DNA-Based Skin Care Products Market Size

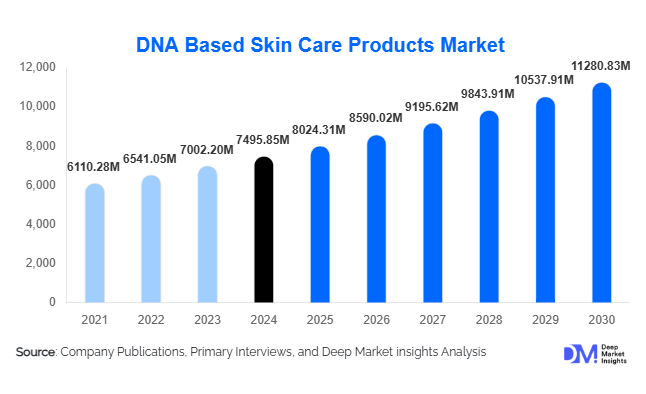

According to Deep Market Insights, the global dna based skin care products market size was valued at USD 7,495.85 million in 2024 and is projected to grow from USD 8,024.31 million in 2025 to reach USD 11,280.83 million by 2030, expanding at a CAGR of 7.05% during the forecast period (2025–2030). The DNA-based skin care products market growth is driven by rising consumer demand for scientifically validated anti-aging solutions, increasing adoption of personalized skin care, and continuous advancements in genomic, enzyme-based, and nano-delivery technologies.

Key Market Insights

- DNA repair and protection products dominate premium skin care portfolios, supported by increasing awareness of UV-induced cellular damage and aging.

- Personalized skin care powered by genomic analysis is gaining traction, particularly among high-income consumers seeking targeted treatments.

- North America leads global demand, driven by strong dermatology infrastructure, high disposable income, and early adoption of biotech-based cosmetics.

- Asia-Pacific is the fastest-growing region, supported by K-beauty innovation, rising middle-class income, and strong digital commerce penetration.

- E-commerce is the fastest-expanding distribution channel, supported by D2C models, subscription-based offerings, and AI-driven product recommendations.

- R&D-led innovation and clinical validation are key competitive differentiators among leading brands.

What are the latest trends in the DNA-based skin care products market?

Personalized and Genomic-Based Skin Care Solutions

Personalization is becoming a defining trend in the DNA-based skin care products market. Brands are increasingly offering genomic testing kits and AI-driven diagnostics to identify individual skin needs based on DNA profiles. These insights allow companies to formulate customized serums, creams, and treatment regimens targeting aging, pigmentation, hydration, and sensitivity at a cellular level. Subscription-based personalized skin care models are gaining popularity, improving customer retention while increasing average revenue per user. This trend is particularly strong in North America, Japan, and South Korea, where consumers are more receptive to data-driven beauty solutions.

Advanced DNA Repair and Enzyme Technologies

DNA repair enzyme technology is rapidly advancing, enabling products to directly target and repair UV-induced DNA damage. Enzymes such as photolyases and endonucleases are being incorporated into serums and sunscreens, enhancing efficacy and supporting preventive dermatology. Nano-delivery systems are further improving the absorption and stability of DNA-based actives. These innovations are driving premium pricing and strong clinical positioning, particularly within dermatologist-recommended and professional skin care segments.

What are the key drivers in the DNA-based skin care products market?

Growing Demand for Anti-Aging and Preventive Skin Care

The global aging population and increasing awareness of premature skin aging are major drivers for DNA-based skin care products. Consumers are shifting from corrective cosmetics to preventive solutions that protect and repair skin at the cellular level. DNA repair creams and serums address root causes of aging, such as oxidative stress and UV damage, making them highly attractive to premium consumers. This demand is strongest among consumers aged 30–55 years with higher disposable income.

Technological Advancements in Biotechnology and Genomics

Continuous advancements in genomics, biotechnology, and nanotechnology are enabling the development of highly effective DNA-based formulations. Integration of AI diagnostics, enzyme-based repair systems, and nano-encapsulation technologies is improving product efficacy and differentiation. These innovations are driving higher adoption across dermatology clinics, medical aesthetics centers, and luxury cosmetic brands, reinforcing market growth.

What are the restraints for the global market?

High Cost of DNA-Based Products

DNA-based skin care products are significantly more expensive than conventional cosmetics due to high R&D costs, specialized ingredients, and clinical validation requirements. This limits adoption among price-sensitive consumers and restricts penetration in developing markets. Premium pricing remains a key barrier for mass-market expansion.

Regulatory and Compliance Challenges

Strict regulations related to cosmetic claims, genomic testing, and bioactive ingredients pose challenges for manufacturers. Compliance with varying regional standards can delay product launches and increase operational costs. Regulatory scrutiny around DNA repair claims also limits marketing flexibility.

What are the key opportunities in the DNA-based skin care products industry?

Expansion into Emerging Markets

Rapid urbanization, rising disposable income, and increasing awareness of advanced skin care solutions in Asia-Pacific and Latin America present strong growth opportunities. Localization of products, regional manufacturing, and digital-first marketing strategies can help brands capture untapped demand in countries such as China, India, Brazil, and Indonesia.

Integration with Dermatology and Aesthetic Clinics

Collaborations with dermatologists and aesthetic clinics offer opportunities to strengthen clinical credibility and expand professional-use applications. DNA-based skin care products are increasingly used for post-procedure recovery and preventive dermatology, opening new revenue streams beyond retail channels.

Product Type Insights

DNA repair creams and serums dominate the market, accounting for approximately 32% of the 2024 global market, driven by strong demand for anti-aging and UV damage repair solutions. DNA protection products, including sunscreens and daily-use moisturizers, represent a growing segment as consumers prioritize preventive care. Specialized DNA-based treatments targeting pigmentation, acne scars, and skin sensitivity are expanding rapidly within premium and clinical segments.

Technology Insights

DNA repair enzyme technology leads the market with an estimated 35% market share in 2024, supported by strong clinical evidence and high efficacy. Genomic-based personalization technologies are gaining momentum, particularly in high-income markets. Nano-delivery systems are increasingly adopted to enhance penetration and stability of DNA actives, while CRISPR-based applications remain in early-stage development.

Distribution Channel Insights

E-commerce is the leading distribution channel, accounting for 28% of global sales in 2024, driven by D2C models, subscription offerings, and personalized recommendations. Specialty beauty stores and dermatology clinics remain critical for premium and professional products. Pharmacies and drugstores support wider accessibility, particularly in Europe and North America.

End-User Insights

The premium and luxury consumer segment represents approximately 40% of global demand, driven by a willingness to pay for advanced, science-backed skin care. Professional and clinical end users, including dermatology and aesthetic clinics, are the fastest-growing segment due to increasing use of DNA-based products in treatment protocols. Mid-tier consumers are gradually adopting affordable DNA-infused products.

| By Product Type | By Technology | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global market in 2024, led by the United States. Strong R&D capabilities, high consumer awareness, and widespread adoption of personalized skin care solutions support market leadership. Canada also shows steady growth driven by premium cosmetic demand.

Europe

Europe represents a significant share, with Germany, France, and the U.K. leading demand. Regulatory emphasis on product safety and strong dermatological research support the adoption of DNA-based formulations. Premium and pharmacy-backed skin care brands dominate the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to grow at a CAGR of ~12%. Japan, South Korea, and China are key markets, driven by innovation in K-beauty, rising disposable income, and strong e-commerce penetration. India is emerging as a high-growth market.

Latin America

Latin America, led by Brazil and Argentina, is witnessing the gradual adoption of premium DNA-based skin care products, supported by increasing urbanization and exposure to global beauty trends.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, shows strong demand for luxury skin care products. Africa remains a nascent but growing market, primarily driven by high-income urban consumers.

Company Market Share

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the DNA-Based Skin Care Products Market

- L’Oréal

- Estée Lauder Companies

- Shiseido Company

- Procter & Gamble

- Johnson & Johnson

- Unilever

- Amorepacific

- Beiersdorf

- Coty

- Clarins

- Kao Corporation

- Pierre Fabre

- DSM Nutritional Products

- Allergan

- Revance Therapeutics