Diatonic Harmonicas Market Size

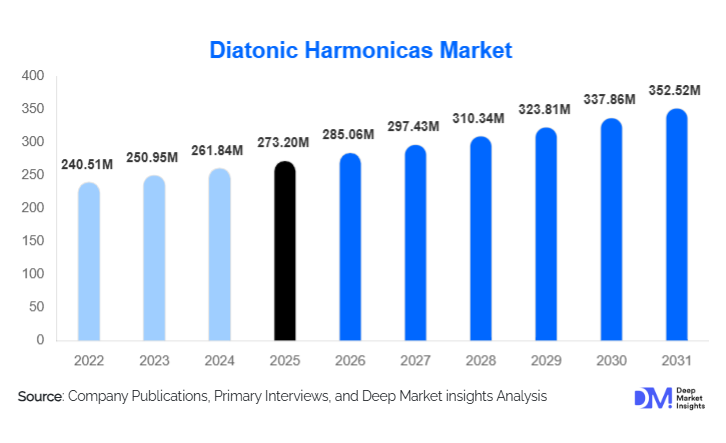

According to Deep Market Insights, the global diatonic harmonicas market size was valued at USD 273.20 million in 2025 and is projected to grow from USD 285.06 million in 2026 to reach USD 352.52 million by 2031, expanding at a CAGR of 4.34% during the forecast period (2026–2031). The diatonic harmonicas market growth is supported by steady demand from amateur musicians, strong cultural relevance in blues and folk music, rising music education initiatives, and expanding online retail penetration that continues to bring new users into the market.

Key Market Insights

- Diatonic harmonicas remain the most widely used harmonica type globally, driven by their simplicity, affordability, and expressive tonal range.

- Beginner and hobbyist users dominate demand, accounting for over half of total market consumption in 2024.

- Online marketplaces are reshaping distribution, enabling manufacturers to directly reach customers across emerging economies.

- North America leads global demand, supported by strong blues and folk music traditions in the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, driven by music education expansion and rising disposable incomes.

- Therapeutic and wellness applications are emerging as a high-growth niche for diatonic harmonicas.

What are the latest trends in the diatonic harmonicas market?

Growth of Online Learning and Digital Music Communities

The increasing popularity of online music tutorials, virtual classrooms, and social media-based harmonica instruction is reshaping demand patterns. Beginners are increasingly purchasing diatonic harmonicas alongside digital learning resources, including app-based lessons and video tutorials. Brands that bundle harmonicas with digital content or QR-based learning guides are experiencing higher conversion rates, particularly among younger demographics. This trend is also strengthening repeat purchases as learners upgrade from beginner to intermediate instruments.

Product Innovation Focused on Durability and Comfort

Manufacturers are investing in improved reed materials, corrosion-resistant metals, and ergonomic comb designs to enhance durability and player comfort. Plastic and hybrid comb harmonicas are gaining traction due to moisture resistance and ease of maintenance, especially among beginners and educational institutions. Precision tuning and laser-cut reeds are also becoming more common in mid-range and professional models, allowing brands to justify premium pricing.

What are the key drivers in the diatonic harmonicas market?

Strong Cultural and Genre-Based Demand

Diatonic harmonicas remain integral to blues, folk, country, and indie music genres, particularly in North America and Europe. Ongoing interest in acoustic and roots music has sustained demand among professional musicians and enthusiasts. Live performances, music festivals, and recording activities continue to support replacement and upgrade purchases.

Affordability and Ease of Entry

With entry-level prices typically below USD 15, diatonic harmonicas are among the most accessible musical instruments worldwide. Their ease of learning and portability make them a popular choice for first-time musicians, supporting high unit volumes and consistent market inflow.

Expansion of Music Education Programs

Government-backed music education initiatives and school-level arts programs increasingly adopt diatonic harmonicas due to low cost, durability, and suitability for group learning. Educational institutions represent a stable and recurring source of bulk demand globally.

What are the restraints for the global market?

Competition from Digital Music Alternatives

Digital music apps and virtual instruments compete for attention among younger consumers, particularly at the beginner level. These alternatives can reduce initial adoption rates for physical instruments in some markets.

Raw Material Price Volatility

Fluctuations in brass, stainless steel, and specialty wood prices impact production costs, particularly for premium and professional-grade harmonicas. This can pressure margins and limit pricing flexibility for manufacturers.

What are the key opportunities in the diatonic harmonicas industry?

Therapeutic and Wellness Applications

Diatonic harmonicas are increasingly used in respiratory therapy, stress management, and neurological rehabilitation. Healthcare providers and wellness centers are adopting harmonicas as low-cost therapeutic tools, creating institutional demand with higher growth potential than traditional consumer segments.

Emerging Market Penetration in Asia-Pacific and Latin America

Rising disposable incomes, expanding e-commerce infrastructure, and growing interest in music education are driving demand in Asia-Pacific and Latin America. Manufacturers that localize pricing and distribution strategies are well-positioned to capture long-term growth.

Product Type Insights

Standard 10-hole diatonic harmonicas dominate the global market, accounting for approximately 58% of total revenue in 2024. Their universal tuning, ease of play, portability, and extensive instructional resources make them the preferred choice for both beginners and professional musicians. These harmonicas are widely used in blues, folk, country, and indie music genres, which supports consistent demand across regions. Low- and high-tuned variants cater to niche musical styles and specialized genres, while specialty diatonic harmonicas—such as valved or custom reed models—are gaining modest traction among advanced players seeking enhanced tonal control and expressive performance. The dominance of the standard 10-hole segment is further driven by rising interest in music education programs, online tutorials, and virtual harmonica lessons, which primarily focus on this harmonica type, reinforcing its global leadership.

Material Composition Insights

Plastic comb harmonicas lead the market with an estimated 46% share, driven by their durability, moisture resistance, low maintenance, and suitability for beginners and educational institutions. Wood comb harmonicas retain strong appeal among traditionalists and professional musicians, valued for their warmer tonal characteristics and classic aesthetics. Metal and hybrid comb designs are increasingly preferred in the premium segment due to superior resonance, longevity, and precision tuning, which align with the needs of professional performers and enthusiasts. Rising consumer awareness about product quality and longevity is fueling the adoption of these high-end materials, particularly in North America and Europe, where professional musicians dominate demand.

Distribution Channel Insights

Online marketplaces represent the largest distribution channel globally, accounting for roughly 38% of total sales in 2024. Growth in e-commerce is driven by wider geographic reach, convenience, and competitive pricing, enabling manufacturers to directly connect with new consumers in emerging markets. Brand-owned direct-to-consumer (D2C) websites are also expanding rapidly, allowing manufacturers to offer bundled products, personalized instruments, and exclusive content such as digital lessons. Offline music stores remain essential for professional-grade instruments and personalized customer service, while institutional and bulk sales channels, especially in schools and music programs, play a critical role in education-driven harmonica adoption. This multi-channel distribution approach ensures consistent market penetration and supports both entry-level and premium harmonica segments.

End-Use Insights

Amateur and hobbyist users account for approximately 49% of total market demand, fueled by the rising popularity of online tutorials, recreational music trends, and social media-driven music learning communities. Music education institutions represent one of the fastest-growing end-use segments, driven by government programs promoting arts education, bulk harmonica purchases for schools, and curriculum integration of musical instruments. Professional musicians continue to drive premium product demand, particularly for metal and hybrid comb harmonicas with advanced tuning. Additionally, therapeutic and wellness applications, such as respiratory therapy and stress relief programs, are emerging as high-growth niches, expanding at over 6% CAGR due to increasing awareness of harmonica’s health benefits.

| By Product Type | By Material Composition | By Distribution Channel | By End-Use Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 32% of the global market share in 2024, with the United States as the primary contributor. Market growth is driven by a strong blues and folk music heritage, high professional musician density, and robust consumer spending on musical instruments. The region’s adoption of premium harmonicas is bolstered by online music communities, professional music schools, and recreational hobbyist demand. Access to advanced distribution channels, including e-commerce platforms and specialty music stores, further supports growth. Government-backed music education programs and community-based arts initiatives provide an additional driver by increasing harmonica penetration in schools and local music programs.

Europe

Europe represents about 27% of global demand, led by Germany, the U.K., and France. Growth in this region is fueled by long-standing music education traditions, strong professional and amateur musician communities, and cultural appreciation for folk and blues music. Rising interest in premium and eco-friendly harmonicas, along with higher disposable incomes, drives demand for metal and hybrid comb instruments. Educational institutions and music conservatories across the continent also act as key buyers, supporting steady bulk purchases. Additionally, technological integration, such as harmonicas bundled with digital lessons or online practice tools, is boosting adoption among younger consumers, particularly in Western Europe.

Asia-Pacific

Asia-Pacific holds roughly 25% of the global market share and is the fastest-growing region, driven by China, Japan, South Korea, and India. Rapid urbanization, expanding middle-class disposable income, and a growing interest in music education programs are key growth drivers. The popularity of online learning platforms, social media music communities, and virtual harmonica tutorials is increasing beginner adoption across the region. Additionally, rising cultural acceptance of Western music styles, combined with government initiatives promoting arts and music in schools, is further driving harmonica sales. China and India, in particular, are witnessing strong growth in entry-level and mid-range harmonicas, while Japan and South Korea continue to support demand for premium professional instruments.

Latin America

Latin America accounts for around 9% of global demand, led by Brazil and Mexico. Market growth is driven by cultural music adoption, increasing popularity of folk and acoustic music, and a growing middle-class consumer base seeking affordable entry-level harmonicas. Educational programs and community music initiatives in Brazil and Mexico further support adoption. The rise of online retail channels is improving accessibility in remote areas, and e-commerce platforms are gradually enabling first-time buyers to purchase instruments conveniently, contributing to steady regional growth.

Middle East & Africa

This region represents approximately 7% of the global market, with growth supported by cultural initiatives, educational programs, and niche professional demand. African countries, home to strong local musical traditions, are increasing harmonica adoption in music schools and community-based arts programs. The Middle East, led by the UAE and Saudi Arabia, is seeing growth due to high-income populations and interest in premium musical instruments. E-commerce expansion and localized marketing campaigns targeting hobbyists and professionals are further contributing to market growth across these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Diatonic Harmonicas Market

- Hohner

- Suzuki Musical Instruments

- Seydel

- Lee Oskar Harmonicas

- Tombo (Japan)

- Easttop Musical Instruments

- Kongsheng

- Huang Harmonicas

- Swan Harmonicas

- DaBell

- Bushman Harmonicas

- Fender (Harmonica Division)

- Golden Cup

- Chongqing Harmonica Works

- Hammond (Suzuki Series)