Dining Car Market Size

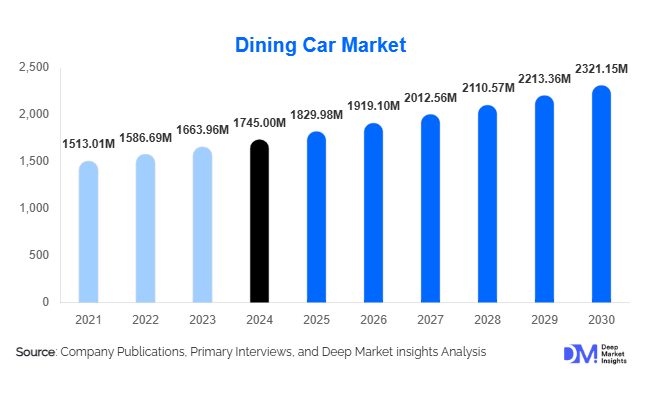

According to Deep Market Insights, the global dining car market size was valued at USD 1,745.00 million in 2024 and is projected to grow from USD 1,829.98 million in 2025 to reach USD 2,321.15 million by 2030, expanding at a CAGR of 4.87% during the forecast period (2025–2030). Growth in the dining car market is primarily driven by the recovery and expansion of long-distance and high-speed passenger rail services, rising demand for premium onboard experiences, and renewed investment in rail infrastructure as a low-carbon alternative to short-haul air and road travel.

Key Market Insights

- Dining cars are evolving from basic onboard catering to experiential, hospitality-driven offerings, supporting brand differentiation and higher yields for passenger rail operators.

- Intercity and long-distance conventional trains remain the largest application segment, accounting for around 40% of global dining car revenues in 2024.

- Full-service restaurant dining cars lead by value due to higher build and refurbishment costs and their role in premium and overnight services.

- Europe dominates the global market with roughly 35% of 2024 revenue, while Asia-Pacific is the fastest-growing region led by China and India.

- State-owned and public railways account for over 60% of global spending on dining cars and related refurbishments, backed by public infrastructure programs.

- Digitalization and contactless commerce are reshaping onboard food service, with mobile ordering, cashless payments, and data-driven menu optimization becoming standard.

What are the latest trends in the dining car market?

Experiential and Premium Rail Dining on the Rise

Dining cars are increasingly positioned as a core element of the passenger experience rather than a peripheral service. Rail operators are investing in restaurant-style interiors, panoramic windows, mood lighting, and regionally inspired menus that convert travel time into a hospitality event. Luxury and tourist trains are at the forefront of this shift, offering multi-course fine dining, wine-pairing journeys, and chef-collaborations that rival upscale restaurants. Even mainstream intercity and high-speed services are upgrading from simple snack bars to bistro and café-style dining cars, enabling fare segmentation (standard vs. premium) and ticket bundles that include meals. This experiential focus helps rail operators compete more effectively with airlines and long-distance coaches, particularly on routes where journey times are long enough to justify full-service dining.

Digital, Contactless and Data-Driven Dining Car Operations

Technology integration is transforming how passengers discover, order, and pay for onboard meals. Many operators are rolling out mobile apps and QR-based menus that allow passengers to order from their seats, receive notifications when orders are ready in the dining car, or opt for delivery directly to their coach. Contactless and cashless payment systems are becoming standard, reducing transaction times and improving hygiene. On the back end, connected kitchen equipment and cloud-based POS systems provide real-time visibility into sales and inventory, supporting data-driven menu engineering, waste reduction, and staffing optimization. Over time, operators are expected to move toward dynamic menus that adapt to time of day, route profile, and passenger mix, further enhancing revenue per passenger and operational efficiency.

What are the key drivers in the dining car market?

Rising Passenger Rail Volumes and Network Expansion

The steady rebound and growth of passenger rail volumes are central to dining car market expansion. As more countries invest in intercity and high-speed corridors, the number of passengers traveling medium and long distances by rail is increasing, directly lifting demand for onboard meals. Long-distance day and overnight trains, in particular, rely on dining cars to maintain service quality and justify premium fares. Increased train frequencies and new routes expand the installed base of dining-capable rolling stock, while refurbished fleets are frequently upgraded with modern galleys and improved dining spaces to better monetize passenger traffic.

Policy Support for Low-Carbon Transport and Rail Infrastructure

Governments worldwide are positioning rail as a cornerstone of climate policy and sustainable mobility, channeling significant capex into electrification, high-speed rail, and intercity networks. As these investments materialize, operators are encouraged, and in some cases mandated, to upgrade passenger amenities and service quality. Dining cars benefit directly from rolling-stock procurement programs that specify integrated restaurant or bistro coaches, as well as from modernization initiatives that retrofit existing fleets. In markets where policy pushes modal shift from short-haul flights to rail, high-quality onboard catering becomes a competitive differentiator, reinforcing demand for contemporary dining cars.

Shift Toward Premiumization and Experiential Travel

Across travel and tourism, consumers are gravitating toward experiences that blend comfort, authenticity, and storytelling. Dining cars tap into this trend by turning journeys into curated experiences featuring local cuisine, regional specialties, and thematic menus. Premium and luxury rail services, including tourist and heritage trains, use high-end dining to justify elevated tariffs and attract affluent travelers. Even on standard intercity routes, operators are introducing differentiated F&B offerings and upgraded dining environments to support business travelers, families, and leisure passengers seeking more than basic transportation. This premiumization trend supports higher average spend per passenger and drives investment in better-equipped, more attractive dining cars.

What are the restraints for the global market?

High Operating and Labor Costs

Dining cars are among the most resource-intensive components of a passenger train. They require trained culinary and service staff, continuous provisioning of food and beverages, compliance with stringent hygiene standards, and energy-intensive kitchen operations. Wage inflation in both the rail and hospitality sectors, coupled with rising food and energy prices, compresses margins for operators and catering partners. On lightly used routes or during off-peak seasons, the fixed cost base of dining cars can outweigh revenues, leading some operators to scale back services, shorten operating hours, or replace full-service restaurants with smaller bistro formats.

Capital-Intensive Upgrades and Regulatory Complexity

Introducing or modernizing dining cars involves substantial capital expenditure. New-build dining coaches must comply with rigorous technical standards for fire safety, crashworthiness, and electrical systems, while also meeting food safety and occupational health regulations. Retrofitting existing rolling stock to incorporate modern kitchens, ventilation, waste handling, and digital infrastructure can be equally costly and technically challenging. Regulatory fragmentation across countries—in terms of technical approvals, food-handling rules, and alcohol licensing—raises complexity for multinational rail operators and catering companies. These barriers can delay fleet renewal decisions, limit dining car penetration on some networks, and moderate the overall pace of market growth.

What are the key opportunities in the dining car industry?

High-Speed Rail and Intercity Corridor Expansion

The global pipeline of high-speed and upgraded intercity rail projects presents one of the most compelling growth opportunities for dining car vendors and service providers. As new lines open and existing routes are upgraded, operators are defining onboard service concepts that often include bistro or restaurant cars to differentiate rail from air in terms of comfort and convenience. Vendors that can supply lightweight, energy-efficient dining cars with optimized layouts for high passenger throughput and rapid service will be well-positioned to win contracts. There is also scope for modular designs that can be adapted to varying journey lengths, passenger mixes, and regional culinary preferences.

Luxury, Tourist and Heritage Rail Experiences

Luxury rail tourism and heritage trains represent a high-margin niche where dining cars are at the heart of the value proposition. Growing demand for slow travel, scenic journeys, and themed experiences creates opportunities to refurbish classic rolling stock into premium dining cars featuring fine-dining kitchens, artisanal interiors, and intimate seating layouts. Operators can partner with chefs, wineries, and local producers to develop signature menus and tasting journeys. These services command premium pricing and attract international travelers, making them an attractive segment for both rail operators and specialized hospitality firms.

Digital Platforms, Seat-Service Integration and Ancillary Revenue Growth

An additional opportunity lies in fully integrating dining car operations into digital passenger journeys. Pre-ordering meals at the time of ticket purchase, push notifications for last-mile upselling, route-specific promotions, and loyalty program integration all help increase ancillary revenues. Technologically advanced operators can extend the reach of dining cars beyond the restaurant coach, enabling passengers across the train to access menus and delivery to their seats. This not only raises utilization of kitchen capacity but also allows rail companies to better understand passenger preferences and tailor offers over time, strengthening engagement and brand loyalty.

Product Type Insights

Full-service restaurant dining cars account for the largest share of the market by product type, generating an estimated 46% of global revenue in 2024. These coaches feature full commercial kitchens, restaurant-style seating, and extended menus suitable for long-distance and overnight services. Their higher build and refurbishment costs, combined with their central role in premium and first-class offerings, underpin their strong value contribution. Bistro and buffet dining cars form the second-largest segment, serving high-speed and intercity routes where dwell times and journey lengths favor quicker, counter-based service. Lounge-bar dining cars, often combined with panoramic viewing areas, are especially prominent on tourist and scenic routes, providing a high-margin mix of beverages and light snacks. Emerging modular food-service cars, designed with flexible interiors and plug-and-play galley units, are gaining attention as operators seek adaptable solutions for varying passenger volumes and route profiles.

Application Insights

Intercity and long-distance conventional trains represent the dominant application segment, accounting for around 40% of global dining car revenue in 2024. These services often span several hours or overnight journeys, making onboard meals a practical necessity and a key component of passenger satisfaction. High-speed rail applications are steadily increasing as more countries adopt high-speed corridors where passengers expect café or bistro-style offerings as standard. Luxury, tourist, and heritage trains, while smaller in absolute volume, deliver higher revenue per coach due to elevated pricing and bundled dining packages. Commuter and regional trains generally feature limited catering, but some longer regional services are experimenting with compact bistro areas or trolley services linked to a central galley, indicating a potential future growth niche.

Distribution Channel Insights

In the dining car ecosystem, distribution channels refer primarily to how dining services are structured and delivered rather than traditional retail channels. Rail-operator-owned and operated dining services account for the largest share of the market, with national and major private operators maintaining full control over both rolling stock and onboard F&B operations. Third-party contracted catering models form a significant portion of the market, with specialized rail catering companies running dining cars under concession or revenue-sharing agreements; this model is particularly prevalent in Europe and parts of Asia. Leasing and managed-service arrangements are emerging, where rolling-stock leasing companies and hospitality providers offer turnkey dining car solutions, including equipment, staff, and digital platforms, enabling smaller or fast-growing operators to add dining functionality with reduced upfront capex.

Traveler Type Insights

Business travelers, leisure passengers, tourists, and premium-class customers all exhibit distinct usage patterns for dining cars. Business travelers and first-class passengers are more likely to opt for full-service restaurant offerings, valuing quiet environments, power outlets, and high-quality meals that allow them to work or hold informal meetings. Leisure travelers and families, particularly on long-distance services, favor bistro and buffet concepts that offer affordable, familiar food options and kid-friendly menus. Tourists using scenic and heritage trains are highly engaged with the dining car experience, often perceiving meals as a highlight of the journey and a key component of storytelling and regional immersion. Group travelers—such as tour groups and corporate charters—can significantly boost dining car utilization on specific departures, influencing menu planning and seating configurations.

Age Group Insights

Middle-aged travelers in the 31–50 age bracket form a core user base for dining cars, combining higher disposable income with frequent travel for both business and family leisure. They are more likely to pay for premium dining services, seek healthier menu options, and respond positively to digital ordering and loyalty-linked offers. Younger passengers (18–30) contribute substantially to bistro and café-style spending, often prioritizing grab-and-go options, coffee, and snacks; this group is highly responsive to mobile ordering, cashless payments, and social-media-driven promotions. Older passengers (51 and above), including retirees, are strong users of full-service restaurant cars, valuing comfort, table service, and the social atmosphere of shared meals. For this segment, accessibility features, clear menu labelling, and predictable service times are important for sustained satisfaction and repeat usage.

| By Product Type | By Application | By Service Model | By Ownership & Lifecycle |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 18% of the global dining car market in 2024. The United States and Canada operate iconic long-distance routes where restaurant and lounge cars remain central to the brand promise, particularly on overnight and scenic services. While overall passenger rail volumes are lower than in Europe or Asia, high average ticket prices and strong demand for scenic and tourism-oriented routes support targeted investment in refurbished dining cars, upgraded menus, and improved digital ordering. Policy discussions around expanding intercity and regional rail networks create additional medium-term opportunities for dining car suppliers.

Europe

Europe is the largest regional market, capturing around 35% of global dining car revenue in 2024. Dense intercity and high-speed networks in countries such as France, Germany, Italy, Spain, and the U.K. sustain high demand for bistro and restaurant cars. European passengers show a strong preference for integrated rail experiences that include quality food and beverage service, particularly on journeys exceeding three hours. Ongoing investments in cross-border high-speed corridors, night trains, and green mobility initiatives are expected to support continued fleet renewal and dining car modernization, including energy-efficient galleys and sustainability-focused menu strategies.

Asia-Pacific

Asia-Pacific holds approximately 32% of the global market and is the fastest-growing region. China’s extensive high-speed network, Japan’s established culture of onboard food, and India’s rapidly expanding premium and tourist rail services are major demand drivers. Operators in the region are balancing traditional food offerings—such as regional meals and bento-style formats—with modern digital ordering and branded quick-service concepts. As more middle-class travelers opt for rail over air on selected corridors, demand for improved onboard dining is expected to increase, creating opportunities for both OEMs and catering companies.

Latin America

Latin America accounts for about 7% of global dining car revenues, with demand concentrated in Brazil, Mexico, Argentina, and Chile. While regular intercity passenger rail networks are limited compared with other regions, tourist and heritage trains play an outsized role in dining car usage. These services leverage scenic routes and cultural themes, offering immersive meals that showcase local cuisine and beverages. As governments and private investors explore new intercity corridors and tourist rail projects, the region presents niche opportunities for refurbished dining cars and modular dining solutions.

Middle East & Africa

The Middle East & Africa region contributes roughly 8% of the global dining car market and is among the fastest-growing in percentage terms. In the Middle East, large-scale rail projects, including planned high-speed lines and cross-border corridors, are expected to incorporate premium dining services as part of their value proposition. In Africa, iconic tourist and safari trains, as well as selected intercity routes, rely heavily on dining cars to enhance journey appeal and length of stay. As infrastructure investments accelerate and tourism strategies mature, demand for high-quality, robust, and climate-resilient dining cars is likely to increase.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The dining car market share is moderately concentrated, with the top five integrated operators and specialized catering providers holding approximately 35–40% of global revenue. Large national railways and multinational catering companies dominate high-volume markets in Europe and Asia, while regional and niche operators are more prominent in luxury and tourist segments. The remainder of the market is fragmented across smaller national operators, heritage railways, and specialized luxury train companies. This structure allows space for innovation from both established players and new entrants focusing on digital platforms, modular interiors, and sustainability-focused concepts.

Top Players in the Dining Car Market

- IRCTC

- Newrest Group Services SAS

- Compass Group plc

- Elior Group SA

- Sodexo Live!

- Deutsche Bahn AG

- Amtrak

- Eurostar Group

- SNCF Voyageurs

- Trenitalia S.p.A.

- Swiss Federal Railways

- Great Western Railway / FirstGroup plc

- East Japan Railway Company

- VIA Rail Canada Inc.

- Alstom SA

Recent Developments

- In 2024, China unveiled the CR450 prototype high-speed train, which includes redesigned dining and bar cars as part of its next-generation passenger experience.

- In 2025, Accor continued advancing the Orient Express La Dolce Vita luxury train project, which will feature multiple fine-dining cars ahead of its 2027 launch.