DTG Printer Market Size

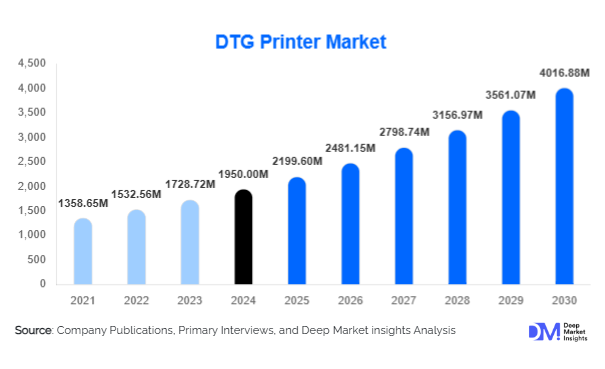

According to Deep Market Insights, the global DTG printer market size was valued at USD 1,950 million in 2024 and is projected to grow from USD 2,199.6 million in 2025 to reach USD 4,016.88 million by 2030, expanding at a CAGR of 12.8% during the forecast period (2025–2030). The DTG printer market growth is primarily driven by the increasing demand for personalized apparel, rapid adoption of on-demand printing in e-commerce, and advancements in eco-friendly water-based ink technology.

Key Market Insights

- DTG printing is increasingly favored for small-batch, custom apparel production, enabling fashion brands and SMEs to reduce inventory costs while meeting growing consumer preference for personalized garments.

- Industrial and flatbed printers dominate due to their ability to print high-resolution designs on multiple fabric types simultaneously, enhancing productivity and operational efficiency.

- North America remains the largest market, with the U.S. leading adoption driven by e-commerce growth and strong demand for custom merchandise.

- Asia-Pacific is the fastest-growing region, particularly India and China, due to expanding apparel manufacturing hubs and increasing SME adoption of DTG technology.

- Europe is witnessing robust growth, supported by high consumer spending, eco-friendly regulatory initiatives, and demand for sustainable fashion printing.

- Technological integration, including piezoelectric printing, specialty inks, and automation for small-batch production, is enhancing market adoption and operational efficiency.

What are the latest trends in the DTG printer market?

On-Demand Printing and E-Commerce Integration

DTG printers are increasingly integrated with online retail platforms such as Shopify, Etsy, and Amazon Merch, enabling small and medium businesses to offer custom apparel without maintaining large inventories. On-demand printing allows brands to cater to individual consumer preferences and seasonal trends efficiently. Automation features in modern DTG printers, including design pre-processing and print queue management, are enhancing productivity and turnaround times.

Eco-Friendly Printing Solutions

The market is witnessing a shift towards water-based inks and energy-efficient DTG printers due to growing environmental concerns. Regulations in Europe and North America are encouraging the adoption of eco-friendly printing technologies. Companies investing in sustainable solutions gain a competitive edge, appealing to both environmentally conscious consumers and global regulatory frameworks.

What are the key drivers in the DTG printer market?

Rising Demand for Custom Apparel

Personalized clothing is a strong growth driver for DTG printers, particularly among millennials and Gen Z consumers. Small-batch and limited-edition production capabilities allow brands to respond quickly to fashion trends while minimizing unsold inventory. This trend is also supported by growing interest in branded merchandise and corporate promotional products.

Technological Advancements in Printing

Modern DTG printers feature high-resolution capabilities, multi-garment printing, and specialized inks, enhancing the quality and versatility of printed apparel. Piezoelectric printing technology dominates due to its precision, consistency, and ability to handle various fabric types, further stimulating market growth.

Expansion of E-Commerce and Direct-to-Consumer Sales

The rapid growth of online fashion retail and print-on-demand services has fueled demand for DTG printers, as businesses can fulfill custom orders quickly and cost-effectively. Integration with design software and automation is also enhancing user experience and operational efficiency.

What are the restraints for the global market?

High Initial Investment Costs

Industrial DTG printers remain expensive, making adoption challenging for small enterprises and start-ups. While prices are gradually decreasing, upfront capital requirements remain a barrier for many potential users.

Fabric Compatibility Limitations

DTG printing works best on 100% cotton or high-cotton blends. Printing on synthetic fabrics such as dark polyester or mixed blends remains challenging, limiting the scope of certain applications and end-use industries.

What are the key opportunities in the DTG printer industry?

Expansion into Emerging Markets

Regions such as APAC and LATAM are witnessing growing demand due to rising disposable incomes, expanding e-commerce platforms, and the proliferation of SMEs in the apparel sector. Localized sales, service centers, and financing options can help companies capture significant market share in these regions.

Integration with E-Commerce Platforms

As online custom apparel grows, DTG printers integrated with design automation software and order management tools offer new revenue streams. Businesses can capitalize on on-demand printing, reducing inventory costs and responding to consumer preferences faster.

Adoption of Sustainable Printing Technologies

Water-based inks, energy-efficient printers, and eco-friendly processes present opportunities to attract environmentally conscious consumers. Companies investing in green technology benefit from regulatory compliance and enhanced brand image, particularly in Europe and North America.

Product Type Insights

Flatbed DTG printers dominate, capturing approximately 38% of the 2024 market share, due to their ability to print on large and varied garment sizes with high precision. Single-garment t-shirt printers are preferred by SMEs and custom apparel start-ups for low-volume production. Multi-garment and industrial printers are gaining traction in large-scale operations due to faster throughput and operational efficiency.

Application Insights

Commercial printing for fashion brands accounts for the largest market share (50%), driven by the need for small-batch, customized production. Home-based and small business printing are rapidly expanding as e-commerce platforms enable entrepreneurs to offer personalized apparel. Industrial and high-volume printing remains niche but critical for large-scale operations in sportswear and corporate merchandise.

End-Use Insights

The fashion & apparel sector accounts for the largest end-use segment (55% market share in 2024), driven by custom T-shirt printing and boutique apparel brands. Sportswear and corporate merchandise printing are emerging applications. Export-driven demand is strong from North America and Europe, supplying personalized apparel globally. The fastest-growing end-use segment is small-scale custom apparel for online retailers, supported by digital print-on-demand services.

| By Printer Type | By End-use | By Distribution |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest market with a 40% share in 2024. The U.S. leads due to e-commerce growth, rising demand for custom merchandise, and strong consumer spending. Canada contributes through SMEs adopting DTG technology for personalized apparel.

Europe

Europe accounts for 30% of the market, led by Germany, the UK, and France. Eco-friendly regulations, sustainable fashion demand, and high disposable income are key growth drivers. The region emphasizes energy-efficient printers and water-based inks.

Asia-Pacific

APAC is the fastest-growing region (12% CAGR), led by China and India. Rising apparel manufacturing hubs, growing SMEs, and increasing online retail adoption drive DTG printer demand. Japan and South Korea contribute through high-end custom apparel demand.

Latin America

Brazil, Argentina, and Mexico are emerging markets, driven by SMEs and growing e-commerce adoption. Demand focuses on affordable, small-batch printing solutions.

Middle East & Africa

Africa hosts key manufacturing hubs and benefits from regional demand for corporate and promotional merchandise. Middle East demand, led by the UAE and Saudi Arabia, is growing due to luxury and branded apparel consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the DTG Printer Market

- Kornit Digital

- Brother Industries

- Epson

- Mutoh

- Roland DG

- DTG Digital

- M&R

- Polyprint

- Aeoon

- Col-Desi

- OmniPrint

- Viper

- Ricoh

- Anajet

- Colorjet

Recent Developments

- In March 2025, Kornit Digital launched a new eco-friendly DTG printer with faster throughput and water-based inks, targeting the European fashion market.

- In January 2025, Brother Industries expanded its single-garment DTG printer portfolio for small businesses in India and Latin America.

- In November 2024, Epson introduced high-resolution industrial DTG printers for multi-garment operations in North America and Europe.