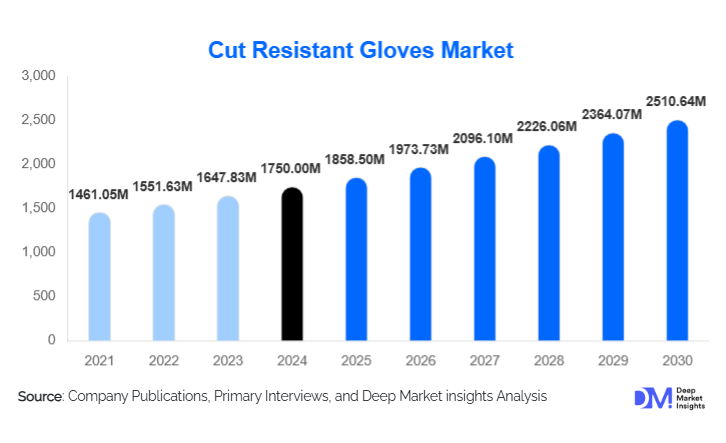

Cut Resistant Gloves Market Size

According to Deep Market Insights, the global cut-resistant gloves market size was valued at USD 1,750.00 million in 2024 and is projected to grow from USD 1,858.50 million in 2025 to reach USD 2,510.64 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). Market growth is driven by increasing enforcement of workplace safety regulations, rising industrial automation, and expanding demand from manufacturing, logistics, and food processing industries. The market is transitioning from basic hand protection toward performance-driven, certified, and ergonomically advanced gloves, supporting sustained global adoption.

Key Market Insights

- HPPE-based cut-resistant gloves dominate globally due to superior cut resistance, lightweight properties, and cost-performance balance.

- Medium cut resistance gloves (ANSI A3–A4) represent the largest protection category, widely used across manufacturing and logistics.

- Asia-Pacific leads global demand, supported by large-scale manufacturing activity and export-oriented industries.

- Logistics and warehousing are the fastest-growing end-use segments, driven by e-commerce expansion and automated material handling.

- Nitrile-coated gloves are the most widely adopted coating type due to durability and oil resistance.

- Premium and performance-certified gloves are gaining share as employers prioritize injury prevention and long-term cost savings.

What are the latest trends in the cut resistant gloves market?

Shift Toward Lightweight High-Performance Materials

Manufacturers are increasingly replacing traditional steel-wire and heavy aramid gloves with lightweight HPPE and composite yarn blends. These materials deliver high cut resistance while improving dexterity, breathability, and worker comfort. This trend is especially pronounced in electronics assembly, automotive manufacturing, and precision metalworking, where tactile sensitivity is critical. Advanced knitting technologies and seamless glove designs are further enhancing wearability, accelerating adoption across both heavy-duty and light-industrial applications.

Rising Adoption of Ergonomic and Task-Specific Gloves

End users are moving away from one-size-fits-all safety gloves toward task-specific designs optimized for grip, abrasion resistance, and cut protection. Dual-layer coatings, foam nitrile finishes, and reinforced fingertips are increasingly common. Customization for specific tasks such as glass handling, food slicing, or battery assembly is becoming a key differentiator, particularly in premium industrial contracts.

What are the key drivers in the cut resistant gloves market?

Strengthening Workplace Safety Regulations

Government agencies across North America, Europe, and the Asia-Pacific are enforcing stricter occupational safety standards. Mandatory compliance with ANSI and EN cut protection levels has made cut-resistant gloves a compulsory procurement item across multiple industries. Rising penalties for workplace injuries and insurance liabilities are further reinforcing employer investment in certified PPE.

Growth of Industrial Automation and Mechanized Handling

While automation improves productivity, it has increased worker exposure to sharp edges, tooling interfaces, and machine components. This has resulted in sustained demand for gloves offering both protection and dexterity. Automated manufacturing lines, CNC machining, and robotic-assisted operations are key demand drivers globally.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

High-performance cut-resistant gloves carry a cost premium compared to conventional cotton or leather gloves. In developing regions, budget constraints often limit adoption to low or medium cut protection levels, slowing penetration of advanced products.

Raw Material Price Volatility

Fluctuations in prices of HPPE fibers, aramid yarns, and specialty coatings impact manufacturing costs and margins. Supply chain disruptions and petrochemical feedstock volatility remain key challenges for pricing stability.

What are the key opportunities in the cut resistant gloves industry?

Expansion into Logistics, E-commerce, and Warehousing

The rapid growth of e-commerce fulfillment centers has significantly increased demand for hand protection. Workers frequently handle sharp packaging materials, metal racks, and cutting tools. Medium cut-resistant gloves optimized for comfort and long wear times present a major growth opportunity for manufacturers.

Smart PPE and Technology Integration

Emerging technologies such as RFID-enabled gloves for inventory tracking, usage monitoring, and compliance audits offer differentiation in premium industrial segments. Companies investing in smart PPE solutions are well-positioned to secure long-term contracts with large industrial clients.

Material Type Insights

HPPE-based gloves account for approximately 38% of the global market in 2024, making them the leading material segment. Their high strength-to-weight ratio, comfort, and compliance with multiple cut standards drive widespread adoption. Para-aramid and composite yarn blends follow, particularly in high-risk metal fabrication and glass handling applications. Steel wire reinforced gloves retain niche demand in extreme cut environments but are gradually losing share due to reduced dexterity.

Cut Protection Level Insights

Medium cut resistance gloves (ANSI A3–A4) represent the largest segment, contributing nearly 42% of total market revenue. These gloves offer sufficient protection for most industrial tasks while maintaining flexibility and affordability. High and very high cut resistance gloves (ANSI A5–A9) are growing steadily, driven by metalworking, mining, and oil & gas industries.

End-Use Industry Insights

Manufacturing and metal fabrication dominate demand, accounting for approximately 31% of the global market in 2024. Automotive production, machinery manufacturing, and fabricated metals generate consistent replacement demand. Logistics and warehousing are the fastest-growing end-use segments, expanding at over 10% CAGR, while food processing continues to gain traction due to strict hygiene and safety requirements.

Distribution Channel Insights

Industrial safety distributors hold the largest share at nearly 46%, supported by long-term supply contracts and bundled PPE solutions. Direct sales to large manufacturers and e-commerce B2B platforms are growing rapidly as buyers seek pricing transparency and streamlined procurement.

| By Material Type | By Cut Protection Level | By Coating Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the market with approximately 38% share in 2024, supported by large-scale industrial activity and export-oriented manufacturing. China alone accounts for nearly 18% of global demand, driven by its dominance in manufacturing, chemicals, and heavy industries. India is the fastest-growing market in the region, benefiting from rapid infrastructure development, expanding construction activity, and increased enforcement of industrial safety standards across factories and public projects.

North America

North America holds around 27% of the global market, led by the United States. Strict OSHA regulations, high workplace safety awareness, and mandatory PPE compliance across manufacturing, healthcare, and construction sectors sustain demand. The U.S. alone contributes over 21% of global revenue, supported by strong demand for high-quality, certified gloves and continued replacement cycles in industrial and medical applications.

Europe

Europe represents approximately 24% of global demand, with Germany, France, and the U.K. as key contributors. Strong labor protection laws, well-established industrial safety frameworks, and widespread adoption of certified PPE drive stable consumption. Demand is particularly strong in automotive manufacturing, pharmaceuticals, food processing, and chemical industries.

Latin America

Latin America accounts for a smaller but steadily growing share of the market, led by Brazil and Mexico. Expanding industrialization, rising construction activity, and increasing awareness of worker safety standards are supporting demand growth. Manufacturing, mining, and infrastructure projects remain the primary end-use sectors across the region.

Middle East & Africa

Growth in the Middle East & Africa is supported by ongoing oil & gas developments, mining operations, and large-scale infrastructure investments. Saudi Arabia and South Africa are emerging as key markets, driven by industrial diversification efforts, energy projects, and improving occupational safety regulations in high-risk work environments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Cut Resistant Gloves Industry

- Ansell Limited

- Honeywell International

- 3M Company

- MSA Safety

- Superior Glove Works

- Lakeland Industries

- SHOWA Group

- Uvex Group

- HexArmor

- MAPA Professional

- Delta Plus Group

- Towa Corporation

- PIP Global

- ATG (Intelligent Glove Solutions)

- Wells Lamont Industrial