Disposable Hand Towels Market Size

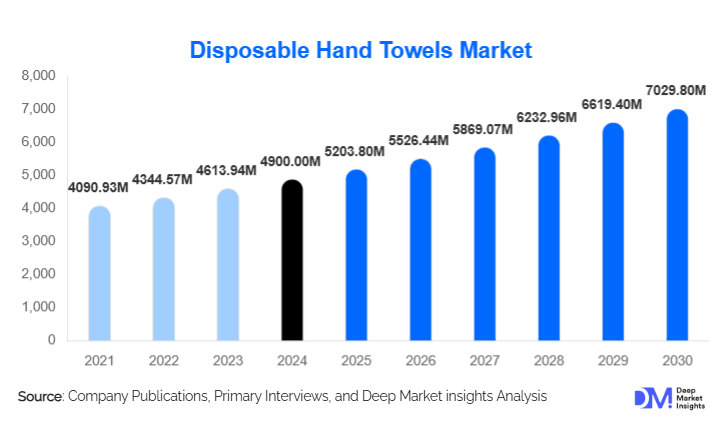

According to Deep Market Insights, the global disposable hand towels market size was valued at USD 4,900.00 million in 2024 and is projected to grow from USD 5,203.80 million in 2025 to reach USD 7,029.80 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The disposable hand towels market growth is primarily driven by rising hygiene awareness across commercial and institutional facilities, increasing healthcare infrastructure investments, and the global shift toward single-use paper-based hygiene solutions to reduce cross-contamination risks.

Key Market Insights

- Folded and interfolded disposable hand towels dominate global demand due to their compatibility with compact dispensers and controlled usage.

- Healthcare and commercial institutions collectively account for the largest consumption share, supported by stringent hygiene and infection-control standards.

- Asia-Pacific leads global volume growth, driven by rapid urbanization, hospital construction, and expanding commercial real estate.

- North America remains the largest value-based market, supported by premium-quality towels, high per-capita usage, and strong institutional procurement.

- Sustainability-focused products, including recycled and bamboo-based towels, are gaining traction among government and corporate buyers.

- Direct B2B procurement channels dominate, driven by long-term supply contracts with hospitals, airports, and corporate campuses.

What are the latest trends in the disposable hand towels market?

Rising Adoption of Sustainable and Recycled Paper Towels

Sustainability has emerged as a defining trend in the disposable hand towels market. Institutional buyers are increasingly prioritizing products made from recycled fibers, bamboo pulp, and low-carbon manufacturing processes. Governments and multinational corporations are mandating eco-certifications and minimum recycled content thresholds in procurement contracts. Manufacturers are responding by expanding recycled pulp capacity, reducing water usage in production, and offering biodegradable packaging. This trend is particularly strong in Europe and North America, where environmental regulations and ESG commitments are influencing purchasing decisions.

Growth of Touchless and Controlled-Dispensing Systems

The integration of disposable hand towels with touchless and controlled-dispensing systems is reshaping product demand. Facilities such as hospitals, airports, and corporate offices are adopting sensor-based or single-sheet dispensing solutions to minimize waste and improve hygiene compliance. Manufacturers offering bundled towel-and-dispenser systems are gaining a competitive advantage by increasing customer retention and recurring revenue streams. Smart dispensers with inventory monitoring capabilities are also being piloted in large facilities, signaling a gradual shift toward technology-enabled hygiene infrastructure.

What are the key drivers in the disposable hand towels market?

Increasing Focus on Hygiene and Infection Control

Heightened awareness of hygiene and infection prevention continues to be a major growth driver. Disposable hand towels are widely preferred over reusable cloth towels and electric hand dryers due to their superior ability to reduce cross-contamination. Healthcare facilities, food-processing plants, and public restrooms increasingly mandate paper-based hand-drying solutions to comply with sanitation regulations. This driver remains structurally strong, particularly in healthcare and food-service environments.

Expansion of Commercial and Institutional Infrastructure

Rapid growth in offices, shopping malls, airports, educational institutions, and healthcare facilities is directly supporting demand for disposable hand towels. Emerging economies in the Asia-Pacific and the Middle East are witnessing large-scale investments in public infrastructure, translating into sustained bulk procurement of hygiene consumables. The return-to-office trend in developed economies has further stabilized demand from corporate and institutional users.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in virgin pulp and recycled paper prices pose a significant challenge for manufacturers. Rising input costs can compress margins, particularly for small and mid-sized producers without long-term supply agreements. Energy and transportation cost volatility further adds to pricing pressure, impacting profitability across the value chain.

Environmental Concerns Around Single-Use Products

Despite hygiene benefits, disposable paper products face scrutiny related to waste generation and deforestation. Regulatory pressure in certain regions to reduce single-use products could limit demand growth unless offset by recyclable, compostable, or certified sustainable alternatives. Manufacturers must balance hygiene performance with environmental compliance to sustain long-term growth.

What are the key opportunities in the disposable hand towels industry?

Emerging Market Infrastructure Expansion

Rapid urbanization and healthcare expansion in Asia-Pacific, the Middle East, and Africa present significant growth opportunities. New hospitals, airports, metro stations, and educational institutions require consistent supplies of disposable hygiene products. Establishing regional manufacturing and distribution hubs can help companies capture high-growth demand while reducing logistics costs.

Technology-Integrated Hygiene Solutions

Opportunities are expanding for manufacturers that integrate disposable hand towels with smart dispensing technologies. Touchless systems, consumption analytics, and bundled service contracts can increase customer loyalty and improve margins. These solutions are particularly attractive to large facilities seeking operational efficiency and waste reduction.

Product Type Insights

Folded hand towels represent the largest product segment, accounting for approximately 42% of the 2024 market value, driven by widespread adoption in commercial and institutional restrooms. Roll hand towels follow, favored in high-traffic environments such as airports and stadiums. Center-pull and interfold towels are gaining popularity due to controlled dispensing and reduced paper waste, particularly in healthcare and food-service applications.

Material Type Insights

Virgin pulp-based disposable hand towels dominate the market with nearly 55% share, supported by superior absorbency and softness requirements in healthcare and hospitality. Recycled paper towels are the fastest-growing segment, driven by sustainability mandates. Bamboo and blended fiber towels remain niche but are gaining traction in premium and eco-certified applications.

End-Use Insights

Commercial and institutional facilities account for approximately 37% of global demand, followed by healthcare, which is the fastest-growing end-use segment with growth exceeding the market average. Hospitality remains a high-value segment, while industrial and educational facilities are steadily increasing adoption due to workplace hygiene standards.

Distribution Channel Insights

B2B direct sales dominate the market with around 46% share, supported by long-term procurement contracts. Wholesalers and janitorial suppliers play a critical role in regional distribution, while e-commerce platforms are gaining traction among small and medium enterprises seeking flexible purchasing options.

| By Product Type | By Material Type | By Ply Structure | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global disposable hand towels market in 2024, led by the United States. High per-capita usage, stringent hygiene regulations, and strong healthcare spending support market leadership. Premium two-ply and recycled-content towels are widely adopted.

Europe

Europe represents nearly 24% of the market, driven by Germany, the U.K., and France. Sustainability-focused procurement and regulatory emphasis on recycled paper products are shaping demand patterns across the region.

Asia-Pacific

Asia-Pacific holds the largest share at approximately 31% and is the fastest-growing region. China and India dominate demand due to expanding healthcare infrastructure, urbanization, and manufacturing capacity. India is expected to record growth above 8.5% CAGR.

Latin America

Latin America shows steady growth, led by Brazil and Mexico. Expansion of commercial facilities and healthcare investments is supporting demand, although price sensitivity remains high.

Middle East & Africa

The Middle East & Africa region is witnessing rising demand driven by healthcare and tourism infrastructure investments in Saudi Arabia, the UAE, and South Africa. Government-led sanitation initiatives are further supporting market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Disposable Hand Towels Market

- Kimberly-Clark Corporation

- Essity AB

- Georgia-Pacific LLC

- Sofidel Group

- Cascades Inc.

- Clearwater Paper Corporation

- Metsä Group

- Hengan International Group

- Asia Pulp & Paper (APP)

- WEPA Group

- Lucart Group

- Kruger Products

- Oji Holdings Corporation

- Resolute Forest Products

- Seventh Generation