Cultured Dextrose Market Size

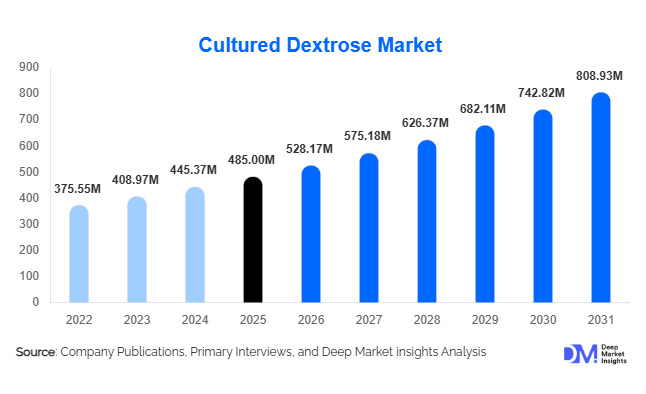

According to Deep Market Insights, the global cultured dextrose market size was valued at USD 485 million in 2025 and is projected to grow from USD 528.17 million in 2026 to reach approximately USD 808.93 million by 2031, expanding at a CAGR of 8.9% during the forecast period (2026–2031). The cultured dextrose market growth is primarily driven by rising adoption of clean-label food ingredients, increasing regulatory pressure to eliminate synthetic preservatives, and growing demand for extended shelf life in processed and convenience foods across global food manufacturing industries.

Key Market Insights

- Clean-label food reformulation is the primary demand driver, with cultured dextrose increasingly replacing chemical preservatives such as sorbates and propionates.

- Bakery and processed meat applications dominate global demand, accounting for more than 60% of total consumption due to high spoilage sensitivity.

- North America leads global adoption, supported by advanced food processing infrastructure and strong retailer-driven clean-label mandates.

- Asia-Pacific is the fastest-growing regional market, driven by expanding packaged food consumption in China, India, and Southeast Asia.

- Powdered cultured dextrose remains the preferred form, owing to superior stability, ease of handling, and compatibility with dry food formulations.

- Fermentation technology advancements are improving cost efficiency, yield optimization, and antimicrobial performance.

What are the latest trends in the cultured dextrose market?

Acceleration of Clean-Label Reformulation

Food manufacturers worldwide are accelerating the removal of artificial preservatives from product labels to meet evolving consumer expectations and retailer requirements. Cultured dextrose has gained traction as a naturally derived, fermentation-based ingredient that delivers antimicrobial protection while supporting transparent labeling. Major bakery, meat, and dairy producers are actively reformulating legacy product lines using cultured dextrose to retain shelf life without compromising taste or texture. This trend is particularly strong in private-label food products, where retailers enforce stringent ingredient standards to differentiate offerings.

Technology-Driven Fermentation Optimization

Technological innovation is reshaping the cultured dextrose production landscape. Manufacturers are investing in advanced microbial strain selection, precision fermentation, and process automation to improve consistency and reduce production costs. AI-enabled fermentation monitoring and optimized downstream processing are enabling higher yields and more application-specific formulations. These advancements are expanding adoption across cost-sensitive markets while supporting customized solutions for bakery, dairy, and plant-based food applications.

What are the key drivers in the cultured dextrose market?

Rising Demand for Natural Preservatives

Consumer skepticism toward artificial additives has intensified demand for natural preservation solutions. Cultured dextrose offers antimicrobial benefits derived from fermentation metabolites, aligning with clean-label and “naturally preserved” claims. This driver is particularly strong in North America and Europe, where regulatory oversight and consumer awareness are highest.

Growth of Packaged and Convenience Foods

The global expansion of ready-to-eat meals, frozen bakery products, and processed meats is significantly boosting demand for shelf-life extension solutions. Cultured dextrose is increasingly used to maintain freshness, inhibit microbial growth, and stabilize sensory attributes, making it a critical ingredient for high-volume food processing operations.

Retailer and Regulatory Pressure

Large retailers and foodservice chains are mandating the use of clean-label ingredients across supplier networks. Simultaneously, tightening food safety regulations are encouraging manufacturers to adopt multi-functional ingredients that enhance both safety and quality, further accelerating cultured dextrose adoption.

What are the restraints for the global market?

Higher Cost Compared to Synthetic Preservatives

Cultured dextrose remains more expensive than traditional chemical preservatives, creating cost barriers for small and mid-sized food processors. Price sensitivity is particularly evident in emerging markets, where margin constraints can delay adoption.

Formulation and Application Complexity

The efficacy of cultured dextrose varies across food matrices, moisture levels, and processing conditions. Limited formulation expertise can lead to inconsistent results, restraining adoption among manufacturers lacking strong technical support.

What are the key opportunities in the cultured dextrose market?

Expansion in Emerging Markets

Asia-Pacific and Latin America represent high-growth opportunities as packaged food consumption rises and multinational food brands expand regional manufacturing. Establishing localized fermentation capacity can significantly reduce costs and unlock large-volume demand.

Plant-Based and Alternative Protein Applications

The rapid growth of plant-based meats and dairy alternatives presents new application opportunities for cultured dextrose. Natural preservation is critical in these products, positioning cultured dextrose as a preferred clean-label solution.

Product Type Insights

Among all product types, antimicrobial cultured dextrose dominates the global market, accounting for approximately 58% of demand in 2025. This leadership is primarily driven by its ability to extend shelf life across bakery, processed meat, and dairy products, while meeting consumer demand for clean-label, naturally preserved foods. Flavor-enhancing and texture-stabilizing variants are also gaining traction, particularly in premium bakery and dairy applications, where sensory quality and natural ingredients are critical for market differentiation. By form, powdered cultured dextrose commands over 70% market share due to its superior stability, ease of handling, and compatibility with dry food formulations, whereas liquid cultured dextrose is steadily growing in wet-processing applications, including sauces, dressings, and ready-to-eat meals.

Application Insights

In terms of applications, bakery products remain the largest segment, representing nearly 34% of global consumption in 2025. This segment leads due to the high spoilage sensitivity of baked goods and the ongoing trend of clean-label reformulation by manufacturers. The processed meat and poultry segment follows closely, supported by strong antimicrobial requirements to maintain food safety and extend shelf life. Dairy products, including frozen desserts and yogurt, are emerging as high-growth applications, fueled by increasing demand for natural alternatives to chemical preservatives and expanding consumption in emerging markets. Additionally, ready-to-eat and convenience food applications are rising due to urbanization, fast-paced lifestyles, and the growing preference for preservative-free meals.

Distribution Channel Insights

The direct B2B sales channel dominates the cultured dextrose market, reflecting long-term supply agreements between ingredient manufacturers and food producers that ensure consistent quality and application-specific support. Ingredient distributors also play a crucial role, particularly in emerging markets and among small-scale processors, by providing localized supply, technical guidance, and flexible order volumes. Increasingly, hybrid models combining direct sales with distributor networks are emerging to optimize reach, reduce lead times, and serve niche markets efficiently.

End-Use Industry Insights

Food and beverage manufacturers remain the largest consumers, accounting for nearly 78% of global demand, driven by high-volume industrial production, extensive product portfolios, and stringent quality and shelf-life requirements. The foodservice and QSR chains segment is experiencing the fastest growth, as centralized kitchens and franchise operations increasingly adopt clean-label formulations to meet consumer expectations. Private-label processors are also scaling up cultured dextrose usage in response to retailer mandates, particularly in bakery and ready-to-eat products, reflecting the influence of large retail chains on ingredient selection.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global cultured dextrose market, led by the United States. The region’s growth is driven by high consumer awareness of clean-label products, stringent FDA food safety regulations, and strong retailer mandates that require naturally preserved formulations. The dominance of industrial-scale bakery and processed meat manufacturing, combined with widespread adoption of powdered antimicrobial cultured dextrose, supports sustained market leadership. Additionally, rising investment in R&D for fermentation technologies further strengthens North America’s position as a market innovator.

Europe

Europe contributes nearly 27% of global demand, with Germany, France, and the U.K. as major contributors. Growth is fueled by stringent food safety regulations, clean-label consumer preference, and high adoption in processed meats and bakery products. Antimicrobial cultured dextrose adoption is accelerating, particularly in large-scale industrial bakeries and dairy operations, to meet regulatory compliance while reducing synthetic preservative use. Retailer-driven reformulation and the premiumization of bakery and dairy products are key factors sustaining market expansion in the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR exceeding 10%. China and India are the primary growth engines due to the rapid expansion of packaged food manufacturing, increasing urbanization, rising disposable incomes, and growing awareness of natural preservatives. The bakery and dairy sectors are adopting cultured dextrose to meet rising demand for clean-label foods. Additionally, the region benefits from expanding modern retail networks and foodservice chains, which are increasingly mandating preservative-free solutions in large-scale operations. Powdered cultured dextrose remains the preferred form due to logistical advantages, while liquid variants are gaining traction in wet food processing.

Latin America

Latin America represents approximately 7% of global demand, with Brazil and Mexico as the key markets. Growth is driven by expanding bakery and dairy production, increased investment in packaged foods, and rising adoption of natural preservatives in industrial applications. The segment is also benefiting from growing urban middle-class demand for preservative-free products and increasing regional trade of packaged foods requiring shelf-life extension, positioning cultured dextrose as a key ingredient for domestic and export-oriented food manufacturers.

Middle East & Africa

The region accounts for around 5% of global demand, with growth concentrated in Saudi Arabia, the UAE, and South Africa. The market is driven by rising food imports, investment in modern food processing infrastructure, and increasing demand for clean-label products in both retail and foodservice segments. Bakery and processed meat applications are the primary growth sectors. Additionally, emerging awareness of natural preservatives and expansion of QSR chains in urban centers are creating new adoption opportunities for antimicrobial cultured dextrose.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|