Digital Denture Market Size

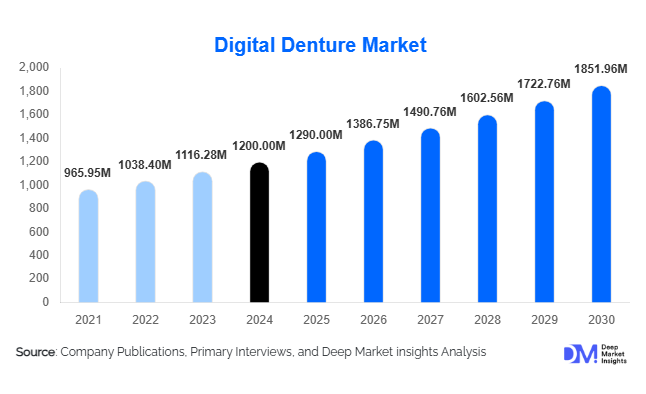

According to Deep Market Insights, the global digital denture market size was valued at USD 1,200.00 million in 2024 and is projected to grow from USD 1,290.00 million in 2025 to reach USD 1,851.96 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). Market expansion is fueled by rapid adoption of CAD/CAM technologies, widespread integration of 3D printing systems in dental laboratories, a rising geriatric population, and increasing preference for accurate, aesthetic, and high-comfort digital prosthetic solutions.

Key Market Insights

- The transition from conventional denture fabrication to digital workflows is accelerating, driven by the need for quicker turnaround times, enhanced precision, and aesthetic customization.

- Dental laboratories dominate digital denture adoption as they invest heavily in CAD/CAM systems, 3D printers, and next-generation denture materials.

- Complete digital dentures represent the largest product segment, supported by rising edentulism rates globally.

- North America leads the global market, driven by a well-established dental infrastructure and high patient awareness.

- Asia-Pacific is the fastest-growing region due to expanding dental tourism, rising disposable incomes, and rapid modernization of dental clinics and labs.

- Material innovation, especially biocompatible polymers and high-strength resins, is reshaping prosthetic quality, expanding longevity and comfort of digital dentures.

What are the latest trends in the digital denture market?

Advanced CAD/CAM & 3D Printing Workflows Transform Denture Fabrication

Digital workflows are becoming the backbone of modern denture manufacturing. High-resolution intraoral scanners, AI-enabled CAD software, and precision milling or 3D-printing systems now allow technicians to fabricate dentures with unprecedented accuracy. Dental labs are replacing multi-appointment traditional impression methods with digital impressions, enabling faster turnaround times, often reducing the denture delivery cycle by more than 50%. CAD/CAM workflows also reduce manual labor, errors, and material wastage. As 3D-printing speeds rise and biocompatible materials improve, digital dentures are rapidly becoming the preferred option for both patients and dental professionals.

Next-Generation Biocompatible Materials Elevate Comfort & Aesthetics

Material innovation is a defining trend, with manufacturers introducing advanced polymer and resin formulations specifically engineered for digital denture fabrication. These materials offer enhanced strength, color stability, wear resistance, and gum-like translucency. 3D-printed biocompatible resins now compete directly with premium milled acrylics in aesthetics and durability. Hybrid materials, combining polymers with reinforced composites, are gaining traction in implant-supported digital prostheses. As materials continue to improve, digital dentures increasingly replicate natural tooth structure and gum anatomy, boosting patient acceptance and long-term satisfaction.

What are the key drivers in the digital denture market?

Rapid Technological Advancements in Dental CAD/CAM & 3D Printing

Advancements in CAD/CAM workflows and high-performance 3D printers significantly enhance accuracy, uniformity, and customization of digital dentures. Clinics and labs benefit from streamlined processes, reduced chair time, and automated denture design capabilities. These technologies enable same-day or next-day delivery in some cases, improving patient experience while expanding clinical throughput. As equipment prices gradually decline and software becomes more user-friendly, adoption among mid-sized clinics and emerging-market laboratories is accelerating.

Growing Geriatric Population & Rising Edentulism Rates

Global aging trends are directly influencing digital denture demand. The rising incidence of complete tooth loss among elderly populations, especially in North America, Europe, China, and Japan, is increasing the need for full dentures. Digital dentures offer geriatric patients superior comfort, better fit through precision scanning, and shorter adjustment cycles. This demographic-driven demand is a strong and predictable long-term growth driver for the industry.

Patient Shift Toward Aesthetic, Comfortable, and Quick-Turn Dentures

Modern patients increasingly prioritize aesthetic dental solutions. Digital dentures deliver a natural appearance, improved shade-matching, lightweight comfort, and better functional performance. Combined with reduced clinic visits and quicker production times, this shift toward improved patient experience is reinforcing global adoption. Digital workflows also allow easy replication of lost or damaged dentures, offering convenience unmatched by conventional fabrication.

What are the restraints for the global digital denture market?

High Capital Investment Requirements

Adopting digital denture workflows requires substantial initial investment in CAD/CAM systems, 3D printers, milling units, specialized software, and training. Small dental clinics and independent labs often face financial barriers, slowing adoption rates in developing countries. Ongoing maintenance and software licensing costs add to affordability challenges.

Limited Adoption & Skill Gaps in Emerging Markets

Digital denture technology requires trained technicians and digital dental professionals. Many emerging markets still lack digital infrastructure and formal training programs. Regulatory complexities, import duties on scanners and printers, and limited clinical awareness further delay uptake. These factors collectively constrain the speed of global expansion.

What are the key opportunities in the digital denture industry?

Expanding Demand in Aging Economies & Senior Care Ecosystems

The world’s aging population, particularly in the U.S., Western Europe, Japan, South Korea, and China, is creating a long-term opportunity for digital denture manufacturers. Senior living communities, geriatric hospitals, and assisted healthcare facilities increasingly require digital denture solutions due to resident turnover, ongoing denture repairs, and patient demand for comfort-focused prosthetics. Tailored geriatric denture programs and mobile denture clinics represent new growth avenues.

Technology Integration Across AI, Cloud, and Tele-Dentistry

AI-driven denture design, cloud-based workflow management, remote digital scans, and 3D-print farms are reshaping production ecosystems. Companies integrating artificial intelligence into denture modeling can reduce design time, minimize errors, and achieve mass customization. Tele-dentistry is also enabling remote assessments and consultations, particularly beneficial for elderly or mobility-limited patients. This creates opportunities for scalable, decentralized denture production networks worldwide.

Product Type Insights

Complete digital dentures dominate the market, accounting for 55–60% of total 2024 revenue due to the higher prevalence of full edentulism. Consumables, especially resins and polymers, represent the largest revenue category within product offerings, contributing nearly 40–50% of total revenue because they are required for every denture fabricated. Software and dental design services are also expanding rapidly as clinics and labs increasingly outsource complex prosthetic design tasks.

Application Insights

Applications include removable digital dentures, fixed implant-supported prostheses, temporary dentures, and hybrid prosthetic solutions. Removable digital dentures hold the largest share at 65–75% of 2024 volume, supported by broad adoption among edentulous elderly patients. Implant-supported digital dentures represent a fast-growing subsegment as dental implants become more accessible worldwide. Digital replicas, same-day dentures, and multi-arch solutions are gaining popularity in dental tourism hubs.

Distribution Channel Insights

Dental laboratories remain the primary distribution channel, representing 45–55% of total market share. Labs invest heavily in CAD/CAM systems and 3D printing equipment, enabling them to serve multiple clinics and scale production efficiently. Direct clinic adoption is growing as scanners become more affordable. Outsourced denture design services, cloud-based CAD providers, and digital design marketplaces are emerging channels supporting decentralized digital denture production.

End-User Insights

Dental laboratories, dental clinics, hospitals, prosthodontic centers, and dental outsourcing hubs constitute the major end-users. Laboratories dominate due to their specialized equipment and production capacity. Dental clinics are the fastest-growing end-user group, particularly in APAC and LATAM, driven by patient demand for aesthetic and fast-turn dentures. Nursing homes, geriatric centers, and dental tourism facilities are emerging as new high-value end-use markets.

| By Denture Type | By Product Type | By Material Type | By Usability / Prosthetic Mode | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global digital denture market with a 35–40% share in 2024. The U.S. drives most demand, supported by advanced dental infrastructure, high dental expenditure, and rapid technology adoption. Digital workflows are now standard among larger labs, and implant-supported digital dentures are increasingly common. Growing senior populations and widespread insurance coverage further support market expansion.

Europe

Europe accounts for 20–25% of the global market in 2024. Germany, France, the U.K., Italy, and Spain are key contributors. Digital dentistry is widely integrated into dental curricula, improving professional adoption. Strong government support for elderly dental care and rising interest in aesthetic prosthetics bolster the regional market. Europe's demand is reinforced by well-established dental lab ecosystems and expanding digital manufacturing capabilities.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, South Korea, and Australia. Increasing disposable incomes, modernization of clinics and labs, and booming dental tourism fuel growth. China and India are witnessing the rapid adoption of 3D printing and CAD/CAM technologies across dental chains and corporate labs. By 2030, APAC is projected to significantly increase its global market share.

Latin America

LATAM is an emerging market with rising acceptance of digital prosthetics. Brazil, Mexico, and Argentina are leading contributors. Growth is supported by expanding dental tourism, modernization of urban dental clinics, and rising demand for cost-effective digital dentures. However, limited infrastructure and high equipment costs still constrain widespread adoption.

Middle East & Africa

MEA shows gradual adoption, led by the UAE, Saudi Arabia, South Africa, and Egypt. Growing investment in private dental clinics, high-income patient segments, and the expansion of dental training centers support regional growth. In Africa, adoption remains slower but is expected to rise as clinics modernize and dental tourism gains traction.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Denture Market

- Dentsply Sirona

- 3Shape A/S

- Formlabs

- Ivoclar Vivadent

- Straumann Group

- Amann Girrbach

- VITA Zahnfabrik

- Zimmer Biomet

- Kulzer GmbH

- DGSHAPE (Roland DG)

- EnvisionTEC

- Kulzer Mitsui

- Zirkonzahn

- Carbon Inc.

- Exocad GmbH

Recent Developments

- In May 2025, Formlabs expanded its dental resin portfolio with new high-performance biocompatible materials optimized for full-arch digital dentures.

- In March 2025, Dentsply Sirona introduced an AI-powered denture design module integrated into its CAD/CAM ecosystem, reducing design time by over 40%.

- In February 2025, Straumann Group partnered with several APAC dental labs to establish cloud-connected 3D-printing hubs targeting high-volume denture production.