Cucumber Seed Oil Market Size

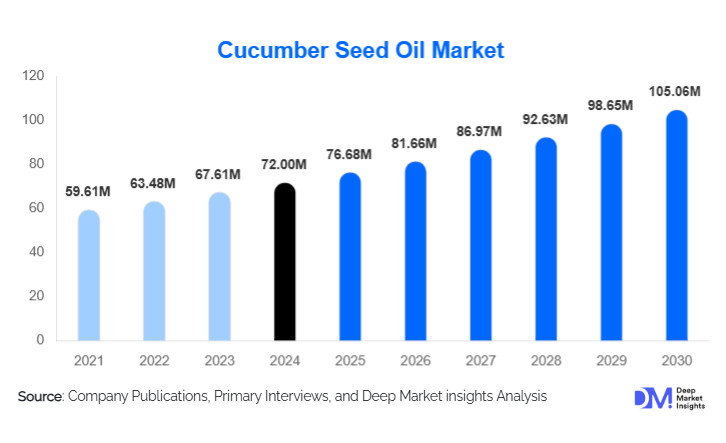

According to Deep Market Insights, the global cucumber seed oil market size was valued at USD 72.00 million in 2024 and is projected to grow from USD 76.68 million in 2025 to reach USD 105.06 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The cucumber seed oil market growth is primarily driven by the rising demand for natural and clean-label cosmetic ingredients, increasing adoption of botanical oils in dermatology-backed skincare formulations, and the expanding use of cucumber seed oil in nutraceutical and wellness applications.

Key Market Insights

- Cucumber seed oil is increasingly positioned as a premium cosmetic ingredient, valued for its lightweight texture, high linoleic acid content, and anti-inflammatory properties.

- Cosmetics and personal care applications dominate global demand, accounting for more than 60% of total market consumption in 2024.

- Europe leads global consumption, driven by strong luxury skincare manufacturing bases in France, Germany, and the U.K.

- Asia-Pacific is the fastest-growing regional market, supported by expanding beauty industries in China, South Korea, Japan, and India.

- Cold-pressed extraction remains the preferred processing method, reflecting consumer preference for minimally processed, high-purity oils.

- Sustainability and circular economy sourcing, particularly the use of cucumber processing by-products, are reshaping supply chains.

What are the latest trends in the cucumber seed oil market?

Premiumization in Clean and Clinical Skincare

Cucumber seed oil is increasingly being used as an active functional ingredient in premium and dermatology-backed skincare products. Its non-comedogenic nature, soothing properties, and compatibility with sensitive skin have made it popular in formulations targeting redness reduction, barrier repair, and post-procedure care. Luxury skincare brands are highlighting cucumber seed oil in serums, facial oils, and eye-care products, supporting higher average selling prices and margin expansion. This trend is reinforced by consumer willingness to pay premiums for transparency, ingredient traceability, and clinically supported botanical actives.

Adoption of Advanced Extraction Technologies

Manufacturers are investing in supercritical CO₂ extraction and improved cold-pressing techniques to enhance oil purity and nutrient retention. These technologies help preserve tocopherols and phytosterols while ensuring compliance with stringent cosmetic and pharmaceutical regulations. The shift toward advanced extraction methods is also enabling suppliers to offer differentiated grades for cosmetic, pharmaceutical, and nutraceutical applications, strengthening long-term supplier–brand partnerships.

What are the key drivers in the cucumber seed oil market?

Rising Demand for Natural and Plant-Based Ingredients

Consumers across global beauty and personal care markets are increasingly favoring plant-derived ingredients over synthetic alternatives. Cucumber seed oil aligns well with clean-label, vegan, and cruelty-free product positioning. Regulatory pressure on synthetic emollients and silicones in Europe and North America is further accelerating adoption, making natural oils a preferred formulation choice for global brands.

Growth of Dermatology-Backed and Sensitive-Skin Products

The expansion of clinical skincare, medical aesthetics, and dermatologist-recommended product lines has boosted demand for oils with low irritation potential. Cucumber seed oil’s mild profile and anti-inflammatory benefits support its use in products designed for eczema-prone, acne-prone, and post-treatment skin, contributing significantly to market growth.

What are the restraints for the global market?

Limited Raw Material Availability

Cucumber seed oil production is constrained by low oil yield per seed and dependence on cucumber harvest volumes. Seasonal fluctuations and geographic concentration of cucumber cultivation can limit supply scalability, leading to price volatility and longer lead times for bulk buyers.

High Production and Processing Costs

Cold-pressed and CO₂-extracted cucumber seed oil involves higher capital and operational costs compared to conventional vegetable oils. These cost structures restrict penetration into mass-market food and personal care products, confining usage largely to premium and specialty applications.

What are the key opportunities in the cucumber seed oil industry?

Expansion in Asia-Pacific Beauty and Wellness Markets

Asia-Pacific presents strong growth opportunities as regional beauty markets increasingly adopt lightweight botanical oils suited to humid climates. The rise of K-beauty and J-beauty formulations, along with Ayurvedic and herbal product demand in India, is expected to drive sustained volume growth. Local extraction and regional partnerships can further improve cost efficiency and market penetration.

Sustainable and Circular Economy Sourcing Models

Utilizing cucumber seeds as by-products from food processing offers significant opportunities for cost optimization and sustainability branding. Suppliers adopting waste-to-value sourcing models can secure long-term supply contracts, access ESG-linked funding, and differentiate themselves with sustainability certifications.

Product Type Insights

Cosmetic-grade cucumber seed oil dominates the market, accounting for approximately 62% of total revenue in 2024. This dominance reflects strong usage in facial oils, serums, creams, and haircare formulations. Pharmaceutical-grade oil represents a smaller but rapidly growing segment, driven by topical dermatology and nutraceutical applications. Food-grade cucumber seed oil remains niche due to higher costs but is gaining interest in gourmet and functional food segments. Industrial-grade oil is limited to specialty lubricants and niche technical applications.

Application Insights

Cosmetics and personal care applications lead global demand, representing nearly 64% of the market in 2024. Skincare remains the largest sub-application, followed by haircare and fragrance formulations. Pharmaceuticals and nutraceuticals account for a growing share as cucumber seed oil is incorporated into topical treatments and dietary supplements. Aromatherapy and wellness applications, including massage oils and spa products, are expanding steadily, supported by premium wellness trends.

Distribution Channel Insights

Direct B2B sales dominate distribution, accounting for approximately 47% of global market revenue, as cosmetic and pharmaceutical manufacturers prefer direct sourcing for quality assurance and traceability. Specialty ingredient suppliers play a critical role in serving small and mid-sized brands. Online retail channels are growing, particularly for small-volume cosmetic formulators and wellness brands, while offline retail remains limited to niche specialty stores.

End-Use Industry Insights

The beauty and personal care industry is the largest end-use sector, valued at approximately USD 250 million in 2024. Pharmaceutical and healthcare applications are expanding at a faster pace, supported by rising demand for dermatological and anti-inflammatory products. The wellness and spa industry is emerging as a complementary end-use segment, particularly in luxury and therapeutic offerings.

| By Extraction Method | By Product Grade | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds the largest market share at approximately 34% in 2024, led by France, Germany, and the U.K. The region’s dominance is supported by its strong luxury cosmetics manufacturing base, strict regulatory standards favoring natural ingredients, and high consumer awareness of clean beauty products.

North America

North America accounts for around 28% of global demand, with the U.S. leading consumption. Growth is driven by dermatology-backed skincare brands, premium personal care products, and rising imports of specialty botanical oils.

Asia-Pacific

Asia-Pacific is the fastest-growing region, registering a CAGR of over 11%. China, South Korea, Japan, and India are key contributors, supported by expanding beauty markets, rising disposable incomes, and growing adoption of natural skincare formulations.

Latin America

Latin America represents a developing market, led by Brazil and Mexico. Demand is primarily driven by natural and organic personal care brands and increasing export-oriented cosmetic manufacturing.

Middle East & Africa

The Middle East and Africa market is relatively small but growing, supported by luxury skincare demand in the UAE and South Africa, along with increasing regional processing of botanical oils.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|