Edutainment Market Size

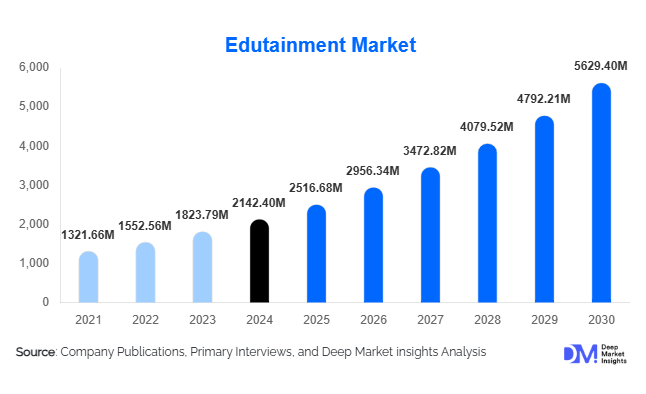

According to Deep Market Insights, the global edutainment market size was valued at USD 2,142.40 million in 2024 and is projected to grow from USD 2,516.68 million in 2025 to reach USD 5,629.40 million by 2030, expanding at a CAGR of 17.47% during the forecast period (2025–2030). The edutainment market growth is driven by rising demand for interactive learning platforms, rapid adoption of AR/VR-based educational content, and the global shift toward gamified learning experiences across both consumer and corporate ecosystems.

Key Market Insights

- Digital edutainment is transitioning toward AI-integrated, personalized learning environments that enhance engagement and long-term learning retention.

- Interactive digital platforms dominate global spending, supported by widespread smartphone adoption and demand for gamified learning.

- Early childhood edutainment remains the largest age segment, fueled by parental preference for cognitive skill development tools.

- Asia-Pacific is the fastest-growing region due to strong government investments in digital education and an expanding middle class.

- Corporate edutainment is emerging as a high-value segment, as businesses globally embrace simulation-based and gamified training programs.

- Technological integration, AI tutors, AR/VR classrooms, robotics kits, and immersive simulations are transforming traditional learning models.

What are the latest trends in the edutainment market?

Immersive AR/VR Learning Becoming Mainstream

AR/VR technologies are reshaping edutainment by enabling students and learners to access virtual laboratories, interactive science experiments, historical reconstructions, and 3D storytelling. Schools and training centers are integrating VR headsets to deliver experiential lessons that improve engagement and retention. Global providers are producing VR-based curricula for STEM learning, language immersion, and safety training. Corporate edutainment is also benefiting from AR-enabled simulations for manufacturing, healthcare, aviation, and industrial upskilling. This trend is strengthening the role of immersive technology as a core component of future edutainment ecosystems.

Gamification and AI-Powered Personalization

Gamified learning models, featuring rewards, progress dashboards, challenges, and adaptive difficulty, are rising in popularity across all age groups. AI-driven personalization enhances these models by recommending content based on learner performance, behavior, and preferences. Platforms now offer analytics dashboards to parents, teachers, and HR departments, enabling real-time tracking of outcomes. As AI continues to evolve, edutainment companies are incorporating virtual assistants, automated assessment engines, and intelligent tutoring systems to deepen interactivity and drive long-term platform engagement.

What are the key drivers in the edutainment market?

Technology Convergence Across Digital Learning

Rapid advancements in AI, VR headsets, 5G connectivity, and cloud platforms are driving the adoption of interactive edutainment. The combination of gamification engines, immersive simulations, and adaptive learning systems has significantly improved learning outcomes, encouraging schools, households, and corporations to integrate edutainment solutions into daily training and development activities. With hardware becoming increasingly accessible, immersive learning ecosystems are now a mainstream driver of global edutainment growth.

Growing Adoption of Experiential Learning for Children

Parents worldwide are increasingly investing in STEM toys, coding kits, robotics kits, and interactive educational apps for children aged 3–12. This shift from passive content consumption toward hands-on learning experiences is expanding demand for early childhood edutainment, which currently forms the largest age-based segment of the market. Discovery centers and children’s museums are also gaining traction, particularly in urban markets seeking innovative family-friendly entertainment options.

What are the restraints for the global market?

High Cost of Immersive Edutainment Infrastructure

Developing high-quality AR/VR content, purchasing immersive hardware, and operating physical edutainment venues require significant capital investment. This increases the cost of adoption for low-income regions and limits the worldwide scalability of premium edutainment services. Schools with limited budgets, in particular, face challenges in adopting advanced digital learning systems, slowing down market penetration in developing economies.

Regulatory and Content Compliance Challenges

Educational content must comply with strict regulatory guidelines, child-safety standards, and data privacy frameworks across multiple countries. This increases development costs and extends product-launch timelines. Additionally, content localization requirements, such as language, cultural adaptation, and curriculum alignment, pose further constraints for global expansion. These regulatory complexities continue to be a significant restraint on market growth.

What are the key opportunities in the edutainment industry?

Expansion of Edutainment Venues in Emerging Markets

Growing disposable income in emerging economies is creating strong opportunities for science centers, themed experience parks, and interactive learning venues. Governments in Southeast Asia, the Middle East, and Latin America are investing heavily in digital education, making these regions prime opportunities for global edutainment operators. Franchising and licensing models are particularly appealing for companies seeking to expand with minimal capital investment.

Corporate Edutainment and Simulation-Based Training

Businesses worldwide are transitioning from traditional classroom training to gamified learning platforms and immersive simulations. Sectors such as manufacturing, aviation, healthcare, logistics, and finance are adopting AR/VR modules to enhance employee engagement and retention. Edutainment providers can capitalize on this trend by building customizable simulation libraries and AI-based skill assessment tools. Corporate edutainment is expected to be one of the fastest-growing segments through 2030.

Product Type Insights

Interactive Digital Platforms dominate the edutainment market, contributing to nearly 38% of total revenue in 2024. Their scalability, affordability, and compatibility with smartphones and tablets drive adoption across households and schools. Physical edutainment products, including STEM kits and robotics sets, continue to expand, appealing to early childhood and pre-teen learners. Experiential venues form a strong offline segment, especially as families seek immersive educational outings. Broadcast & multimedia content, distributed via streaming platforms, strengthens supplemental learning, while corporate edutainment tools support workforce development in large enterprises.

Application Insights

Edutainment applications range from early childhood development and STEM learning to corporate skill development and AR/VR-enhanced simulations. Early childhood learning remains the largest application area due to high parental demand for cognitive development tools. Corporate edutainment applications, such as gamified onboarding, soft skills training, and VR-based industrial safety modules, are growing rapidly at double-digit rates. Fast-growing applications also include language learning, robotics education, and immersive subject-based curriculum content.

Distribution Channel Insights

Online distribution dominates edutainment sales, supported by app stores, D2C platforms, and subscription-based digital content. E-commerce channels drive demand for STEM kits, robotics sets, and educational toys, particularly in North America, Europe, and Asia-Pacific. Physical retail remains relevant in emerging markets, where in-store discovery influences purchasing decisions. Hybrid distribution models, combining online subscriptions with offline kits, are gaining popularity among premium edutainment brands. Social media and influencer-driven educational content also play a significant role in shaping purchasing behavior among parents.

End-User Insights

Households account for the largest share of edutainment consumption, representing nearly 44% of global demand. Schools and educational institutions are rapidly adopting digital learning platforms, smart classrooms, and VR labs. Corporations represent a fast-growing segment, with increasing investments in gamified e-learning and skill development tools. Public-sector agencies are also integrating edutainment platforms into national digital education programs. Theme parks and entertainment operators use edutainment attractions to enhance visitor engagement and diversify revenue streams.

Age Group Insights

Children aged 3–8 account for the largest user segment in the edutainment market, driven by parental emphasis on foundational skill-building and early literacy. The 9–12 and 13–18 age groups increasingly adopt coding tools, robotics, digital labs, and gamified curriculum content. Adult learners show growing interest in language learning apps and micro-learning platforms. Corporate workforce learners represent the highest growth opportunity, driven by digital upskilling initiatives across industries.

| By Product Type | By Age Group | By Deployment Mode | By Revenue Model | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for nearly 32% of the global edutainment market, led by the United States. High digital adoption, advanced corporate training ecosystems, and strong demand for early childhood edutainment drive regional growth. Canada is also witnessing the rapid adoption of STEM-based learning and VR-led training programs.

Europe

Europe holds around 28% of the market, with Germany, the U.K., and France leading adoption. Strong education infrastructure, high spending power, and preference for sustainable, skill-focused learning tools support regional growth. The EU’s digital education initiatives further accelerate demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region (CAGR 13.5%), driven by China, India, Japan, and South Korea. Government-led digital education programs, rising middle-class incomes, and demand for STEM learning kits fuel strong market expansion. Public–private partnerships are accelerating digital adoption in schools.

Latin America

LATAM shows increasing demand for digital learning apps and affordable STEM tools, particularly in Brazil and Mexico. Smartphone penetration and government-backed learning platforms support future growth.

Middle East & Africa

The Middle East is experiencing rapid edutainment adoption due to investments in youth development, innovation hubs, and immersive learning centers. Africa is leveraging mobile-based learning platforms to expand education access, especially in emerging markets like Kenya, Nigeria, and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Edutainment Market

- The LEGO Group

- Mattel

- LeapFrog Enterprises

- Duolingo

- Khan Academy

- Byju’s

- Curiosity Stream

- Kahoot!

- Rosetta Stone

- Tencent Education

- Sphero Robotics

- WizKids

- DreamWorks Education

- Discovery Education

- Pico Interactive