Customized Travel Market Size

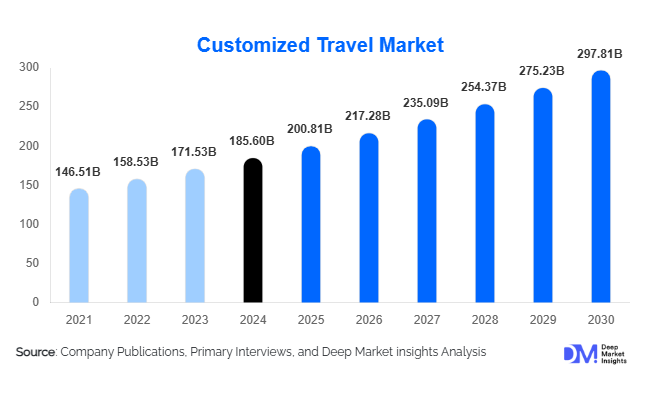

According to Deep Market Insights, the global customized travel market size was valued at USD 185.6 billion in 2024 and is projected to grow from USD 200.81 billion in 2025 to reach USD 297.81 billion by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). The customized travel market growth is driven by the rapid shift in consumer preferences toward personalized, experience-led travel, increasing digitalization of travel planning, and rising disposable incomes across both developed and emerging economies.

Key Market Insights

- Personalization has become a core expectation, with travelers prioritizing flexible itineraries, unique experiences, and tailored services over standardized tour packages.

- Online customized travel platforms are gaining dominance, supported by AI-powered itinerary planning, dynamic pricing, and real-time customization tools.

- Leisure travel remains the largest demand segment, accounting for over half of global customized travel bookings.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class populations, outbound tourism growth, and digital adoption.

- Luxury and premium customized travel segments are expanding rapidly, supported by high-net-worth travelers seeking exclusivity and experiential depth.

- Sustainability and experiential travel trends are reshaping itinerary design, supplier selection, and destination choices.

What are the latest trends in the customized travel market?

AI-Driven Personalization and Smart Itinerary Design

Artificial intelligence and data analytics are transforming the customized travel market by enabling hyper-personalized trip planning at scale. Travel companies are leveraging traveler data, preferences, and behavioral insights to create tailored itineraries in real time. AI-powered recommendation engines suggest destinations, activities, accommodations, and transport options aligned with individual traveler interests and budgets. This trend improves booking conversion rates, increases average trip value, and enhances customer satisfaction, particularly among millennial and Gen Z travelers who expect seamless digital experiences.

Experience-Based and Theme-Oriented Travel Growth

Customized travel is increasingly centered on experiences rather than destinations alone. Travelers are opting for theme-based itineraries such as wellness retreats, adventure travel, culinary tours, cultural immersion, slow travel, and eco-tourism. These experiential journeys often integrate local communities, unique accommodations, and off-the-beaten-path activities. This trend is expanding demand across both luxury and mid-range segments, allowing providers to differentiate offerings while commanding premium pricing for niche experiences.

What are the key drivers in the customized travel market?

Rising Demand for Personalized Travel Experiences

Modern travelers increasingly seek journeys that reflect their individual interests, travel pace, and lifestyle choices. Customized travel allows flexibility in itinerary design, accommodation selection, and activity planning, driving higher satisfaction and repeat bookings. This driver is particularly strong among leisure travelers, honeymooners, and senior travelers who prioritize comfort, authenticity, and convenience.

Digital Transformation of Travel Booking Ecosystems

The rapid adoption of digital platforms, mobile applications, and cloud-based CRM systems has significantly reduced the operational complexity of offering customized travel. Advanced booking engines, real-time supplier integrations, and automated itinerary management tools enable travel companies to scale personalization efficiently while improving margins and customer engagement.

Growth in Global Disposable Income and Premium Travel Spending

Rising disposable incomes, especially in Asia-Pacific and the Middle East, are fueling demand for customized international travel. Travelers are increasingly willing to spend on curated experiences, premium accommodations, and private services, supporting strong growth across mid-range and luxury customized travel segments.

What are the restraints for the global market?

Operational Complexity and Cost Pressures

Customized travel involves higher operational complexity compared to standardized packages. Designing personalized itineraries requires skilled manpower, strong supplier networks, and robust technology infrastructure. These factors can increase operating costs and limit scalability for smaller players, particularly in price-sensitive markets.

Geopolitical Uncertainty and Regulatory Challenges

Geopolitical tensions, visa restrictions, regulatory variability, and sudden changes in travel policies can disrupt customized travel demand. Since many customized trips involve multi-country itineraries, regulatory uncertainty increases risk exposure for both travelers and service providers.

What are the key opportunities in the customized travel industry?

Expansion in Emerging Outbound Travel Markets

Emerging economies such as India, China, Southeast Asia, and parts of Latin America present strong growth opportunities due to rising middle-class populations and increasing international travel aspirations. Customized travel providers that localize offerings and pricing strategies can capture significant untapped demand in these regions.

Integration of Sustainability and Responsible Travel

Travelers are increasingly prioritizing eco-friendly accommodations, low-impact transport, and community-based tourism. Customized travel providers can capitalize on this shift by embedding sustainability into itinerary design, partnering with responsible suppliers, and offering carbon-conscious travel options.

Customization Type Insights

Fully customized itineraries dominate the market, accounting for approximately 46% of global revenue in 2024, driven by demand from luxury travelers and long-haul international tourists. Semi-customized modular packages are gaining traction among mid-range travelers seeking flexibility at controlled costs. Experience-based and theme-oriented customization is the fastest-growing sub-segment, reflecting rising interest in wellness, adventure, and cultural travel.

Traveler Type Insights

Leisure travelers represent the largest share of the customized travel market, contributing nearly 52% of total demand in 2024. Corporate and business travelers form a significant segment, particularly for MICE and incentive travel. Luxury and honeymoon travelers generate the highest per-trip spending, while senior travelers drive demand for comfort-focused, slower-paced itineraries.

Booking Channel Insights

Online customized travel platforms account for approximately 41% of total bookings, driven by convenience, transparency, and digital engagement. Offline travel agencies remain influential in luxury and corporate travel segments where high-touch service is preferred. Direct supplier bookings are rising as hotels, airlines, and destination management companies enhance direct-to-consumer capabilities.

| By Traveler Type | By Customization Type | By Booking Channel | By Travel Purpose | By Destination Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the customized travel market at around 32% in 2024. The United States dominates regional demand due to high outbound travel volumes, strong digital adoption, and high per-trip spending. Customized leisure and luxury travel are particularly prominent.

Europe

Europe accounts for approximately 27% of the global market, led by Germany, the UK, France, and Italy. Strong intra-regional travel, cultural tourism, and sustainability-driven preferences support demand for customized travel solutions.

Asia-Pacific

Asia-Pacific represents about 26% of the market and is the fastest-growing region, with a CAGR exceeding 11%. China, India, Japan, and Southeast Asia are key growth engines due to rising incomes, outbound tourism, and digital booking adoption.

Latin America

Latin America contributes around 7% of global demand, led by Brazil and Mexico. Growth is driven by rising outbound travel among affluent consumers and increasing availability of customized international itineraries.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of the market. The UAE and Saudi Arabia drive luxury outbound demand, while Africa benefits from growing regional and inbound customized travel linked to cultural and experiential tourism.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Customized Travel Market

- TUI Group

- Expedia Group

- Booking Holdings

- American Express Global Business Travel

- Flight Centre Travel Group

- Trip.com Group

- Kuoni Travel

- Abercrombie & Kent

- Thomas Cook India

- Cox & Kings

Recent Developments

- In 2025, leading customized travel platforms expanded AI-based itinerary personalization tools to improve real-time traveler engagement and conversion rates.

- In 2024, multiple global travel companies increased investments in experiential and sustainable travel offerings, integrating local communities and eco-certified suppliers.

- In 2024, several major players expanded their Asia-Pacific presence through partnerships and acquisitions to capture rising outbound travel demand.