Customized Holidays Market Size

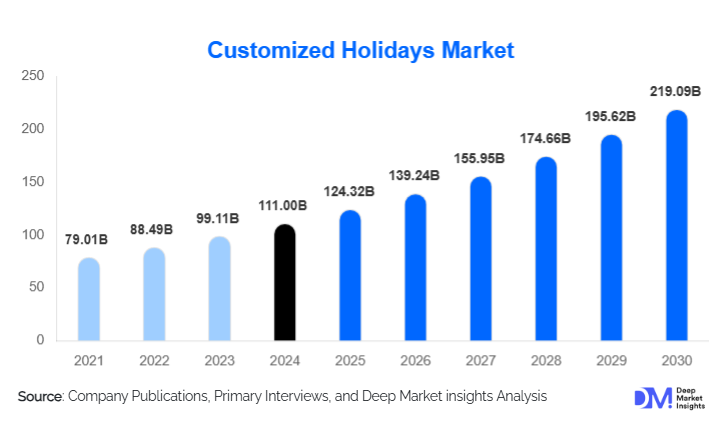

According to Deep Market Insights, the global customized holidays market size was valued at USD 111.00 billion in 2024 and is projected to grow from USD 124.32 billion in 2025 to reach USD 219.09 billion by 2030, expanding at a CAGR of 12.0% during the forecast period (2025–2030). The customized holidays market growth is driven by rising demand for personalized travel experiences, increasing disposable incomes, rapid digitalization of travel services, and growing preference for experiential, flexible, and value-added travel over standardized tour packages.

Key Market Insights

- Personalized travel experiences are replacing mass tourism, with travelers seeking flexibility, authenticity, and control over itineraries.

- Fully customized and AI-driven itineraries are gaining traction, enabling real-time personalization, dynamic pricing, and enhanced traveler engagement.

- International customized holidays dominate demand, driven by post-pandemic recovery in long-haul travel and improved air connectivity.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class populations in China, India, and Southeast Asia.

- Mid-range customized holidays account for the largest share, reflecting affordability improvements and wider consumer access.

- Direct-to-consumer and OTA platforms are transforming distribution, reducing dependency on traditional offline agencies.

What are the latest trends in the customized holidays market?

AI-Driven Hyper-Personalization

Artificial intelligence is rapidly reshaping the customized holidays market by enabling hyper-personalized itinerary planning. AI-powered platforms analyze traveler preferences, past behavior, budgets, and seasonal trends to create tailor-made trips in minutes rather than days. Real-time itinerary adjustments, dynamic bundling of flights and accommodations, and predictive pricing models are enhancing customer satisfaction while improving operational efficiency. This trend is particularly influential among younger, tech-savvy travelers who value convenience and digital-first engagement.

Experience-Led and Purpose-Driven Travel

Customized holidays are increasingly centered around experiences rather than destinations alone. Travelers are prioritizing cultural immersion, wellness retreats, adventure activities, and sustainable tourism. Purpose-driven travel, such as eco-friendly stays, community engagement, wellness tourism, and slow travel, is becoming mainstream. Providers are integrating local experiences, sustainability metrics, and wellness elements into bespoke itineraries, positioning customized holidays as premium, meaningful travel solutions.

What are the key drivers in the customized holidays market?

Growing Demand for Personalized Experiences

Modern travelers increasingly seek holidays that align with their individual interests, travel pace, and lifestyle preferences. Customized holidays allow travelers to design unique itineraries based on themes such as adventure, wellness, culture, or luxury. This shift away from standardized packages has significantly boosted demand, especially among millennials, Gen Z, and high-net-worth individuals.

Digital Transformation of Travel Services

The adoption of digital platforms, mobile apps, cloud-based booking engines, and AI-driven recommendation systems has made customization scalable and accessible. Travel companies can now efficiently manage supplier integration, pricing, and customer engagement, lowering operational complexity and enabling mass personalization.

Rise of Bleisure and Remote Work Travel

The global adoption of hybrid and remote work models has blurred the line between business and leisure travel. Travelers increasingly extend trips or combine work with leisure, driving demand for flexible, long-stay, and customized holiday solutions that accommodate work schedules and lifestyle needs.

What are the restraints for the global market?

Pricing Complexity and Margin Pressure

Customized holidays involve multiple suppliers, dynamic pricing, and currency fluctuations, making cost control and margin optimization challenging. Sudden changes in airfare or accommodation pricing can impact profitability, particularly for smaller operators with limited pricing flexibility.

Operational Scalability Challenges

Delivering consistent service quality across diverse destinations requires strong local partnerships and destination expertise. Scaling highly personalized services without compromising customer experience remains a challenge, especially for mid-sized and emerging players.

What are the key opportunities in the customized holidays industry?

Expansion in Emerging Travel Markets

Rapid economic growth and rising middle-class incomes in Asia-Pacific, the Middle East, and Latin America present significant growth opportunities. Countries such as India, China, Saudi Arabia, and Brazil are witnessing increased outbound travel demand, creating opportunities for tailored international and premium domestic holiday offerings.

Wellness, Sustainable, and Niche Travel Integration

The integration of wellness tourism, sustainability, and niche experiences into customized holidays offers strong differentiation. Demand for wellness retreats, eco-conscious travel, medical tourism, and community-based experiences is expanding, allowing providers to command premium pricing and improve margins.

Trip Purpose Insights

Leisure and vacation travel dominate the customized holidays market, accounting for approximately 42% of global revenue in 2024. This segment leads due to sustained demand from families and couples seeking flexible, experience-rich vacations. Honeymoon and romantic travel represent a high-value segment, driven by premium customization and destination exclusivity. Adventure and experiential travel continue to gain momentum, particularly among younger travelers seeking immersive and activity-driven itineraries.

Customization Depth Insights

Fully customized itineraries hold the largest share of the market at around 46%, reflecting growing preference for bespoke travel planning. Semi-customized packages remain popular among budget-conscious travelers, while AI-driven hyper-personalized trips are emerging as the fastest-growing sub-segment due to advancements in travel technology.

Booking Channel Insights

Online travel agencies with customization capabilities account for approximately 38% of global bookings, driven by transparency, convenience, and competitive pricing. Direct-to-consumer travel companies are rapidly gaining share by leveraging AI tools and personalized customer engagement. Offline travel consultants remain relevant for luxury and complex itineraries.

Price Band Insights

Mid-range customized holidays lead the market with nearly 44% share, reflecting improved affordability of personalization. Luxury and ultra-luxury segments are growing steadily, supported by high-net-worth travelers seeking exclusivity and premium services.

| By Trip Purpose | By Traveler Type | By Customization Depth | By Booking Channel | By Price Band |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 31% of the global customized holidays market in 2024, led by the United States. High disposable incomes, strong outbound travel culture, and advanced digital booking platforms support demand for customized international and domestic travel.

Europe

Europe holds around 27% market share, with the U.K., Germany, France, and Italy as key contributors. Demand is driven by experiential travel preferences, sustainability awareness, and strong intra-regional travel flows.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of approximately 13%. China, India, Japan, and Southeast Asia are major growth engines, supported by rising middle-class populations and government tourism initiatives.

Latin America

Latin America is an emerging market for customized holidays, led by Brazil and Mexico. Growth is driven by increasing outbound travel among affluent consumers and demand for adventure-led itineraries.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing strong growth in luxury customized travel. Africa benefits from inbound customized tourism linked to wildlife, culture, and experiential travel, supporting regional market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Customized Holidays Market

- TUI Group

- Expedia Group

- Booking Holdings

- Flight Centre Travel Group

- American Express Global Business Travel

- Kuoni Travel

- Trailfinders

- Abercrombie & Kent

- Intrepid Travel

- MakeMyTrip

- Thomas Cook Tourism

- Audley Travel

- Scott Dunn

- The Travel Corporation

- Cox & Kings