Cutting Board Market Size

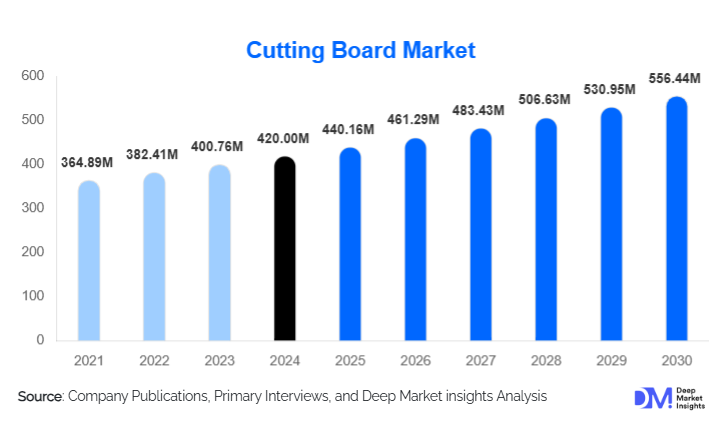

According to Deep Market Insights, the global cutting board market size was valued at USD 420.00 million in 2024 and is projected to grow from USD 440.16 million in 2025 to reach USD 556.44 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). Market growth is driven by rising food safety awareness, increasing penetration of commercial foodservice establishments, and growing consumer preference for premium, durable, and sustainable kitchenware products across both residential and professional kitchens.

Key Market Insights

- Plastic cutting boards dominate global demand due to cost efficiency, hygiene compliance, and widespread adoption in commercial kitchens.

- Wooden and premium cutting boards are gaining traction in residential segments, driven by aesthetic appeal and durability.

- Asia-Pacific holds the largest market share, supported by population growth, urbanization, and expanding foodservice infrastructure.

- Commercial foodservice is the fastest-growing end-use segment, driven by restaurant expansion, cloud kitchens, and institutional catering.

- Online retail channels are growing rapidly, supported by e-commerce penetration and direct-to-consumer brand strategies.

- Sustainability and antimicrobial innovations are reshaping product development and premium pricing strategies.

What are the latest trends in the cutting board market?

Sustainable and Eco-Friendly Materials Gaining Momentum

Manufacturers are increasingly focusing on FSC-certified wood, bamboo composites, and recycled polymer materials to align with sustainability regulations and consumer preferences. Eco-friendly cutting boards are gaining strong traction in Europe and North America, where environmental awareness and regulatory scrutiny on plastics are high. Brands offering traceable sourcing, biodegradable materials, and recyclable packaging are commanding premium pricing and stronger brand loyalty.

Premiumization and Design-Oriented Kitchenware

The market is witnessing strong premiumization, particularly in residential segments. Consumers are investing in aesthetically pleasing end-grain and designer cutting boards that double as serving platters. Features such as knife-friendly surfaces, non-slip bases, juice grooves, and antimicrobial coatings are increasingly becoming standard in mid-range and premium products, supporting higher average selling prices.

What are the key drivers in the cutting board market?

Rising Focus on Food Safety and Hygiene

Strict food safety regulations across commercial kitchens and food processing facilities are a key growth driver. Color-coded plastic and composite cutting boards are widely adopted to prevent cross-contamination, particularly in meat, poultry, and ready-to-eat food preparation environments. Compliance with HACCP and FDA standards continues to sustain replacement-driven demand.

Expansion of Foodservice and Food Processing Industries

The global recovery and expansion of restaurants, hotels, catering services, and institutional kitchens have resulted in higher capital expenditure on kitchen equipment. Growth in packaged and ready-to-eat food production further supports industrial demand for durable and regulation-compliant cutting boards.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of hardwood lumber and petroleum-based resins impact manufacturing costs and profit margins. Manufacturers with limited sourcing diversification face margin pressure, particularly in premium wooden and composite cutting boards.

Market Commoditization in Economy Segments

Low-priced plastic cutting boards face intense competition from unorganized and regional players, especially in Asia and Latin America. This limits pricing power and differentiation, making volume growth critical for profitability in the economy segment.

What are the key opportunities in the cutting board industry?

Commercial and Institutional Kitchen Expansion

Rapid growth in quick-service restaurants, cloud kitchens, and institutional catering across emerging economies presents a strong volume-driven opportunity. Suppliers offering customized, regulation-compliant cutting boards for bulk procurement are well-positioned to benefit from this trend.

Technological and Antimicrobial Product Innovations

Advanced cutting boards featuring antimicrobial coatings, modular designs, and enhanced durability are gaining adoption in professional kitchens. Emerging applications such as RFID-enabled boards for hygiene tracking in large food processing facilities present high-margin opportunities.

Material Type Insights

Plastic cutting boards account for approximately 38% of the global market in 2024. Their dominance is primarily driven by affordability, lightweight design, and high hygiene compliance, making them ideal for both residential households and commercial kitchens where cross-contamination prevention is critical. Wooden cutting boards follow closely, representing a significant share due to rising demand for premium residential kitchenware, aesthetic appeal, and growing consumer preference for sustainable and eco-friendly materials. Composite and engineered boards are steadily gaining traction as they offer a balance of durability, knife-friendliness, and antimicrobial properties, appealing to both commercial and high-end residential users. Glass and stone cutting boards remain niche due to concerns over knife damage and weight, though they are occasionally favored for decorative purposes or as serving boards in premium households. Overall, material innovation, sustainability initiatives, and hygiene compliance continue to drive product development across all material categories, positioning the plastic and wooden segments as the global leaders.

End-Use Insights

Residential households represent around 54% of global demand, benefiting from frequent replacement cycles, growing multi-board usage, and increasing interest in premium and aesthetically appealing boards. The segment’s growth is further fueled by the rise of home cooking trends, influenced by social media, cooking shows, and an emphasis on safe food preparation. Commercial foodservice is the fastest-growing end-use segment, expanding at over 6% CAGR. This growth is primarily driven by the rapid expansion of QSRs, restaurants, hotels, and institutional kitchens across emerging economies, coupled with stringent food safety regulations that mandate the use of multiple, color-coded cutting boards to prevent cross-contamination. Industrial food processing, while smaller in volume, represents a high-value segment due to frequent replacement needs and compliance requirements, particularly in meat, poultry, and ready-to-eat food production facilities. The adoption of durable, regulation-compliant cutting boards is key to minimizing operational risk, which continues to drive demand in this segment.

Distribution Channel Insights

Offline retail dominates the global cutting board market with nearly 61% market share, driven by supermarkets, hypermarkets, and specialty kitchenware stores offering immediate availability and product variety. Brand visibility, in-store promotions, and the tactile experience of testing materials contribute to strong offline performance. Online channels now account for nearly 28% of global sales and are expanding rapidly, driven by e-commerce platforms, direct-to-consumer (D2C) brand websites, and international shipping capabilities. Online retail is particularly effective for premium and niche products, allowing consumers to compare materials, prices, and sustainability certifications. B2B and institutional sales remain critical for commercial and industrial buyers, who often procure cutting boards in bulk for restaurants, hotels, and food processing operations, further supporting channel diversity.

| By Material Type | By Product Construction | By Price Tier | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 29% of global demand, led by the United States. Market growth is supported by strict food safety and hygiene standards, high disposable income, and widespread adoption of both plastic and premium wooden cutting boards in households and commercial kitchens. Rising awareness of antimicrobial properties and kitchen hygiene, coupled with a preference for durable, premium products in urban areas, is driving the replacement cycle. The commercial foodservice sector, particularly restaurants, hotels, and catering chains, is expanding, creating consistent demand for color-coded and regulation-compliant cutting boards.

Europe

Europe holds around 26% of the market share, with Germany, France, and the U.K. leading consumption. Sustainability and eco-conscious trends are primary growth drivers, encouraging the use of FSC-certified wooden and composite cutting boards. Stringent food safety regulations in commercial kitchens further boost demand for plastic and color-coded boards. Urbanization, rising disposable income, and a preference for premium kitchenware contribute to steady residential growth, while the hospitality sector’s adoption of standardized cutting boards drives commercial demand.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, representing nearly 31% of the global market and expanding at over 6.5% CAGR. Key drivers include rapid urbanization, population growth, rising disposable incomes, and an expanding middle-class demographic, which fuels both premium residential demand and commercial adoption. The region’s foodservice and institutional sectors are growing quickly, with new restaurants, cloud kitchens, and institutional cafeterias demanding bulk purchases of durable, regulation-compliant cutting boards. Government-led initiatives to improve food safety standards in countries such as China, India, and Japan also encourage the adoption of high-quality materials and hygienic designs, accelerating market growth further.

Latin America

Latin America accounts for approximately 8% of global demand, led by Brazil and Mexico. Growth is driven by increasing restaurant penetration, rising urbanization, and expanding middle-class consumer bases, which elevate demand for both economy and mid-range cutting boards. Commercial foodservice expansion, particularly in hotels and QSRs, supports bulk procurement of color-coded boards, while consumer awareness of kitchen hygiene and home cooking trends is boosting residential segment adoption.

Middle East & Africa

The Middle East & Africa region represents around 6% of the market. GCC countries, including the UAE, Saudi Arabia, and Qatar, drive growth due to strong disposable incomes, rapid hospitality expansion, and a booming tourism sector. Investments in commercial kitchens for hotels, resorts, and catering facilities support sustained demand. Additionally, in Africa, rising urbanization and increasing availability of affordable and mid-range kitchenware products, combined with growth in institutional foodservice, are stimulating cutting board adoption in both residential and commercial segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cutting Board Market

- John Boos & Co.

- OXO International

- Joseph Joseph Ltd.

- Cuisinart

- Rubbermaid Commercial Products

- Epicurean

- Dexas International

- Winco

- Totally Bamboo

- Victorinox