Drinking Fountain Market Size

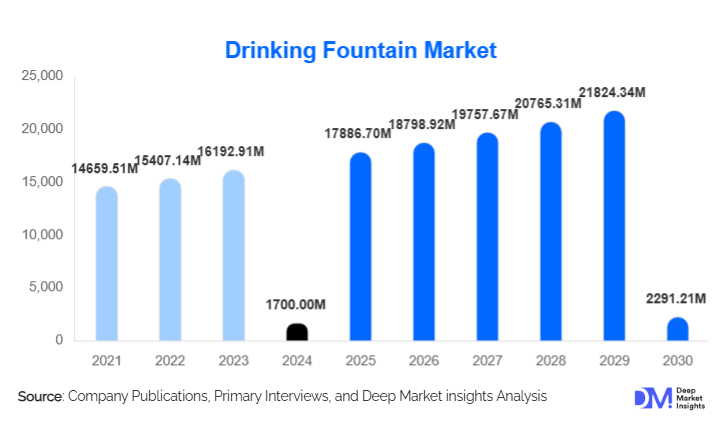

According to Deep Market Insights, the global drinking fountain market size was valued at USD 1,700 million in 2024 and is projected to grow from USD 1,786.7 million in 2025 to reach USD 2,291.21 million by 2030, expanding at a CAGR of 5.1% during the forecast period (2025–2030). The market growth is primarily driven by rising awareness of hygiene and safe drinking water, increasing urban infrastructure development, and the adoption of technologically advanced, smart, and touchless fountains across educational, healthcare, and commercial sectors.

Key Market Insights

- Hygiene-conscious and touchless fountains are becoming mainstream, particularly in public spaces and healthcare facilities, reflecting a post-pandemic focus on sanitation and public health.

- Stainless steel fountains dominate due to durability, low maintenance, and corrosion resistance, making them the preferred choice across schools, offices, and public infrastructure.

- North America holds a significant market share, driven by investments in public infrastructure, corporate wellness initiatives, and the adoption of smart fountain technology in schools and parks.

- APAC is the fastest-growing region, fueled by urbanization, government programs for safe drinking water, and growing awareness in countries such as China, India, and Japan.

- Technological adoption, including IoT-enabled monitoring, filtration integration, and touchless dispensing, is transforming user experience and driving premium fountain adoption.

What are the latest trends in the drinking fountain market?

Smart and Touchless Fountains on the Rise

Technological innovations such as touchless operation, sensor-based dispensing, and filtration systems are rapidly reshaping the drinking fountain market. Public spaces, corporate offices, and healthcare facilities increasingly prefer these advanced solutions to ensure hygiene, reduce contamination, and provide real-time water quality monitoring. IoT-enabled fountains also allow remote monitoring of usage, maintenance alerts, and water consumption tracking, enhancing operational efficiency for institutional buyers. Additionally, integration of eco-friendly materials and water-saving technologies is emerging as a key trend among environmentally conscious users and government procurement programs.

Filtration and Sustainability Driving Demand

Demand for fountains with integrated filtration systems is rising as urban populations and institutions focus on providing safe and clean drinking water. Schools, hospitals, and public parks are increasingly installing fountains with advanced filtration technologies to prevent contaminants and improve water taste. Sustainability is also influencing fountain design, with manufacturers promoting recycled materials, reduced water wastage, and energy-efficient cooling systems. These trends are shaping both consumer preferences and government infrastructure initiatives globally.

What are the key drivers in the drinking fountain market?

Growing Urbanization and Infrastructure Development

Rapid urbanization and expansion of public infrastructure are key drivers for the drinking fountain market. Cities in APAC, Europe, and North America are investing in parks, transit hubs, schools, and corporate buildings with fountains integrated into wellness and sustainability initiatives. Government programs aimed at providing clean drinking water in urban public spaces are further fueling adoption.

Rising Health and Hygiene Awareness

Increasing awareness of waterborne diseases and hygiene standards is driving the adoption of fountains, especially touchless and sensor-based models. Educational institutions, healthcare facilities, and corporate offices are prioritizing user safety and operational cleanliness, boosting demand for technologically advanced fountains.

Technological Advancements

Innovations such as temperature-controlled dispensing, IoT-based monitoring, and filtration integration are enabling modern fountains to offer enhanced convenience and safety. Such technological adoption is attracting institutions, government buyers, and eco-conscious consumers, contributing to revenue growth in premium fountain segments.

What are the restraints for the global market?

High Initial Cost

Smart and filtration-integrated fountains come with higher upfront costs compared to traditional models. This can limit adoption in budget-conscious regions and smaller institutions, restricting growth potential in price-sensitive markets.

Maintenance and Durability Concerns

Frequent maintenance, replacement of filtration units, and the use of low-quality materials in some fountains can impact product lifespan and operational efficiency, posing challenges for both manufacturers and institutional buyers.

What are the key opportunities in the drinking fountain market?

Public Infrastructure Expansion

Governments globally are investing in public parks, schools, transit hubs, and commercial spaces to provide safe drinking water. This creates a substantial opportunity for manufacturers to supply both traditional and advanced fountains, particularly in urbanizing regions of APAC, LATAM, and the Middle East.

Technological Integration and Smart Solutions

Innovations in sensor-based, IoT-enabled, and filtration-integrated fountains present opportunities to differentiate products and expand market share. Smart fountains that provide usage tracking, water quality monitoring, and low-maintenance operations can capture premium institutional buyers.

Emerging Regional Demand

High-growth markets in China, India, Brazil, and other emerging economies present new opportunities. Government programs targeting safe drinking water, corporate wellness initiatives, and increased urbanization are driving fountain adoption, providing fertile ground for new entrants and existing players.

Product Type Insights

Wall-mounted drinking fountains dominate the market, accounting for approximately 35% of global sales in 2024 due to their compact design, affordability, and suitability for educational and office environments. Freestanding and bottle-filling stations are gaining traction, particularly in public spaces and commercial complexes, reflecting the trend toward convenience and sustainability. Countertop fountains remain niche, primarily in institutional cafeterias and healthcare facilities.

Material Type Insights

Stainless steel fountains lead the market with a 50% share, favored for durability, hygiene, and corrosion resistance. Brass is preferred in premium installations for aesthetics and longevity, while plastic models are popular in cost-sensitive or temporary installations due to affordability and light weight.

End-Use Insights

Educational institutions are the largest end-use segment, contributing 30% of the market, driven by mandatory installations in schools and universities. Healthcare facilities and corporate offices are also significant, with growing adoption of touchless, filtration-equipped fountains. Public infrastructure and urban parks are increasingly integrating fountains for sustainability and wellness purposes. Industrial applications are emerging as organizations invest in employee hydration programs.

| By Product Type | By Material Type | By End-Use / Application | By Distribution Channel | By Technology |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 30% of the market in 2024, with the U.S. and Canada leading due to strong public infrastructure investments and corporate wellness programs. The adoption of smart, touchless fountains is particularly high in schools, hospitals, and office complexes, driving steady growth.

Europe

Europe accounts for 28% of the global market, led by Germany, France, and the U.K. Stringent public water safety regulations and urban infrastructure expansion are driving the adoption of hygienic and technologically advanced fountains. Sustainability-focused designs are increasingly popular in the region.

Asia-Pacific

APAC is the fastest-growing region, with a CAGR of 7–8%, driven by China, India, and Japan. Rising urbanization, government initiatives for safe drinking water, and growing awareness of hygiene are fueling demand. Public parks, schools, and commercial facilities are primary growth drivers.

Latin America

Brazil and Mexico are key markets, with growing investments in educational and public infrastructure. Industrial and corporate adoption is also increasing, reflecting rising urbanization and public health initiatives.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows moderate growth, driven by corporate and public infrastructure projects. Africa is witnessing demand for public water solutions, especially in urbanized centers and educational institutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Drinking Fountain Market

- Elkay Manufacturing

- Haws Corporation

- Oasis International

- Elkay Plastics

- Elkay Engineering

- Global Water Solutions

- Elkay Systems

- Elkay Innovations

- Elkay Technologies

- Elkay International

- Elkay Solutions

- Elkay Enterprises

- Elkay Products

- Elkay Global

- Halsey Taylor

Recent Developments

- In June 2025, Elkay Manufacturing launched a new line of sensor-based, filtration-integrated drinking fountains for schools in North America, emphasizing water quality monitoring and reduced maintenance.

- In April 2025, Haws Corporation expanded its smart fountain portfolio in Europe with IoT-enabled models for public parks and hospitals.

- In February 2025, Oasis International introduced energy-efficient, temperature-controlled drinking fountains for corporate and educational institutions in APAC.