Effects Processors and Pedals Market Size

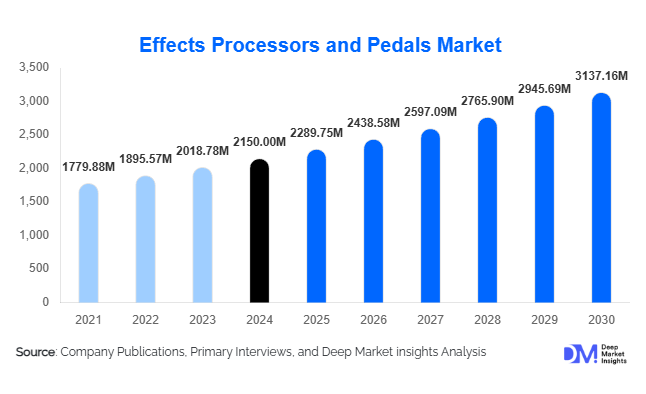

According to Deep Market Insights, the global effects processors and pedals market size was valued at USD 2,150 million in 2024 and is projected to grow from USD 2,289.75 million in 2025 to reach USD 3,137.16 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of digital and hybrid pedals, growing popularity of live music performances, and rising demand for home studios and professional recording setups.

Key Market Insights

- Multi-effects processors are increasingly preferred by professional musicians due to their versatility and ability to consolidate multiple sound effects into a single unit, simplifying both studio and live setups.

- Digital and hybrid pedals dominate technological adoption, driven by integration with DAWs, app control features, and AI-based sound modeling.

- North America and Europe account for over 60% of global demand in 2024, supported by mature music equipment ecosystems, live performance culture, and widespread adoption of electric instruments.

- Asia-Pacific is the fastest-growing region, with rising demand in countries such as India, China, and Japan, fueled by music education expansion and home studio adoption.

- Online retail channels are rapidly gaining share, offering convenience, broader product availability, and app-enabled purchasing options for amateur and professional musicians.

- Technological advancements in digital signal processing and hybrid analog-digital pedals are reshaping product innovation and user experience in the market.

What are the latest trends in the effects processors and pedals market?

Digital and Hybrid Pedal Adoption

Musicians are increasingly adopting digital and hybrid pedals due to their enhanced flexibility, connectivity, and sound fidelity. These devices often include programmable presets, app integration, and multi-instrument compatibility, appealing to both professional and amateur users. Hybrid pedals combine analog warmth with digital precision, making them suitable for studio and stage applications. Manufacturers are focusing on compact, portable designs that reduce setup complexity and improve live performance efficiency.

Integration with Music Production Software

Effects processors are increasingly integrated with digital audio workstations (DAWs), mobile apps, and cloud-based platforms. This allows musicians to control and customize effects remotely, store presets, and synchronize devices across multiple setups. The trend is particularly strong in home studios and educational institutions, where seamless connectivity enhances creative workflows and reduces hardware redundancy. Software integration also provides opportunities for subscription-based models and continuous updates, creating long-term engagement with end-users.

What are the key drivers in the effects processors and pedals market?

Rising Popularity of Live Music and Home Studios

The growing number of live performances, music festivals, and independent concerts has increased demand for versatile, portable effects processors. Similarly, home studio adoption is accelerating due to the affordability of multi-effects processors, digital pedals, and hybrid solutions that provide studio-quality sound at lower costs. The accessibility of music production tools and remote collaboration platforms has further amplified this trend.

Technological Advancements in Digital Signal Processing

Advances in DSP and modeling technologies allow for highly customizable and precise sound effects. Musicians can replicate studio-quality reverbs, delays, distortions, and modulations in real-time. Digital pedals also minimize noise, improve reliability, and offer seamless integration with other devices, driving adoption across both professional and amateur segments.

Increasing Adoption of Electric Instruments

The rising popularity of electric guitars, basses, keyboards, and synthesizers has increased the need for complementary effects pedals. Guitarists remain the primary consumers, driving consistent demand for distortion, modulation, reverb, and multi-effects units globally.

What are the restraints for the global market?

High Cost of Advanced Pedals

Premium multi-effects and hybrid pedals often carry higher price tags, limiting accessibility for entry-level musicians. The cost factor remains a barrier to mass-market adoption, particularly in emerging regions where budget constraints are significant.

Technical Complexity and Learning Curve

Advanced processors require technical knowledge for optimal usage, which may discourage casual users. Configuring, programming, and maintaining digital and hybrid pedals can be challenging for beginners, slowing market penetration among hobbyists and semi-professional musicians.

What are the key opportunities in the effects processors and pedals industry?

Expansion into Emerging Regions

Asia-Pacific, Latin America, and the Middle East are experiencing rapid growth due to rising disposable incomes, urbanization, and expanding music education programs. Tailoring affordable products for these markets presents a significant opportunity. India, China, and Brazil are particularly attractive for new entrants targeting mid-range and entry-level pedals.

Institutional and Educational Adoption

Music schools and academies are an emerging demand driver. Institutions are investing in high-quality effects processors and pedals for training, performance, and studio use. Partnerships with educational organizations offer opportunities for product bundles, subscription models, and specialized training programs that increase brand visibility and adoption.

Technological Integration and Innovation

There is strong potential in developing AI-powered sound customization, app-controlled devices, and hybrid analog-digital pedals. Innovations that simplify user experience, offer creative flexibility, and enhance portability are likely to attract professional musicians and enthusiasts alike. Subscription models for software updates and cloud-based presets represent additional revenue streams for manufacturers.

Product Type Insights

Multi-effects processors dominate the market, accounting for approximately 35% of global demand in 2024. Their popularity stems from the ability to consolidate multiple effects into a single unit, reducing setup complexity and costs for both studio and live performance scenarios. Single-effect pedals remain popular among hobbyists seeking specific tonal qualities, while hybrid pedals are gaining traction for combining analog warmth with digital precision.

Application Insights

Guitar effects lead the application segment, contributing 60% of the 2024 market. Distortion, reverb, modulation, and delay pedals are essential tools for guitarists, both professional and amateur. Bass and keyboard effects are growing steadily, while vocal processors and drum effects represent niche applications. Home studios and live performance setups increasingly rely on multi-effects solutions for efficient sound management.

Distribution Channel Insights

Offline retail remains the primary sales channel, accounting for 55% of market share, particularly in mature markets like the USA, Germany, and Japan. Musicians often prefer testing pedals in-store. However, online platforms and brand-owned e-commerce websites are rapidly expanding, offering convenience, wider product availability, and app-enabled purchasing options.

End-User Insights

Professional musicians represent the largest end-user segment, contributing 45% of the market in 2024. Home studios and hobbyist musicians are rapidly growing, driven by affordable multi-effects processors and online tutorials. Music schools and academies are emerging as high-growth segments, particularly in the Asia-Pacific and Latin America. Export-driven demand is significant from North America and Europe, which import high-end pedals and processors for professional use.

| By Product Type | By Technology | By End-User | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

The USA leads the market in North America with strong demand for professional and home studio equipment, contributing to 30% of the global market share in 2024. Canada also demonstrates steady growth, supported by a mature music ecosystem, live performances, and recording studios. The region prioritizes digital and hybrid pedals due to advanced music production infrastructure.

Europe

Germany and the UK are major contributors, together representing 32% of global demand. The region benefits from high disposable incomes, a strong culture of live music performances, and professional recording studios. Germany is the fastest-growing market in Europe, with increasing adoption of boutique analog and multi-effects pedals.

Asia-Pacific

APAC is the fastest-growing region, with India, China, and Japan driving adoption. Growth is fueled by music education programs, expanding home studios, and rising interest in live music performances. Multi-effects processors and affordable digital pedals are in high demand, with a projected CAGR of 8% during 2025–2030.

Latin America

Brazil and Mexico are leading markets, showing growing adoption of electric instruments and live performance setups. Affluent consumers are increasingly importing premium pedals, while mid-range products cater to hobbyists and music schools.

Middle East & Africa

UAE and South Africa show steady demand, particularly among professional musicians and educational institutions. Africa, as a whole, benefits from a growing music culture and increasing investment in recording studios.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Effects Processors and Pedals Market

- Boss

- Line 6

- Electro-Harmonix

- TC Electronic

- Zoom Corporation

- MXR

- Digitech

- Strymon

- Eventide

- Moog Music

- Behringer

- Keeley Electronics

- Pigtronix

- EBS

- Source Audio

Recent Developments

- In March 2025, Boss launched a new series of compact multi-effects pedals with app-controlled presets and AI-based sound customization.

- In January 2025, Line 6 introduced a hybrid analog-digital pedal series integrating DAW compatibility for professional recording studios.

- In February 2025, Electro-Harmonix expanded its boutique analog pedal line targeting the home studio and hobbyist musician segments.