Distress Flare Market Size

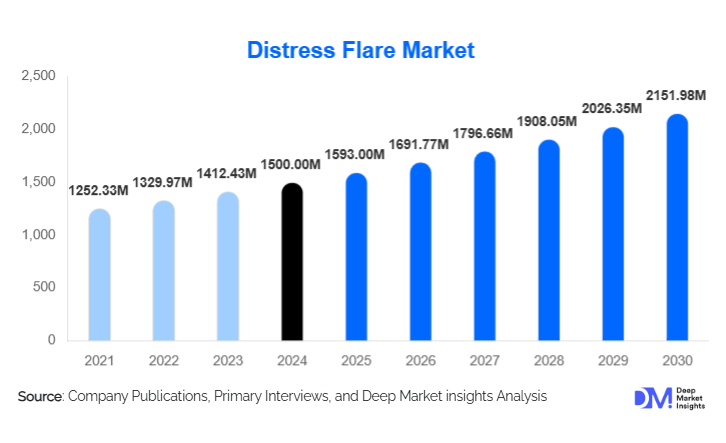

According to Deep Market Insights, the global distress flare market size was valued at USD 1,500.00 million in 2024 and is projected to grow from USD 1,593.00 million in 2025 to reach USD 2,151.98 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The distress flare market growth is primarily driven by mandatory maritime and aviation safety regulations, increasing global maritime trade, rising defense and search & rescue (SAR) expenditures, and the gradual adoption of electronic and environmentally safer distress signaling technologies.

Key Market Insights

- Maritime safety applications dominate global demand, supported by compulsory carriage regulations under international maritime conventions.

- Pyrotechnic distress flares remain the most widely used product type, owing to global regulatory acceptance and cost efficiency.

- Electronic and LED-based distress flares are the fastest-growing segment, driven by longer lifespan, reusability, and lower environmental impact.

- North America and Europe together account for over 60% of global demand, supported by strict safety compliance and defense procurement.

- Asia-Pacific is the fastest-growing regional market, led by shipbuilding expansion, naval modernization, and offshore energy activity.

- Government and defense agencies represent the largest end-user group, ensuring stable, long-term procurement volumes.

What are the latest trends in the distress flare market?

Shift Toward Electronic and Eco-Friendly Distress Flares

The distress flare market is witnessing a gradual but steady transition toward electronic and low-toxicity signaling solutions. Traditional pyrotechnic flares, while effective, pose challenges related to hazardous material handling, disposal, and environmental pollution. As a result, regulatory authorities and end users are increasingly evaluating LED-based electronic distress flares that offer extended operational life, reusability, and reduced fire risk. These products are gaining acceptance in recreational boating, SAR operations, and selected defense applications. Manufacturers are investing in certification programs to ensure compliance with maritime and aviation safety standards, which is expected to accelerate adoption over the next decade.

Integration with Modern Search & Rescue Systems

Another emerging trend is the integration of distress flares with modern SAR ecosystems. Hybrid solutions combining visual distress signals with GPS-enabled alerts, AIS-based maritime systems, and digital emergency communication platforms are being developed. These innovations enhance rescue response times and accuracy, particularly in offshore and remote environments. Defense forces and coast guards are increasingly prioritizing multi-functional signaling systems that align with digital command-and-control frameworks, positioning technology integration as a key differentiator among leading manufacturers.

What are the key drivers in the distress flare market?

Mandatory Safety Regulations Across Maritime and Aviation Sectors

Strict international safety regulations remain the most influential growth driver for the distress flare market. Maritime conventions and aviation safety standards mandate the carriage of certified distress signaling devices on vessels and aircraft. These regulations ensure consistent replacement demand, as pyrotechnic flares typically have a limited shelf life of three to five years. Regulatory enforcement by coast guards and aviation authorities sustains baseline demand regardless of economic cycles.

Growth in Global Maritime Trade and Offshore Activity

Expanding global maritime trade and offshore operations are directly contributing to increased demand for distress flares. The growth in commercial shipping fleets, offshore oil & gas installations, and renewable energy platforms requires compliance with safety norms, including emergency signaling equipment. Each vessel or offshore unit typically carries multiple flares, creating cumulative demand aligned with fleet expansion.

Rising Defense and Disaster Preparedness Spending

Increased defense budgets and disaster preparedness initiatives worldwide are strengthening procurement of high-reliability distress signaling systems. Naval forces, border security agencies, and disaster-response organizations rely heavily on flares for emergency communication during operations, exercises, and humanitarian missions. This driver provides long-term stability to the market.

What are the restraints for the global market?

Hazardous Material Handling and Disposal Challenges

Pyrotechnic distress flares involve strict storage, transportation, and disposal requirements due to their explosive and toxic components. These requirements increase lifecycle costs for end users and discourage adoption in some recreational and commercial segments. Disposal compliance remains a persistent challenge, particularly in regions with stringent environmental regulations.

Lengthy Certification Processes for New Technologies

While electronic distress flares present clear advantages, certification across multiple regulatory jurisdictions remains complex and time-consuming. Delays in approval can slow commercialization and restrict rapid market penetration, acting as a restraint on innovation-driven growth.

What are the key opportunities in the distress flare industry?

Expansion of Electronic Distress Signaling Solutions

The transition toward electronic distress flares represents a significant opportunity for both existing manufacturers and new entrants. As regulatory bodies gradually approve these solutions, early movers can secure premium pricing and long-term supply contracts. Electronic flares also align with sustainability goals, making them attractive to environmentally conscious end users.

Rising Demand from the Asia-Pacific Maritime and Naval Sectors

Asia-Pacific offers strong growth potential due to expanding shipbuilding activity, rising naval budgets, and increased offshore infrastructure development. Countries such as China, India, and South Korea are strengthening maritime safety enforcement, creating opportunities for localized manufacturing, partnerships, and government-aligned procurement strategies.

Product Type Insights

Pyrotechnic handheld flares dominate the distress flare market, accounting for approximately 38% of global revenue in 2024, due to universal regulatory acceptance and low upfront cost. Parachute rockets and aerial meteor flares are widely used in maritime and defense applications where long-range visibility is critical. Smoke signal flares play a vital role in daytime rescue operations, particularly for SAR agencies. Electronic and LED-based flares, while currently representing a smaller share, are the fastest-growing product category, driven by safety, reusability, and environmental benefits.

Application Insights

Maritime safety represents the largest application segment, contributing nearly 47% of global demand in 2024. This dominance is supported by mandatory carriage laws for commercial and recreational vessels. Military and defense applications form the second-largest segment, driven by naval operations and training requirements. Aviation safety and SAR operations represent specialized but high-value applications, while outdoor and recreational safety uses are expanding steadily due to increased participation in adventure activities.

Distribution Channel Insights

Direct government contracts dominate the distribution landscape, accounting for approximately 44% of market revenue, reflecting large-volume procurement by defense and coast guard agencies. OEM supply agreements with shipbuilders and aircraft manufacturers represent a stable channel. Specialty safety equipment retailers and online platforms serve recreational and commercial buyers, with e-commerce channels gradually gaining traction for standardized products.

End-User Insights

Government and defense organizations are the largest end users, representing about 41% of global demand, driven by bulk procurement and stringent performance standards. Commercial maritime operators form a significant share, supported by fleet expansion and regulatory compliance. Recreational boat owners and aviation operators contribute steadily, while emergency and disaster-response agencies are the fastest-growing end-user segment due to increased preparedness spending.

| By Product Type | By Application | By End User | By Technology | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global distress flare market in 2024. The United States leads regional demand, supported by high defense budgets, extensive coast guard operations, and strict enforcement of maritime safety standards across commercial and recreational vessels. Regular replacement requirements, coupled with the adoption of electronic and low-toxicity signaling solutions, continue to sustain stable market growth.

Europe

Europe represented around 28% of the global market share in 2024. Demand is driven by stringent maritime safety and environmental regulations, particularly in the U.K., Germany, France, and Norway. Strong compliance requirements for commercial fleets and offshore operators, along with early adoption of eco-friendly and electronic distress flare alternatives, support consistent regional demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 8% CAGR. China, India, South Korea, and Japan are key contributors, driven by expanding shipbuilding capacity, naval fleet modernization, and rising offshore energy investments. Increased regulatory oversight and growing awareness of maritime safety standards are further accelerating market adoption.

Latin America

Latin America shows moderate growth, led by Brazil and Mexico, where expanding commercial shipping, fishing fleets, and offshore exploration activities are increasing demand for safety equipment. Gradual improvements in maritime regulations and port infrastructure are strengthening adoption across both commercial and government-operated vessels.

Middle East & Africa

The Middle East & Africa region benefits from extensive offshore oil and gas operations and strategic naval modernization programs. Countries such as the UAE, Saudi Arabia, and South Africa are key demand centers, supported by high maritime traffic, port expansion projects, and ongoing investments in maritime security and safety compliance.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Distress Flare Market

- Orion Safety Products

- Pains Wessex

- Wescom Group

- Hansson Pyrotech

- Comet Marine

- Nico Signal

- Datrex

- McMurdo Group

- JRC Co.

- Alco-Tec

Recent Developments

- In May 2025, Orion Safety Products announced updates to its electronic distress flare lineup, focusing on longer battery life and enhanced visibility for marine and roadside safety applications.