Decorative Panels Market Size

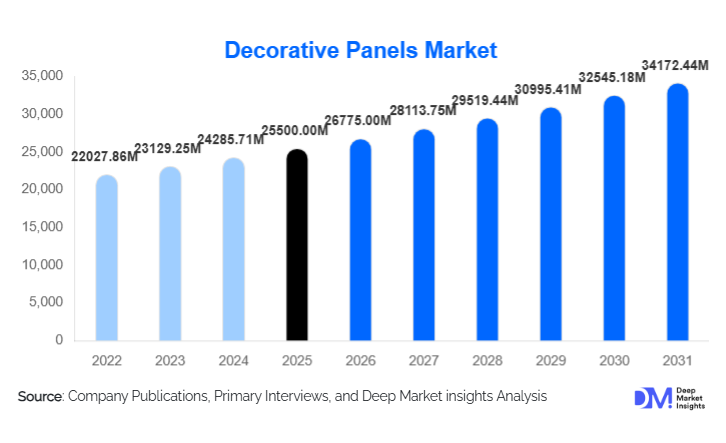

According to Deep Market Insights, the global decorative panels market size was valued at USD 25,500.00 million in 2024 and is projected to grow from USD 26,775.00 million in 2025 to reach USD 34,172.44 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The decorative panels market growth is driven by rising residential and commercial construction activity, increasing focus on interior aesthetics, and growing adoption of modular and sustainable building materials across developed and emerging economies.

Key Market Insights

- Wood-based decorative panels remain the dominant material segment, supported by their cost efficiency, versatility, and widespread use in residential interiors.

- Wall panel applications account for the largest share of demand, as panels increasingly replace traditional paint, wallpaper, and plaster finishes.

- Asia-Pacific leads global consumption, driven by rapid urbanization, housing development, and furniture manufacturing in China and India.

- Commercial construction is the fastest-growing end-use segment, fueled by office spaces, retail chains, hospitality projects, and institutional buildings.

- Sustainable and low-emission decorative panels are gaining strong traction due to green building regulations and ESG-focused construction practices.

- Technological innovation, including digital surface printing, 3D texturing, and fire-resistant composites, is reshaping product differentiation.

What are the latest trends in the decorative panels market?

Rising Demand for Sustainable and Eco-Friendly Panels

Sustainability has emerged as a defining trend in the decorative panels market. Manufacturers are increasingly introducing panels made from recycled wood fiber, bamboo, and wood-plastic composites (WPC) to comply with green building standards. Low-VOC adhesives, formaldehyde-free resins, and recyclable substrates are becoming standard offerings, particularly in Europe and North America. Architects and developers are prioritizing decorative panels that support LEED, BREEAM, and WELL certifications, positioning sustainability as both a compliance requirement and a competitive advantage.

Growth of Digitally Printed and 3D Decorative Panels

Advancements in digital printing and CNC machining technologies are enabling highly customized decorative panel designs with realistic textures, patterns, and finishes. Digitally printed laminates allow manufacturers to replicate natural materials such as stone, marble, and wood grain at lower costs and with consistent quality. Three-dimensional wall panels are gaining popularity in premium residential and commercial interiors, offering enhanced visual depth and acoustic performance. This trend is particularly strong in hospitality, retail, and corporate office spaces.

What are the key drivers in the decorative panels market?

Expansion of Residential and Commercial Construction

Rapid urbanization, population growth, and rising disposable incomes are driving global construction activity, directly boosting demand for decorative panels. Residential housing projects, renovation activities, and interior refurbishment are key demand generators, accounting for nearly 40% of global consumption. In the commercial sector, office buildings, shopping malls, hotels, and healthcare facilities increasingly prefer decorative panels for their ease of installation, durability, and aesthetic appeal.

Shift Toward Modular and Prefabricated Interiors

The growing adoption of modular construction and prefabricated interior solutions is a major growth driver for decorative panels. Panels are well-suited for dry construction techniques, reducing installation time, labor costs, and material wastage. This trend is particularly evident in office fit-outs, retail chains, and hospitality projects, where standardized design and fast project execution are critical.

Innovation in Materials and Functional Performance

Continuous innovation in panel materials has expanded their application scope. Fire-rated mineral panels, moisture-resistant PVC panels, and acoustic decorative panels are increasingly used in institutional, healthcare, and educational buildings. These functional enhancements improve safety, comfort, and regulatory compliance, further accelerating market adoption.

What are the restraints for the global market?

Raw Material Price Volatility

The decorative panels market is sensitive to fluctuations in raw material prices, including wood fiber, resins, aluminum, and polymers. Price volatility can impact manufacturing costs, margins, and long-term supply contracts. Smaller manufacturers are particularly vulnerable, as they have limited ability to absorb cost increases or pass them on to customers.

Regulatory and Fire Safety Compliance Challenges

Stringent regulations related to fire resistance, emissions, and indoor air quality pose challenges for market participants. Compliance with varying regional standards increases product development costs and extends approval timelines, particularly for new entrants and innovative panel solutions.

What are the key opportunities in the decorative panels industry?

High-Growth Demand in Emerging Economies

Emerging markets in Asia-Pacific, the Middle East, and Africa present significant growth opportunities due to large-scale housing projects, smart city initiatives, and commercial infrastructure development. Countries such as India, Indonesia, Vietnam, Saudi Arabia, and the UAE are witnessing strong demand for cost-effective yet visually appealing interior materials, creating opportunities for both global and regional manufacturers.

Integration of Technology and Customization

Technology-driven customization offers strong growth potential. Manufacturers that leverage digital design tools, mass customization, and rapid prototyping can cater to architects and interior designers seeking differentiated solutions. Integration of acoustic, antimicrobial, and fire-retardant properties further opens opportunities in healthcare, education, and corporate environments.

Material Type Insights

Wood-based decorative panels dominate the market, accounting for approximately 42% of global revenue in 2024. MDF, plywood, and particleboard panels are widely used due to their affordability, machinability, and compatibility with various surface finishes. Plastic-based panels, including PVC and acrylic, are gaining traction in moisture-prone areas such as kitchens and bathrooms. Mineral-based panels, such as gypsum and cement fiber boards, are increasingly adopted for fire-rated and commercial applications, while metal and glass panels cater to premium architectural and facade applications.

Application Insights

Wall panels represent the largest application segment, accounting for nearly 45% of global demand, driven by their extensive use in residential interiors, offices, hospitality, and retail spaces. Ceiling panels are widely used in commercial and institutional buildings for acoustic and aesthetic purposes. Partition panels are gaining popularity in flexible office layouts, while facade and exterior cladding panels are increasingly adopted in modern architectural designs. Furniture and cabinet panels remain a steady demand segment, closely tied to furniture manufacturing output.

Distribution Channel Insights

Direct sales dominate great project-based demand, particularly for commercial and institutional construction projects. Building material retailers play a critical role in residential and small contractor purchases, offering standardized decorative panel solutions. Online and digital marketplaces are an emerging channel, enabling manufacturers to reach architects, designers, and small builders with improved product visibility and faster ordering processes.

End-Use Insights

Residential construction is the largest end-use segment, driven by housing development and interior renovation trends. Commercial buildings are the fastest-growing end-use segment, expanding at over 8% CAGR, supported by office spaces, retail outlets, hotels, and healthcare facilities. Industrial and institutional buildings contribute to steady demand, particularly for functional and fire-rated decorative panels.

| By Material Type | By Surface Finish | By Application Area | By End-Use Sector | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 38% of the global decorative panels market, led by China, India, Japan, and South Korea. China alone represents nearly 18% of global demand, supported by large-scale residential construction and furniture manufacturing. India is the fastest-growing major market, with growth exceeding 9% CAGR, driven by urban housing, commercial development, and government-led infrastructure programs.

North America

North America holds around 24% market share, with the United States accounting for the majority of regional demand. Growth is driven by renovation spending, commercial interior upgrades, and increasing adoption of sustainable and fire-rated decorative panels. Canada contributes a steady demand from residential and institutional construction.

Europe

Europe represents approximately 22% of global demand, led by Germany, France, Italy, and the UK. The region emphasizes premium, eco-certified, and design-oriented panels, supported by strict environmental regulations and high renovation activity.

Latin America

Latin America accounts for nearly 7% of the market, with Brazil and Mexico as key contributors. Demand is driven by residential construction and a gradual recovery in commercial building activity.

Middle East & Africa

The Middle East & Africa region holds about 9% market share, supported by hospitality, commercial, and infrastructure projects in Saudi Arabia, the UAE, and South Africa. Luxury hotels and mixed-use developments are key demand drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Decorative Panels Market

- Kronospan

- Arauco

- Egger Group

- Swiss Krono Group

- Greenlam Industries

- Duratex

- West Fraser

- Pfleiderer Group

- Panolam Industries

- Sonae Arauco

- FunderMax

- Century Plyboards

- Unilin Group

- Stylam Industries

- Roseburg Forest Products