Drawer Refrigerators Market Size

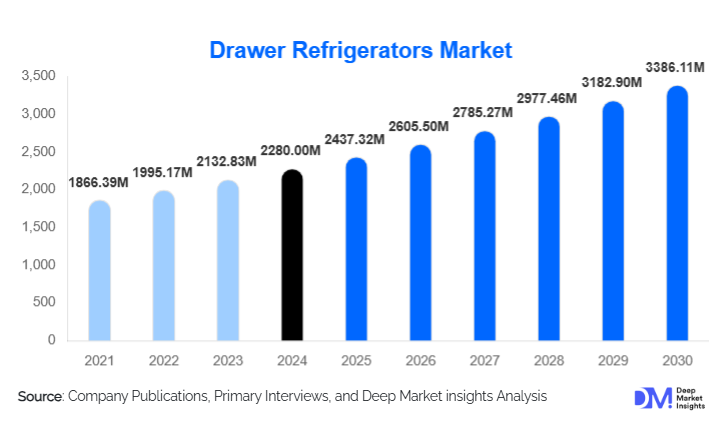

According to Deep Market Insights, the global drawer refrigerators market size was valued at USD 2,280.00 million in 2024 and is projected to grow from USD 2,437.32 million in 2025 to reach USD 3,386.11 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). Market growth is primarily driven by rising adoption of modular kitchens, increasing demand for space-efficient premium appliances, and growing commercial usage across hospitality, healthcare, and foodservice industries.

Key Market Insights

- Built-in and under-counter drawer refrigerators are becoming mainstream, supported by urban housing constraints and premium kitchen design trends.

- Residential applications dominate demand, accounting for over half of global revenue, driven by luxury housing and renovation activity.

- North America leads the global market, supported by high disposable incomes and strong adoption of premium appliances.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class income, and expanding real estate development.

- Energy efficiency and sustainability are influencing purchasing decisions, with inverter compressors and eco-friendly refrigerants gaining traction.

- Smart and connected drawer refrigerators are reshaping competition through app-based control, temperature zoning, and predictive maintenance features.

What are the latest trends in the drawer refrigerators market?

Growth of Modular and Smart Kitchen Ecosystems

The global shift toward modular kitchens is significantly influencing the drawer refrigerators market. Consumers increasingly prefer appliances that integrate seamlessly into cabinetry while offering ergonomic access and flexible storage. Drawer refrigerators complement this trend by enabling customized kitchen layouts and efficient space utilization. Simultaneously, smart kitchen ecosystems are expanding, with drawer refrigerators being integrated into connected home platforms. Features such as remote temperature monitoring, voice control compatibility, and energy usage optimization are becoming standard offerings in premium models, particularly in North America and Europe.

Commercial Adoption in Foodservice and Healthcare

Commercial demand for drawer refrigerators is accelerating, especially across restaurants, hotels, cloud kitchens, and healthcare facilities. In foodservice environments, drawer refrigerators improve workflow efficiency by providing quick-access cold storage near preparation areas. Healthcare and laboratory settings are adopting drawer-based refrigeration for medicine, vaccines, and sample storage due to precise temperature control and compartmentalization. This trend is expanding the market beyond residential use and driving demand for durable, high-capacity, and multi-drawer configurations.

What are the key drivers in the drawer refrigerators market?

Rising Demand for Space-Efficient Premium Appliances

Urbanization and shrinking residential spaces are driving demand for compact and space-efficient appliances. Drawer refrigerators offer flexible installation options, including built-in and under-counter designs, making them ideal for apartments, condominiums, and luxury homes. Rising disposable incomes and consumer willingness to invest in premium kitchen solutions further support adoption, particularly in developed economies.

Expansion of Hospitality and Foodservice Industries

The global growth of hotels, restaurants, cafés, and quick-service restaurants is a major driver for drawer refrigerator adoption. These units enhance operational efficiency by reducing movement in kitchens and supporting food safety compliance. The rapid expansion of cloud kitchens and food delivery platforms is further boosting demand for compact, high-performance refrigeration solutions.

What are the restraints for the global market?

High Initial Cost of Installation

Drawer refrigerators are generally priced higher than conventional refrigerators due to premium materials, built-in installation requirements, and advanced features. This limits adoption in price-sensitive markets and among middle-income consumers, particularly in developing regions.

Limited Awareness in Emerging Economies

In several emerging markets, drawer refrigerators are still perceived as niche or luxury products. Limited consumer awareness and lower retail penetration restrict broader adoption, requiring manufacturers to invest heavily in marketing and consumer education.

What are the key opportunities in the drawer refrigerators market?

Smart and IoT-Enabled Product Development

Integration of IoT and smart technologies presents a major opportunity for manufacturers. Connected drawer refrigerators with AI-driven temperature management, predictive maintenance alerts, and inventory tracking can command premium pricing and strengthen brand differentiation.

Emerging Market Expansion

Rapid urbanization in Asia-Pacific, the Middle East, and Latin America offers strong growth potential. Rising residential construction, expanding hospitality infrastructure, and government-backed manufacturing initiatives such as “Make in India” and “Made in China 2025” are creating favorable conditions for market expansion.

Product Configuration Insights

Double-drawer refrigerators dominate the market, accounting for approximately 38% of global revenue in 2024, due to their balance of storage flexibility and cost efficiency. Single-drawer units are popular in compact residential applications, while triple and multi-drawer refrigerators are gaining traction in commercial kitchens and healthcare facilities requiring advanced compartmentalization.

Installation Type Insights

Built-in drawer refrigerators lead the market with nearly 44% share, driven by premium residential demand and hospitality projects emphasizing seamless kitchen aesthetics. Under-counter units are widely used in commercial environments, while freestanding models cater to flexible installation needs.

End-Use Insights

The residential segment accounts for around 57% of the global market, supported by luxury housing and renovation trends. Commercial end use is growing faster, with an estimated CAGR exceeding 12%, driven by hospitality, healthcare, and foodservice expansion. Healthcare applications alone represent a market opportunity of over USD 420 million in 2024.

Distribution Channel Insights

Specialty appliance retail stores dominate distribution with approximately 46% market share, as consumers prefer in-store demonstrations for premium appliances. Online channels are the fastest-growing, supported by improved digital visualization tools, virtual consultations, and direct-to-consumer strategies by manufacturers.

| By Product Configuration | By Installation Type | By Temperature Function | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global drawer refrigerators market with approximately 34% share in 2024. The United States accounts for nearly 27% of global demand, driven by high disposable income, strong renovation activity, and early adoption of smart appliances.

Europe

Europe holds around 29% of the global market, led by Germany, the U.K., France, and Italy. Demand is supported by energy efficiency regulations, premium appliance adoption, and strong hospitality infrastructure.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of approximately 12.8%. China, Japan, South Korea, and India are key growth markets, driven by urbanization, rising middle-class income, and expanding residential and commercial construction.

Latin America

Latin America represents a smaller but growing market, led by Brazil and Mexico. Growth is supported by hospitality development and the increasing penetration of premium home appliances among affluent consumers.

Middle East & Africa

The Middle East & Africa region is driven by luxury residential projects and hospitality expansion in the UAE, Saudi Arabia, and South Africa. High-end hotels and mixed-use developments are key demand contributors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Companies in the Drawer Refrigerators Market

- Whirlpool Corporation

- LG Electronics

- Samsung Electronics

- Electrolux AB

- BSH Hausgeräte (Bosch)

- Haier Group

- Sub-Zero Group

- Miele

- Panasonic Corporation

- Hitachi Appliances

- Liebherr Group

- Sharp Corporation

- Hisense Group

- Fisher & Paykel

- Viking Range