Digital Music Content Market Size

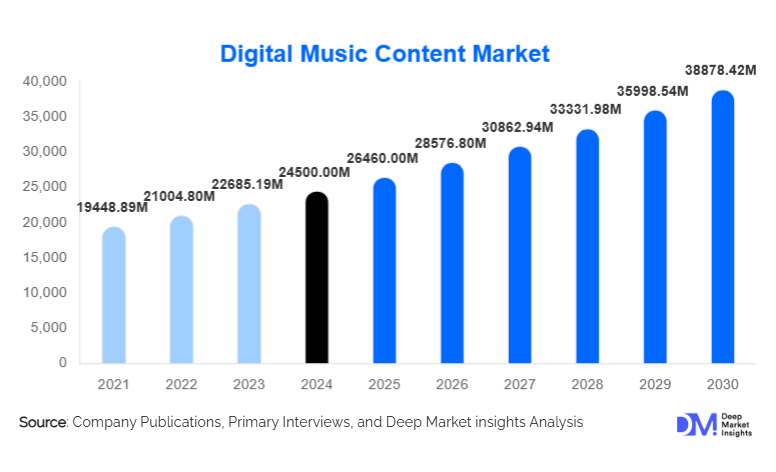

According to Deep Market Insights, the global digital music content market size was valued at USD 24,500.00 million in 2024 and is projected to grow from USD 26,460.00 million in 2025 to reach USD 38,878.42 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). The digital music content market growth is primarily driven by the rise of subscription-based streaming, rapid 5G expansion enabling high-quality audio delivery, and growing demand for personalised music discovery powered by AI and machine learning algorithms. Increasing integration of music across social platforms, gaming, and fitness applications further strengthens long-term demand, while global cross-cultural music trends, such as K-pop, Latin urban, and Afrobeat, continue to expand the commercial potential of digital music ecosystems.

Key Market Insights

- Streaming dominates global music consumption, accounting for more than 60% of total digital music revenue in 2024 across on-demand, curated, and personalised streaming formats.

- Subscription-based revenue remains the strongest growth engine, fueled by multi-tier pricing, bundled services, and premium offerings such as lossless and spatial audio.

- Asia-Pacific is the fastest-growing region, driven by massive smartphone adoption, affordability of data, and expanding local-language content libraries.

- North America leads the global market in terms of ARPU, premium conversions, and adoption of high-fidelity streaming formats.

- Commercial music licensing is becoming a major revenue stream for retail, hospitality, fitness centres, and entertainment venues adopting curated digital soundtracks.

- AI-driven personalisation and discovery tools are transforming user engagement and reshaping how consumers interact with music platforms.

What are the latest trends in the digital music content market?

AI-Driven Personalization Transforming User Engagement

AI continues to redefine the way users discover and engage with music. Platforms now use machine learning to analyze listening habits, moods, contexts, and behavioural cues to generate hyper-personalized playlists. These AI-driven discovery engines significantly improve retention rates and drive upgrades to premium tiers. Predictive recommendation systems are also influencing global music trends, helping emerging artists reach international audiences. As generative AI gains momentum, new opportunities in automated music creation, remixing, and adaptive soundscapes are emerging, reshaping how content is produced and consumed across platforms.

Short-Video and Social Media Platforms Driving Music Consumption

Short-video platforms such as TikTok, YouTube Shorts, and Instagram Reels have become foundational to music discovery. Viral audio snippets often trigger global streaming surges, impacting charts and commercial licensing opportunities. Music labels and artists now design promotional strategies around social virality, leveraging user-generated content to amplify reach. The integration of licensed track libraries into short-video apps is expanding micro-licensing models and presenting new revenue avenues for rights holders, while also fostering cross-genre collaborations and global music diffusion.

What are the key drivers in the digital music content market?

Rapid Adoption of Subscription Streaming Models

Subscription streaming accounts for more than half of global digital music revenue and serves as the primary driver of market growth. Users increasingly prefer uninterrupted, high-quality listening and multi-device access. Premium features such as offline downloads, spatial audio, exclusive content, and bundled services (e.g., telecom or cloud storage packages) continue to push adoption. Emerging markets are benefiting from mobile-only micro-subscriptions, making streaming accessible to millions of new users annually.

Integration of Music Across Connected Devices

Music consumption is expanding beyond smartphones to smart speakers, wearables, gaming consoles, and connected cars. Voice-activated assistants such as Alexa and Google Assistant are enabling frictionless listening experiences, while automotive OEM partnerships are integrating streaming natively into dashboard systems. These connected environments drive higher streaming volumes, longer listening hours, and broader consumer engagement across age groups and lifestyles.

What are the restraints for the global market?

High Licensing and Royalty Costs

The digital music ecosystem faces substantial cost pressures due to complex royalty structures and rising payouts to rights holders. These expenses limit profitability, particularly for platforms operating in price-sensitive regions. Multi-territory licensing challenges and ongoing disputes between publishers, artists, and platforms also delay international expansions and discourage smaller entrants from scaling operations.

Piracy and Unlicensed Distribution

Despite advancements in DRM technologies, piracy remains a major concern, especially in developing regions. Illegal downloads, unauthorized music-sharing applications, and unlicensed commercial usage reduce potential revenue and undermine creators' earnings. This persistent issue demands stronger regulatory frameworks, consumer education, and scalable content identification technologies to curb revenue leakage and ensure fair compensation across the value chain.

What are the key opportunities in the digital music content industry?

AI-Enhanced Content Monetization Opportunities

The integration of AI into content recommendation, playlist curation, user behaviour analysis, and automated music production presents a significant growth opportunity. Platforms adopting advanced personalization systems experience higher consumer loyalty, increased session durations, and stronger premium conversion rates. AI-assisted tools also provide independent artists with access to professional-grade production capabilities, widening the creative pipeline and boosting global digital music supply.

Commercial Licensing Expansion

The global expansion of retail, fitness, hospitality, and entertainment venues is driving demand for licensed digital music solutions. Businesses increasingly rely on curated playlists to enhance customer experiences and brand ambience. As more countries enforce intellectual property compliance, formal licensing adoption is expanding rapidly. This shift creates a strong commercial revenue stream, empowering music licensors and rights management platforms to scale across sectors.

Product Type Insights

Streaming content leads the market, contributing over 62% of total digital music revenue in 2024. This includes on-demand, curated, and algorithmically personalised streaming services, driven by rising smartphone usage and affordable internet access. Downloaded music remains relevant in niche segments such as collectors and offline-first markets, while digital radio maintains a loyal audience through curated broadcasts and genre-specific channels. Music licensing content is growing rapidly due to increasing adoption by retail, hospitality, and corporate environments seeking legally compliant, mood-enhancing soundtracks.

Application Insights

The largest application of digital music content lies within individual consumer streaming, supported by rising demand for subscription-based premium experiences. Commercial usage in retail, gyms, restaurants, and hospitality is accelerating as businesses invest in atmosphere-enhancing playlists. Media and entertainment applications, including background scoring, sync licensing for advertisements, and content for gaming, represent a high-growth segment. Emerging applications include AI-generated background music for digital creators, virtual concerts, and immersive metaverse environments where personalised music experiences are becoming key engagement tools.

Distribution Channel Insights

Online platforms dominate distribution, with streaming apps and digital stores serving as the primary access points for global consumers. Telecom bundle partnerships, smart device integrations, and direct-to-consumer channels enhance accessibility. Social media platforms and short-video apps are becoming crucial distribution channels, driving viral engagement and micro-licensing demand. Commercial licensing platforms distribute curated music catalogues tailored for enterprise use, supporting fast-growing B2B applications. Offline channels, including in-car systems and smart home devices, further expand distribution capabilities by embedding music directly into daily routines.

Consumer Type Insights

Individual consumers make up more than 83% of global digital music demand, driven by mobile-first streaming habits and expanding premium subscriptions. Commercial enterprises represent a growing segment as curated digital music becomes integral to customer experience strategies. Media and entertainment companies form a stable but rapidly evolving consumer group, relying on sync licensing and soundtrack sourcing for film, TV, advertising, and gaming. The rise of independent creators across YouTube, Twitch, and TikTok is shaping a new consumer segment reliant on licensed, monetizable background music for continuous content production.

Age Group Insights

The 18–34 demographic dominates digital music consumption, contributing significantly to premium subscriptions and social media-driven discovery. This group is highly responsive to AI-generated playlists, personalised recommendations, and high-quality audio formats. Consumers aged 35–50 represent a strong segment for family plans, multi-device bundles, and mid-tier subscription models. Older demographics (50+) are steadily adopting streaming services due to ease of access, voice-assisted controls, and nostalgic catalogues, making them an increasingly valuable segment for subscription retention.

| By Content Type | By Revenue Model | By Platform Type | By Device Type | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global digital music content market, contributing approximately 34% in 2024. The U.S. leads with the highest ARPU globally, supported by widespread adoption of premium subscriptions, smart speakers, and connected car integrations. The region's strong digital rights enforcement and robust entertainment ecosystem further fuel market dominance.

Europe

Europe accounts for around 28% of global demand, driven by diverse music cultures, strong streaming adoption, and high consumer willingness to pay for premium features. Leading markets include the U.K., Germany, France, and the Nordics. Europe’s emphasis on sustainability and ethical consumption also drives growth in localised, culturally curated platforms.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a projected CAGR of nearly 12% through 2030. India and China drive massive user volume, while South Korea and Japan generate strong ARPU through high engagement with premium content. Local-language diversification and cost-effective subscription models are accelerating regional penetration.

Latin America

Brazil and Mexico lead digital music adoption in Latin America, benefiting from a strong cultural affinity for music and rapid smartphone growth. Latin genres such as reggaeton and regional Mexican music achieve global streaming visibility, boosting both local and international licensing revenues.

Middle East & Africa

MEA presents emerging opportunities, led by high-income markets such as the UAE and Saudi Arabia. Africa's streaming ecosystem is expanding quickly, fueled by Afrobeat’s global prominence and rising mobile internet access. Local-language catalogues, affordable data plans, and growing creator communities are accelerating regional adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Music Content Market

- Spotify Technology S.A.

- Apple Inc. (Apple Music)

- Amazon.com Inc. (Amazon Music)

- Alphabet Inc. (YouTube Music)

- Tencent Music Entertainment

- Deezer S.A.

- Pandora (Sirius XM)

- SoundCloud Ltd.

- ByteDance Ltd. (TikTok Music)

- NetEase Cloud Music

- TIDAL

- Anghami

- Yandex Music

- KKBOX

- JioSaavn

Recent Developments

- In March 2025, Spotify announced expanded AI playlist capabilities, integrating mood, context, and voice-driven commands to enhance personalised user experiences.

- In January 2025, Apple Music rolled out its new high-fidelity lossless and spatial audio catalogue globally, strengthening premium subscription appeal.

- In December 2024, Tencent Music partnered with global labels to launch cross-border digital concerts featuring interactive fan experiences and virtual merchandise integrations.