Digital Media Frame Market Size

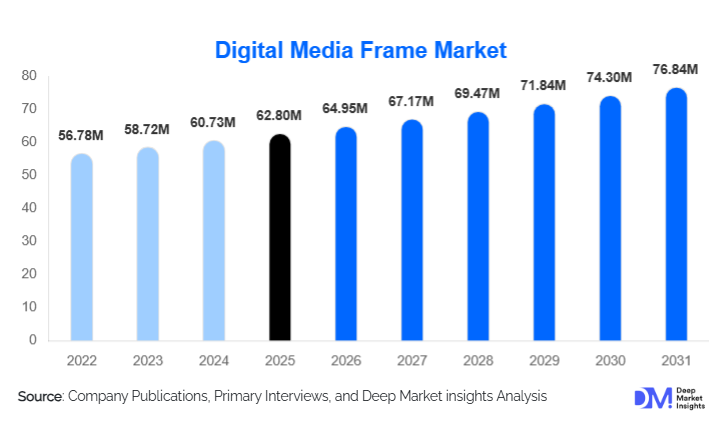

According to Deep Market Insights, the global digital media frame market size was valued at USD 62.80 million in 2025 and is projected to grow from USD 64.95 million in 2026 to reach USD 76.84 million by 2031, expanding at a CAGR of 3.42% during the forecast period (2026–2031). The digital media frame market growth is primarily driven by rising adoption of smart home devices, increasing use of digital displays for commercial communication, and growing demand for cloud-connected and IoT-enabled visual solutions across residential and enterprise environments.

Key Market Insights

- Wi-Fi and cloud-connected digital media frames dominate demand, driven by seamless content sharing, remote updates, and smart home integration.

- Residential usage remains the largest segment, supported by gifting trends, personalized photo sharing, and smart living adoption.

- Commercial applications are expanding rapidly, particularly in retail, hospitality, and corporate communication.

- North America leads the global market in revenue share due to premium pricing and high smart device penetration.

- Asia-Pacific is the fastest-growing region, supported by expanding electronics manufacturing and rising middle-class consumption.

- Technological advancements, including AI-powered content management and high-resolution displays, are reshaping product differentiation.

What are the latest trends in the digital media frame market?

Integration with Smart Home and IoT Ecosystems

Digital media frames are increasingly being positioned as multifunctional smart displays within connected home ecosystems. Integration with voice assistants, cloud photo platforms, and home automation systems allows frames to display calendars, reminders, weather updates, and security notifications alongside visual content. This convergence is expanding their role beyond photo viewing into household information hubs, increasing both average selling prices and replacement cycles. Manufacturers are embedding AI-driven content curation and facial recognition to personalize displayed content, improving user engagement and retention.

Rising Adoption in Commercial and Retail Spaces

Retailers, restaurants, and hospitality providers are adopting digital media frames as cost-effective alternatives to large-format digital signage. Compact frames are being used for menu boards, promotional messaging, brand storytelling, and in-store navigation. The ability to update content remotely and dynamically adjust messaging based on time or promotions has significantly increased adoption among small and medium enterprises. This trend is particularly strong in organized retail formats across Asia-Pacific and the Middle East.

What are the key drivers in the digital media frame market?

Growing Demand for Smart and Connected Displays

Consumers increasingly prefer connected devices that integrate seamlessly with smartphones and cloud platforms. Digital media frames benefit from this shift by offering real-time photo sharing, remote management, and smart display functionality. Rising smart home penetration in North America and Europe has directly supported demand for Wi-Fi-enabled and cloud-connected frames, positioning connectivity as a core growth driver.

Expansion of Digital Advertising and Corporate Communication

Businesses are increasingly shifting from static communication tools to dynamic digital displays. Digital media frames are widely used in offices, retail outlets, hotels, and healthcare facilities to display announcements, branding, and promotional content. Their affordability and ease of deployment compared to large signage systems make them attractive for decentralized and multi-location enterprises.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

Despite declining display panel costs, digital media frames remain discretionary purchases in many developing regions. Consumers often prioritize smartphones and televisions over standalone display devices, limiting adoption in price-sensitive markets. This restrains volume growth in parts of Latin America, Africa, and South Asia.

Content Management and Usability Challenges

Complex setup processes, software compatibility issues, and content synchronization challenges can deter non-technical users. Older demographics and small businesses without dedicated IT support may face adoption barriers, slowing penetration in certain end-user segments.

What are the key opportunities in the digital media frame industry?

Institutional Adoption in Education and Healthcare

Educational institutions and healthcare facilities are increasingly adopting digital media frames for announcements, wayfinding, patient education, and awareness campaigns. Government-funded digital infrastructure initiatives are supporting this trend, creating long-term institutional demand that offers stable, recurring revenue opportunities for manufacturers.

Emerging Demand from Hospitality and Tourism

Hotels, resorts, and serviced apartments are deploying digital media frames for guest communication, branding, and personalized experiences. Integration with property management systems allows customized messaging for guests, enhancing satisfaction and operational efficiency. This represents a high-growth commercial opportunity, particularly in tourism-driven regions.

Product Type Insights

LCD digital media frames dominate the market, accounting for approximately 58% of global revenue in 2024 due to cost efficiency and wide availability. LED frames are gaining traction in premium segments, offering better brightness and energy efficiency. OLED and e-paper frames remain niche but are gradually expanding in high-end residential and corporate applications where design aesthetics and power efficiency are prioritized.

Application Insights

Personal and home use remains the largest application segment, representing nearly 44% of the market in 2024, driven by gifting demand and family photo sharing. Commercial advertising and signage applications are the fastest-growing, supported by retail digitization and corporate communication needs. Educational and healthcare applications are emerging as stable, institution-driven segments with long-term growth potential.

Distribution Channel Insights

Online direct-to-consumer channels account for over 52% of total sales, supported by e-commerce platforms, brand-owned websites, and subscription-based cloud services. Consumer electronics retail stores remain important for mid-range and premium products, while B2B and enterprise sales channels are expanding for corporate, hospitality, and institutional deployments.

End-Use Industry Insights

Residential consumers represent the largest end-use segment, contributing approximately 48% of total market revenue. Retail and hospitality are the fastest-growing end-use industries, expanding at double-digit growth rates due to rising digital signage adoption. Healthcare and education are emerging end-use segments, benefiting from increasing digital communication needs and government-supported digitization initiatives.

| By Display Technology | By Screen Size | By Connectivity Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 34% of the global market share in 2024, led by the United States. High disposable income, strong smart home adoption, and premium pricing support market leadership. Corporate and residential demand remains strong, with increasing use in retail and hospitality environments.

Europe

Europe represents a mature but steadily growing market, driven by demand in Germany, the U.K., and France. Sustainability regulations and energy-efficient display standards are shaping product innovation, while commercial adoption remains robust.

Asia-Pacific

Asia-Pacific held nearly 29% of the global market in 2024 and is the fastest-growing region, with a CAGR exceeding 12%. China, Japan, South Korea, and India are key markets, supported by electronics manufacturing, rising middle-class consumption, and expanding retail infrastructure.

Latin America

Latin America is an emerging market led by Brazil and Mexico. Growth is driven by expanding retail chains and the gradual adoption of smart home devices, though price sensitivity remains a constraint.

Middle East & Africa

The Middle East is witnessing growing adoption in the hospitality and retail sectors, particularly in the UAE and Saudi Arabia. Africa remains a nascent market but shows potential through smart city and commercial infrastructure projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Media Frame Market

- Samsung Electronics

- LG Electronics

- Sony Corporation

- Panasonic Corporation

- Philips (TP Vision)

- Lenovo Group

- ViewSonic

- Hisense

- TCL Technology

- Xiaomi

- ASUS

- Amazon

- Aluratek

- Nixplay

- Skylight Frame