E-Paper Display Market Size

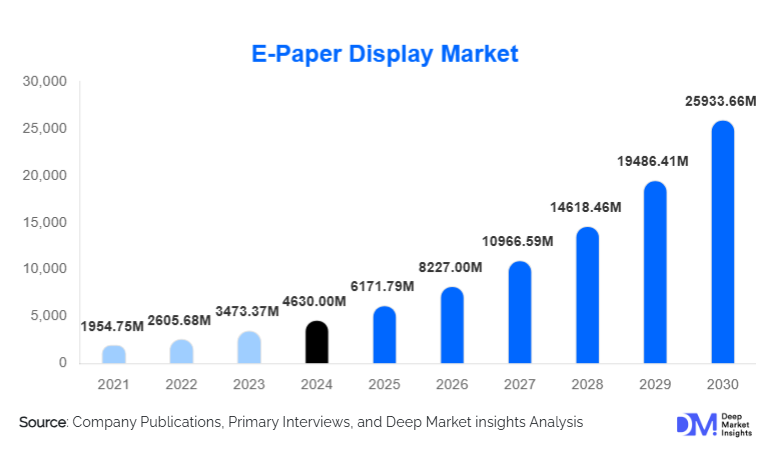

According to Deep Market Insights, the global e-paper display market size was valued at USD 4,630.00 million in 2024 and is projected to grow from USD 6,171.79 million in 2025 to reach USD 25,933.66 million by 2030, expanding at a CAGR of 33.3% during the forecast period (2025–2030). Market growth is primarily driven by rising demand for ultra-low-power display technologies, rapid adoption of electronic shelf labels (ESLs) in retail automation, and increasing deployment of e-paper displays across IoT, logistics, and smart infrastructure applications.

Key Market Insights

- Electronic shelf labels represent the largest application segment, accounting for nearly half of global e-paper display demand in 2024.

- Asia-Pacific dominates global production and consumption, led by China, Japan, and South Korea, due to strong manufacturing ecosystems.

- Monochrome e-paper displays continue to lead, supported by cost efficiency and widespread use in retail and industrial applications.

- Color and flexible e-paper technologies are gaining traction, expanding adoption in signage, advertising, and branding applications.

- Retail automation and smart store initiatives remain the strongest growth drivers globally.

- Integration with IoT, RFID, and wireless connectivity is reshaping use cases across logistics, healthcare, and industrial monitoring.

What are the latest trends in the e-paper display market?

Retail Automation and ESL Proliferation

Retailers worldwide are rapidly deploying electronic shelf labels to enable real-time pricing, inventory synchronization, and omnichannel consistency. Large retail chains are prioritizing ESL systems to reduce labor costs, eliminate pricing errors, and support dynamic promotions. As ESL penetration remains below full saturation globally, especially in emerging markets, this trend continues to drive large-volume, long-term deployment contracts for e-paper display manufacturers.

Advancements in Color and Flexible E-Paper

Technological improvements in multi-color and full-color e-paper displays are expanding applications beyond text-based use cases. Flexible substrates are enabling curved, lightweight, and rugged displays suitable for transportation, industrial environments, and wearable devices. These advancements are positioning e-paper as a viable alternative to LCDs in select low-power signage and information display applications.

What are the key drivers in the e-paper display market?

Rising Demand for Energy-Efficient Displays

E-paper displays consume power only when content is refreshed, making them highly energy-efficient compared to LCD and OLED technologies. This characteristic aligns strongly with global sustainability goals, carbon reduction initiatives, and enterprise-level cost optimization strategies, driving adoption across retail, logistics, and public infrastructure.

Growth of Smart Retail and Digital Pricing

The expansion of organized retail and the shift toward data-driven pricing models are accelerating ESL adoption. Retailers are increasingly leveraging centralized pricing systems supported by e-paper displays to improve operational efficiency and customer experience. This driver has resulted in consistent double-digit growth in retail-focused deployments.

What are the restraints for the global market?

Limited Refresh Rates and Multimedia Capability

E-paper displays are not suitable for video or high-refresh applications, limiting adoption in entertainment and dynamic advertising segments. This technical limitation confines e-paper primarily to static or semi-static information display use cases.

Higher Initial Deployment Costs

Although e-paper displays offer lower total cost of ownership, upfront system costs—especially for color and large-format displays—can be a barrier for small retailers and price-sensitive markets, slowing adoption in certain regions.

What are the key opportunities in the e-paper display industry?

IoT-Integrated Smart Labels and Logistics Applications

The integration of e-paper displays with IoT, RFID, and cloud-based platforms is creating new opportunities in logistics, cold-chain monitoring, and asset tracking. Smart labels capable of displaying real-time information with minimal power consumption are gaining traction across pharmaceuticals, food logistics, and industrial supply chains.

Government-Led Smart Infrastructure and Sustainability Initiatives

Smart city programs, digital governance initiatives, and paperless public communication systems are driving demand for e-paper displays in transportation signage, public information boards, and utility metering. Government-backed sustainability policies are expected to further accelerate adoption over the forecast period.

Technology Insights

Electrophoretic display (EPD) technology continues to dominate the global e-paper display market, accounting for approximately 68% of global revenue in 2024. Its leadership is attributed to its maturity, high reliability, superior readability in bright environments, and proven performance in applications such as electronic shelf labels (ESL) and e-readers. EPD’s low power consumption and long lifespan further reinforce its adoption across retail, consumer electronics, and industrial sectors. Meanwhile, electrochromic and electrowetting technologies occupy niche applications but are gradually gaining attention for specialized industrial, outdoor, and flexible display use cases where high durability and environmental resilience are critical. Innovation in color rendering, flexible substrates, and faster refresh rates is expected to further expand the relevance of these emerging technologies over the forecast period.

Color Capability Insights

Monochrome e-paper displays hold around 57% of the market due to their cost-effectiveness, simplicity, and widespread deployment in retail and logistics environments. They are highly favored for ESLs, smart labels, and industrial indicators, where energy efficiency and visibility under direct sunlight are critical. Multi-color and full-color e-paper displays are the fastest-growing segments, propelled by increasing demand for visual differentiation in digital signage, branding, advertising, and immersive smart retail experiences. The expansion of multi-color and flexible displays also enables new applications in healthcare, transportation, and wearable devices, further broadening market potential.

Application Insights

Electronic shelf labels dominate application demand, representing approximately 46% of the global market in 2024. Their growth is primarily driven by the rapid digital transformation of the retail sector, the adoption of dynamic pricing strategies, and the need for operational efficiency in multi-store networks. E-readers maintain a stable demand due to sustained popularity in digital publishing and education. High-growth applications include digital signage, smart labels, and industrial displays, which benefit from IoT integration, real-time content updates, and wireless connectivity. These emerging applications are increasingly supported by advancements in color, flexibility, and ruggedized e-paper technologies, positioning them as critical growth drivers in diverse end-use industries.

End-Use Industry Insights

Retail and commercial end users remain the largest contributors to market demand, accounting for nearly 49% of total revenue. Growth in this sector is driven by large-scale ESL deployment, automation of inventory management, and enhanced customer engagement through dynamic signage. Consumer electronics and transportation & logistics follow closely, leveraging e-paper for e-readers, smart cards, asset tracking, and low-power displays for logistics management. Healthcare and industrial applications are emerging as high-potential growth areas due to their increasing adoption of low-power, high-durability displays for monitoring, compliance, and operational efficiency. The expanding scope of smart infrastructure and IoT integration is expected to further accelerate adoption across all end-use industries.

| By Technology Type | By Color Capability | By Display Size | By Application | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global e-paper display market, holding approximately 41% share in 2024. China dominates manufacturing and exports, driven by strong production capabilities, low-cost scale manufacturing, and government-backed “Made in China 2025” initiatives that promote advanced display technologies. Japan and South Korea lead in retail automation and early adoption of color and flexible e-paper solutions. The growth in this region is fueled by expanding organized retail chains, rapid adoption of electronic shelf labels, increasing consumer electronics demand, and rising smart city investments. Additionally, rising R&D investments in color and flexible displays are expected to strengthen the region’s market leadership.

Europe

Europe accounts for around 29% of global demand, with Germany, France, and the U.K. driving growth. High labor costs and a strong focus on retail automation accelerate ESL deployment in large-scale supermarkets and hypermarkets. Sustainability initiatives, energy-efficient display adoption, and smart city projects are additional growth drivers. Governments are promoting paperless systems, digital signage, and energy reduction in commercial applications, further boosting e-paper adoption. The demand is particularly strong in sectors requiring long-term low-power displays, such as transportation signage and public information boards.

North America

North America holds approximately 21% market share, driven primarily by the United States. Growth is supported by extensive retail digitization, logistics automation, and increasing investments in smart infrastructure. Large-scale deployment of ESLs in supermarkets, warehouses, and supply chains contributes significantly to demand. Technology adoption is facilitated by a strong R&D ecosystem, availability of skilled workforce, and consumer preference for digital transformation solutions. Government incentives for energy-efficient technologies in commercial and public infrastructure further support the regional market expansion.

Latin America

Latin America represents a smaller but rapidly growing market, led by Brazil and Mexico. Market expansion is driven by the modernization of organized retail chains, growing e-commerce penetration, and smart logistics initiatives in supply chain operations. Government incentives for digital transformation, coupled with increasing adoption of low-power display solutions in commercial and industrial sectors, are supporting regional growth. Rising consumer awareness and investments in smart retail technologies are further propelling the adoption of e-paper displays in this region.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth, with the UAE and Saudi Arabia leading adoption. Investments in smart cities, digital infrastructure, and public information systems are key growth drivers. Increasing demand in transportation, retail, and government sectors, coupled with high disposable incomes in GCC countries, supports e-paper deployment. Regional growth is further encouraged by initiatives to implement energy-efficient and sustainable technologies in commercial and public infrastructure projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the E-Paper Display Market

- E Ink Holdings

- BOE Technology Group

- LG Display

- Samsung Display

- AUO Corporation

- Sharp Corporation

- Sony Corporation

- Visionect

- Solomon Systech

- Plastic Logic

- Pervasive Displays

- CLEARink Displays

- Good Display

- WaveShare

- Guangzhou OED Technologies