Direct to Film Printing Market Size

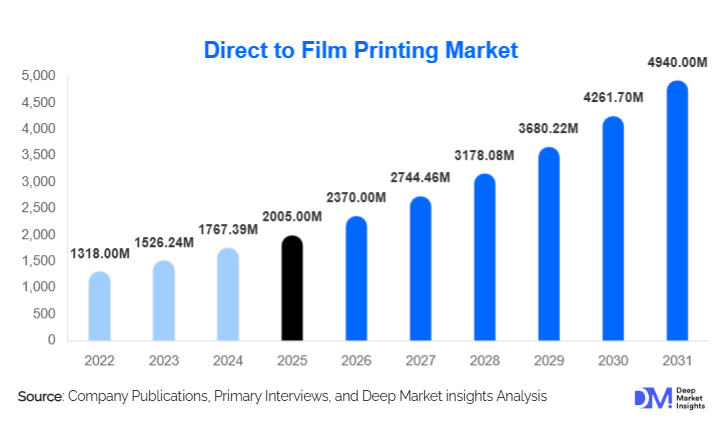

According to Deep Market Insights, the global Direct to Film (DTF) printing market size was valued at USD 2,050 million in 2025 and is projected to grow from USD 2,370 million in 2026 to reach USD 4,940 million by 2031, expanding at a robust CAGR of 15.8% during the forecast period (2026–2031). The DTF printing market growth is driven by the rapid adoption of digital textile printing, increasing demand for customized and short-run apparel, and the cost-efficiency and versatility of DTF technology compared to traditional screen printing and direct-to-garment (DTG) solutions.

Key Market Insights

- DTF printing is emerging as a preferred digital textile printing technology due to its compatibility with multiple fabric types, including cotton, polyester, blends, nylon, and leather.

- Consumables such as inks, films, and adhesive powders account for a significant recurring revenue share, supporting stable long-term market growth.

- Asia-Pacific dominates the global market, driven by strong textile manufacturing bases in China, India, Vietnam, and South Korea.

- North America leads in technological adoption, supported by demand from print service providers and e-commerce-driven apparel brands.

- Small and home-based printing businesses are expanding rapidly, enabled by low capital investment requirements for DTF setups.

- Ongoing innovation in ink chemistry and film coatings is improving print durability, wash resistance, and color vibrancy.

What are the latest trends in the direct-to-film printing market?

Shift Toward On-Demand and Personalized Printing

Customization and personalization trends are significantly influencing the DTF printing market. Apparel brands, online merchandisers, and influencers increasingly rely on on-demand printing to minimize inventory risk and respond quickly to fashion trends. DTF technology supports low minimum order quantities without compromising quality, making it ideal for short production runs and rapid design changes. This trend is particularly strong in North America and Europe, where e-commerce apparel sales and direct-to-consumer business models continue to expand.

Automation and Workflow Optimization

Automation is becoming a critical trend in the DTF printing ecosystem. Automated powder application systems, curing tunnels, and integrated RIP software are being adopted to increase throughput and reduce labor dependency. Mid-sized and industrial print service providers are increasingly investing in semi-automated DTF production lines to handle higher order volumes. Software-driven color management and AI-enabled maintenance alerts are also enhancing operational efficiency and print consistency.

What are the key drivers in the Direct to Film printing market?

Rising Demand for Custom Apparel and Merchandise

The global surge in demand for customized apparel, promotional merchandise, and branded products is a primary growth driver for the DTF printing market. Businesses across fashion, sportswear, corporate branding, and events increasingly prefer DTF printing due to its ability to deliver vibrant, durable prints on diverse substrates. The growing popularity of influencer-led merchandise and social media-driven fashion trends further supports sustained demand.

Cost and Operational Advantages Over Competing Technologies

DTF printing offers high cost and operational advantages compared to DTG and screen printing. It eliminates fabric pre-treatment, reduces setup time, and supports a wider range of materials. These benefits translate into faster turnaround times and higher return on investment, particularly for small and mid-sized print service providers. As a result, many operators are transitioning from traditional printing methods to DTF solutions.

What are the restraints for the global market?

Quality Variability Across Consumables

Inconsistent quality of inks, films, and adhesive powders remains a challenge, especially in price-sensitive markets. Variations in consumable performance can lead to adhesion failures, color inconsistency, and reduced wash durability, impacting end-user confidence. This restraint underscores the importance of standardized quality control and certified consumables.

Environmental and Regulatory Concerns

Despite lower water usage compared to traditional textile printing, DTF printing faces scrutiny related to PET film waste and adhesive powder disposal. Increasing environmental regulations in Europe and North America may require manufacturers to develop recyclable films and eco-friendly adhesives, potentially increasing production costs.

What are the key opportunities in the direct-to-film printing industry?

Expansion of Home-Based and Micro Printing Businesses

The affordability and compact nature of DTF printing systems present significant opportunities among home-based entrepreneurs and small businesses. Government support for micro-enterprises and digital manufacturing in emerging economies is accelerating adoption, creating strong demand for desktop and mid-format printers.

Integration of Smart Manufacturing Technologies

The integration of AI-based color management, predictive maintenance, and automated production workflows presents opportunities for vendors to differentiate their offerings. Manufacturers providing end-to-end DTF ecosystems combining hardware, software, and consumables are well-positioned to capture higher-value customers.

Component Type Insights

DTF inks represent the largest component segment in the Direct to Film printing market, accounting for approximately 32% of global revenue in 2025. This dominance is primarily driven by their recurring consumption nature, as inks are replenished frequently regardless of printer replacement cycles, ensuring steady demand across both commercial and small-scale operations. In addition, continuous advancements in water-based pigment ink formulations, improving color vibrancy, stretchability, and wash durability, have further accelerated adoption, particularly in apparel and sportswear applications.

DTF films constitute the second-largest component segment, supported by rising print volumes and increasing adoption of hot-peel and instant-peel films that improve production speed and efficiency. As print service providers scale operations, consistent film quality has become critical, reinforcing repeat purchases. DTF printers remain a significant revenue contributor, with mid-format printers (A2–A1) leading demand due to their optimal balance between productivity, footprint, and affordability. Adhesive powders and ancillary equipment, such as curing units and heat presses, contribute stable supplementary revenues, benefiting from ecosystem lock-in once a DTF setup is installed.

Application Insights

Apparel printing dominates the DTF printing market, accounting for nearly 61% of total demand in 2025. The segment’s leadership is driven by the fashion industry’s growing reliance on short-run, on-demand, and customized production, where DTF offers superior flexibility compared to screen printing and DTG. Fashion brands, online sellers, and influencer-led merchandise businesses increasingly use DTF to respond rapidly to trends without holding inventory.

Sportswear and athleisure represent the fastest-growing application sub-segment, supported by demand for stretchable, crack-resistant, and durable prints on polyester and blended fabrics. Promotional merchandise and home textiles are expanding steadily as corporate branding spend recovers globally. Meanwhile, industrial and functional textile applications, such as workwear, safety apparel, and uniform printing, are emerging as niche but high-value growth areas due to DTF’s durability and substrate versatility.

End-Use Industry Insights

Print service providers (PSPs) represent the largest end-use segment, contributing approximately 47% of global demand in 2025. Their dominance is driven by the increasing outsourcing of printing activities by apparel brands, marketing agencies, and e-commerce sellers seeking flexible production without capital investment. PSPs benefit significantly from DTF’s low setup time and multi-fabric compatibility, allowing them to serve diverse customer requirements.

Small and home-based businesses are the fastest-growing end-use segment, supported by low entry barriers, compact equipment availability, and strong demand from online marketplaces. Fashion and apparel manufacturers remain key contributors, particularly in export-driven markets across Asia-Pacific, where DTF is widely used for sampling, private labeling, and small-batch export orders.

Distribution Channel Insights

Authorized distributors and resellers dominate the DTF printing market, accounting for over 50% of global sales, especially in emerging economies. Their leadership is driven by the need for local technical support, training, and after-sales service, which is critical for ensuring consistent print quality. In developed markets, direct OEM sales are prominent, particularly for industrial and mid-format systems where customers prefer direct manufacturer engagement.

Online platforms are gaining traction for consumables and entry-level printers, driven by price transparency, faster delivery, and increasing confidence among small businesses. The rise of e-commerce-based consumable sales is also enabling global reach for ink and film manufacturers.

| By Component Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global DTF printing market with approximately 42% share in 2025. China is the largest contributor, driven by its strong domestic manufacturing base, large-scale production of DTF consumables, and export-oriented textile industry. India, Vietnam, Japan, and South Korea are experiencing rapid adoption due to growing textile exports, rising SME participation, and government-led manufacturing initiatives. Low labor costs, increasing digitalization of textile production, and the rapid expansion of small printing businesses are key regional growth drivers.

North America

North America accounts for around 27% of the global market, led by the United States. Regional growth is driven by high demand for customization, strong e-commerce apparel sales, and a mature digital printing ecosystem. The presence of advanced print service providers, high consumer spending on personalized apparel, and rapid adoption of automation technologies further support market expansion. Canada also contributes steadily through promotional merchandise and corporate branding demand.

Europe

Europe holds approximately 21% market share, with Germany, Italy, the U.K., and Spain as key contributors. Growth in the region is driven by strict environmental regulations favoring water-based inks, strong fashion and luxury apparel industries, and increasing demand for sustainable printing solutions. European print service providers are early adopters of certified consumables and automation, positioning the region as a hub for high-quality, compliance-driven DTF printing.

Latin America

Latin America represents nearly 6% of global demand, led by Brazil and Mexico. Regional growth is supported by apparel exports, nearshoring trends, and increasing adoption of digital printing technologies among local manufacturers. Improving access to mid-format DTF systems and rising demand for customized promotional products are further accelerating adoption.

Middle East & Africa

The Middle East & Africa region accounts for about 4% of the global market. Turkey and the UAE are emerging as regional hubs due to strong textile manufacturing capabilities, re-export activities, and strategic trade positioning. Growth is also supported by increasing investments in textile infrastructure, rising demand for branded apparel, and the gradual digital transformation of printing operations across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|