Dirt Bike Market Size

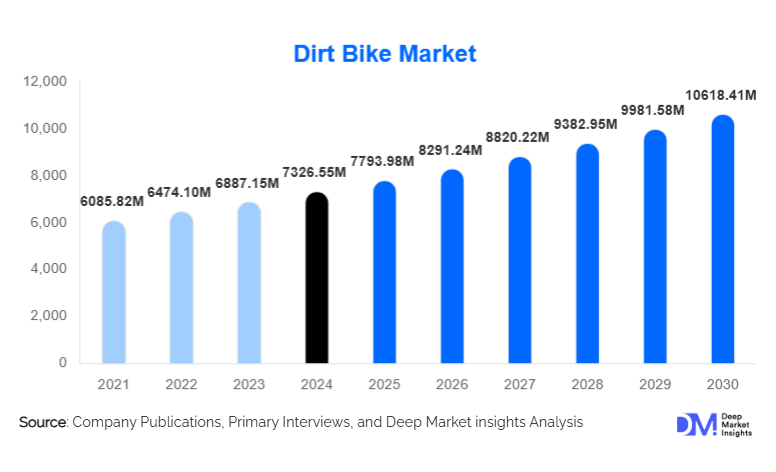

According to Deep Market Insights, the global dirt bike market size was valued at USD 7,326.55 million in 2024 and is projected to grow from USD 7,793.98 million in 2025 to reach USD 10,618.41 million by 2030, expanding at a CAGR of 6.38% during the forecast period (2025–2030). The dirt bike market growth is primarily driven by rising participation in recreational and competitive off-road riding, increasing youth engagement in motorsports, and continuous innovation in lightweight materials, suspension systems, and electric powertrains.

Key Market Insights

- Recreational and leisure riding dominates global demand, supported by lifestyle adoption and adventure sports culture.

- Internal combustion engine (ICE) dirt bikes continue to lead, although electric dirt bikes are the fastest-growing segment.

- North America holds the largest market share, driven by strong motorsports infrastructure and high consumer spending.

- Asia-Pacific is the fastest-growing region, fueled by expanding middle-class income and increasing participation in off-road sports.

- Mid-range dirt bikes (USD 3,000–7,000) account for the largest share due to balanced performance and affordability.

- Technological advancements such as fuel injection systems, lightweight frames, and connected diagnostics are reshaping product differentiation.

What are the latest trends in the dirt bike market?

Rising Adoption of Electric Dirt Bikes

Electric dirt bikes are emerging as a transformative trend within the global market. Manufacturers are introducing high-torque electric models with improved battery range, faster charging, and lower maintenance requirements. These bikes are gaining traction in regions with strict emission and noise regulations, particularly in Europe and select U.S. states. Electric dirt bikes are also being increasingly adopted in training academies and indoor riding tracks due to their quieter operation, positioning them as a viable alternative to ICE models for entry-level and recreational riders.

Performance-Oriented Design and Lightweight Materials

OEMs are focusing heavily on performance enhancement through the use of lightweight aluminum frames, advanced suspension systems, and improved engine tuning. Weight reduction improves maneuverability and rider control, making bikes suitable for both competitive racing and recreational use. The integration of electronic fuel injection and ride modes is also becoming standard, enabling riders to customize performance based on terrain and skill level.

What are the key drivers in the dirt bike market?

Growing Popularity of Off-Road and Adventure Sports

The increasing popularity of motocross, enduro racing, and trail riding is a major growth driver. Organized racing events, grassroots competitions, and social media exposure are attracting younger riders globally. Governments and private operators are investing in off-road parks and riding tracks, directly supporting demand for dirt bikes across recreational and professional segments.

Technological Advancements in Motorcycle Engineering

Continuous innovation in suspension technology, engine efficiency, and rider safety systems has improved durability and usability. These advancements are expanding the customer base by making dirt bikes more accessible to beginners while still meeting the performance expectations of professional riders.

What are the restraints for the global market?

High Cost of Premium and Electric Dirt Bikes

Premium dirt bikes, especially high-performance racing and electric models, carry high upfront costs. This limits adoption in price-sensitive markets and among first-time riders. Battery replacement costs and limited charging infrastructure further constrain electric dirt bike penetration in emerging economies.

Regulatory Restrictions on Off-Road Riding

Environmental regulations and land-use restrictions limit access to off-road trails in several regions. Noise and emission concerns have resulted in stricter compliance requirements, increasing development costs for manufacturers and reducing available riding areas for consumers.

What are the key opportunities in the dirt bike industry?

Expansion of Adventure Tourism and Rental Fleets

Adventure tourism operators are increasingly investing in dirt bike fleets for guided tours and off-road experiences. Regions such as Southeast Asia, Latin America, and the Middle East offer strong growth potential due to favorable terrain and rising tourist inflows. OEM partnerships with rental operators present opportunities for bulk sales and recurring revenue.

Youth and Entry-Level Rider Programs

Growing interest among younger riders and beginners is creating demand for lightweight, lower-capacity dirt bikes. Training academies and riding schools are expanding globally, providing manufacturers with opportunities to supply purpose-built entry-level models and long-term brand loyalty.

Engine Capacity Insights

The 251cc–450cc segment dominates the global dirt bike market, accounting for approximately 38% of total revenue in 2024. This segment leads primarily due to its optimal balance between power, control, and durability, making it suitable for both competitive motocross racing and advanced recreational riding. Dirt bikes in this engine range offer high torque, superior suspension compatibility, and adaptability across diverse terrains, which has positioned them as the preferred choice for professional riders, racing teams, and serious enthusiasts globally. OEMs continue to focus innovation on this category, introducing lightweight frames, advanced fuel injection, and electronic ride modes, further reinforcing its leadership.

The 126cc–250cc segment is witnessing steady growth, driven by increasing demand from beginner riders, youth participants, and training academies. This segment benefits from lower acquisition costs, easier handling, and reduced maintenance requirements, making it ideal for entry-level and semi-professional users. Meanwhile, above 450cc dirt bikes cater primarily to professional racing, desert riding, and niche adventure applications. Although smaller in volume, this segment commands premium pricing due to high-performance engineering and specialized use cases.

Powertrain Insights

Internal combustion engine (ICE) dirt bikes account for nearly 82% of the global market share in 2024, supported by established fueling infrastructure, widespread service availability, and proven performance reliability. ICE platforms remain dominant in professional racing and high-performance applications where extended range, rapid refueling, and mechanical familiarity are critical. Continuous improvements in emission compliance and fuel efficiency have helped sustain ICE dominance despite tightening regulations.

Electric dirt bikes, although representing a smaller share of the overall market, are the fastest-growing powertrain segment, expanding at over 12% CAGR. Growth is driven by sustainability initiatives, stricter emission norms, and advancements in battery technology, including higher energy density and faster charging. Electric dirt bikes are gaining traction in urban-adjacent riding zones, training facilities, and regions with noise restrictions, positioning them as a key long-term growth pillar for the market.

Application Insights

Recreational and leisure riding represents the largest application segment, contributing approximately 46% of global demand in 2024. This segment is driven by the growing perception of dirt biking as a lifestyle and adventure activity rather than solely a competitive sport. Increasing disposable incomes, social media influence, and the expansion of off-road parks and trail networks are supporting sustained recreational demand.

Professional racing remains a high-value application segment, despite lower unit volumes. It plays a critical role in driving technological innovation, premium pricing, and brand visibility. Manufacturers leverage racing platforms to test advanced materials, suspension systems, and engine tuning technologies. Adventure and trail riding applications are expanding rapidly, supported by adventure tourism, organized off-road expeditions, and rental-based business models, particularly in emerging markets.

Distribution Channel Insights

Authorized OEM dealerships dominate global dirt bike sales, driven by strong brand trust, access to financing, warranty coverage, and comprehensive after-sales support. These dealerships play a critical role in premium and performance-oriented segments, where service reliability and spare parts availability influence purchasing decisions.

Online direct-to-consumer (D2C) channels are gaining traction, particularly for electric dirt bikes, entry-level models, and aftermarket accessories. Digital platforms enable OEMs to reach younger, tech-savvy consumers while improving margin control. Multi-brand retailers continue to play an important role in emerging markets, where consumers prioritize price comparison, product availability, and localized service support.

| By Engine Capacity | By Powertrain Type | By Application | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global dirt bike market in 2024, making it the largest regional market. The United States leads demand due to its deeply entrenched motocross and off-road racing culture, extensive trail networks, and high disposable income levels. Strong participation in organized racing events, robust aftermarket ecosystems, and widespread availability of financing options further support market growth. Additionally, the rising adoption of electric dirt bikes is being driven by emission regulations in select states and growing interest in sustainable recreational vehicles.

Europe

Europe holds nearly 26% of the global market share, led by Germany, France, and Italy. The region’s growth is supported by a strong motorsports heritage, well-established racing leagues, and advanced manufacturing capabilities. Stringent emission and noise regulations are accelerating the transition toward electric dirt bikes, particularly in Western Europe. Government support for electric mobility, combined with consumer preference for technologically advanced and environmentally compliant products, continues to shape regional demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of approximately 9.2%. China, India, and Australia are key growth markets, driven by rising youth participation, increasing disposable income, and expanding motorsports infrastructure. Governments and private operators are investing in off-road tracks, adventure parks, and training academies, particularly in Australia and Southeast Asia. In China and India, growing interest in affordable entry-level dirt bikes and electric models is broadening the consumer base.

Latin America

Latin America represents a developing yet high-potential market, with Brazil and Mexico leading regional demand. Growth is supported by favorable terrain, increasing participation in regional racing events, and rising adventure sports tourism. The expansion of local racing championships and improved access to mid-range dirt bikes are encouraging greater adoption among younger riders and recreational users.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth in dirt bike demand, particularly for desert riding and adventure tourism applications. The UAE and South Africa are key markets, supported by favorable climatic conditions, vast off-road landscapes, and growing motorsports investments. Government-backed tourism initiatives and private off-road adventure operators are driving fleet demand, while premium performance bikes are gaining popularity among high-income consumers in the Middle East.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Dirt Bike Industry

- KTM AG

- Honda Motor Co.

- Yamaha Motor Co.

- Kawasaki Heavy Industries

- Suzuki Motor Corporation

- Husqvarna Motorcycles

- GasGas

- Beta Motorcycles

- Sherco

- TM Racing

- Fantic Motor

- Rieju

- Alta Motors

- Sur-Ron

- Zero Motorcycles