Ecotel Tourism Market Size

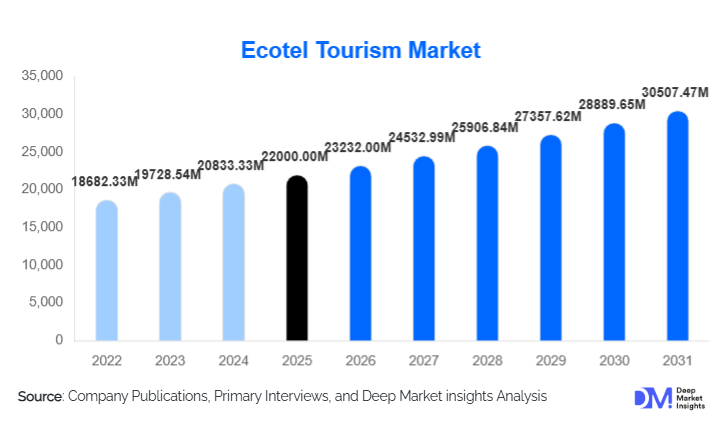

According to Deep Market Insights, the global ecotel tourism market size was valued at USD 310.00 million in 2024 and is projected to grow from USD 392.15 million in 2025 to reach USD 1,270.30 million by 2030, expanding at a CAGR of 26.5% during the forecast period (2025–2030). The ecotel tourism market growth is primarily driven by rising consumer demand for sustainable travel, increasing adoption of eco-friendly accommodations, and the expansion of community-based and conservation-focused eco-stays tailored to environmentally conscious global travelers.

Key Market Insights

- Ecotel tourism is increasingly emphasizing sustainability and community engagement, attracting travelers seeking authentic, low-impact experiences aligned with conservation principles.

- Eco-hotels and green resorts dominate the accommodation segment, offering certified sustainability practices and renewable energy integration.

- North America leads demand for ecotel tourism, driven by high environmental awareness and strong outbound travel from the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class affluence in China, India, and Southeast Asia and increasing domestic eco-travel demand.

- Europe remains a major market, driven by cultural preference for sustainable and experiential travel, and strong adoption of eco-certifications.

- Digital and technological integration, including OTA platforms, eco-rating systems, and online eco-experience visualization, is shaping consumer engagement.

What are the latest trends in the ecotel tourism market?

Sustainability and Conservation Integration

Ecotel operators are embedding sustainability into core operations. Practices such as renewable energy usage, water and waste management, community engagement, and conservation programs are increasingly standard. Many lodges collaborate with local communities and NGOs, integrating activities like wildlife monitoring, reforestation, and cultural exchanges. Some operators offer carbon-neutral packages or voluntary contribution programs for guests to offset their travel footprint, enhancing credibility and appeal to eco-conscious travelers.

Technology-Enhanced Eco-Stays

Emerging technologies enhance traveler experience and operational efficiency. Online platforms allow users to filter accommodations by eco-certifications, sustainability ratings, and carbon footprint. Mobile apps provide real-time activity tracking, local ecological information, and booking tools for conservation-oriented excursions. AI and IoT solutions optimize energy and water use in lodges, while virtual reality previews enable travelers to experience accommodations and local environments before arrival, attracting tech-savvy Millennials and Gen-Z consumers.

What are the key drivers in the ecotel tourism market?

Growing Environmental Awareness

Travelers increasingly seek low-impact and ethical tourism options. Rising awareness of climate change, biodiversity loss, and resource conservation motivates demand for eco-certified hotels, lodges, and resorts. Millennials and Gen-Z travelers, in particular, are driving the shift toward experiences that combine leisure with sustainability and responsible consumption.

Expansion of Eco-Certifications and Government Support

Certifications like LEED, Green Globe, and GSTC assure sustainable practices, building consumer trust. Governments are promoting eco-tourism via tax incentives, funding for green infrastructure, and simplified approvals for sustainable accommodations. These policies encourage new entrants and investments in environmentally responsible properties.

What are the restraints for the global market?

High Development Costs

Developing eco-friendly accommodations involves higher capital expenditures for sustainable construction materials, renewable energy systems, and eco-certifications. This can deter smaller operators and limit expansion, particularly in emerging markets.

Inconsistent Standards and Greenwashing Risks

Absence of uniform global sustainability standards can lead to confusion and skepticism among consumers. Some properties may market superficial eco-features without substantial environmental benefits, undermining trust and potentially slowing market growth.

What are the key opportunities in the ecotel tourism industry?

Adventure-Wellness Eco-Tourism

The intersection of eco-tourism and wellness presents opportunities for hybrid offerings. Eco-lodges and green resorts are increasingly integrating yoga, meditation, nature therapy, and plant-based cuisine alongside conservation experiences. These offerings attract health-conscious travelers and extend visitor stays, boosting revenue.

Community-Based Eco-Tourism

Engaging local communities in operations, cultural experiences, and conservation initiatives enhances authenticity and traveler satisfaction. Such models provide economic benefits to residents while creating incentives for biodiversity protection, aligning tourism growth with social and environmental objectives.

Accommodation Type Insights

Eco-hotels dominate the market (38–40% share), combining sustainability and comfort for a wide range of travelers. Green resorts and eco-lodges appeal to adventure and leisure tourists seeking immersive experiences. Boutique eco-accommodations and community-run stays offer niche experiences, catering to travelers focused on authenticity and conservation impact. Treehouses and unique eco-stays are gaining popularity as experiential tourism grows, particularly among younger demographics.

Application Insights

Recreational travel is the primary application, with adventure and wildlife experiences leading demand. Educational and conservation tours are growing, offering hands-on experiences such as reforestation, wildlife tracking, and habitat restoration. Wellness-focused retreats are an emerging niche, combining low-impact travel with mindfulness, yoga, and eco-conscious lifestyle experiences. Corporate and business eco-travel is also expanding, with companies integrating sustainability into retreats and team-building programs.

Distribution Channel Insights

Online travel agencies (OTAs) dominate bookings (45–50%), enabling travelers to compare accommodations, verify certifications, and access curated eco-experiences. Direct booking through hotel websites is rising, supported by enhanced digital marketing and loyalty programs. Specialist eco-tourism agencies and tour operators cater to niche and high-value travelers, offering bespoke packages emphasizing sustainability, wellness, and community engagement.

Traveler Type Insights

Adventure and leisure travelers constitute the largest share of ecotel tourism. Solo travelers and Millennials prioritize flexible, immersive, and eco-conscious experiences. Families increasingly seek child-friendly eco-lodges and educational programs, while couples and honeymooners favor luxury or boutique eco-stays combining romance and sustainability. Corporate travelers contribute to mid-range and premium bookings through retreats and incentive programs.

Age Group Insights

Travelers aged 31–50 represent the largest segment, balancing disposable income with experiential travel preferences. The 18–30 age group drives growth in budget-friendly and adventure-focused eco-tourism. Older demographics (51–65 years) contribute to premium eco-stays with wellness and comfort-oriented packages, while the 65+ segment represents a niche for high-value, accessible, and safe eco-experiences.

| By Accommodation Type | By Traveler Type | By Destination Type | By Tour Type | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America (43% of global share in 2024) leads ecotel tourism, driven by high environmental awareness, disposable income, and interest in sustainable travel. U.S. and Canadian travelers prioritize eco-certified lodges and conservation experiences, including wildlife and adventure-focused stays.

Europe

Europe (30% of global share in 2024) is characterized by strong adoption of eco-certifications, voluntourism, and sustainable travel policies. Countries such as Germany, France, the U.K., and Scandinavia lead demand, with younger travelers favoring experiential and conservation-focused trips.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Southeast Asia, and Australia. Rising middle-class incomes, social media influence, and outbound travel growth are driving demand for both mid-range and luxury eco-stays. Domestic eco-tourism is also expanding rapidly.

Latin America

Latin American travelers are increasingly engaging in outbound ecotel tourism, particularly from Brazil, Mexico, and Argentina. Adventure-driven and family-friendly eco-tours are gaining popularity.

Middle East & Africa

Africa hosts key ecotourism destinations with rich biodiversity and well-established eco-lodges. The Middle East is emerging as a source market, with UAE, Saudi Arabia, and Qatar travelers preferring luxury eco-experiences. Intra-African tourism is growing with South African, Nigerian, and Kenyan travelers participating in regional eco-circuits.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ecotel Tourism Market

- Six Senses Hotels, Resorts, and Spas

- Banyan Tree Holdings

- Soneva

- Accor Group

- Marriott International

- Radisson Hotel Group

- Scandic Hotels

- Wilderness Safaris

- Inkaterra

- EcoCamp Patagonia

- Whitepod Eco-Luxury Hotel

- Lapa Rios Lodge

- Alila Hotels (Hyatt)

- CGH Earth

- Feynan Ecolodge