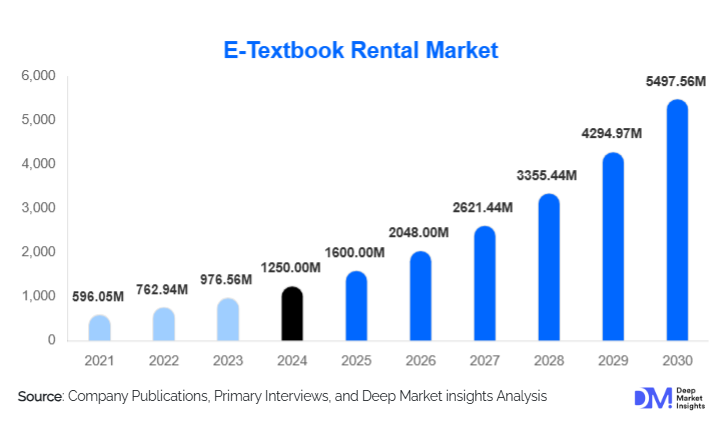

E-Textbook Rental Market Size

According to Deep Market Insights, the global e-textbook rental market size was valued at USD 1,250.00 million in 2024 and is projected to grow from USD 1,600.00 million in 2025 to reach USD 5,497.56 million by 2030, expanding at a CAGR of 28.00% during the forecast period (2025–2030). The e-textbook rental market is witnessing rapid acceleration driven by the rising shift toward digital learning, cost-efficiency needs among students, and the expansion of cloud-based and mobile-friendly reading platforms. Increased adoption of online and hybrid learning models worldwide is creating a sustained surge in demand for affordable, accessible, and flexible digital textbook rental solutions.

Key Market Insights

- E-textbook rentals are becoming the preferred alternative to expensive print textbooks, especially for university students seeking cost-effective access to academic content.

- Subscription-based rental models dominate the industry, offering convenient and affordable monthly or yearly access to large digital textbook libraries.

- STEM textbooks account for the largest subject share, driven by frequent curriculum updates and high textbook replacement costs.

- North America leads the global market, with strong institutional partnerships and widespread adoption of digital learning ecosystems.

- Asia-Pacific is the fastest-growing region, supported by massive student populations, digital education investments, and rising smartphone penetration.

- Cloud-enabled, multi-device access and LMS integrations are transforming the user experience, offering seamless learning across smartphones, tablets, and laptops.

What are the latest trends in the e-textbook rental market?

AI-Integrated, Adaptive Digital Reading Platforms

The latest wave of e-textbook platforms is centered around intelligent, adaptive learning tools. AI-powered features such as automated summaries, personalized reading pathways, contextual search, and study recommendations are enhancing student engagement and retention. Platforms now integrate analytics dashboards that help both students and educators track learning patterns, time spent on chapters, and topic comprehension. As such capabilities mature, rental platforms are increasingly differentiating based on technology rather than just pricing or book availability.

Mobile-First Digital Learning Experiences

With over half of global learners studying on smartphones, e-textbook rental providers are optimizing mobile-first experiences. This includes offline reading capabilities, low-data usage formats, enhanced readability, and synchronization across devices. Short-form learning tools, flashcards, chapter highlights, and smart notes are integrated into mobile apps to support multitasking learners. These trends appeal strongly to Gen-Z and working professionals seeking seamless learning-on-the-go, contributing to higher platform retention rates.

What are the key drivers in the e-textbook rental market?

High Cost of Print Textbooks Driving Digital Shift

The continuous surge in print textbook prices has made traditional learning materials increasingly unaffordable. University students, in particular, are turning to digital rentals, which offer 60–80% lower costs compared to purchasing new textbooks. This price sensitivity is a significant driver pushing educational institutions to explore digital-first procurement and partnerships with rental platforms.

Acceleration of Online & Hybrid Learning Models

Post-pandemic educational models have permanently shifted toward remote and hybrid formats. With institutions digitizing curricula and deploying cloud-based learning management systems (LMS), e-textbooks have naturally become essential components of the modern academic ecosystem. Their instant accessibility, ease of updates, and compatibility with online coursework drive widespread adoption.

Growing Device Penetration & Cloud Infrastructure

Global smartphone, tablet, and laptop penetration, especially in emerging regions, combined with expanding broadband access, has unlocked new opportunities for digital textbook consumption. Cloud-based delivery enables on-demand access, cross-device synchronization, and secure DRM protection, ensuring scalable and cost-efficient distribution for publishers and rental platforms.

What are the restraints for the global market?

Competition from Free & Open Educational Resources (OER)

Open-source educational platforms provide free alternatives to commercial textbooks, creating competitive pressure on rental services. Many institutions, especially in developing regions, are increasingly adopting open-access course materials to reduce student costs, thereby limiting the expansion potential for paid rental providers.

Digital Divide & Limited Access to Reliable Internet

Despite rapid digitization, many regions still face critical connectivity gaps, device shortages, and lower digital literacy. These factors hinder e-textbook penetration in rural and underserved communities, particularly across Africa, parts of Latin America, and some Asian markets. Without substantial infrastructure improvements, adoption in these regions will remain slow.

What are the key opportunities in the e-textbook rental industry?

Institutional Licensing & Bulk Academic Partnerships

Universities, colleges, and K-12 institutions are increasingly adopting centralized digital textbook rental solutions for entire cohorts. This creates opportunities for rental platforms to offer bulk subscription models that lower student costs while guaranteeing publishers stable revenues. Corporate learning departments are also emerging as lucrative customers for professional textbooks and training materials.

Expansion Across Emerging Markets

Rapid growth in student populations across India, China, Indonesia, Vietnam, Brazil, and Africa presents enormous untapped potential. With smartphone penetration rising and governments subsidizing digital learning, e-textbook rentals can expand into millions of new households. Local-language content development will be a major avenue for market expansion in these regions.

Product Type Insights

STEM textbooks dominate the product landscape, accounting for 30–35% of global market share in 2024. These subjects require frequent content updates and traditionally carry the highest retail costs, making rental models particularly attractive. Business and economics textbooks represent the second-largest segment, while humanities, social sciences, and law textbooks collectively contribute to steady demand. Vocational and professional upskilling books are emerging as fast-growing categories due to rising adult learning and certification trends.

Application Insights

Academic applications form the core of the market, contributing over 65% of total demand. University-level courses dominate usage patterns. Non-academic applications, including corporate training, professional certification, test preparation, and self-learning, are rising rapidly. These segments increasingly prefer digital rentals due to lower costs and shorter content usage cycles. Microlearning modules integrated with e-textbooks are emerging as a popular application for working professionals.

Distribution Channel Insights

Online distribution channels dominate, with direct-to-consumer (D2C) platforms and publisher-backed portals offering subscription or rental-based access. University learning management systems are becoming a critical channel as institutions integrate digital libraries and course-specific rentals directly into coursework. Corporate L&D platforms represent another emerging distribution avenue. App-based rentals via mobile marketplaces also support growing adoption among younger learners.

User Type Insights

Higher-education students represent the largest user base, driven by high textbook requirements and cost sensitivity. K–12 students are increasingly adopting rentals as schools transition to digital curricula. Professionals and adult learners, seeking short-term access to skill-building resources, form a fast-growing user group. Corporate employees participating in online certification programs also contribute to rising demand.

Age Group Insights

Learners aged 18–30 account for the largest share, driven by university enrollments and reliance on digital education platforms. The 31–45 segment is rapidly expanding due to professional upskilling needs. Younger students (under 18) represent an emerging demographic as digital classrooms and tablet-based learning spread globally. Older users (46+) represent a small but growing niche, largely tied to lifelong learning and hybrid training programs.

| By End-User Type | By Revenue / Payment Model | By Product / Subject Type | By Device / Delivery Mode |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global e-textbook rental market with 35–40% of the 2024 share. Strong university partnerships, high digital literacy, and robust publisher ecosystems anchor regional dominance. The U.S. drives most demand, with Canada showing steady adoption across higher education, vocational, and certification programs.

Europe

Europe represents a mature yet growing market, capturing 15–20% of global revenue. The U.K., Germany, France, and the Netherlands are key contributors, driven by digital-first educational reforms and sustainability goals. European institutions are rapidly adopting digital libraries, boosting rental demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 20–25% of global market share in 2024 but projected to surpass Europe by 2030. Massive student populations, government-led digital education initiatives, and rising mobile penetration in India, China, Indonesia, and Vietnam are accelerating adoption.

Latin America

Latin America is gradually adopting e-textbook rentals, with Brazil, Mexico, and Argentina leading demand. Infrastructure challenges persist, but increasing digital learning adoption in urban centers is boosting growth.

Middle East & Africa

MEA remains an emerging market with strong potential. The UAE and Saudi Arabia are rapidly digitizing education, while African nations are adopting tablet-based learning systems. Growth is steady but dependent on infrastructural investment and device affordability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the E-Textbook Rental Market

- McGraw-Hill Education

- Cengage Learning

- Chegg, Inc.

- Pearson Education

- VitalSource Technologies

- Barnes & Noble Education

- RedShelf

- TextbookRush

- OpenStax

- BookRenter

- Kortext

- Perlego

- Cambridge University Press (Digital)

- Wiley (Digital Learning Division)

- Scribd (Academic/Professional Content Rentals)

Recent Developments

- In April 2025, Cengage expanded its digital rental catalog with AI-backed study tools integrated across more than 8,000 academic titles.

- In March 2025, VitalSource partnered with several global universities to launch bulk institutional rental programs covering entire academic departments.

- In January 2025, Chegg introduced a cloud-based multi-device reading platform with offline access, aiming to increase accessibility in emerging markets.