Dental Tourism Market Size

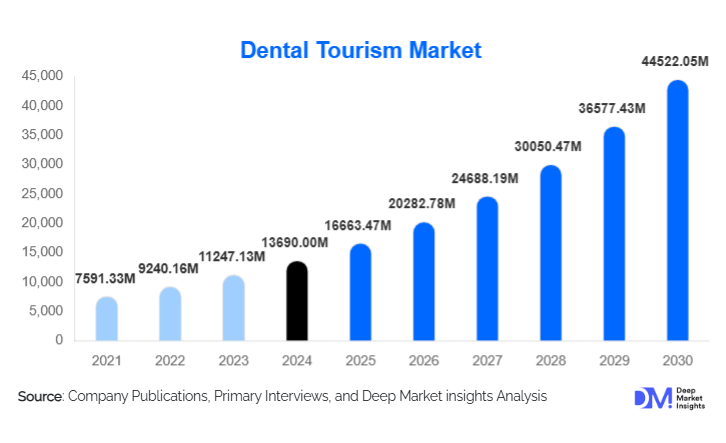

According to Deep Market Insights, the global dental tourism market size was valued at USD 13,690.00 million in 2024 and is projected to grow from USD 16,663.47 million in 2025 to reach USD 44,522.05 million by 2030, expanding at a CAGR of 21.72% during the forecast period (2025–2030). Growth in the dental tourism market is driven by the widening cost gap between dental care in developed and emerging countries, expanding adoption of advanced dental technologies, the rise of digitally enabled clinic chains, and growing confidence among patients in accredited international dental care centers.

Key Market Insights

- Dental implants dominate revenue generation across global dental tourism, accounting for the highest per-patient treatment value.

- Asia-Pacific remains the largest destination region for inbound dental tourists, led by India, Thailand, Malaysia, and South Korea.

- North America and Western Europe together generate nearly half of global outbound demand, driven by high domestic treatment costs.

- Digital dentistry adoption, including CAD/CAM, CBCT, and guided implant surgery, is rapidly strengthening treatment reliability and reducing chair time.

- Mexico, Turkey, and Hungary are fast-growing hubs, benefiting from proximity to large patient source markets and competitive pricing.

- Tele-dentistry, AI-driven diagnostics, and virtual consultations are transforming the pre-travel decision-making process for patients.

What are the latest trends in the dental tourism market?

Technology-Driven Dental Care Expansion

Dental tourism is experiencing a surge in technologically advanced treatment workflows. Clinics in destination hubs are increasingly investing in CBCT imaging, same-day CAD/CAM restorations, 3D-guided implantology, and digital smile design systems. These advancements shorten treatment timelines, improve accuracy, and heighten patient trust, critical factors for cross-border care. Enhanced digital case-planning allows clinics to provide precise pre-travel cost estimates, improving conversion rates among patients comparing international treatment packages. In addition, tele-dentistry platforms have become central to remote consultations, enabling follow-up appointments and long-term monitoring without requiring repeat travel.

Accreditation, Quality Assurance & Warranty Models

Accredited clinics offering structured, transparent quality controls are becoming the preferred choice for international patients. Facilities adhering to ISO standards or hospital groups with JCI accreditation increasingly publish success rates, sterilization compliance, and implant brand traceability. A growing trend is the introduction of warranty-backed treatment packages, covering implants, crowns, or veneers for multi-year periods. This feature directly addresses concerns about post-procedure complications and helps premium clinics differentiate themselves. The rise of bundled packages, including treatment, hotel stay, transportation, and follow-up coordination, further standardizes the patient experience.

What are the key drivers in the dental tourism market?

High Treatment Costs in Developed Countries

Rising dental care expenses in the U.S., Canada, the U.K., Germany, and Australia have made complex dental procedures financially prohibitive for many patients. Limited insurance coverage for implants, cosmetic dentistry, and full-mouth rehabilitations continues to push patients to seek more affordable care abroad. In many cases, total costs, including flights and accommodation, remain up to 70% lower than domestic prices, making cross-border treatment financially compelling for large patient segments.

Growing Interest in Cosmetic & Implant Dentistry

Cosmetic procedures and dental implants have become major value drivers in dental tourism. A combination of aging populations, lifestyle-driven cosmetic preferences, and improved treatment materials is spurring demand. Destination countries have developed strong reputations for advanced implantology and cosmetic dentistry, often backed by highly trained specialists and internationally recognized dental programs. With cosmetic dentistry increasingly trending on social platforms, digitally documented before-and-after transformations further accelerate global demand.

What are the restraints for the global market?

Continuity-of-Care Limitations

A major barrier for dental tourism is the challenge of follow-up care once the patient returns home. Many dental procedures, particularly implants, require multi-stage visits, monitoring, and occasional adjustments. Local dentists may hesitate to treat complications arising abroad, leaving patients uncertain about long-term support. This issue influences patient hesitancy and limits adoption among risk-averse consumers.

Regulatory & Legal Uncertainty

Cross-border dental treatment often lacks standardized international accreditation, consistent liability frameworks, or harmonized regulatory oversight. Variability in clinical quality, infection control protocols, and dentist qualifications can deter potential patients. Legal recourse for medical disputes is limited across borders, further acting as a constraint to rapid market expansion.

What are the key opportunities in the dental tourism industry?

Integrated End-to-End Travel & Treatment Platforms

A major opportunity lies in developing vertically integrated digital platforms that unify consultation, treatment booking, accommodation, transport, and post-treatment care. Clinics offering seamless, all-inclusive experiences significantly improve patient trust and service satisfaction. With digital health adoption rising, platforms that integrate tele-consultations, AI-assisted case planning, transparent pricing, and real-time scheduling can capture substantial market share.

Premiumization Through Digital Dentistry & Advanced Materials

Destination clinics can differentiate themselves by adopting high-end technologies such as 3D-guided implant placement, zirconia prosthetics, chairside milling, and fully digital treatment plans. These innovations expand profitability and attract affluent patients who prioritize precision, durability, and aesthetics. Investment in advanced labs and same-day restorations further enhances competitiveness in global dental tourism hubs.

Product Type Insights

Dental implants lead the global dental tourism market, followed by restorative dentistry services such as crowns, bridges, and veneers. Implant procedures account for the highest revenue share due to complex workflows and premium materials. Mid-range cosmetic dentistry, particularly veneers and smile design packages, continues to grow as digital imaging makes aesthetic outcomes more predictable. Orthodontic services, especially clear aligners with remote monitoring, are emerging as hybrid models combining destination treatment with at-home follow-ups. Preventive and general dentistry represent lower-value but high-volume segments, often bundled with cosmetic procedures.

Application Insights

The most common applications of dental tourism include implantology, cosmetic smile makeovers, full-mouth rehabilitation, and restorative dentistry. Implant dentistry dominates due to high global demand among aging populations and patients seeking durable tooth replacement solutions. Cosmetic dentistry is the fastest-growing category, influenced by social media trends and strong aesthetic preferences among millennials and Gen Z. Orthodontic applications, particularly aligner-based treatments, are rising due to their flexibility and compatibility with remote follow-up. Oral surgery procedures, such as extractions and bone grafts, are frequently paired with implants in treatment packages.

Distribution Channel Insights

Online platforms are the primary distribution channel for dental tourism, enabling patients to compare clinic ratings, treatment costs, digital portfolios, and accreditation information. Many clinics rely heavily on SEO-driven websites, social media marketing, and patient testimonial videos. Specialized medical travel agencies continue to support complex multi-stage travel arrangements, especially for high-value implant packages. Increasingly, clinics are adopting direct-to-consumer (D2C) digital models, offering dynamic pricing, virtual consultations, and secure payment gateways. Influencer-led marketing and user-generated content play influential roles in shaping patient decisions.

Traveler Type Insights

Solo travelers represent a large share of dental tourism due to the medical nature of the trip and the convenience of scheduling. Couples and family travelers are increasingly combining cosmetic or restorative treatments with vacation packages in destination countries such as Thailand, Turkey, and Mexico. Older adults, especially those aged 55 and above, drive demand for implants and full-mouth rehabilitation treatments due to higher tooth loss rates. Younger travelers often pursue cosmetic procedures like veneers and whitening, influenced by social media trends and lower costs abroad.

Age Group Insights

The 31–50 age group accounts for the largest share of dental tourism demand, combining disposable income with willingness to travel for cost-effective or cosmetic dental care. The 18–30 demographic drives cosmetic procedure demand, especially veneers, whitening, and aligners. Patients aged 51–70 represent the strongest demand for implantology due to age-related tooth loss and the high cost of implants at home. The 70+ consumer group remains smaller but increasingly active, seeking high-quality restorative care paired with accessible travel arrangements.

| By Service Type | By Procedure Complexity | By Patient Origin | By Destination Region | By Service Provider |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest outbound region for dental tourism, led by the United States, where high domestic dental costs encourage cross-border treatment. Mexico and Costa Rica attract substantial patient inflow from U.S. states near the southern border. Patients often travel for implants, crowns, and cosmetic treatments, taking advantage of both price savings and short travel times.

Europe

Europe is both a source and a destination for dental tourism. Western European patients frequently travel to Hungary, Poland, Turkey, and Spain for affordable implants and full-mouth rehabilitation. Eastern Europe remains one of the strongest dental tourism hubs globally due to advanced dental education, cost competitiveness, and short-haul accessibility from major European cities.

Asia-Pacific

Asia-Pacific is the largest global destination region for dental tourism, led by India, Thailand, Malaysia, and South Korea. APAC destinations offer advanced dental technologies, internationally accredited clinics, and highly competitive prices. Thailand and India are among the world’s fastest-growing dental hubs, drawing patients from the Middle East, Europe, Australia, and North America.

Latin America

Mexico, Colombia, and Brazil are emerging as major dental tourism hubs. Mexico dominates due to proximity to the U.S., while Colombia is gaining popularity for cosmetic dentistry. Brazil’s reputation for aesthetic expertise continues to attract inbound patients despite higher travel costs.

Middle East & Africa

The Middle East serves primarily as an outbound market, with affluent patients from the UAE, Saudi Arabia, and Qatar seeking dental treatments in APAC and Turkey. However, Dubai is becoming a rising regional dental hub driven by high private healthcare investment. Africa contributes modestly but steadily to regional patient flows, particularly intra-African travel to South Africa for specialized procedures.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Dental Tourism Market

- Apollo Hospitals Enterprise

- Fortis Healthcare

- Bumrungrad International Hospital

- Raffles Medical Group

- KPJ Healthcare

- Clove Dental

- Bangkok International Dental Hospital (BIDH)