elderly population, supportive government policies, and a focus on institutional safety standards are driving growth. Emerging awareness of home modifications and technological innovations further strengthens market penetration.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with Japan, China, and India leading adoption. Rising incomes, urbanization, and increased awareness of eldercare solutions are supporting demand. Institutional growth and government initiatives in home healthcare are further driving the market.

Latin America

Latin America represents 5–7% of the market, with Brazil and Mexico leading demand. Growth is moderate, constrained by affordability and infrastructure limitations, but affluent urban populations are driving niche adoption.

Middle East & Africa

The region accounts for 3–5% of the market, with higher adoption in GCC countries such as the UAE, Saudi Arabia, and Qatar. Infrastructure limitations and awareness challenges in other countries limit broader growth. Regional demand is primarily driven by residential users and private healthcare facilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Elderly Bath Chairs Market

- Drive DeVilbiss Healthcare

- Invacare Corporation

- Medline Industries, Inc.

- Nova Medical Products

- Moen

- Etac AB

- Essential Medical

- TFI HealthCare

- Maddak

- Medical Depot

- Carex Health Brands

- Sunrise Medical

- Handicare Group AB

- Graham-Field Health Products

- Hollister Incorporated

Recent Developments

- In March 2025, Drive DeVilbiss Healthcare launched a foldable, lightweight bath chair for residential use, targeting “aging-in-place” consumers in North America.

- In January 2025, Invacare Corporation introduced an electric height-adjustable shower chair, integrating anti-slip technology for rehabilitation and hospital facilities.

- In June 2024, Medline Industries expanded its online distribution in Europe and Asia-Pacific, offering advanced bath chairs directly to consumers and healthcare institutions.