Dormitories Market Size

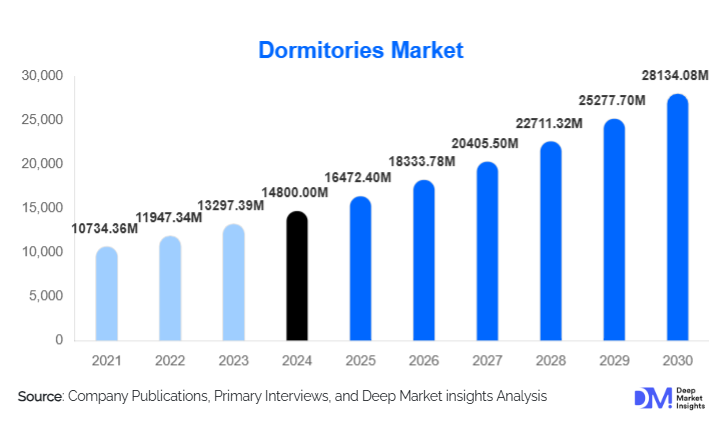

According to Deep Market Insights, the global dormitories market size was valued at USD 14,800.00 million in 2024 and is projected to grow from USD 16,472.40 million in 2025 to reach USD 28,134.08 million by 2030, expanding at a CAGR of 11.3% during the forecast period (2025–2030). The dormitories market growth is driven by rising global student enrollment, increasing international student mobility, urban housing affordability challenges, and expanding public–private partnerships for education and institutional infrastructure development.

Key Market Insights

- Private and purpose-built dormitories dominate the global supply, supported by faster execution, better amenities, and institutional investment interest.

- Higher education students account for the largest share of demand, contributing over 60% of total dormitory revenues globally.

- Asia-Pacific represents the fastest-growing region, driven by expanding university infrastructure in China, India, and Southeast Asia.

- On-campus dormitories remain the preferred accommodation type, offering proximity, security, and institutional integration.

- Standard-service dormitories lead demand, balancing affordability with modern amenities such as Wi-Fi, furnished rooms, and security.

- Technology adoption and ESG-aligned construction are becoming critical differentiators in new dormitory developments.

What are the latest trends in the dormitories market?

Rise of Purpose-Built Student Accommodation (PBSA)

Purpose-built student accommodation is increasingly replacing legacy dormitory infrastructure. Universities and private developers are investing in modern PBSA projects that integrate academic, residential, and recreational spaces within a single ecosystem. These facilities offer improved safety, higher comfort levels, and better space utilization compared to older dormitories. The PBSA trend is particularly strong in North America, Europe, and the Asia-Pacific region, where enrollment growth has outpaced housing availability. Enhanced property management, long-term leasing models, and higher occupancy stability are making PBSA a preferred asset class for institutional investors.

Smart and Sustainable Dormitories

Sustainability and digitalization are reshaping dormitory design and operations. New projects increasingly incorporate energy-efficient materials, solar power, water recycling, and green building certifications. Smart access systems, IoT-enabled energy monitoring, and AI-driven security solutions are improving operational efficiency and reducing long-term costs. These technology-driven dormitories command higher occupancy rates and rental premiums, particularly in developed markets. ESG-compliant dormitories are also attracting government funding and private capital, reinforcing sustainability as a long-term market trend.

What are the key drivers in the dormitories market?

Growth in Global Higher Education Enrollment

Rising enrollment in universities and colleges worldwide is a primary driver of dormitory demand. International student mobility has rebounded strongly, intensifying housing shortages near academic institutions. Many universities lack the capital to independently expand accommodation capacity, increasing reliance on private operators and PPP models. This sustained enrollment growth ensures stable long-term demand for dormitories across both developed and emerging economies.

Urban Housing Affordability Constraints

Rapid urbanization and rising rental costs have made private housing unaffordable for students and early-career professionals. Dormitories offer cost advantages of 25–40% compared to private rentals, making them the preferred option in major education hubs. This affordability factor is particularly critical in cities such as London, New York, Sydney, Beijing, and Mumbai, where housing supply constraints are severe.

What are the restraints for the global market?

High Capital Expenditure Requirements

Dormitory development involves significant upfront investment, especially for premium and technology-enabled facilities. High land costs, construction expenses, and regulatory compliance increase project risk, particularly in urban centers. These capital-intensive requirements can delay project timelines and restrict entry for smaller developers.

Regulatory and Zoning Challenges

Complex zoning laws, safety regulations, and local approval processes often slow dormitory development. In some regions, restrictions on building height, density, or student housing classification limit supply expansion. Navigating these regulatory frameworks remains a key challenge for market participants.

What are the key opportunities in the dormitories market?

Public–Private Partnership Expansion

Governments are increasingly adopting PPP models to address student housing shortages without straining public finances. These partnerships allow private developers to build and operate dormitories under long-term agreements, ensuring stable returns while expanding institutional capacity. PPP-led dormitory projects are accelerating in India, Southeast Asia, the Middle East, and Africa.

Co-Living Dormitories for Working Professionals

Dormitory-style co-living for young professionals is emerging as a high-growth opportunity. Urban workforce migration, startup ecosystems, and flexible employment models are driving demand for short-term, affordable accommodations. These dormitories achieve faster occupancy and higher revenue per bed, particularly in Asia-Pacific and Latin America.

Product Type Insights

Shared-room dormitories dominate the market, accounting for approximately 47% of total capacity, driven by affordability in price-sensitive regions. Semi-private and private rooms are gaining traction in developed markets, particularly within premium and standard service categories. New construction projects represent over 60% of market value, reflecting aggressive capacity expansion, while renovation and retrofit projects remain significant in North America and Europe to modernize aging infrastructure.

Application Insights

Higher education institutions represent the largest application segment, contributing around 62% of global dormitory revenues. Military and defense dormitories provide stable, government-backed demand, while co-living dormitories for professionals are the fastest-growing application segment. Religious and institutional housing remains a niche but stable contributor in select regions.

Distribution Channel Insights

Dormitories are primarily distributed through institutional contracts and direct university partnerships. Private operators increasingly use digital platforms for bookings, payments, and resident management. Long-term leasing agreements with universities and governments dominate revenue streams, while short-term rental models are emerging in co-living segments.

End-User Insights

Higher education students remain the dominant end-user group, followed by working professionals and military personnel. Demand from international students continues to outpace domestic enrollment growth, particularly in North America, Europe, and Australia. Co-living demand from young professionals is expanding rapidly in urban employment hubs.

| By Ownership Model | By End User | By Accommodation Type | By Room Configuration | By Service Level |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 28% of the global dormitories market in 2024, led by the United States. Strong private investment in PBSA, high international student inflows, and renovation of aging campus housing drive demand. Occupancy rates remain above 90% in major university cities.

Europe

Europe held around 24% market share, with the U.K., Germany, and France leading demand. Sustainability-focused dormitories and student housing shortages in major cities support growth. Europe is also witnessing strong institutional investment activity.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, accounting for roughly 31% of global demand. China and India are driving large-scale dormitory construction, supported by government education spending and rising enrollment. The region is forecast to grow at over 9% CAGR.

Latin America

Latin America holds approximately 7% market share, led by Brazil and Mexico. Growth is supported by expanding private universities and urban student populations, though supply remains fragmented.

Middle East & Africa

The Middle East & Africa region accounts for about 10% of global demand. Saudi Arabia, the UAE, and South Africa are key markets, supported by education infrastructure investments and national development programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dormitories Market

- Brookfield Asset Management

- Greystar Real Estate Partners

- American Campus Communities

- Unite Group PLC

- GIC Private Limited

- Mapletree Investments

- EQT Group

- Scion Group

- Capstone Development Partners

- CA Ventures