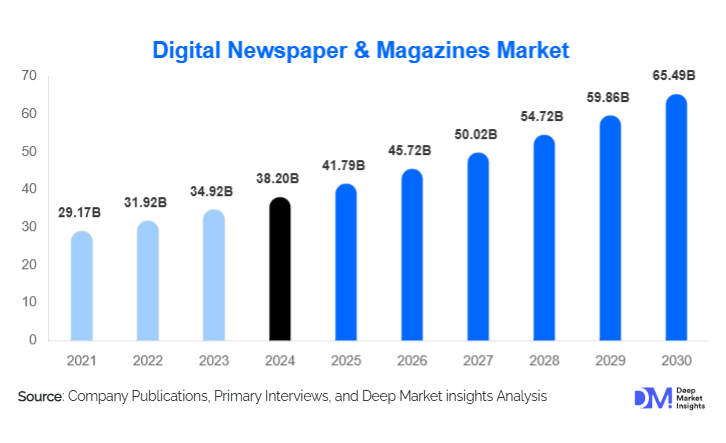

Digital Newspaper & Magazines Market Size

According to Deep Market Insights, the global digital newspaper & magazines market size was valued at USD 38.2 billion in 2024 and is projected to grow from USD 41.79 billion in 2025 to reach USD 65.49 billion by 2030, expanding at a CAGR of 9.4% during the forecast period (2025–2030). The market growth is driven by the continued shift from print to digital consumption, rising smartphone and internet penetration, increasing adoption of paid subscription models, and growing demand for credible, real-time news and premium editorial content across global audiences.

Key Market Insights

- Paid digital subscriptions are becoming the primary revenue backbone, replacing traditional print circulation and stabilizing publisher revenues.

- Mobile-first content consumption dominates, accounting for more than half of total digital readership globally.

- North America leads the market due to high subscription penetration and strong institutional demand.

- Asia-Pacific is the fastest-growing region, driven by regional language content and rising middle-class digital adoption.

- Advertising models are shifting toward programmatic and native formats, improving monetization efficiency.

- AI-driven personalization and analytics are transforming content delivery, pricing strategies, and user retention.

What are the latest trends in the digital newspaper & magazines market?

AI-Powered Personalization and Smart Paywalls

Publishers are increasingly deploying artificial intelligence to personalize content feeds, recommend articles, and dynamically price subscriptions. Smart paywalls powered by user behavior analytics are optimizing conversion rates by offering tailored trial periods, content previews, and flexible pricing tiers. These technologies enhance reader engagement, reduce churn, and maximize lifetime customer value, particularly for premium news and business publications.

Growth of Regional and Vernacular Digital Content

Demand for regional-language digital newspapers and magazines is rising sharply, especially in the Asia-Pacific, Latin America, and parts of Africa. Publishers are investing in local journalism, multilingual platforms, and culturally relevant content to capture first-time digital readers. This trend is expanding the addressable market beyond English-speaking audiences and unlocking high-growth, underserved regions.

What are the key drivers in the digital newspaper & magazines market?

Shift from Print to Digital Media

Declining print circulation and rising production costs have accelerated the transition to digital formats. Consumers increasingly prefer instant access, multimedia storytelling, and mobile-friendly experiences. Established publishers have successfully migrated loyal print readers to digital subscriptions, strengthening recurring revenue streams.

Expansion of Mobile Internet Access

Rapid growth in smartphone adoption and affordable data plans has made digital news accessible to broader populations. Mobile apps, push notifications, and short-form content formats are driving higher daily engagement, particularly among younger demographics and urban users.

What are the restraints for the global market?

Subscription Fatigue and Price Sensitivity

Consumers face increasing subscription costs across multiple digital services, leading to subscription fatigue. Price sensitivity remains a challenge, particularly in emerging markets, limiting publishers’ ability to raise prices aggressively without increasing churn.

Competition from Free and Social Media Content

Social media platforms, news aggregators, and user-generated content compete for audience attention, reducing time spent on paid news platforms. Publishers must continuously differentiate through credibility, depth, and exclusive content.

What are the key opportunities in the digital newspaper & magazines industry?

Institutional and Enterprise Licensing

Demand from universities, corporations, research institutions, and government agencies for licensed digital news access is growing rapidly. Institutional subscriptions offer high-margin, long-term contracts and lower churn rates, providing stable revenue growth opportunities.

Integration of Multimedia and Interactive Formats

Expanding into podcasts, video journalism, interactive infographics, and immersive storytelling creates opportunities to attract younger audiences and advertisers. These formats increase engagement time and open new monetization channels.

Content Type Insights

Digital newspapers account for approximately 58% of the global market in 2024, driven by daily news consumption habits and strong subscription models. Digital magazines hold a significant share in lifestyle, business, and professional segments, benefiting from longer content lifecycles and niche audience loyalty. Special-interest and professional magazines are showing faster growth due to targeted readership and premium pricing.

Revenue Model Insights

Paid subscriptions represent around 46% of total market revenue, making them the leading monetization model globally. Advertising-based revenues, including programmatic and native advertising, remain critical, particularly for large-scale publishers. Freemium and hybrid models continue to gain traction as entry points for new users.

Platform Insights

Mobile applications dominate with over 52% market share, reflecting the shift toward mobile-first consumption. Web-based platforms remain relevant for long-form and professional content, while tablet and e-reader editions serve niche audiences.

End-User Insights

Individual consumers account for approximately 61% of demand, supported by personalized content and affordable monthly plans. Educational institutions and corporate users are the fastest-growing segments, with adoption driven by research, training, and professional information needs.

| By Content Type | By Revenue Model | By Platform | By End User | By Language |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market share in 2024. The United States leads due to high digital subscription penetration, strong advertising demand, and widespread institutional licensing. Canada follows with growing academic and public-sector adoption.

Europe

Europe accounts for around 27% of the market share, led by the U.K., Germany, France, and the Nordic countries. Strong public trust in journalism and willingness to pay for quality news support sustained growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 12% CAGR. China, India, Japan, and Australia are key markets, driven by mobile adoption, regional language content, and expanding middle-class readership.

Latin America

Latin America represents approximately 7% of the market, with Brazil and Mexico leading digital adoption. Growth is supported by increasing internet penetration and mobile-first news consumption.

Middle East & Africa

The Middle East & Africa account for around 5% of global demand, with growth concentrated in the UAE, Saudi Arabia, South Africa, and Nigeria, supported by digital literacy initiatives and expanding media ecosystems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Newspaper & Magazines Market

- The New York Times Company

- News Corp

- Axel Springer SE

- Financial Times Group

- The Economist Group

- Schibsted ASA

- Nikkei Inc.

- Daily Mail & General Trust

- Gannett Co., Inc.

- Hearst Communications