Eco-Friendly Laundry Detergent Market Size

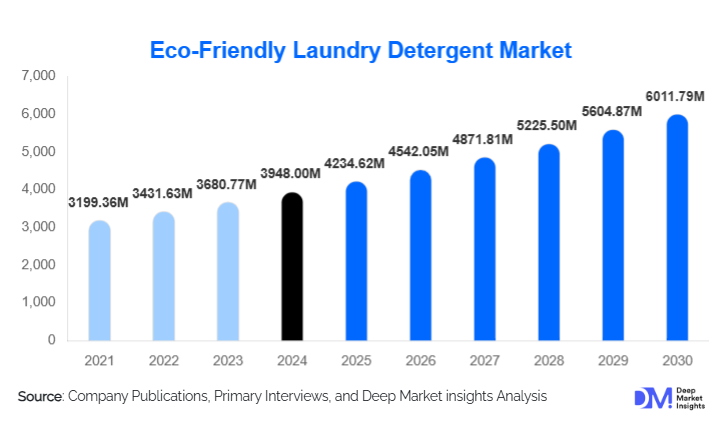

According to Deep Market Insights, the global eco-friendly laundry detergent market size was valued at USD 3,948.00 million in 2024 and is projected to grow from USD 4,234.62 million in 2025 to reach USD 6,011.79 million by 2030, expanding at a CAGR of 7.26% during the forecast period (2025–2030). The eco-friendly laundry detergent market growth is primarily driven by rising environmental awareness among consumers, stricter regulations on chemical-based detergents, and increasing adoption of sustainable household products across residential and commercial sectors.

Key Market Insights

- Plant-based and biodegradable formulations dominate product innovation, as consumers increasingly prioritize non-toxic, skin-safe, and environmentally responsible laundry solutions.

- Liquid eco-friendly detergents account for the largest product share, driven by superior cold-water performance and compatibility with high-efficiency washing machines.

- North America leads the global market, supported by strong regulatory frameworks, high consumer awareness, and premium product adoption.

- Europe remains a sustainability-driven stronghold, with stringent environmental regulations accelerating the shift toward biodegradable and zero-waste detergents.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable income, and expanding middle-class demand for green consumer goods.

- E-commerce and D2C channels are transforming market access, enabling subscription models, transparent ingredient disclosures, and direct consumer engagement.

What are the latest trends in the eco-friendly laundry detergent market?

Rise of Concentrated, Low-Waste Detergent Formats

One of the most prominent trends in the eco-friendly laundry detergent market is the rapid adoption of concentrated formats such as detergent pods, tablets, and sheets. These products significantly reduce water usage, packaging material, and transportation emissions. Detergent sheets and strips, in particular, are gaining popularity due to their ultra-lightweight design, plastic-free packaging, and ease of use. This trend aligns strongly with zero-waste lifestyles and urban consumer preferences, positioning concentrated formats as a high-growth innovation segment within the market.

Clean-Label and Transparency-Focused Branding

Consumers are increasingly demanding transparency in ingredient sourcing and formulation. As a result, manufacturers are emphasizing clean-label claims such as “plant-derived,” “enzyme-based,” “cruelty-free,” and “free from phosphates and synthetic fragrances.” Digital platforms and QR-code-enabled packaging now provide detailed lifecycle and sourcing information, strengthening consumer trust. Brands that clearly communicate environmental impact, carbon footprint reduction, and third-party certifications are gaining stronger brand loyalty and premium pricing power.

What are the key drivers in the eco-friendly laundry detergent market?

Growing Environmental and Health Awareness

Heightened awareness of water pollution, microplastics, and chemical residue from conventional detergents is a major growth driver. Consumers are increasingly concerned about skin irritation, allergies, and long-term health risks associated with synthetic surfactants. Eco-friendly detergents, formulated using biodegradable and plant-based ingredients, address these concerns, driving adoption across households with children, pets, and sensitive skin users. This shift in consumer mindset has transitioned eco-friendly detergents from niche products into mainstream household essentials.

Regulatory Pressure and Sustainability Mandates

Government regulations restricting the use of phosphates, petrochemical surfactants, and non-biodegradable compounds are accelerating market growth. Regions such as Europe and North America have implemented strict wastewater discharge standards, pushing manufacturers and institutional buyers toward sustainable alternatives. Public procurement policies increasingly favor eco-certified cleaning products, boosting demand from healthcare, hospitality, and municipal sectors and reinforcing long-term market expansion.

What are the restraints for the global market?

Higher Cost of Sustainable Raw Materials

Eco-friendly laundry detergents rely on plant-based surfactants, enzymes, and biodegradable packaging, all of which are more expensive than conventional chemical inputs. This results in higher product prices, limiting adoption in price-sensitive markets. Cost pressures also compress margins for manufacturers that lack economies of scale, particularly smaller or emerging brands competing against large FMCG players.

Supply Chain Volatility for Bio-Based Inputs

Raw materials used in eco-friendly formulations are often derived from agricultural sources, making them vulnerable to climate variability and price fluctuations. Inconsistent availability of sustainable inputs can disrupt production planning and pricing stability. Managing these risks requires long-term supplier contracts and investment in backward integration, which can be capital-intensive.

What are the key opportunities in the eco-friendly laundry detergent industry?

Expansion into Commercial and Institutional Laundry

Commercial laundries, hotels, hospitals, and institutional facilities represent a significant untapped opportunity. As organizations strengthen ESG commitments, demand for non-toxic, low-temperature, and water-efficient detergents is rising. Eco-friendly detergents that deliver industrial-grade cleaning performance while reducing environmental impact can capture high-volume, recurring contracts and drive long-term revenue stability.

Refillable and Circular Packaging Models

The transition toward circular economy models presents strong growth opportunities. Refill stations, reusable containers, and compostable packaging solutions are gaining traction, particularly in urban markets. Brands that invest in packaging innovation and closed-loop systems can differentiate themselves, reduce long-term packaging costs, and strengthen sustainability credentials.

Product Type Insights

Liquid eco-friendly detergents dominate the market, accounting for approximately 38% of global revenue in 2024. Their leadership is driven by superior stain removal, cold-water efficiency, and ease of dosing. Powder detergents remain relevant in cost-sensitive regions due to longer shelf life and lower packaging costs. Pods, tablets, and detergent sheets are the fastest-growing product types, benefiting from convenience, portability, and reduced environmental footprint, particularly among urban and younger consumers.

Ingredient Composition Insights

Plant-based detergents lead the market with roughly 42% share in 2024, reflecting strong consumer preference for renewable and biodegradable ingredients. Enzyme-based formulations are gaining traction due to enhanced cleaning performance at lower temperatures, supporting energy savings. Hybrid formulations combining plant-based surfactants and enzymes are emerging as a balanced solution, offering both sustainability and high efficacy.

Distribution Channel Insights

Supermarkets and hypermarkets remain the largest distribution channel, contributing approximately 41% of global sales, supported by high consumer visibility and trust. However, online and direct-to-consumer channels are growing at the fastest rate, driven by subscription models, transparent pricing, and personalized product offerings. Specialty organic stores continue to play a critical role in premium and certified product segments.

End-Use Insights

Residential households represent the largest end-use segment, accounting for nearly 68% of global demand in 2024, driven by recurring consumption and rising eco-consciousness. Commercial laundry services and hospitality are the fastest-growing segments, expanding at double-digit growth rates as sustainability becomes integral to operational standards. Healthcare and institutional users are emerging as important demand centers due to stringent hygiene and safety requirements.

| By Product Form | By Ingredient Composition | By Distribution Channel | By End Use | By Packaging Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global eco-friendly laundry detergent market in 2024, led by the United States. Strong regulatory enforcement, high disposable income, and widespread adoption of premium sustainable brands underpin regional dominance. Consumers in this region actively seek certified, cruelty-free, and low-toxicity products.

Europe

Europe held close to 29% market share, driven by countries such as Germany, the U.K., and France. Stringent environmental regulations, high recycling rates, and early adoption of zero-waste packaging models continue to support market growth. European consumers show a strong preference for biodegradable and refillable detergent formats.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 12% CAGR. China, Japan, India, and South Korea are key contributors, supported by urbanization, rising middle-class income, and government-backed green manufacturing initiatives. Local production and export-oriented growth are strengthening the region’s global role.

Latin America

Latin America represents a developing market, led by Brazil and Mexico. Growing awareness of environmental and health impacts, along with gradual premiumization of household products, is supporting steady growth.

Middle East & Africa

The Middle East & Africa region is witnessing gradual adoption, led by the UAE and South Africa. Demand is supported by hospitality sector growth, tourism-driven laundry services, and rising interest in sustainable consumer goods.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Eco-Friendly Laundry Detergent Market

- Procter & Gamble

- Unilever

- Henkel AG

- Church & Dwight

- Seventh Generation

- Ecover

- Method Products

- Reckitt

- Kao Corporation

- Lion Corporation

- Bio-D

- Sonett GmbH

- Dropps

- Frosch (Werner & Mertz)

- Attitude Living