Document Camera Market Size

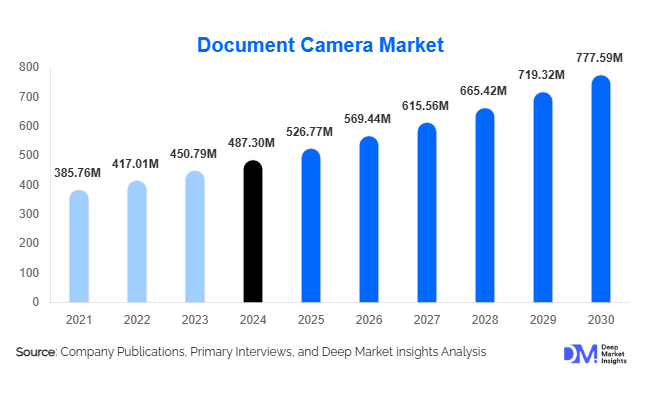

According to Deep Market Insights, the global document camera market size was valued at USD 487.30 million in 2024 and is projected to grow from USD 526.77 million in 2025 to reach USD 777.59 million by 2030, expanding at a CAGR of 8.10% during the forecast period (2025–2030). Growth in the document camera market is primarily fueled by the rapid adoption of digital and hybrid learning systems, the rise of remote and corporate training environments, and increasing integration of AI-driven and wireless collaboration technologies that enhance real-time content sharing and presentation capabilities.

Key Market Insights

- Education remains the dominant end-use segment, accounting for over 60% of global demand, backed by the expansion of smart classrooms and digital curriculum integration.

- Portable document cameras lead the product category, supported by rising demand for mobility, flexibility, and quick setup in classrooms, offices, and remote work environments.

- North America holds the largest regional market share (30–32%), driven by strong EdTech adoption and enterprise collaboration spending.

- Asia-Pacific is the fastest-growing region, supported by large-scale government investments in digital education in China, India, and Southeast Asia.

- Wireless and AI-enhanced document cameras are reshaping the competitive landscape, offering features such as auto-focus, image enhancement, OCR, and cloud connectivity.

- Corporate, healthcare, legal, and public-sector applications are expanding rapidly, indicating a shift of document cameras from traditional teaching tools to broader professional utilities.

What are the latest trends in the document camera market?

AI-Integrated and Intelligent Document Cameras

A major emerging trend in the document camera market is the rapid adoption of AI-enabled document cameras that enhance image quality, automate manual adjustments, and streamline real-time content sharing. Modern AI-driven features now include intelligent auto-focus, glare removal, handwriting recognition, automatic cropping, and real-time optical character recognition, all of which help presenters deliver clearer and more visually accurate materials with minimal effort. These capabilities are especially valuable in hybrid classrooms, medical demonstrations, legal proceedings, and corporate training sessions where precision and clarity are essential. Manufacturers are increasingly embedding onboard processors, edge-AI modules, and smart enhancement software to provide smoother, faster, and more adaptive image processing, enabling document cameras to operate as intelligent collaboration tools rather than simple imaging devices. The move toward AI-powered functionality signals a long-term industry shift toward more automated, smart, and context-aware presentation hardware.

Wireless & Hybrid-Ready Collaboration Systems

Another defining trend shaping the document camera market is the transition toward wireless and hybrid-ready collaboration systems designed to support modern digital learning environments and flexible enterprise workflows. Document cameras are increasingly being built with Wi-Fi connectivity, USB-C interfaces, HDMI output, and AV-over-IP compatibility, allowing seamless integration with existing audiovisual ecosystems in classrooms, conference rooms, and courtrooms. Wireless models provide greater mobility, reduce cable congestion, and allow presenters to move freely without disrupting connectivity, making them particularly valuable in higher education lecture halls, corporate hybrid meeting rooms, and legal environments that require fluid communication and multi-device access. As remote collaboration platforms continue to mature, features such as cloud syncing, remote-access controls, real-time annotation, multi-screen casting, and network-based device management are becoming central differentiators. The shift toward wireless, software-integrated document camera systems reflects a broader move toward flexible learning and working environments where digital interaction and mobility are core priorities for institutions worldwide.

What are the key drivers in the document camera market?

Expansion of Digital & Hybrid Learning Ecosystems

The education sector continues to drive global demand for document cameras, representing more than 60% of total adoption. Smart classroom transformation initiatives across the U.S., Europe, China, India, and Southeast Asia are integrating document cameras as core instructional tools. They enhance visual learning by enabling teachers to display physical textbooks, worksheets, science experiments, art demos, and handwritten notes to both in-class and remote students. As hybrid and blended learning become long-term models post-pandemic, institutions increasingly invest in high-quality presentation hardware, solidifying this segment as the primary growth engine.

Advanced Optics, High-Resolution Sensors & Connectivity Upgrades

Technological advancement is a central driver of market expansion. High-resolution sensors (10–15MP+), AI-enhanced lighting, ultra-fast autofocus, 4K streaming, and noise-free processing are making document cameras more powerful than ever. The adoption of wireless and plug-and-play models (USB-C/Wi-Fi) is accelerating uptake in offices, universities, and judicial environments. These capabilities are transforming document cameras into versatile real-time collaboration devices that outperform traditional webcams or scanners in professional settings.

Growing Corporate, Legal & Healthcare Applications

Beyond classroom use, document cameras are penetrating corporate training centers, medical institutions (for telemedicine & telepathology), and courts of law (for evidence presentation). As workplaces embrace hybrid work and remote collaboration, the need for tools that capture physical documents, prototypes, and objects in high fidelity is rising sharply. Corporate digitization, compliance documentation, and the need for visually rich communication are strong drivers pushing adoption across professional sectors.

What are the restraints for the global market?

High Cost of Advanced and Premium Models

Premium document cameras that offer 4K resolution, wireless capabilities, and smart AI-driven features come at higher price points, limiting adoption among budget-sensitive institutions, especially in developing economies. Schools and small organizations often delay upgrades due to cost barriers, impacting faster market expansion. The price gap between basic wired models and advanced wireless AI units remains a key challenge.

Competition from Alternative Technologies

Document cameras increasingly compete with smartphones, tablets, high-resolution webcams, and advanced scanning apps that can replicate some of their functionality. Integrated videoconferencing systems and digital whiteboards also reduce reliance on standalone document cameras. In sectors where cost sensitivity is high, these alternatives can slow the adoption of dedicated hardware.

What are the key opportunities in the document camera industry?

Massive Digital Education Investments in Emerging Economies

Governments in Asia-Pacific, Africa, and Latin America are investing heavily in digital classroom ecosystems, creating enormous opportunities for document camera manufacturers. India’s NEP 2020, China’s smart-classroom mandate, and Southeast Asia’s EdTech funding surge will dramatically accelerate adoption. Portable and mid-range models are expected to dominate these deployments given their affordability and ease of integration.

Integration of Cloud Collaboration, OCR, and AI Workflows

There is a significant opportunity for brands to differentiate by integrating AI-based text extraction, cloud storage synchronization, multi-user annotation, and advanced image processing. Corporate, legal, and medical verticals will particularly benefit from such workflow-centered solutions, opening new recurring revenue opportunities for software-enabled document cameras.

Healthcare, Telemedicine & Evidence Presentation Markets

Hospitals, laboratories, and legal courts are rapidly adopting document cameras for remote diagnosis, specimen demonstrations, and evidentiary workflows. Manufacturers that tailor devices for medical clarity, sterile environments, or high-detail forensic visualization can unlock niche but high-value market segments. AI-based forensic zoom, 4K trial documentation feeds, and digital case record integration represent high-potential innovations for 2024–2030.

Product Type Insights

Portable document cameras dominate the global market, accounting for approximately 45% of total demand. Their lightweight design, foldable structures, quick-connect features, and mobility make them ideal for hybrid classrooms, remote teaching, and corporate training rooms. Desktop/tabletop models serve high-stability applications such as laboratories and courtrooms, offering strong optical performance and large working areas. Ceiling-mounted/overhead visualizers are preferred in advanced lecture halls and large auditoriums due to their ability to capture wide surfaces with minimal instructor interaction. The rising popularity of wireless portable models is further reinforcing the dominance of the portable segment.

Application Insights

The education sector remains the primary application area, representing more than 60% of global revenue in 2024. Document cameras are central to interactive learning, science labs, higher education lectures, and digital whiteboard workflows. Corporate applications are expanding rapidly as organizations adopt hybrid work practices requiring real-time sharing of physical documents, product prototypes, and training materials. Healthcare usage is rising in telemedicine, medical education, and digital pathology. Legal and government applications, such as evidence presentation and archival digitization, are also growing steadily, driven by court modernization and e-governance initiatives.

Distribution Channel Insights

Online channels, including global e-commerce platforms, EdTech procurement portals, and OEM-direct websites, dominate sales due to broad product availability and bulk institutional purchasing. Specialized AV integrators and education technology distributors play a critical role in institutional deployments involving smart classrooms, boardrooms, and hybrid learning environments. Direct enterprise procurement is rising as corporations invest in standardized office collaboration hardware. Subscription-based hardware-as-a-service (HaaS) models are starting to appear, offering institutions predictable upgrade cycles and reduced upfront costs.

End-User Insights

Schools and universities remain the largest end-user group, driven by digital curriculum adoption, interactive learning preferences, and hybrid teaching needs. Corporate users represent the fastest-growing end-user segment, supported by rising remote collaboration and training digitization. Healthcare institutions, legal bodies, government offices, and financial service organizations form emerging high-value segments demanding high-fidelity presentations for diagnostics, evidence handling, and compliance workflows. Libraries, museums, and archival institutions are adopting document cameras for digitization and public presentations, further expanding market scope.

Age Group Insights

In the education-driven segment, document cameras support age groups from K–12 to university-level learners, with the strongest adoption in secondary and higher education institutions due to a heavier emphasis on interactive content delivery. In corporate and professional environments, usage is highest among working professionals aged 25–50, who rely heavily on hybrid meetings and remote training workflows. Senior professionals in the legal and medical sectors increasingly use document cameras for high-detail visualization, evidentiary presentation, and remote collaboration.

| By Product Type | By Connectivity Type | By Resolution / Sensor Type | By End-User Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 30–32% share in 2024. High EdTech penetration, strong institutional funding, and widespread hybrid learning adoption drive growth. The U.S. dominates regional demand, supported by university-level adoption, corporate collaboration upgrades, and judicial system modernization. Canada shows growing uptake in K–12 digital classrooms and corporate training deployments.

Europe

Europe accounts for nearly 25% of global revenue, with strong demand from Germany, the U.K., France, and the Nordics. The region’s focus on digital education transformation and remote collaboration accelerates adoption. European schools and corporate offices increasingly prefer wireless and AI-enabled devices aligned with sustainability initiatives and standardized AV systems.

Asia-Pacific

Asia-Pacific is the fastest-growing region and is expected to exceed 28–30% market share by 2030. China leads production and consumption, while India experiences exponential EdTech adoption driven by government-backed digital classrooms. Japan and South Korea show strong demand for premium high-resolution devices. Southeast Asia (Indonesia, Vietnam, Philippines) is emerging as a major opportunity through public education modernization programs.

Latin America

Demand in Latin America is growing gradually, with Brazil and Mexico as key buyers of portable and mid-range document cameras for education and government usage. Public-school digitalization efforts and corporate training investments support steady expansion, though budget constraints can slow adoption of premium features.

Middle East & Africa

MEA shows rising adoption driven by smart classroom installations in the GCC (UAE, Saudi Arabia, Qatar) and public-sector modernization across Africa. South Africa, Kenya, and Nigeria are adopting document cameras for educational enhancement and judicial reforms. The region balances high-end demand from wealthy Gulf states with volume-driven education demand across African markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Document Camera Market

- AVer Information

- ELMO

- Epson

- IPEVO

- Lumens

- WolfVision

- HoverCam

- QOMO

- Ricoh

- Smart Technologies

- Canon

- Panasonic

- Kodak (Visualizer Solutions)

- BenQ

- Huddly

Recent Developments

- In January 2025, AVer launched a new AI-enabled 15MP wireless document camera with real-time OCR and cloud-sync features targeting hybrid classrooms.

- In March 2025, Epson expanded its education portfolio by integrating document camera compatibility with its latest interactive projector series.

- In June 2025, WolfVision introduced an advanced ceiling-mounted visualizer system designed for large auditoriums and university lecture halls.