Data Center Logical Security Market Size

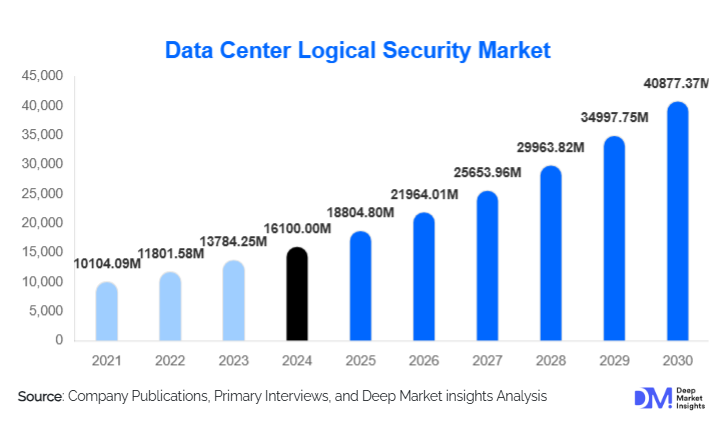

According to Deep Market Insights, the global data center logical security market size was valued at USD 16,100.00 million in 2024 and is projected to grow from USD 18,804.80 million in 2025 to reach USD 40,877.37 million by 2030, expanding at a CAGR of 16.8% during the forecast period (2025–2030). The growth of the data center logical security market is primarily driven by the rapid expansion of hyperscale and edge data centers, rising cyber threats, increasing regulatory and compliance requirements, and growing adoption of zero-trust and AI/ML-driven security technologies.

Key Market Insights

- Solutions remain the primary revenue generator, with software and appliances accounting for approximately 68% of the market in 2024 due to foundational needs for IAM, encryption, and threat detection.

- North America dominates the market, holding around 37% share in 2024, driven by mature data center infrastructure, regulatory compliance, and early adoption of zero-trust architectures.

- APAC is the fastest-growing region, led by China and India, as digital transformation and hyperscale cloud investments accelerate logical security demand.

- BFSI is the leading end-use industry, accounting for 32% of market revenue, due to high regulatory pressure and critical data protection needs.

- Cloud and hybrid deployments are gaining traction, particularly for edge and modular data centers, though on-premises solutions still dominate with a 65% share.

- Technological adoption, including AI/ML for threat detection, micro-segmentation, and automation, is reshaping logical security solutions and services.

What are the latest trends in the Data Center Logical Security Market?

Zero-Trust and Micro-Segmentation Adoption

Enterprises and cloud operators are increasingly implementing zero-trust architectures and micro-segmentation to secure sensitive workloads. These approaches reduce lateral movement risks and ensure identity-based access control across hybrid and multi-cloud environments. Vendors are offering solutions that integrate identity management, network segmentation, and automated threat detection into a unified platform. The shift toward zero-trust has accelerated due to regulatory mandates, increased remote access, and the rise of edge computing.

AI/ML-Driven Security Solutions

Artificial intelligence and machine learning are being embedded into logical security solutions for predictive threat detection, automated incident response, and anomaly detection. These technologies help data centers proactively detect suspicious activity, reduce false positives, and improve operational efficiency. Managed security service providers (MSSPs) are leveraging AI/ML to offer continuous monitoring and intelligence-driven protection for clients. The adoption of AI/ML in logical security is expected to expand rapidly over the next five years, particularly in large enterprises and hyperscale data centers.

What are the key drivers in the Data Center Logical Security Market?

Rapid Expansion of Data Center Infrastructure

Hyperscale, colocation, and edge data centers are proliferating globally, increasing the exposure of digital workloads to cyber threats. As organizations scale their computing infrastructure, they require advanced logical security solutions, including access management, encryption, monitoring, and automated threat response. This structural expansion is a primary growth driver for the market.

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks targeting data centers, including ransomware, insider threats, and supply chain attacks, drive higher investment in logical security. Organizations are focusing on proactive detection, identity protection, and threat analytics to safeguard critical data, which directly fuels market growth.

Regulatory Compliance and Zero-Trust Initiatives

Data privacy and regulatory frameworks like GDPR, CCPA, and local data localization laws are compelling organizations to adopt advanced logical security solutions. Additionally, the industry-wide shift toward zero-trust models ensures that every user and device is authenticated and monitored continuously, further boosting the adoption of logical security technologies.

What are the restraints for the global market?

Skill Gap and Deployment Complexity

Implementing and managing advanced logical security across hybrid and multi-cloud environments requires specialized expertise. The shortage of skilled personnel and the complexity of integrating legacy systems with new security technologies limit adoption and can slow market growth.

High Cost of Retrofitting Legacy Systems

Many existing data centers are built on legacy architectures. Upgrading to next-generation logical security, including zero-trust and micro-segmentation, can involve significant capital investment and operational disruption, restraining widespread adoption, particularly in SMEs.

What are the key opportunities in the Data Center Logical Security Market?

AI/ML Integration for Predictive Security

Integrating AI and ML into logical security platforms presents a major opportunity for both existing vendors and new entrants. Predictive analytics, automated threat remediation, and anomaly detection can help organizations mitigate risks proactively, positioning AI-enabled solutions as a high-value differentiator in the market.

Regulatory and Compliance-Driven Demand

Emerging markets with evolving data sovereignty, localization, and cybersecurity regulations create opportunities for region-specific solutions. Vendors offering compliance-aligned logical security, such as localized encryption, key management, and identity federation, can capitalize on these regulatory tailwinds.

Edge and Modular Data Center Security

The rise of edge computing and modular data centers increases the need for distributed logical security services. Solutions and managed services that secure geographically dispersed nodes present a growth opportunity, allowing vendors to deliver scalable, as-a-service models for emerging edge deployments.

Component Insights

The Solutions segment dominates the global data center logical security market, representing approximately 68% of total revenue in 2024. This segment includes key technologies such as Identity and Access Management (IAM), encryption solutions, Security Information and Event Management (SIEM), Intrusion Detection and Prevention Systems (IDPS), and zero-trust appliances. Services, including managed security services, consulting, and implementation support, are growing rapidly, particularly in regions with high data center expansion, such as APAC. The demand for integrated, end-to-end security platforms continues to drive investments in software solutions over standalone hardware appliances.

Security Type Insights

Access control and authentication are the leading security types, accounting for approximately 28% of the total market in 2024. Identity management, multi-factor authentication, and access provisioning are critical for regulatory compliance and securing hybrid workloads. Adoption is particularly strong in enterprise and hyperscale data centers, driven by the need for zero-trust enforcement and protection against insider threats.

Deployment Insights

On-premises deployments hold the majority share of 65% in 2024, reflecting the presence of legacy infrastructures in large enterprises. However, cloud and hybrid deployments are expanding rapidly, especially in edge and colocation data centers. These deployments offer scalability, flexibility, and operational efficiency, while reducing upfront capital expenditure and supporting distributed security models.

End-Use Industry Insights

The BFSI sector is the largest end-use vertical, capturing approximately 32% share of the market in 2024, driven by stringent regulatory compliance and the critical need to secure sensitive financial data. Other rapidly growing industries include government & defense, healthcare, and IT & telecom, fueled by digital transformation initiatives and cloud adoption. Additional sectors such as energy, manufacturing, and retail are increasingly implementing logical security solutions to protect distributed systems and critical workloads.

| By Component Type | By Security Type | By Deployment | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for a 37% share in 2024. The U.S. and Canada lead demand due to mature data center ecosystems, strong regulatory compliance mandates, and early adoption of zero-trust and AI-based security solutions. Hyperscale cloud providers and financial institutions are key drivers of market growth.

Europe

Europe holds approximately 23% of the global market in 2024, led by the UK, Germany, and France. Adoption is fueled by regulatory frameworks such as GDPR, national cloud policies, and a strong emphasis on cybersecurity in government and BFSI sectors. Zero-trust initiatives are rapidly accelerating, particularly within large enterprise data centers.

Asia-Pacific

APAC is the fastest-growing region, with China and India leading investments in hyperscale, colocation, and edge data centers. Expanding digital infrastructure, compliance mandates, and increased cloud adoption are driving rapid uptake of logical security solutions across enterprises and government sectors.

Latin America

LATAM accounts for approximately 7% of the global market, with Brazil and Mexico showing strong growth in cloud and colocation infrastructure. BFSI and telecom industries are the primary adopters of logical security solutions in this region.

Middle East & Africa

MEA is an emerging market, with demand increasing in countries such as the UAE, Saudi Arabia, and South Africa. Investments in smart cities, digital infrastructure, and government-driven cybersecurity initiatives are key factors supporting the adoption of data center logical security solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Data Center Logical Security Market

- Cisco Systems, Inc.

- IBM Corporation

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Microsoft Corporation

- Thales Group

- Broadcom Inc.

- Okta, Inc.

- Splunk Inc.

- Trend Micro Incorporated

- Sophos Group plc

- CyberArk Software Ltd.

- Varonis Systems, Inc.

- FireEye, Inc.

Recent Developments

- In May 2025, Cisco Systems expanded its AI-driven zero-trust portfolio for hyperscale data centers, enhancing access control and threat detection capabilities.

- In April 2025, IBM launched a managed security service for hybrid data centers in Europe, combining AI-based threat analytics with compliance reporting for BFSI clients.

- In February 2025, Palo Alto Networks introduced micro-segmentation solutions for edge and modular data centers, addressing distributed workload security challenges.