Designer Sneakers Market Size

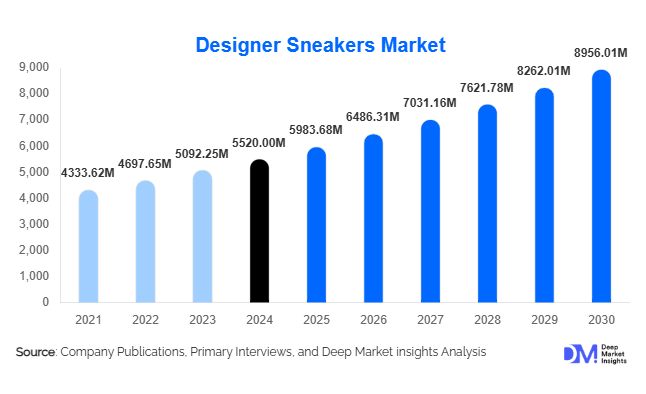

According to Deep Market Insights, the global designer sneakers market size was valued at USD 5,520.00 million in 2024 and is projected to grow from USD 5,983.68 million in 2025 to reach USD 8,956.01 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer affinity for luxury fashion, increasing collaborations between designers and sneaker brands, the influence of streetwear culture, and the growing demand for limited-edition and sustainable sneakers among affluent consumers globally.

Key Market Insights

- Luxury and limited-edition designer sneakers are gaining momentum, driven by exclusivity, celebrity endorsements, and collector culture, enhancing brand value and secondary market activity.

- Casual and lifestyle sneakers dominate daily wear preferences, blending style and comfort for millennial and Gen Z consumers, especially in North America and Europe.

- Asia-Pacific is emerging as the fastest-growing region, led by rising middle-class incomes, urbanization, and increasing brand awareness in countries such as China and India.

- Technological adoption in e-commerce, AR try-ons, and personalized online shopping is reshaping consumer engagement and driving online sales growth.

- Sustainable and eco-friendly sneakers are becoming a key differentiator, with consumers seeking products made from recycled and bio-based materials.

What are the latest trends in the designer sneakers market?

Rise of Limited-Edition and Collaboration Models

Designer sneakers increasingly rely on limited-edition releases and brand collaborations to drive exclusivity and hype. Partnerships between iconic fashion houses and sports brands, or celebrity endorsements, create high resale values and attract collector communities. Digital launches, pre-order campaigns, and NFT-linked sneaker drops are enhancing consumer engagement, particularly among tech-savvy younger audiences. These trends not only increase profitability per unit but also strengthen brand loyalty and social media visibility.

Digital and E-Commerce Expansion

The shift toward online retail is accelerating, with direct-to-consumer models and e-commerce platforms becoming a primary sales channel. Augmented reality (AR) for virtual try-ons, AI-based personalization, and mobile apps for real-time product tracking are transforming the shopping experience. Brands are increasingly using digital platforms to collect consumer data, optimize inventory, and offer personalized recommendations, improving both operational efficiency and customer satisfaction. Social media marketing, influencer campaigns, and targeted digital ads are also playing a crucial role in driving online sales.

What are the key drivers in the designer sneakers market?

Rising Brand Consciousness and Luxury Affinity

Consumers are increasingly willing to pay premium prices for designer sneakers as a symbol of status and fashion statement. Affluent millennials and Gen Z consumers are drawn to luxury and limited-edition sneakers, driving growth in high-value segments. The demand for exclusive, stylish, and performance-oriented footwear has also encouraged brands to innovate in design, materials, and collaborations.

Growth of Streetwear and Lifestyle Culture

The fusion of streetwear with high fashion has expanded the appeal of designer sneakers across demographics. Sneakers are no longer just functional footwear but a core element of lifestyle fashion, worn in casual, professional, and social settings. Influencer-driven trends, social media exposure, and pop culture collaborations are reinforcing this demand, particularly in urban centers.

Technological Innovation and Personalization

Advanced manufacturing technologies, including 3D printing, performance-enhancing materials, and custom design options, are attracting a premium consumer base. Personalized sneakers, limited releases, and smart footwear integrations (such as fitness tracking) are providing new avenues for differentiation and value addition.

What are the restraints for the global market?

High Pricing and Accessibility

Designer sneakers are typically priced at a premium, limiting accessibility for price-sensitive consumers. The high cost of raw materials, brand positioning, and limited-edition scarcity often restricts market penetration, particularly in emerging economies.

Supply Chain and Counterfeit Risks

The market is challenged by counterfeit products and supply chain disruptions, which can damage brand reputation and revenue. Maintaining authenticity, quality control, and global logistics efficiency is critical, especially as e-commerce and cross-border sales expand.

What are the key opportunities in the designer sneakers industry?

Expansion into Emerging Markets

Rising middle-class income, urbanization, and exposure to global fashion trends in countries like India, China, and Southeast Asia offer substantial growth potential. Establishing local brand stores, region-specific collections, and leveraging e-commerce can unlock new consumer segments.

Integration of Technology and Sustainability

Brands can capitalize on wearable technology, smart insoles, and sustainable materials to differentiate products. Sneakers made from recycled fabrics or bio-leather not only cater to environmentally conscious consumers but also strengthen brand positioning as innovators in luxury footwear.

Limited Edition and Digital Launches

Exclusive releases and collaborations generate hype, attract collectors, and enhance resale values. Digital campaigns, NFT-linked releases, and gamified purchasing experiences are emerging as effective strategies to engage tech-savvy audiences and reinforce brand loyalty.

Product Type Insights

Luxury designer sneakers dominate the market, capturing nearly 40% of the 2024 market due to premium pricing, exclusivity, and high brand loyalty. Casual designer sneakers follow, driven by comfort and daily wearability, particularly in North America and Europe. Limited-edition collector sneakers are smaller in volume but command the highest margins due to scarcity, collaborations, and resale potential, highlighting the growing influence of sneaker culture on the market.

End-Use Insights

Fashion and lifestyle applications represent the largest end-use segment, reflecting the sneakers’ role as a status symbol and trend accessory. Sports and performance sneakers are steadily gaining traction due to collaborations with sports brands and celebrity endorsements. The collector/resale market is expanding rapidly, fueled by limited releases and social media-driven demand. Export-driven demand is particularly strong from North America and Europe to emerging APAC markets, contributing to global growth.

| By Product Type | By Material Type | By Price Range | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 35% of the global designer sneakers market in 2024, led by the U.S. Consumers prioritize lifestyle, luxury, and limited-edition releases. Social media, streetwear culture, and influencer marketing significantly influence purchasing decisions.

Europe

Europe contributes 30% of the global market, with the U.K., Germany, and France driving demand. Consumers are increasingly focusing on sustainable products and exclusive collaborations, and fashion hubs like Milan and Paris remain critical for brand visibility and high-end sales.

Asia-Pacific

APAC is the fastest-growing region, led by China, India, Japan, and South Korea. Rising disposable income, growing middle-class awareness, and e-commerce adoption are fueling designer sneaker consumption, particularly for mid-range and premium products.

Middle East & Africa

Luxury demand is strong in the UAE and Saudi Arabia, with high-income populations driving growth. Africa remains a smaller market but is emerging due to growing urbanization and brand exposure.

Latin America

Brazil and Argentina show growing interest in lifestyle and limited-edition sneakers. Outbound demand to North American and European e-commerce platforms is increasing, driven by affluent consumers seeking exclusive collections.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Designer Sneakers Market

- Nike

- Adidas

- Puma

- Reebok

- New Balance

- Converse

- Vans

- Balenciaga

- Gucci

- Prada

- Louis Vuitton

- Alexander McQueen

- Off-White

- Yeezy

- Givenchy

Recent Developments

- In 2025, Nike launched a new sustainable sneaker line using recycled materials, enhancing its premium eco-conscious product offerings.

- In early 2025, Adidas released a limited-edition collaboration with luxury fashion designer Balenciaga, creating high resale demand and global consumer buzz.

- In 2024, Gucci expanded its sneaker line to APAC markets, establishing flagship stores in China and Japan and boosting regional sales significantly.