Cruise Safari Market Size

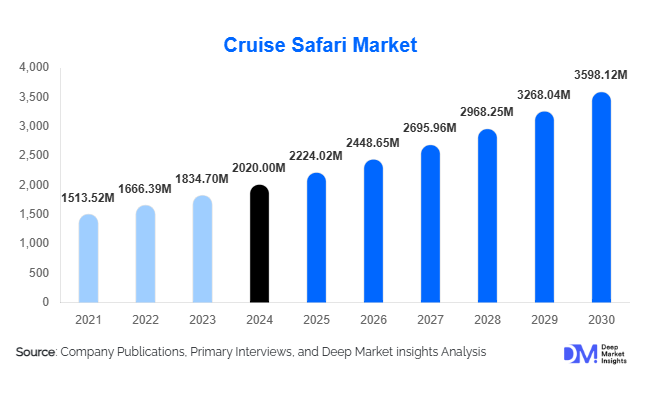

According to Deep Market Insights, the global cruise safari market size was valued at USD 2,020.00 million in 2024 and is projected to grow from USD 2,224.02 million in 2025 to reach USD 3,598.12 million by 2030, expanding at a CAGR of 10.10% during the forecast period (2025–2030). The cruise safari market growth is fueled by rising demand for immersive wildlife-focused voyages, the rapid expansion of small expedition vessels, and increasing consumer preference for sustainable, experience-driven travel. Growing adoption of hybrid-powered fleets, enhanced onboard technology, and curated expedition itineraries are transforming the cruise safari landscape into one of the fastest-growing segments within the adventure tourism industry.

Key Market Insights

- Cruise safaris are increasingly shifting toward eco-conscious, low-impact expedition models, aligning with global sustainability expectations and conservation mandates.

- Small expedition vessels (≤50 passengers) dominate wildlife routes due to their maneuverability and ability to access protected coastal and polar zones.

- North America accounts for the largest share of cruise safari travelers, driven by strong demand for Alaska, polar, and Galápagos routes.

- Asia-Pacific is the fastest-growing source market, supported by rising middle-class wealth in China and India and a surge in outbound adventure tourism.

- Technological integration, AI wildlife tracking, AR/VR education, and smart navigation are reshaping customer engagement and enabling premium pricing for enhanced experiences.

- Hybrid and electric expedition vessels are becoming the industry standard, reducing emissions and enabling navigation within ecologically sensitive regions.

What are the latest trends in the cruise safari market?

Conservation-Centric Expedition Cruising

Cruise safari operators are integrating conservation initiatives directly into their itineraries, allowing travelers to actively participate in marine and wildlife protection programs. Activities such as guided wildlife tagging, habitat monitoring, coastal cleanups, and scientific data collection have become integral components of premium cruise packages. Operators increasingly collaborate with environmental NGOs to fund conservation programs, with many offering "sustainability surcharges" that contribute to species preservation, anti-poaching efforts, and local community development. This shift has enhanced the appeal of cruise safaris among environmentally conscious travelers and solidified the segment’s reputation as a responsible form of eco-tourism.

Technology-Enhanced Wildlife Exploration

Expedition vessels are rapidly adopting next-generation technologies to elevate the cruise safari experience. AI-powered wildlife spotting tools, AR/VR-based learning modules, and real-time marine ecology dashboards help travelers better understand the ecosystems they encounter. Mobile apps now offer species recognition capabilities, interactive route maps, and geo-tagged wildlife logs, creating a highly immersive educational experience. Drone-assisted viewing is emerging in regions where aerial monitoring supports wildlife protection efforts, while VR-based pre-cruise previews allow travelers to sample expedition routes before booking. These technologies have become a defining feature for attracting younger, tech-savvy travelers.

What are the key drivers in the cruise safari market?

Growing Affluent Travel Demand

The global rise of high-net-worth and upper-middle-class travelers is fueling the popularity of luxury and ultra-luxury cruise safaris. These travelers seek exclusive wildlife encounters, private deck viewing, fine dining, and personalized expedition services. Premium cruise safaris often include top-tier naturalists, custom landing excursions, boutique cabins, and hybrid-powered vessels designed for minimal ecological impact. Demand is especially strong from the Middle East, Asia-Pacific, Europe, and North America, regions where affluent consumers increasingly prioritize high-value experiential travel.

Acceleration of Sustainable and Experiential Tourism

Modern tourists are increasingly favoring eco-friendly and experience-driven travel that offers deeper engagement with nature. Cruise safaris align perfectly with these preferences, combining wildlife observation, scientific learning, and cultural immersion. Governments and private operators are investing heavily in green ports, low-emission systems, and eco-certified expedition programs. Travelers are drawn to itineraries that offer guided wildlife education, indigenous cultural experiences, and conservation-led excursions, reinforcing sustainability as a core market driver.

What are the restraints for the cruise safari market?

High Travel and Operational Costs

Cruise safaris remain cost-intensive due to the premium nature of wildlife routes, vessel fuel requirements, specialized expedition staff, and limited berth capacity on small expedition ships. Remote ports, seasonal restrictions, and complex logistics further raise operational expenses. High consumer pricing restricts affordability to upper-income travelers, limiting market penetration among broader tourism segments. Air travel cost fluctuations and limited flight connectivity to remote cruise departure points add additional constraints.

Environmental and Regulatory Challenges

Sensitive ecosystems such as the Galápagos, Antarctica, and Arctic zones impose strict caps on cruise entries, vessel sizes, and landing rights. Regulatory inconsistencies across regions complicate operator planning and increase compliance costs. Climate change, manifested through melting ice, shifting wildlife migration, and unpredictable weather, affects cruising windows and wildlife sightings. Ensuring tourism demand does not compromise fragile habitats remains a core challenge for long-term market stability.

What are the key opportunities in the cruise safari industry?

Wellness-Adventure Expedition Hybrids

Combining wellness tourism with wildlife expedition cruising presents a significant growth opportunity. Many operators are introducing programs that blend guided wildlife excursions with onboard yoga sessions, mindfulness workshops, nature therapy, and wellness cuisine. This positions cruise safaris as restorative escapes, appealing to wellness-focused travelers seeking stress relief and nature immersion. Hybrid offerings extend guest stay duration and expand the market beyond conventional adventure travelers.

Community-Integrated Cruise Safari Experiences

Indigenous and local community participation in cruise safari itineraries is gaining strong traction. Cruiser-led cultural experiences, such as traditional ceremonies, artisanal workshops, and indigenous-guided wildlife walks, enhance authenticity and deliver economic benefits directly to local populations. Such initiatives strengthen social sustainability and improve the perception of tourism within host regions. Governments and NGOs increasingly support community-based models, providing funding and capacity-building programs to develop locally managed marine tourism activities.

Product Type Insights

Luxury cruise safaris dominate the market, driven by affluent travelers seeking exclusivity, immersive wildlife encounters, and premium ship amenities. These itineraries include private zodiac tours, refined dining, expert naturalists, and eco-certified vessels. Premium cruise safaris attract mid-to-upper income travelers seeking comfort and adventure without ultra-premium pricing. Standard safari cruises offer more accessible options, appealing to mainstream tourists and families through cost-efficient packages and group excursions. Expedition-class vessels with low passenger capacity remain a key asset for wildlife-dense regions, offering superior access and ecological compliance.

Application Insights

Wildlife-oriented cruises remain the most popular application, offering encounters with whales, penguins, marine mammals, sea birds, and Arctic or African coastal wildlife. Photographic expeditions are rapidly expanding, supported by digital content trends and partnerships with professional wildlife photographers. Cultural expedition cruises integrate indigenous experiences and marine heritage exploration, broadening demographic appeal. Eco-volunteering cruises that incorporate conservation activities, such as species tagging or marine habitat assessment, are attracting travelers seeking purpose-driven travel. Adventure extensions such as kayaking, guided hikes, and polar plunges are increasingly popular among repeat travelers.

Distribution Channel Insights

Digital booking platforms and direct-to-consumer websites dominate the cruise safari market, enabling travelers to explore itineraries, compare wildlife routes, and access dynamic pricing. Specialist expedition travel agencies remain valuable for high-net-worth clients requiring personalized consultation. Direct cruise line bookings are growing as operators expand digital engagement through virtual tours, online wildlife briefings, and mobile booking apps. Social media, influencer campaigns, and experiential marketing are increasingly shaping traveler decisions, especially among younger demographics.

Traveler Type Insights

Group travelers, including multi-generational families and organized adventure groups, represent a significant share of bookings. Solo travelers increasingly seek flexible itineraries emphasizing cultural immersion and guided wildlife education. Couples and honeymooners remain a premium segment, often opting for luxury cabins, private balconies, and tailored excursions. Families are a growing category, supported by educational wildlife programs and child-safe expedition activities. This demographic diversification is expanding the cruise safari addressable market.

Age Group Insights

Travelers aged 31–50 years represent the largest market segment, driven by strong spending power and interest in immersive, experience-led travel. Young adults aged 18–30 play a major role in the growth of adventure and budget safari cruises, leveraging digital booking platforms and seeking social, content-driven travel. The 51–65 age group contributes significantly to luxury cruise safari demand, valuing guided expeditions and comfort. Travelers above 65 represent a niche but high-value segment seeking accessible onboard amenities and slower-paced wildlife itineraries.

| By Cruise Type | By Duration | By Customer Demographics | By Booking Channel | By Vessel Capacity |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for the largest share of global cruise safari travelers, with strong demand from the U.S. and Canada for Alaska wildlife cruises, Arctic expeditions, and Galápagos routes. High disposable incomes, strong conservation interests, and robust air connectivity support sustained growth. Photographic and luxury expedition cruises are particularly popular among North American travelers.

Europe

Europe remains a key outbound market, with travelers from the U.K., Germany, France, Norway, and the Netherlands fueling demand for polar and coastal wildlife cruises. Europeans show a strong preference for sustainable expedition vessels, low-impact operations, and scientific enrichment programs. Younger demographics drive interest in budget-friendly expedition cruises, while retirees favor longer, premium voyages.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Australia. Rising middle-class wealth and expanding outbound tourism are increasing demand for wildlife expeditions, particularly to the Galápagos, Antarctica, and East Africa. China shows strong demand for luxury cruises, while India drives growth in premium and mid-range expedition segments. Japan and Australia maintain mature markets with consistent interest in photography and polar expeditions.

Latin America

Latin American demand is concentrated in Brazil, Argentina, Chile, and Mexico. The Galápagos Islands serve as the region’s primary cruise safari hub, attracting both domestic and outbound travelers. Affluent consumers in Brazil and Mexico show growing interest in luxury and family-oriented expedition cruises.

Middle East & Africa

Africa is central to the global cruise safari industry, offering unique coastal and river wildlife routes across South Africa, Namibia, Kenya, and Tanzania. Middle Eastern demand, especially from the UAE and Saudi Arabia, is rising rapidly due to strong luxury travel trends and increased outbound tourism to polar and African destinations. Intra-African cruise tourism is also growing, supported by improved regional connectivity.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cruise Safari Market

- Hurtigruten Expeditions

- Lindblad Expeditions

- Silversea Expeditions

- Ponant

- Quark Expeditions

- Celebrity Cruises (Expedition Division)

- Aurora Expeditions

- Viking Expeditions

- Seabourn

- UnCruise Adventures

- Oceanwide Expeditions

- Albatros Expeditions

- Paul Gauguin Cruises

- Coral Expeditions

- Aqua Expeditions

Recent Developments

- In March 2025, Hurtigruten Expeditions launched its latest hybrid-powered expedition vessel, enhancing low-emission navigation across Arctic wildlife routes.

- In January 2025, Lindblad Expeditions announced expanded Galápagos itineraries integrating citizen-science wildlife monitoring programs.

- In November 2024, Ponant introduced a new series of luxury eco-expeditions in the Indian Ocean, featuring scientific partnerships and onboard environmental labs.