Digital Tattoos Market Size

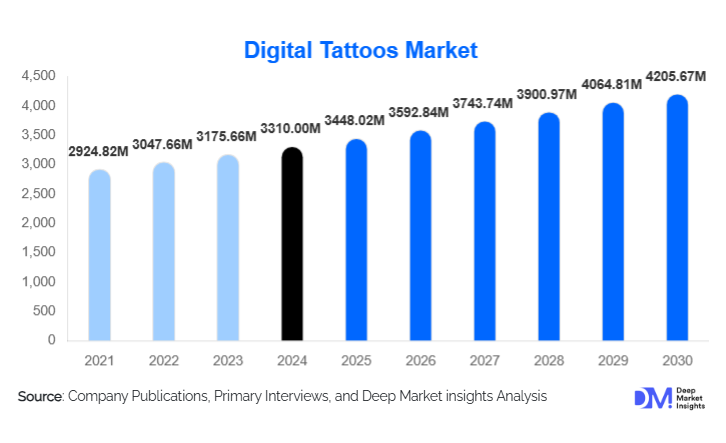

According to Deep Market Insights, the global digital tattoos market size was valued at USD 3,310.00 million in 2024 and is projected to grow from USD 3,448.02 million in 2025 to reach USD 4,205.67 million by 2030, expanding at a CAGR of 4.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of wearable healthcare devices, integration with consumer electronics and AR technologies, and rising demand for personalized health monitoring solutions that enable continuous biometric tracking.

Key Market Insights

- Healthcare applications dominate the market, as digital tattoos provide continuous monitoring of chronic conditions like diabetes, cardiovascular disorders, and neurological diseases.

- Flexible electronics and biocompatible materials are driving product innovation, enhancing comfort, functionality, and skin compatibility for both medical and consumer applications.

- North America leads globally, with the U.S. at the forefront due to advanced healthcare infrastructure, high R&D investment, and early adoption of wearable technologies.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by rising disposable incomes, government innovation initiatives, and strong consumer electronics penetration.

- Consumer electronics and sports applications are expanding, enabling digital tattoos to serve as interactive human-machine interfaces, fitness trackers, and AR-based devices.

- Technological integration, including IoT connectivity, AI-powered health analytics, and low-power flexible sensors, is redefining the market and attracting tech-savvy users.

What are the latest trends in the digital tattoos market?

Healthcare Monitoring and Personalized Medicine

Digital tattoos are increasingly integrated into healthcare monitoring systems, offering real-time tracking of heart rate, glucose levels, and other vital signs. The trend toward personalized medicine is driving adoption, with tattoos enabling remote patient monitoring, reducing hospital visits, and improving chronic disease management. Collaborations between digital tattoo manufacturers and hospitals are creating standardized monitoring solutions that enhance patient compliance and improve treatment outcomes.

Consumer Electronics and Interactive Applications

The market is witnessing rapid adoption of digital tattoos in consumer electronics, where tattoos serve as wearable interfaces for smartphones, AR/VR devices, and IoT systems. Interactive tattoos can provide notifications, biometric authentication, gesture controls, and augmented reality experiences. This trend is particularly strong among younger, tech-savvy consumers who value convenience, immersive experiences, and seamless connectivity with personal devices. Gaming and entertainment applications are also contributing to market growth.

What are the key drivers in the digital tattoos market?

Rising Demand for Wearable Health Devices

The prevalence of chronic conditions is driving demand for continuous health monitoring solutions. Digital tattoos provide unobtrusive, precise, and real-time tracking of vital signs. Telehealth integration and remote patient monitoring initiatives further accelerate adoption, particularly in hospitals, clinics, and research institutions.

Technological Advancements in Flexible Electronics

Advances in stretchable circuits, conductive inks, and micro-LEDs have improved the durability, comfort, and reliability of digital tattoos. These innovations have expanded applications in healthcare, fitness, and consumer electronics, positioning digital tattoos as a preferred alternative to conventional wearable devices.

Growing Popularity of AR and Interactive Consumer Wearables

Interactive applications in gaming, virtual reality, and fitness are driving market adoption. Digital tattoos now function as touchless controllers, authentication devices, and AR interfaces, offering novel experiences that integrate seamlessly with smartphones and IoT devices. This trend enhances appeal among early adopters and tech enthusiasts worldwide.

What are the restraints for the global market?

High Manufacturing Costs

The production of biocompatible and flexible electronic tattoos involves complex materials and processes, resulting in higher prices. This limits adoption among price-sensitive consumers and small healthcare providers. Reducing manufacturing costs through scalable processes remains a key challenge for market expansion.

Regulatory and Safety Concerns

Digital tattoos must comply with strict biocompatibility and medical device standards. Safety, long-term skin compatibility, and electronic waste management pose challenges for regulators, which can slow commercialization and increase approval timelines.

What are the key opportunities in the digital tattoos market?

Expansion in Healthcare and Remote Patient Monitoring

Integration of digital tattoos into telemedicine and remote patient monitoring platforms represents a major opportunity. Hospitals and clinics can leverage continuous monitoring to improve chronic disease management, reduce hospitalization rates, and enhance patient engagement. Strategic partnerships with healthcare providers provide new entrants with lucrative entry points into the medical device ecosystem.

Consumer Electronics and AR Integration

Digital tattoos are increasingly used as interactive interfaces for AR, VR, and IoT devices. Gaming, entertainment, and smart home applications offer opportunities to enhance user engagement, personalization, and seamless device interaction. Companies can tap into this growing consumer segment by developing multifunctional, aesthetically appealing tattoos that integrate seamlessly with digital devices.

Emerging Regional Markets

Asia-Pacific, the Middle East, and Latin America present high growth potential. Government initiatives such as “Made in China 2025” and India’s startup ecosystem foster innovation, while rising disposable incomes and urbanization drive adoption. Expanding presence in these regions allows companies to access new consumer bases and capitalize on rapid technology adoption trends.

Product Type Insights

Biometric tattoos lead the market with approximately 35% share of the 2024 market. They are widely adopted in healthcare due to their ability to provide real-time tracking of glucose, cardiac activity, and other vital parameters. Increasing demand from hospitals, clinics, and research institutions underpins this segment’s growth. Other product types, including RFID-enabled and electroluminescent tattoos, are gaining traction in consumer electronics and AR applications.

Application Insights

Healthcare and medical diagnostics dominate the market, capturing 38% of the 2024 market. Hospitals and clinics are integrating digital tattoos into remote monitoring systems, while sports and fitness applications are expanding rapidly. Consumer electronics applications, including AR interfaces and payment authentication, represent an emerging niche. Defense and security applications are also developing, particularly for biometric identification and secure access solutions.

Distribution Channel Insights

Direct sales to hospitals and clinics are the dominant channel, complemented by partnerships with consumer electronics brands for interactive tattoos. Online platforms and e-commerce portals are gaining relevance, enabling consumer access to wearable tattoo products. Distribution models are evolving to include B2B partnerships, subscription models for fitness applications, and integrated IoT device ecosystems.

End-Use Insights

Hospitals and clinics represent the largest end-use segment, accounting for 42% of the total market value. Sports and fitness centers, consumer electronics companies, and research institutions are emerging as high-growth users. Export-driven demand is strong in North America and Europe, with increasing adoption from APAC markets. Healthcare, sports, and AR applications are driving growth at 11–13% CAGR.

| By Product Type | By Application | By Technology | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market with 45% share in 2024. The U.S. leads due to advanced healthcare infrastructure, technological adoption, and high R&D spending. Hospitals, clinics, and tech-savvy consumers are major adopters of biometric and interactive digital tattoos.

Europe

Europe accounts for 25% of the market, led by Germany and the U.K. Strong focus on healthcare digitization, telehealth integration, and early adoption of wearable technologies drives growth. Eco-conscious and technologically advanced consumers are fueling demand for flexible, interactive tattoos.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a 14% CAGR, led by China and India. Rising disposable incomes, government innovation programs, and increasing adoption of consumer electronics and fitness technologies are key growth drivers.

Latin America

Brazil, Argentina, and Mexico are driving slow but steady adoption, mainly in healthcare and sports applications. Outbound purchases of high-tech wearable tattoos are gradually increasing.

Middle East & Africa

Adoption is moderate, with the UAE and Saudi Arabia driving demand in consumer electronics and biometric security applications. Africa’s growth is tied to healthcare monitoring initiatives and regional R&D efforts.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Tattoos Market

- MC10

- VivaLnk

- Chaotic Moon

- Epicore Biosystems

- Skin Motion

- Electronics For Imaging

- NXP Semiconductors

- Motorola Solutions

- Philips Healthcare

- Intel Corporation

- IBM

- Samsung Electronics

- Sony Corporation

- Qualcomm

- Medtronic