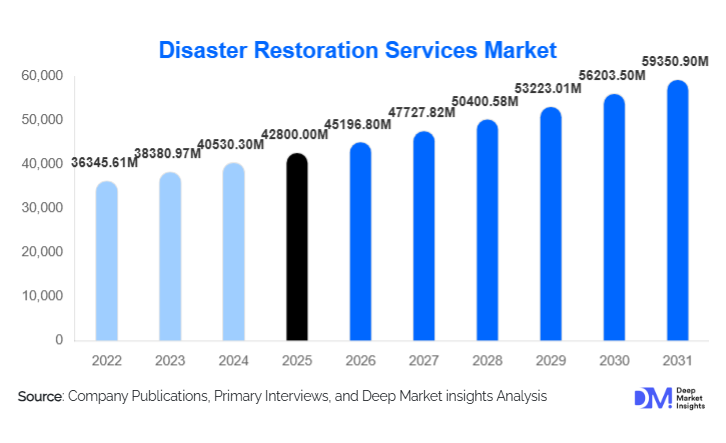

Disaster Restoration Services Market Size

According to Deep Market Insights, the global disaster restoration services market size was valued at USD 42,800.00 million in 2024 and is projected to grow from USD 45,196.80 million in 2025 to reach USD 59,350.90 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The disaster restoration services market growth is primarily driven by the increasing frequency of natural disasters, rising integration with insurance claims processes, and the adoption of advanced technologies for rapid and efficient restoration.

Key Market Insights

- Water damage restoration leads the market, driven by recurrent floods, storms, and plumbing failures requiring immediate mitigation.

- Residential end-use dominates, reflecting the sheer volume of homes exposed to disaster events and high adoption of insured restoration services.

- North America holds the largest market share, led by the U.S. and Canada, due to frequent disasters, advanced restoration infrastructure, and mature insurance ecosystems.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, climate vulnerability, and government initiatives supporting disaster preparedness.

- Technological integration, including AI-based damage assessment, drones, IoT sensors, and mobile restoration management platforms, is reshaping service delivery and efficiency.

- Insurance partnerships continue to drive growth, as insurers prefer certified restoration providers to manage claims and limit losses.

What are the latest trends in the disaster restoration services market?

Technology-Driven Restoration Solutions

Restoration service providers are increasingly integrating advanced technologies such as AI-driven damage assessment tools, drones for rapid site evaluation, IoT-based moisture and air quality monitoring, and cloud-based project management platforms. These technologies enhance operational efficiency, accelerate response times, and improve transparency for insurance claims. Companies adopting predictive analytics and remote monitoring can reduce property downtime, lower restoration costs, and differentiate themselves in a competitive market.

Expansion of Insurance-Linked Services

Disaster restoration services are increasingly aligned with insurance processes. Providers are integrating digital workflows to support claims verification, real-time project updates, and cost control. This trend ensures faster claim settlements for homeowners and businesses, while creating recurring demand for professional restoration firms. Insurers are also increasingly mandating certified restoration partners, enhancing quality standards and market accountability.

Government Support and Infrastructure Resilience Initiatives

Governments are investing in disaster preparedness and resilient infrastructure projects. Funding programs for flood mitigation, fire safety upgrades, and climate adaptation are boosting demand for professional restoration services. Regulations encouraging rapid recovery, post-disaster assessments, and structural compliance are further enhancing the market outlook, particularly in regions vulnerable to climate-related disasters.

What are the key drivers in the disaster restoration services market?

Increasing Frequency and Severity of Natural Disasters

Rising incidences of floods, wildfires, hurricanes, and storms, exacerbated by climate change, directly fuel demand for disaster restoration services. Aging infrastructure and urban expansion in hazard-prone areas further increase vulnerability, driving the need for rapid and professional restoration services across residential, commercial, and industrial sectors.

Integration with Insurance Ecosystems

Restoration services are increasingly embedded in insurance workflows to manage claims efficiently. This integration enables providers to secure contracts with homeowners and businesses, ensuring recurring demand. Timely restoration minimizes property deterioration and reduces financial losses, reinforcing the dependency on professional services for insured properties.

Adoption of Advanced Technologies

Technological innovations such as drones, AI, IoT monitoring systems, and moisture mapping have revolutionized restoration services. These technologies allow precise damage assessment, real-time monitoring, and predictive maintenance planning. Providers that leverage these innovations enhance service quality, reduce operational costs, and gain a competitive advantage in a crowded market.

What are the restraints for the global market?

High Operational Costs

Restoration work requires specialized equipment, safety-compliant tools, and skilled technicians. Small and mid-sized service providers often face high capital expenditures for machinery and training, creating entry barriers and limiting scalability in the market.

Skilled Labor Shortages

The industry requires trained personnel for structural repairs, hazardous material handling, and equipment operation. Labor shortages in many regions lead to service delays, higher wages, and reduced overall efficiency, potentially constraining growth despite rising demand.

What are the key opportunities in the disaster restoration services industry?

Integration of Smart Technologies

Opportunities exist to expand digital solutions such as AI damage assessment, drones, IoT-based environmental monitoring, and cloud project management. Early adopters can provide faster, more precise, and higher-quality restoration, positioning themselves as industry leaders.

Government-Funded Resilience Programs

Investment in infrastructure resilience, climate adaptation projects, and post-disaster recovery initiatives by governments offers substantial growth potential. Companies partnering with public programs can secure large-scale contracts and establish long-term revenue streams.

Insurance-Driven Demand Growth

As property and casualty insurance penetration increases globally, restoration services are increasingly required to support claims. Partnerships with insurers present a recurring revenue opportunity, allowing providers to expand geographically and across end-use segments.

Service Type Insights

Among service types, water damage restoration is the largest segment, accounting for approximately 38–40% of global demand, due to floods, storm surges, and plumbing-related damages. Fire & smoke damage restoration follows, driven by increasing wildfire events and urban fire incidents. Mold remediation is growing rapidly, particularly in moisture-prone regions, due to health concerns and regulatory enforcement.

End-Use Insights

The residential sector dominates, representing around 55% of total market volume, driven by homeowners’ need for rapid restoration to prevent property degradation and health risks. Commercial facilities, including offices and retail spaces, generate high-value contracts due to operational downtime costs. Industrial and institutional sectors, including hospitals, factories, and schools, are increasingly adopting multi-year restoration agreements, ensuring continuity and risk mitigation. Emerging end-use applications, such as data centers and critical infrastructure, are also contributing to market growth.

| By Service Type | By End-Use / Customer Segment | By Disaster Type | By Response Time & Service Level |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the market with a 35–38% share, driven by frequent disasters, mature insurance ecosystems, and sophisticated restoration infrastructure. The U.S. accounts for the largest share within the region, followed by Canada, due to flood and wildfire prevalence and strong regulatory frameworks.

Europe

Europe holds around 25% of the market, with Germany, the U.K., and France being major contributors. The market growth is supported by stringent safety regulations, environmental compliance, and insurance-backed restoration demand. Eastern Europe shows moderate growth as infrastructure upgrades drive restoration needs.

Asia-Pacific

APAC is the fastest-growing region (22% share), led by China, India, and Southeast Asia. Rapid urbanization, government disaster preparedness programs, and increasing insurance penetration drive the market. Australia shows steady growth due to wildfire recovery and resilient infrastructure projects.

Latin America

Latin America accounts for 10% of the market, with Brazil and Mexico driving growth. Rising urbanization in disaster-prone areas and increased adoption of insured restoration services support demand, although economic variability moderates growth.

Middle East & Africa

This region represents 5–8% of global demand, with South Africa, the UAE, and Saudi Arabia contributing most. Government investment in resilience projects and private sector infrastructure upgrades supports gradual market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Disaster Restoration Services Market

- BELFOR Holdings, Inc.

- ServiceMaster Restore

- Paul Davis Restoration

- Servpro Industries, LLC

- PuroClean

- Interstate Restoration

- FirstOnSite Restoration

- Disaster Recon

- All-Pro Restoration

- Rainbow International

- AdvantaClean

- BlueSky Restoration

- A1 Restoration

- RestorePro Reconstruction

- Bio-One